Taxes Tag

California aims to tax satellite launches

Posted by Leslie Eastman

on May 06, 2017

15 Comments

President Donald Trump plans to pursue public-private partnerships for develop the space industry, which is likely to increase the development and profitability of these firms.

The State of California obviously foresees this possibility as well. Never having seen a tax that it will not try and collect, the state's Franchise Tax Board is seeking public comment on its proposal for computing taxes on commercial space transportation companies (hat-tip, Legal Insurrection reader Robert).

ECON 101 Comes to Connecticut: Taxing the Rich Doesn’t Work

Posted by Mary Chastain

on May 03, 2017

22 Comments

Connecticut Governor Dannel Malloy did the unthinkable for a Democrat: He admitted taxing the rich does not work. The state has witnessed "two high-end tax hikes in the past six years." So the wealthy in Connecticut have done what any sane person would choose to do: LEAVE.

Now the state faces a $2.2 billion deficit as income state revenue continues to collapse. WTNH reported:

It’s happening because the state of Connecticut depends too much on its wealthy residents, and wealthy residents are leaving, and the ones that are staying are making less, or are not taking their profits from the stock market until they see what happens in Washington.

Trump’s Tax Plan: Cut Corporate Taxes, Three Brackets for Income Taxes

Posted by Mary Chastain

on April 26, 2017

18 Comments

Secretary of Treasury Steven Mnuchin and National Economic Council Director Gary Cohn spoke to the press at the White House today about President Donald Trump's tax reform plan. Trump wants to slash the corporate tax rate to 15%, which I covered yesterday. But he also wants to place income taxes for us regular Americans into three brackets. From The Wall Street Journal:

“Clearly we have a unique opportunity to do something major here,” Mr. Cohn told a small group of reporters in the White House on Wednesday morning. “It’s our intention to create a huge tax cut and equally as important, a huge simplification of the tax system in America.”

Trump Pursuing a 15% Corporate Tax Rate

Posted by Mary Chastain

on April 25, 2017

17 Comments

President Donald Trump has offered us a little hint into the tax reform plan he wants to unveil on Wednesday. He has demanded aides to draft a plan that cuts the corporate tax rate to 15%.

It would help him keep one of his campaign promises. On the trail, he vowed to bring the tax rate to 15% from 35%. Yet, it could cause a fight on Capital Hill. Republicans want to cut taxes, but they cannot agree on how much.

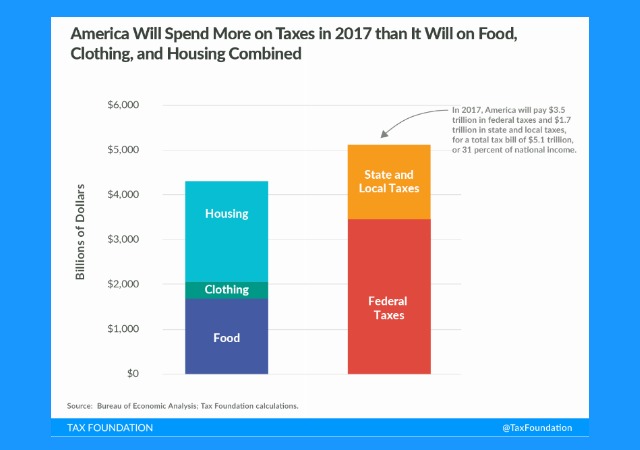

In 2017, Americans Spending More on Taxes Than Food, Clothing, and Housing Combined

Posted by Kemberlee Kaye

on April 24, 2017

6 Comments

April 23rd of this year was Tax Freedom Day, or "the day when the nation as a whole has earned enough money to pay its total tax bill for the year".

A whopping 31% of the nation's earnings are confiscated by the government for federal and state taxes for a total of $5.1 trillion. Amazingly, that's still not enough to pay off state and national deficits.

Trump to Include Dodd-Frank, Taxes in Latest Executive Order

Posted by Mary Chastain

on April 21, 2017

6 Comments

President Donald Trump will sign an executive order for Treasury Secretary Steven Mnuchin to target financial regulations from former President Barack Obama that have caused companies trouble to conduct business.

Mnuchin has said that the orders from Trump "are meant to emphasize the administration's economic priorities to the American people." This includes parts of the Dodd-Frank Act and tax regulations handed out in 2016.

Trump Taking New Approach on Tax Reform

Posted by Mary Chastain

on April 10, 2017

31 Comments

White House aides have told the Associated Press that President Donald Trump has decided to scrap the tax reform plan he campaigned on and start from scratch as a way to bring in more Republicans.

Trump and House Republicans already endured one defeat when many Congressional Republicans would not vote for their healthcare plan. The White House wants to take a more active role with tax reform so failure does not happen again.

Why Are Ivy League Schools Getting Billions in Tax Dollars?

Posted by Mike LaChance

on March 30, 2017

2 Comments

"more than $41 billion from fiscal year 2010 to fiscal year 2015"...

Tax reform takes spotlight after Obamacare repeal fails in Congress

Posted by Mary Chastain

on March 26, 2017

2 Comments

Now that the GOP healthcare bill is dead, the administration will more than likely set its eyes on tax reform. However, this could very well end like the healthcare bill.

House Speaker Paul Ryan (R-WI) insisted that the party has "more agreement" when it comes to tax reform while Treasury Secretary Steven Mnuchin explained that the "plan to overhaul the U.S. tax code would face smoother sailing" than healthcare.

Oh really?

McConnell, White House Battle Over Tax Reform Timeline

Posted by Mary Chastain

on March 10, 2017

9 Comments

Tax reform has been at the forefront of GOP policy issues in Washington. Under the Trump administration, tax reform includes a proposed border adjustment tax or tariff. Treasury Secretary Steven Mnuchin and the White House want tax reform legislation in the works by August, but Senate Majority Leader Mitch McConnell (R-KY) said an August timeframe is unlikely:

"I think finishing on tax reform will take longer. But we do have to finish the health-care debate, up or down, win or lose, before we go to taxes," McConnell told Politico.

Some States Want to Raise Gas Tax for First Time in Decades

Posted by Mary Chastain

on February 21, 2017

41 Comments

With higher construction costs and low revenue from low pump sales, a few states have considered raising the gasoline tax in an effort to raise funds for infrastructure.

President Donald Trump has promised to put forth $1 trillion to fix infrastructure across the country, but state officials have realized they need to do something for themselves.

Tennesse Governor Bill Haslam (R) believes a higher tax would raise $278 million for his state.

GOP’s Border Adjustment Tax Reform Plan On Life Support

Posted by Mary Chastain

on February 18, 2017

40 Comments

House Republicans desperately want to reform taxes, but so far the only plan they have developed has gained no leverage. That's because border adjustment makes up a majority of the plan, which few, including top retailers, want anything to do with.

The border adjustment is a tariff. It adds a tax on imports, which will inevitably raise prices on consumers. Common sense economics: A business must make a profit in order to supply goods and services. It cannot do that without money. In order to make money when a tax is added or raised, the business must raise the price on its goods in order to make that profit.

Feds Collect Record High Taxes in First Quarter of Fiscal Year, Deficit Remains

Posted by Kemberlee Kaye

on February 14, 2017

12 Comments

Elite Republican Group Promotes “Carbon Tax” Scheme

Posted by Leslie Eastman

on February 11, 2017

26 Comments

I recently blogged that a whistleblower revealed startling evidence that the National Oceanic and Atmospheric Agency rushed to release a widely-cited paper that exaggerated global warming and was timed to influence the Paris Agreement on climate change.

Despite the clear evidence of science fraud, big government bureaucrats are still promoting climate change policy. In fact, a group of long-time Republicans who have held high-level government positions are now promoting a "carbon tax" to address changes in global weather patterns.

Will the House GOP Border Tax Survive?

Posted by Mary Chastain

on February 08, 2017

30 Comments

The Republicans in the House have suggested to overhaul the tax code with a "border-adjustment" proposal, but it has caused a massive split with companies before anyone has even drafted legislation.

I brought up this proposal when President Donald Trump explained that he would make Mexico pay for a border wall by placing a 20% tax on imports because it mirrors the House GOP's plan. I also mentioned how these plans will screw the consumer and businesses have started speaking out against it:

Some retailers and other big importers doubt the dollar would rise that much. They warn of tax bills that would exceed profits, forcing them to pass costs to consumers. Some are in the early stages of working on an alternative plan they can present to lawmakers, says a person familiar with those plans.

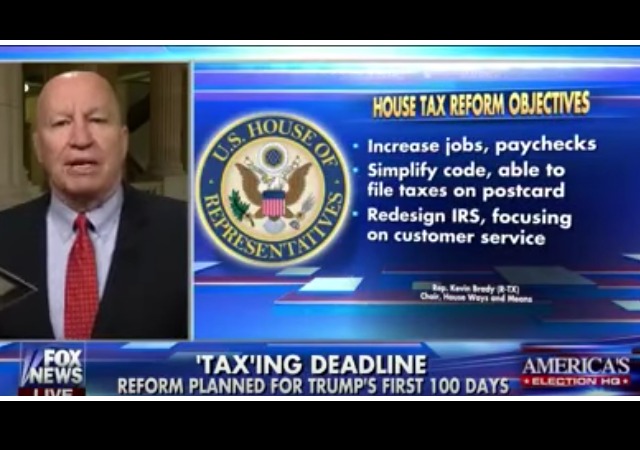

House Republicans Hope to Cut Taxes Without Raising Deficits

Posted by Mary Chastain

on November 16, 2016

26 Comments

Rep. Kevin Brady (R-TX) said the House Republicans hope to change the tax code without raising the deficits:

“We designed our blueprint to break even within the budget, considering that economic growth,” Rep. Kevin Brady (R., Texas), chairman of the House Ways and Means Committee, said at The Wall Street Journal’s CEO Council. If there are some deficits, he said he would accept them if the result was stronger growth.They started working on a plan earlier this year and will make a tax overhaul a priority in 2017.

Chamber of Commerce Endorses Senate Bill to Stop New Estate Tax Rules

Posted by Mary Chastain

on October 24, 2016

3 Comments

The Chamber of Commerce has endorsed a bill that would stop President Barack Obama's administration's new estate tax rules, which they insist would keep those mean wealthy people from reducing value on their assets.

GOP senators proposed legislation to stop these rules because they believe it will harm small and family owned businesses because the owners would not be able to easily transfer the business to future generations.

This is what the administration proposed:

DONATE

Donations tax deductible

to the full extent allowed by law.

CONTRIBUTORS

- William A. Jacobson

Founder

- Kemberlee Kaye

Sr. Contrib Editor

- Mary Chastain

Contrib Editor

- Fuzzy Slippers

Weekend Editor

- Mike LaChance

Higher Ed

- Leslie Eastman

Author

- Vijeta Uniyal

Author

- Stacey Matthews

Author

- Jane Coleman

Author

- James Nault

Author

- Mandy Nagy

Editor Emerita

- Learn more about the Contributors