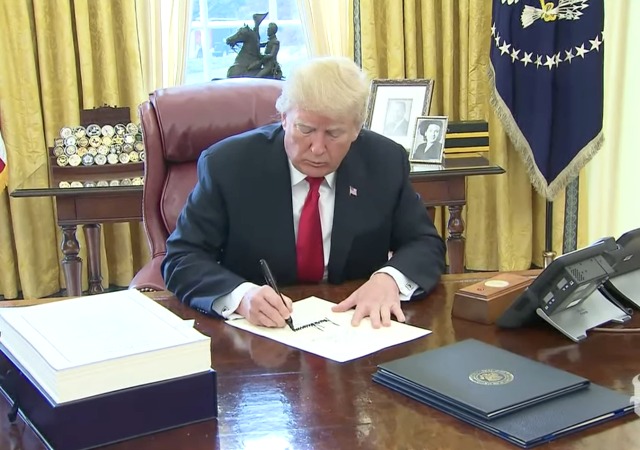

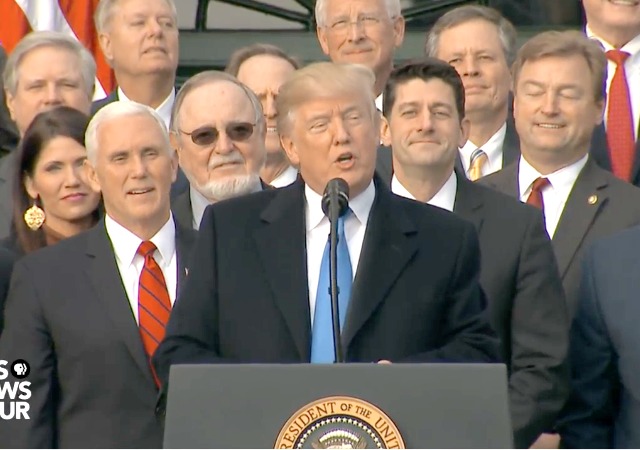

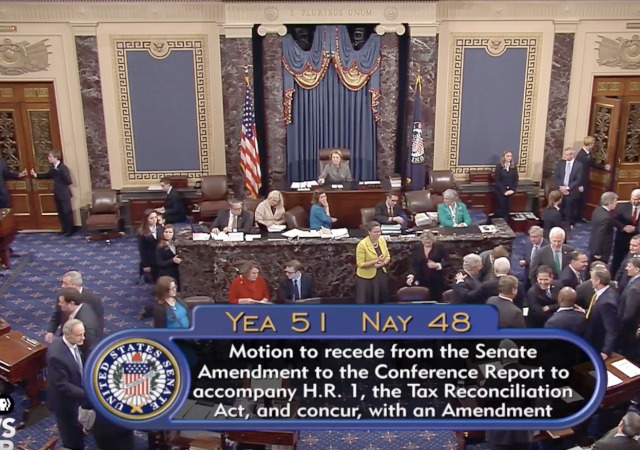

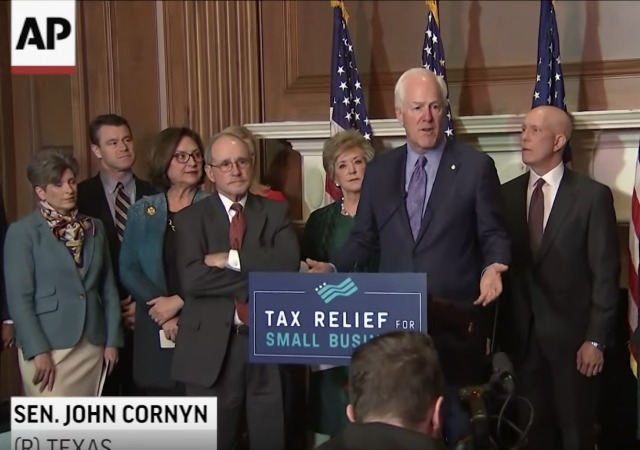

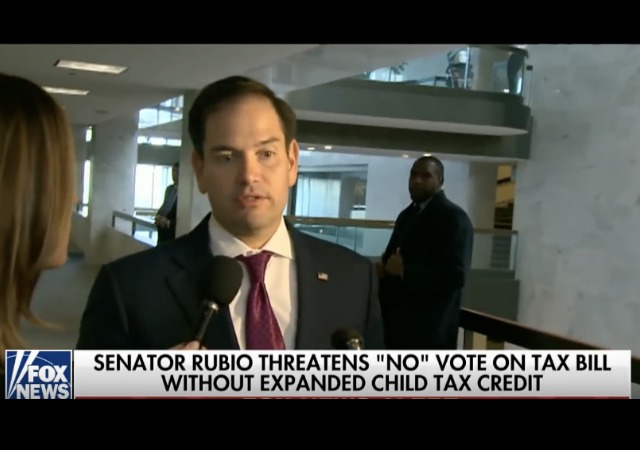

Trump Signs Tax Bill Into Law

on December 22, 2017

14 Comments

President Donald Trump will sign the tax bill before he leaves for his Christmas vacation. At the last minute, Trump allowed in pool reporters.

Trump will also sign the continuing resolution that will keep the government afloat through January 19.