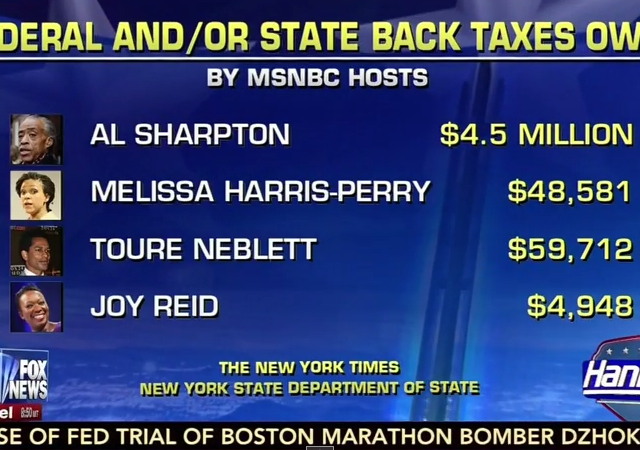

Four MSNBC Hosts Owe Considerable Back Taxes

on April 25, 2015

8 Comments

The progressive hosts of MSNBC may like the idea of big government programs, but for some of them, paying taxes seems to be a challenge.

Jillian Kay Melchior outlined the issue in a recent column for National Review:

MSNBC’s Touré Has the Taxman on His Case Touré Neblett, co-host of MSNBC’s The Cycle, owes more than $59,000 in taxes, according to public records reviewed by National Review. In September 2013, New York issued a state tax warrant to Neblett and his wife, Rita Nakouzi, for $46,862.68. Six months later, the state issued an additional warrant to the couple for $12,849.87. In January 2014, Neblett tweeted, “Regressive taxation & tax-avoidance & union crushing & the financial corruption of legislation has fueled inequality more than hard work.” In 2012, he also criticized Republican politicians, saying they were “all afraid to vote for a modest tax increase of people who can totally afford it.” MSNBC’s hosts and guests regularly call for higher taxes on the rich, condemning wealthy individuals and corporations who don’t pay their taxes or make use of loopholes. But recent reports, as well as records reviewed by National Review, show that at least four high-profile MSNBC on-air personalities have tax liens or warrants filed against them.Melchior discussed the issue with Sean Hannity on Thursday night: