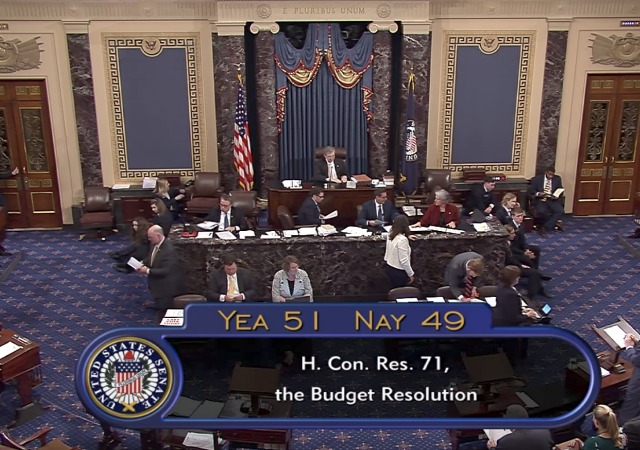

Senate Budget Committee Passes Tax Bill Along Party Lines

on November 28, 2017

6 Comments

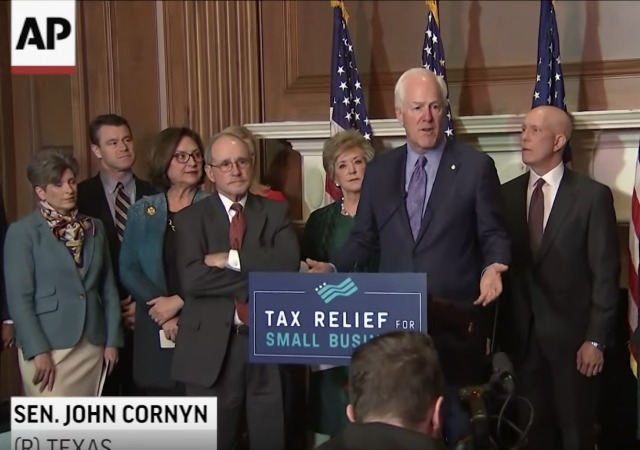

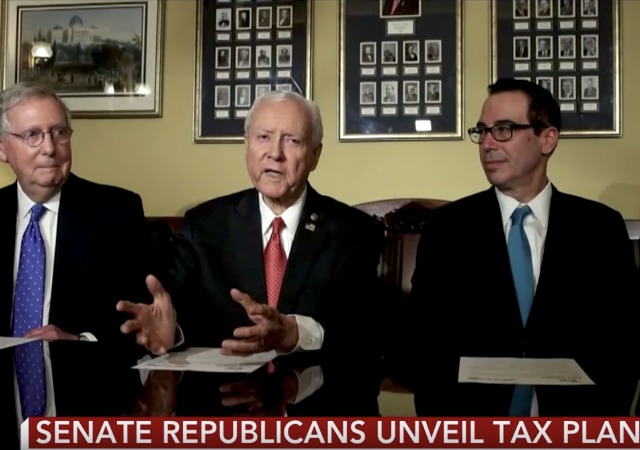

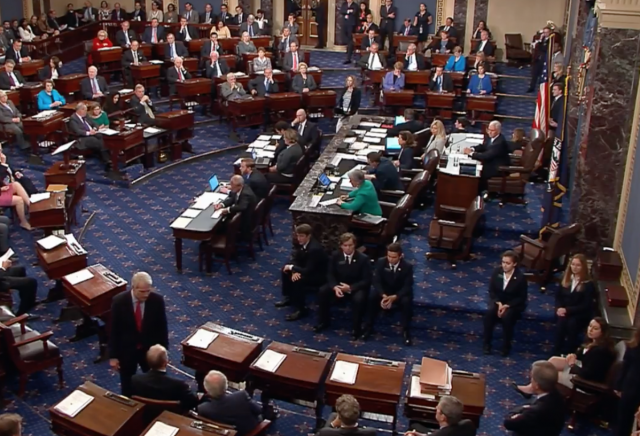

The senate tax bill conquered its first hurdle when the Senate Budget Committee passed it along party lines, 12-11. This also gives some optimism for it on the senate floor since two GOP senators who had hesitations on it voted yes in the committee: Sen. Bob Corker (R-TN) and Sen. Ron Johnson (R-WI).

The Senate could vote on the bill as soon as Thursday, but it should happen by the end of this week.