Yesterday, President Obama announced America should aspire to be more like France when supplying employee benefits.

The Washington Examiner reports:

“Other countries know how to do this,” Obama said. “If France can figure this out, we can figure it out.”

“Many women can't even get a paid day off to give birth,” Obama said. “There is only one developed country in the world that does not offer paid maternity leave, and that is us. And that is not a list you want to be on, by your lonesome.”

On the surface, this sounds like a fair enough argument, but then so does raising the minimum wage... until you consider the numeric reality.

Unlike the United States, France's

unemployment rate clocks in at a steady 10% for workers over 25. Under 25, the rate is closer to 25% unemployed. For perspective, the US and the UK both hover around a 6% unemployment rate. But that's not the only factor worth considering.

Remember the infamous

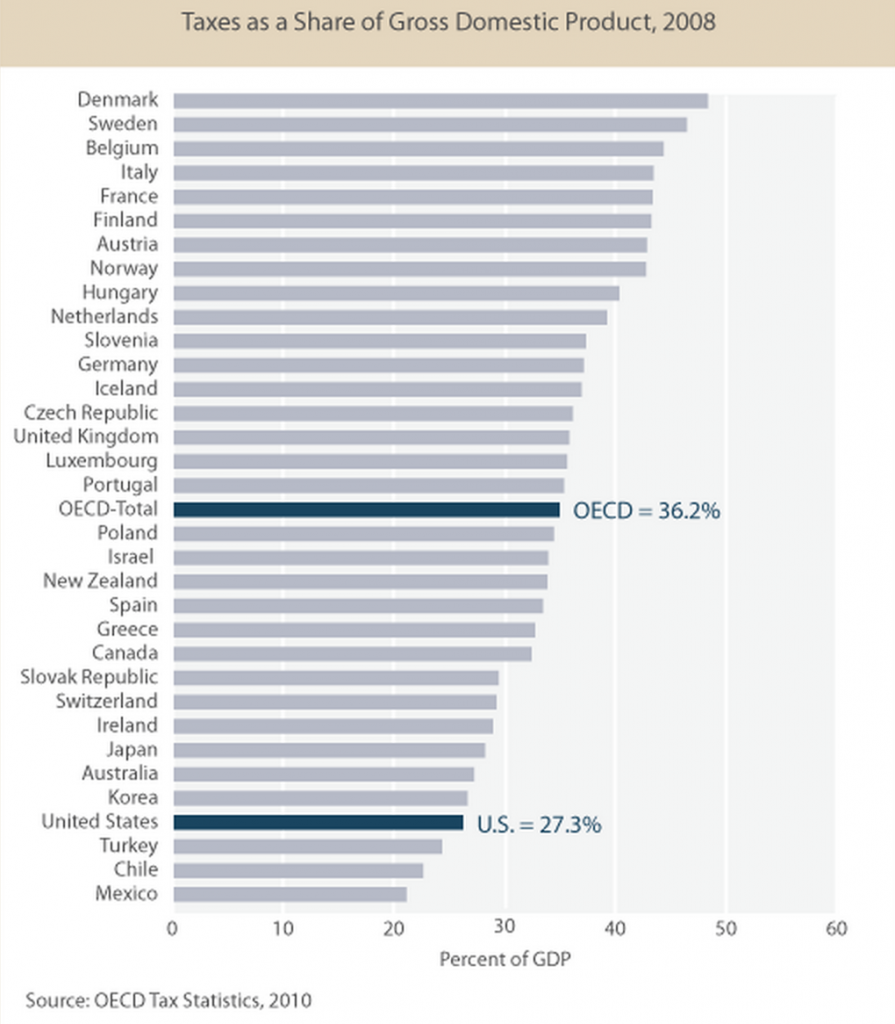

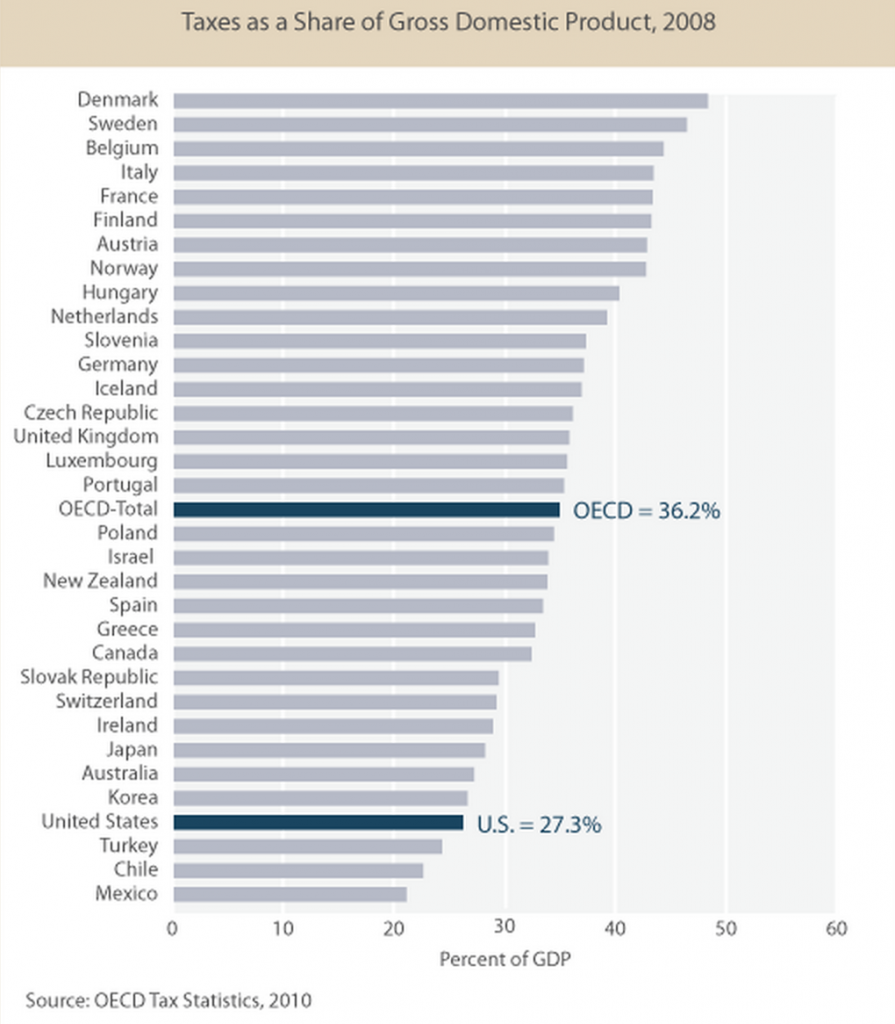

75% tax? That was France, all France. Take a look at where France ranks in taxation comparable to the United States:

[caption id="attachment_90228" align="aligncenter" width="639"]

Source: Tax Policy Center[/caption]

Tax conditions in France are so horrid, that entrepreneurs are fleeing to countries with more agreeable taxation rates. The

New York Times discussed this phenomenon. This aspiring entrepreneur left for the UK: