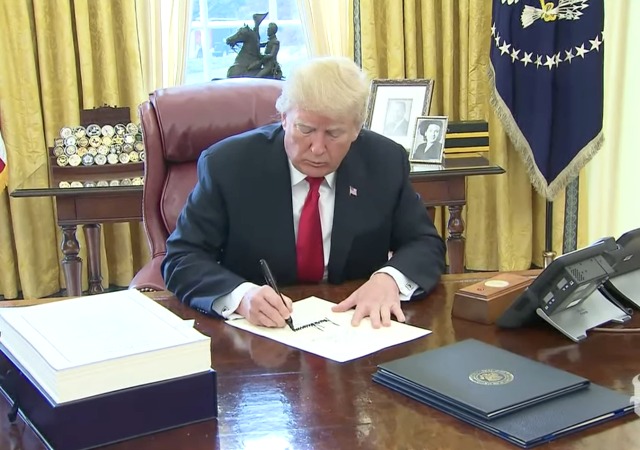

Trump Signs Tax Bill Into Law

He also signed the continuing resolution to fund the government.

President Donald Trump will sign the tax bill before he leaves for his Christmas vacation. At the last minute, Trump allowed in pool reporters.

Trump will also sign the continuing resolution that will keep the government afloat through January 19.

Trump on tax bill: "I consider this very much a bill for the middle class and a bill for jobs." pic.twitter.com/l7TBCpKipa

— Washington Examiner (@dcexaminer) December 22, 2017

Will be signing the biggest ever Tax Cut and Reform Bill in 30 minutes in Oval Office. Will also be signing a much needed 4 billion dollar missile defense bill.

— Donald J. Trump (@realDonaldTrump) December 22, 2017

From ABC News:

“Everything in here is really tremendous things for businesses, for people, for the middle class, for workers. And I consider this very much a bill for the middle class and a bill for jobs. Corporations are literally going wild over this,” Trump said.

Trump indicated that he was going to wait until after the new year to sign the bill, but when he saw reports on the news speculating about the timing he “immediately called and said let’s get it ready.”

As I blogged before, the middle class will receive a large tax cut. Congress’s Joint Committee on Taxation said that those in the middle class “will get $61 billion in tax cuts in 2019.” From The Wall Street Journal:

That amounts to 23% of the tax cuts that go directly to individuals. By 2027, however, these households would get a net tax increase, because tax cuts are set to expire under the proposed law.

The calculations are based on JCT estimates of cuts going to households that earn $20,000 to $100,000 a year in wages, dividends and benefits. Those households account for about half of all U.S. tax filers, with nearly a quarter making more and a quarter making less.

Those who make $500,000 or more, a group that makes up 1% of filers, will also receive a cuts worth $61 billion in the first year. By 2027, that cut could be $12 billion.

WSJ points out that that cut “includes income earned by pass-through businesses such as partnerships and S-corporations that pay taxes on individual returns.”

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

So are the dems going to follow through on their threats to allow the PAYGO Medicare cuts to go into effect?

Never mind. The article states:

In other words, seeing the futility of their position, the dems quietly folded their hand and went home for the holidays.

another promise kept.

Just brilliant first year.

Next year is going to be fun, too.

Get ready for “The Donald: Season Two.”

The blood of NINE MILLION TINY TIMS is on your hands, t-rumpers.

This line of rhetoric is getting pretty old. Everything the Republicans try to do will kill babies? Really? That’s pretty ironic since the Democrats are the ones who fiercely defend the right to kill babies.

I am pretty sure that the Dawg is being sarcastic.

The carnage is awful – first everyone died because Trump pulled out of the Paris Accord and didn’t bow down and worship at the altar of Global Warming; then everyone died because of the end of Net Neutrality; and now everyone is going to die a 3rd time because of the tax bill! Oh the humanity!!!

Apparently, dim voters are like cats with 9 lives.

Only 6 to go, come on Trump!

“I am pretty sure that the Dawg is being sarcastic.”

Understated.

It’s interesting that Patterico decided that Trump lied since he signed it before Christmas. Read the article at the link since he goes through a lot of explanation for his reasoning. http://patterico.com/2017/12/22/trump-lies-about-why-he-signed-the-tax-bill-this-year/

Note that Trump first signed the continuing resolution before he signed the tax bill. I am assuming it is because of the PayGo provisions. I also noted that Trump talked about ordering $4billion in weapons. Was that a hint to NK and Iran?

Our “friends” in the Senate were very busy helping the Democrats advance their Progressive agenda. Not only do the new tax brackets sunset, making this tax bill a tax increase in the long run (it likely already is if you’re single and upper middle class), but there is also one change they didn’t advertise: alimony payments will no longer be deductible and they’re tax-free to the recipient. Feminists will be jumping for joy at this, since it screws divorced men big-time and gives women a huge financial windfall. Since family court judges are notoriously biased they cannot be relied upon to grant petitions for downward reductions in alimony pursuant to the new tax law.