Obamacare Tag

Some Obamacare Customers Owe Taxes on…Their Tax Credit?

Posted by Jay Caruso

on March 26, 2015

37 Comments

Some families who signed up for Obamacare and have been estimating what their tax returns are going to look like this year are in for a rude awakening.

Due to mid-year income levels changing, nearly 50% of people who received an advance payment of the tax credit for Obamacare will have to repay some or all of the tax credit in question. From CNBC:

Half of the households that received federal subsidies to help pay for their health insurance in 2014 will have to repay some money back to the government when they file their tax returns, a new analysis released Tuesday estimates. The average repayment owed by those people will be $794, the Kaiser Family Foundation study found. The repayments will be owed because those households' actual incomes ended up being higher for the year than what they had estimated when they applied for the subsidies.But it gets worse for some families:

But the Kaiser study also found that a relatively small group of households will owe back a lot more than the average when it comes to refunds, after their actual incomes ended up being too high to qualify for the subsidies they got. That group of people will have an average repayment of between $2,306 and $3,837—and some could owe much more. Unlike people who earn below 400 percent of the federal poverty line, higher earners have no limit on the subsidies they must pay back if they were not entitled to them.This is one of those nasty secrets of Obamacare that Nancy Pelosi and company must not have read about even after passing it.

So what if Ted Cruz is enrolling in Obamacare?

Posted by Kemberlee Kaye

on March 25, 2015

29 Comments

The man who garnered national attention by making himself Obamacare's arch nemesis is enrolling in the dastardly program one day into his presidential campaign.

Previously covered by his wife's cadillac Goldman Sach's healthcare plan, Heidi Cruz's departure from the investment behemoth means the Cruz's will be looking to the exchange for their health insurance needs.

Evidently, this is a story.

"Man who hates Obamacare to enroll in Obamacare!!!!" "Hahahaha, it's sooooo ironic Cruz is like, enrolling in Obamacare!" "Cruz is enrolling in Obamacare?! What a hypocrite!"

Who knew abiding by the the law was such a novel accomplishment that it warranted ink from every major news outlet? But that's what happened.

Obamacare forces businessman to sell 16 IHOP restaurants

Posted by Mike LaChance

on March 24, 2015

38 Comments

Indiana business owner Scott Womack knows firsthand how Obamacare affects the economy and jobs. He just sold 16 of his IHOP restaurants because of the rules imposed by the law.

We recently reported that some restaurants in Seattle are having trouble with a new minimum wage policy.

Progressives seem to believe that any issue they care about can be solved through legislation and there's no greater example of that than the Affordable Care Act.

Rob Bluey of The Daily Signal reported:

This Longtime IHOP Owner Sold His 16 Restaurants Because of Obamacare It was a brisk March morning, nearly a year after President Obama signed the Affordable Care Act, and I had trekked to the Midwest with a camera crew to meet Scott Womack, owner of about a dozen IHOP restaurants in Indiana and Ohio. Womack’s testimony before Congress earlier in 2011 caught my attention and I wanted to visit him at one of his restaurants to see firsthand how Washington’s policymaking had impacted his work. The IHOP in Terre Haute is located on South 3rd Street, just a few minutes from the Interstate 70 interchange and a short drive from the Holiday Inn where we had stayed the night before. As we sat in the back of the bustling restaurant waiting for Womack to arrive, we ordered french toast, omelettes and other IHOP specialities. At the time, Womack employed about 1,000 people at his 12 restaurants. When the Affordable Care Act became law on March 23, 2010, he had big plans for his franchise. He had purchased a development agreement in 2006 that would expand the company to 14 new IHOP locations in Ohio... Four Years Later Facing the prospect of Obamacare’s employer mandate on Jan. 1, 2015, Womack opted to sell his 16 IHOP restaurants last year to Romulus Restaurant Group.

#HobbyLobby strikes again: SCOTUS stabs at contraception mandate

Posted by Amy Miller

on March 09, 2015

3 Comments

Obama's big government health care takeover has taken another hit---albeit a small one---to its provisions mandating the coverage of contraception.

Notre Dame v. Burwell seemed dead last year, when the Seventh Circuit threw out a lawsuit laying out the University of Notre Dame's religious objections to Obamacare's contraception mandate. Notre Dame brought their objection in the wake of the Religious Freedom Restoration Act, which allowed religious organizations to opt out of the mandate and pass responsibility for paying the costs of contraception to insurance companies. The institution argued that this still placed a burden on exempt religious institutions, because even when opting out, those institutions still have to authorize the coverage.

The last time the Seventh Circuit considered this case, SCOTUS had not yet ruled in the landmark Hobby Lobby case, which authorized closely held corporations to seek religious exemptions from the contraception mandate.

The Seventh Circuit ruled that Notre Dame failed to show a sufficient burden against the rights of religious institutions; but SCOTUS has now tossed out that ruling completely, and have ordered the appeals court to review the case in light of the Hobby Lobby ruling.

Reuters has more background:

Majority of Obamacare Customers Will Owe Money This Tax Season

Posted by Mike LaChance

on February 25, 2015

25 Comments

Tax season approaches and the Obamacare bill is finally coming due.

Sarah Ferris of The Hill has some bad news for people who have been receiving Obamacare subsidies:

H&R Block: Majority of ObamaCare customers paying back subsidy A majority of ObamaCare customers, 52 percent, are being forced to pay back some of their subsidies during this year’s tax season, according to new data from H&R Block. Customers are paying back an average of $530, which has caused a 17 percent drop in the average return so far this spring, according to the analysis by the tax services giant. The Obama administration had warned that people could end up paying back some of their subsidies because many were relying on previous years’ income when applying for the tax breaks. H&R Block has predicted that “most filers” would owe some of their subsidies back to the federal government because they were relying on 2012 income. The new data, which was released Tuesday, only represents about six weeks of tax filings. Still, it could pose a significant challenge for the administration as it faces an already tough tax season.Remember when Obamacare supporters insisted it wasn't a tax? Good times. Remember when Obama repeatedly claimed Obamacare would save families $2,500 per year?

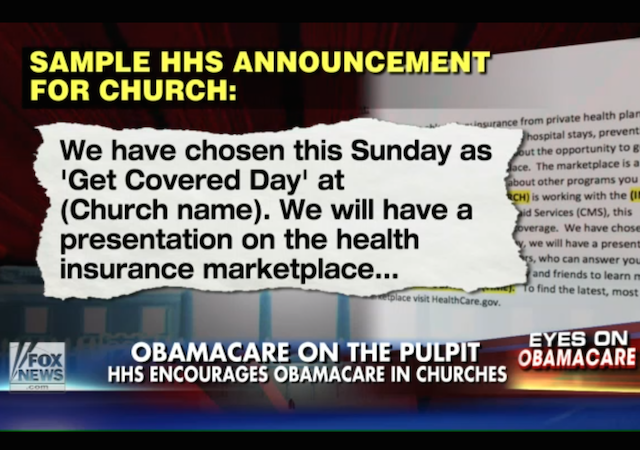

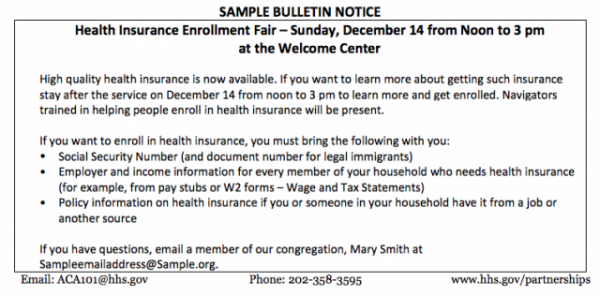

Next Obamacare push will come via the pulpit

Posted by Amy Miller

on February 16, 2015

35 Comments

Obama Administration officials are feeling the heat from the downward spiral of its figurehead health care legislation, and they're looking for allies in what is arguably the most unlikely place on Earth---the Church.

Unlikely indeed, considering religious organizations (and organizations run by religiously-minded entrepreneurs) have been engaged in an all-out war over Obamacare's various mandates since before the thing was signed into law. Officials charged with making sure Americans enroll for coverage have always thought of religious organizations as outlets for promotion, but they've recently stepped up their game and started re-pushing pre-made educational materials to churches.

The Weekly Standard explains:

These materials are part of the "Second Sunday & Faith Weekend of Action Toolkit," which is available on the website of the Department of Health and Human Services (HHS). From the beginning, HHS has sought to develop partnerships with faith-based organizations to promote the Obamacare. This "toolkit" has been available since 2013. However, the details of these partnerships have largely escaped the attention of the national media. The Second Sunday & Faith Weekend of Action program encourages churches to use the second Sunday of each month during open enrollment to hold informational meetings and sign-up events.They've even provided a bulletin insert---how convenient!

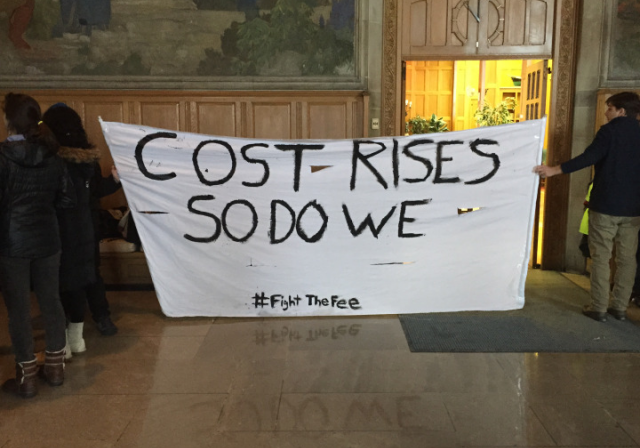

Socialism 101: Cornell Students Revolt Against Obamacare-like Health Fee (#FightTheFee)

Posted by Casey Breznick

on February 14, 2015

19 Comments

"Socialism is like a nude beach. Sounds pretty good until you actually get there." Iowahawk on TwitterLast week, Cornell's President David Skorton dropped a bombshell on the student body when he announced, in an email sent to all students, a $350 student health fee to be levied on all students who do not purchase Cornell's Student Health Insurance Plan (SHIP) starting next academic year. Immediately, the campus erupted in outrage over yet another hike in the cost to attend Cornell---one that would not be covered by financial aid because it is a fee and one that was announced so suddenly without any warning from the University administration. The Cornell Review, the campus's conservative publication of which I am Editor-in-Chief, was the first to break the story and has worked diligently all week gathering and reporting as much information as possible to bring the situation to national attention. I am scheduled to appear on Fox & Friends Sunday morning (tentatively 7:20 a.m. Eastern)[see update below] to discuss the student protests. When the fee was first announced, the student body---conservative, liberal, and apolitical---united in a way it rarely does, directing collective indignation towards the administration for shoving more costs onto students and their families.

President Selfie Stick and Managed Expectations

Posted by Kemberlee Kaye

on February 13, 2015

15 Comments

Earlier this week, President Obama sat down to promote Obamacare interview with Buzzfeed and Vox.

That the President chose listacles, cat memes, and explainer 'journalism' was not unnoticed by Right leaning media, and thus outrage ensued.

Post by BuzzFeed Video.

I yearn for my President looking Presidential and SERIOUS right now #ObamaSelfie #PoliticalPanel @FoxNews

— Greta Van Susteren (@greta) February 13, 2015Staples Workers: Thanks for Nothing, Obamacare

Posted by Mike LaChance

on February 10, 2015

41 Comments

Due to regulations imposed by Obamacare, some businesses are cutting the work hours of their employees. This was a known, predicted consequence of the Affordable Care Act. Staples is just the latest newsworthy example.

Remember, businesses can only try to survive under the given set of rules---but some employees are having a hard time keeping that in mind when they see their pay stubs.

Ashley Lutz of Business Insider:

Staples threatens to fire employees who work more than 25 hours a week Part-time Staples workers are furious that they could be fired for working more than 25 hours a week. The company implemented the policy to avoid paying benefits under the Affordable Care Act, reports Sapna Maheshwari at Buzzfeed. The healthcare law mandates that workers with more than 30 hours a week receive healthcare. If Staples doesn't offer benefits, it could be fined $3,000 in penalties per person. Buzzfeed spoke with several Staples workers who revealed their hours have been drastically cut over the past year. Many reported working as few as 20 hours. The workers started a petition on Change.org asking the company not to "cut part-time hours because of Obamacare."It's terrible that these folks are losing work hours, but it's not unexpected, and it's not the fault of Staples---that's just as far as an employee wants to look when it's suddenly gotten harder to pay the bills and feed their families. You think it's bad now, wait until people start dealing with their tax returns.

Here they go again, working the Sup Ct refs on Obamacare II

Posted by William A. Jacobson

on February 05, 2015

36 Comments

In the months leading up to the first Supreme Court Obamacare decision, there was a concerted media and Democratic effort to portray the legitimacy of the Court, and particularly the legacy of Chief Justice John Roberts, as dependent on the outcome.

The argument went that holding Obamacare's mandate to be unconstitutional would be such a huge interference in the political process that the Court would lose its supposed role as neutral referee and become a political player. Because as we all know, that has never happened before (/sarc), see, Roe v. Wade, etc.

This pressure reportedly caused Roberts to change his vote, and to join with the for liberal members of the Court in finding the mandate justified under Congress' taxing power.

Now the media pressure is mounting on Obamacare II, the subsidy case the Court accepted this term. The issue is whether the statutory language of Obamacare permits subsidies (the only way Obamacare policies are affordable for most) on the federal exchange set up when most states refused.

This issue of statutory interpretation is not exceptional legally, except that the political stakes are so high. If the statute is read not to permit the subsidies, Obamacare likely crumbles of its own weight.

Enter Linda Greenhouse, Supreme Court and judicial reporter for The NY Times, with scare mongering about the legitimacy of the Court, The Supreme Court at Stake: Overturning Obamacare Would Change the Nature of the Supreme Court:

SCOTUS “institutional legitimacy” not at stake in King v. Burwell

Posted by Bryan Jacoutot

on January 26, 2015

30 Comments

The upcoming Supreme Court case of King v. Burwell holds much in the balance, including the very financial sustainability of President Obama’s signature law, the Patient Protection and Affordable Care Act (PPACA). If the Supreme Court rules for the plaintiffs, the ability for the law to support itself would almost certainly collapse.

At issue in King is the legality of an IRS rule allowing exchanges operated by the federal government to issue tax subsidies to qualified individuals purchasing health insurance through the exchange.

This is an incredibly complex issue, and many courts, scholars, and commentators have spent thousands upon thousands (upon thousands) of pages of argument attempting to arrive at the proper conclusion. Ultimately, we must wait until the Supreme Court decides this case at the end of the term to learn the definitive conclusion.

The complexity of the law notwithstanding, many commentators remain convinced that any ruling against the government would be one for politics over the law, leading to familiar questions of the “institutional legitimacy” of the Supreme Court should they rule against the government. This is nothing new, especially when it comes to the issue of PPACA. Indeed, in the wake of the 2012 PPACA challenge, a litany of law professors and legal scholars shared in the assessment that striking down PPACA would result in substantial costs “for the Court as institution and for its credibility carrying out its vital national role going forward.”

Single Payer Activists Disrupt Vermont Gov’s Inauguration

Posted by Mike LaChance

on January 11, 2015

8 Comments

Single payer activists disrupted the inauguration of Vermont Governor Peter Shumlin this weekend. Somewhere between November and now, we forgot to tell them that even though a Democrat won the election, they lost.

Mike Donoghue of the Burlington Free Press:

Police ID 29 arrested at Statehouse protest The Vermont State Police have identified the 29 protesters arrested on suspicion of unlawful trespass for ignoring orders to leave the Statehouse following a sit-in Thursday in Montpelier. James Haslam, executive director of the Vermont Workers' Center and the organizer of the sit-in protest over single-payer health care on the day of Gov. Peter Shumlin's inauguration, was not among them. "I had some commitments in the morning to deliver two little kids to school. Family comes first," Haslam told the Burlington Free Press. Haslam, who kept his distance, said others were prepared to be arrested. For his part, Shumlin said he was disappointed some protesters tried to interrupt his inaugural address, but was bothered more that the demonstrators disrupted the final benediction by the Rev. Robert Potter of the Peacham Congregational Church. "I found it heartbreaking," he said.The incident was caught on video, watch it below.

Obamacare Bill Coming Due

Posted by Mike LaChance

on January 04, 2015

13 Comments

Tax season is right around the corner and this year brings another consequence of the Affordable Care Act. Many Americans are going to discover that instead of getting a tax refund, they will owe money to the IRS.

Tami Luhby of CNN Money reports:

Obamacare tax surprise looming Obamacare enrollees who received subsidies to help pay for coverage will soon have to reconcile how much they actually earned in 2014 with how much they estimated when they applied many, many months ago. This will likely lead to some very unhappy Americans. Those who underestimated their income either will receive smaller tax refunds or will owe the IRS money. That's because subsidies are actually tax credits and are based on annual income, but folks got their 2014 subsidy before knowing exactly what they'd make in 2014. So you'll have to reconcile the two with the IRS during the upcoming tax filing season. It won't be surprising if many enrollees guessed wrong. The sign up period began in October 2013 and many people did not know what they'd earn in 2014. Some went off what they earned in 2012... Those who underestimated their earnings could owe thousands of dollars, though there is a $2,500 cap for those who remain eligible for subsidies. The threshold for eligibility is based on income - $45,900 for an individual and $94,200 for a family in 2014.Isn't it great how Democrats have tied our healthcare system to our tax system?

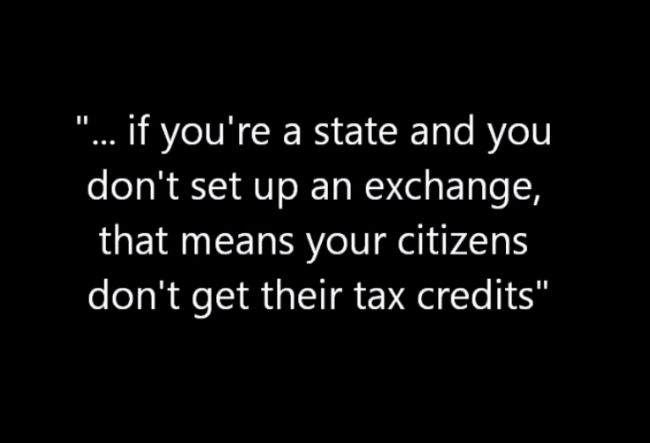

Mark Levin and Jonathan Gruber once agreed: No Obamacare subsidies on federal exchange

Posted by William A. Jacobson

on January 03, 2015

12 Comments

King v. Burwell is the case the Supreme Court agreed to hear involving Obamacare subsidies on federal exchange.

You will recall that the legal issue is whether the IRS violated the express provisions of Obamacare by issuing rules allowing taxpayers to claims federal subsidies when purchasing on the federal exchange, even though the language of the statute appears not to allow that.

In King, the Fourth Circuit ruled that there was possible ambiguity and another potential reading of the law, such that apparently clear language was not that clear, giving the IRS leeway to interpret the statute. In another case, Halbig v. Burwell, a D.C. Circuit panel had ruled that the subsidies were not available on the federal exchange, but that ruling was vacated pending the entire D.C. Circuit Court hearing the case en banc.

In a surprise move, the Supreme Court agreed to hear the King case even though there was no split in the Circuits (after the Halbig decision was vacated).

King will be one of the biggest decisions of this term, and if the Obama administration loses the case, it could be the death of Obamacare as we know it, because 37 states have refused to create state exchanges. Obamacare is affordable only with subsidies, and if the subsidies are not available to citizens of 37 states, the system likely collapses.

One key issue is whether the wording of the statute was a mistake or misstatement, or reflected a logical policy. Obamacare was set up in such a way as to put pressure on states to create state exchanges by providing for federal subsidies in the form of tax credits only for purchases on state exchanges. This was a conscious decision, as explained by none other than Jonathan Gruber:

Into the fray leaps Mark Levin and his Landmark Legal Foundation, which just filed a friend of the court, Amicus Curiae Brief. The full Brief is embedded below.

BREAKING: Medicaid Docs refuse to work for peanuts

Posted by William A. Jacobson

on December 29, 2014

57 Comments

For months, nay years, I have been predicting that the promise of quality healthcare for the poor via rapidly expanded Medicaid enrollments was a house of cards, a fraud, a three-card monte game, a sham, a man-made disaster, a Gruberesque fake meant to deceive the "stupid" people into believing that the promise of Obamacare was real instead of styrofoam faux-Greek columns basking in the neon light of Hollywood-driven love and media sycophancy.

For many reasons, but mostly because doctors would not work for peanuts, they would revolt like the kulaks and choose not to work rather than see the fruits of their labors handed out for free or close to free:

- Medicaid Fraud: Obamacare promise of free quality healthcare

- Forced collectivization of the health care kulaks via single payer is inevitable under Obamacare

- Not only can’t you keep your doctor, you may not even have a doctor

Just as millions of people are gaining insurance through Medicaid, the program is poised to make deep cuts in payments to many doctors, prompting some physicians and consumer advocates to warn that the reductions could make it more difficult for Medicaid patients to obtain care. The Affordable Care Act provided a big increase in Medicaid payments for primary care in 2013 and 2014. But the increase expires on Thursday — just weeks after the Obama administration told the Supreme Court that doctors and other providers had no legal right to challenge the adequacy of payments they received from Medicaid. The impact will vary by state, but a study by the Urban Institute, a nonpartisan research organization, estimates that doctors who have been receiving the enhanced payments will see their fees for primary care cut by 43 percent, on average.

Vermont: Where Single Payer Went to Die

Posted by Mike LaChance

on December 20, 2014

6 Comments

The ultra-liberal state of Vermont never liked Obamacare but not for the reasons most Americans object to the law. Vermont felt it didn't go far enough and was determined to establish its own single payer system. As of this week, that plan is dead.

Sarah Wheaton of Politico:

Why single payer died in Vermont Vermont was supposed to be the beacon for a single-payer health care system in America. But now its plans are in ruins, and its onetime champion Gov. Peter Shumlin may have set back the cause. Advocates of a “Medicare for all” approach were largely sidelined during the national Obamacare debate. The health law left a private insurance system in place and didn’t even include a weaker “public option” government plan to run alongside more traditional commercial ones. So single-payer advocates looked instead to make a breakthrough in the states. Bills have been introduced from Hawaii to New York; former Medicare chief Don Berwick made it a key plank of his unsuccessful primary race for Massachusetts governor. Vermont under Shumlin became the most visible trailblazer. Until Wednesday, when the governor admitted what critics had said all along: He couldn’t pay for it.Advocates of a single payer healthcare system may not realize just how bad this news is for them. Vermont was their best shot. John Fund of National Review noted this:

Health-care experts from outside Vermont point out some of the implications. “It’s a very liberal state, and its leaders spent years trying to design a system that would work,” Grace-Marie Turner of the Galen Institute observes. “If Vermont can’t make it work, single-payer can’t work anywhere in the country where the economy has free and competitive markets. It’s more evidence that centralized government health care is simply not workable in America.”All is not lost for the Green Mountain state. One of their senators might even run for president.

Dr. Vivek Murthy: Our New Anti-Gun Pro-Abortion Surgeon General

Posted by Mike LaChance

on December 19, 2014

21 Comments

In the haze of the recent news about Cuba, you may not have heard that Dr. Vivek Murthy has been confirmed as the new Surgeon General of the United States.

Tanya Somanader of the White House blog reported:

The Nation's Doctor: Dr. Vivek Murthy Is Confirmed as Surgeon General The Surgeon General is America's doctor, responsible for providing Americans with the best scientific information on how to improve our collective well-being. Now, Dr. Vivek Murthy will be the next physician to don the lab coat of the Surgeon General after the Senate confirmed his nomination today. "I applaud the Senate for confirming Vivek Murthy to be our country’s next Surgeon General," the President said following the confirmation. "As ‘America’s Doctor,’ Vivek will hit the ground running to make sure every American has the information they need to keep themselves and their families safe. He’ll bring his lifetime of experience promoting public health to bear on priorities ranging from stopping new diseases to helping our kids grow up healthy and strong."Dr. Murthy supported Obama's candidacy for president and was also an integral member of "Doctors for America" which has ties to Obama's campaign machine "Organizing for America." In a 2009 column, Michelle Malkin connected the dots:

DONATE

Donations tax deductible

to the full extent allowed by law.

CONTRIBUTORS

- William A. Jacobson

Founder

- Kemberlee Kaye

Sr. Contrib Editor

- Mary Chastain

Contrib Editor

- Fuzzy Slippers

Weekend Editor

- Mike LaChance

Higher Ed

- Leslie Eastman

Author

- Vijeta Uniyal

Author

- Stacey Matthews

Author

- Jane Coleman

Author

- James Nault

Author

- Mandy Nagy

Editor Emerita

- Learn more about the Contributors