Some Obamacare Customers Owe Taxes on…Their Tax Credit?

The Affordable Care Act is anything but affordable.

Some families who signed up for Obamacare and have been estimating what their tax returns are going to look like this year are in for a rude awakening.

Due to mid-year income levels changing, nearly 50% of people who received an advance payment of the tax credit for Obamacare will have to repay some or all of the tax credit in question. From CNBC:

Half of the households that received federal subsidies to help pay for their health insurance in 2014 will have to repay some money back to the government when they file their tax returns, a new analysis released Tuesday estimates.

The average repayment owed by those people will be $794, the Kaiser Family Foundation study found. The repayments will be owed because those households’ actual incomes ended up being higher for the year than what they had estimated when they applied for the subsidies.

But it gets worse for some families:

But the Kaiser study also found that a relatively small group of households will owe back a lot more than the average when it comes to refunds, after their actual incomes ended up being too high to qualify for the subsidies they got.

That group of people will have an average repayment of between $2,306 and $3,837—and some could owe much more. Unlike people who earn below 400 percent of the federal poverty line, higher earners have no limit on the subsidies they must pay back if they were not entitled to them.

This is one of those nasty secrets of Obamacare that Nancy Pelosi and company must not have read about even after passing it.

The political implications of this are not yet known, but once this hits it is going to affect a lot of people. The Full Kaiser Family Foundation study can be found here. They have estimated the following:

There is no definitive data yet on the number of people who received premium tax credits during 2014 and will be required to reconcile those tax credits based on actual income on their tax returns.

As of the end of open enrollment for 2014, 6.7 million people selected a plan and qualified for premium tax credits through a state or the federal Marketplace. That figure may be over-stated because not all of those people paid their premiums and actually ended up receiving advance tax credits, though it may also be under-stated because additional people qualifying for special enrollment periods signed up throughout the year. The Treasury Department has estimated that three to five percent of all taxpayers received advance premium tax credits in 2014. Based on an estimated 150 million returns filed, that would translate to 4.5 to 7.5 million tax households receiving advance payments of the premium tax credit in 2014 (with some households including more than one person).

Emphasis is mine. While the numbers could fluctuate it is going to be in the millions.

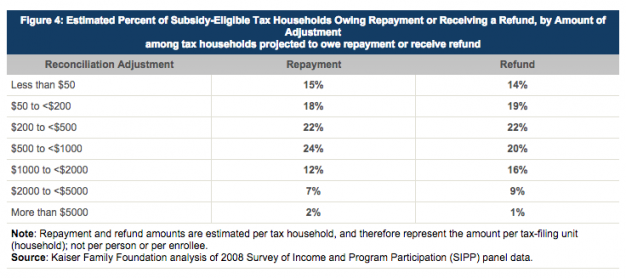

The chart below shows the amounts people will have to repay. While for some it will be less than $50, there are some who will be paying between $2000-$5000 back to the government.

As the layers get peeled back, it becomes more and more apparent just how badly Obamacare was written and rolled out. The consequences of not knowing what was in the bill when it was passed are being felt by a lot of people. This is why the administration and Democrats have shifted from their “affordable health care” rhetoric to merely talking about the number of those with “insurance.”

Every day we are seeing evidence that the Affordable Care Act is anything but affordable.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

I’m not sure I see much of a problem here. People only have to pay back subsidies when they…make enough extra money (over their estimates) to pay back subsidies.

Here is a tip to folks concerned about their own subsidies: If, during the year, you find that you are making more money than you estimated, put some away in savings so that you can pay back subsidies you end up not qualifying for.

Or, even better, go to the exchange when you start earning more income and manually change your subsidy information so that you don’t get hit with a tax bill at the end of the year.

“…will save Families $2500 a year.”

How quickly that is forgotten as these taxes come due.

Even better:

Repeal that horrible law.

Get the gubmint’s hand out of our pockets.

The government has no right to decide how we spend OUR money.

You must have one helluva thick skull, anoNY. First, you and your liberal ilk don’t believe in personal responsibility. Hence why you passed the bill in the first place. People are too stupid to get health insurance on their own and don’t realize the “Real” levels of coverage they NEED. NOW you expect them to take responsibility to log-on to a non-functioning website to make adjustments to their income?? So now they’re “Smart” enough?

And enough with subsidies. These dollars are not guaranteeing ANY amount of Health Care. Sure, they have insurance. But that’s no guarantee they will be seen. And honestly, all this subsidy business has done is increase the doles of medicaid 100x’s over. Where is that money coming from, a donation you plan on making to the government?

Take your liberal emotional dribble elsewhere. My heartstrings aren’t being pulled at all over this nonsense…

The whole system was designed so that people would not realize that the subsidy might be clawed back, and the realization postponed as much as possible.

Except taht it is possible to avoid having it clawed back.

By the way, only the premiums are clawed back, not any amouint in discounts on co-pays.

Population of the United States is about 320 million.

Before obamacare there were 40 million uninsured.

Simple math: there were 280 million insured.

280 MILLION !!!!!!!!

To insure 10 of the 40 million uninsured, they screwed all the rest of us: 280 MILLION !!!!!

Obamacare is the most shameful, most horrible, most un-American, and the worst piece of legislation in the history of America. All those who helped promote it and pass it should be imprisoned.

But we all know it was never about insurance or healthcare.

It’s about “fundamentally changing America”. No lie there …

The Unaffordable Commerce Tax Act makes healthcare universally and perpetually taxable or refundable or taxable or refundable or taxable-a coin flip.

And, it is now absolutely essential to hire thousands of federal IRS employee coin flippers to find out if you are to be taxed or if you are to receive a refund. Then, if it’s determined that you are a Tea Party member then you deserve a ‘special’ dispensation.

It becomes all very Gruber-esque in its simplistic erudite jabber-wocky.

In the current economy, very few of those who will owe repayments will have that much cash on hand or in savings. I suspect that most of the income fluctuations have to do with unpredictable factors like extra hours or a large project. These days, extra income means catching up on bills or covering deferred maintenance/replacement costs. I really doubt that the first thing, people think of when they have a little extra earnings is that they need to run check their health subsidies because it’s just not something people have on their mind like a utility bill.

There is another element for taxpayer dissatisfaction in the repayment scheme. Very few people actually used as most of the insurance features they were forced to purchase last year. I just haven’t heard about the rare and anticipated single guy giving birth to a new born baby with his maternity coverage. So the repayment, is more of a balance due on a product that you probably didn’t use, thought was overpriced and didn’t really like to begin with.

I went to the doctor twice last year, once for an inflamed eye and once to get a note for work because I had the flue.

I paid over $8,000 in health insurance premiums last year. That makes it $4,000 an appointment. That’s a little bit more than the CVS minute-clinic charges. Imagine if I were allowed to put my premiums into a savings account instead.

“NOW you expect them to take responsibility to log-on to a non-functioning website to make adjustments to their income?”

Ugh, this is incoherent. If they have the subsidies, it shows that the website already worked for them. Thus, asking them to get on the website a second time doesn’t seem like that big a deal.

“These dollars are not guaranteeing ANY amount of Health Care. Sure, they have insurance. But that’s no guarantee they will be seen.”

I agree wholeheartedly with these statements. I am generally not a fan of Obamacare, which has not helped me get insurance for my spouse (my workplace offers unaffordable family coverage). My specific point was that I am not going to cry about some people not understanding that their income affects their subsidies and can lead to a bill later on.

“Take your liberal emotional dribble elsewhere. My heartstrings aren’t being pulled at all over this nonsense…”

Looks like you are the one getting all emotional about this issue.

Odd, that was supposed to be a reply to quicksilver. This website is acting just like Healthcare.gov!

Odd, no one else has a problem replying. Do you think…that the people affected by this will actually understand it? Do you think… any of those government employees took the time to explain any of this to those registering? Do you think.. any of those government employees actually understand the law? Do you think…those government employees actually care how if affects anyone else? Do you think?

I think there are people at HHS who understand the law, but didn’t want most of their “customers” to.

Few of us have a problem figuring out how to respond to someone.

You are giving us advice on what to do online?

You’re almost there, libby. Just reconcile yourself with one point you glossed over. This was sold and bought as a money saver for the working class. You said yourself that it’s unaffordable and poorly accessible. It was sold as the “affordable care act”…you can’t get much more false than this. We don’t even have to start with the “keep your doctor” lie.

As for those you are unsympathetic towards…these bozos were duped into the plan; are they responsible for their actions? Yes and no.

Yes, because they should have known that government socialist interference is a plague with a pattern of predictable, lousy outcomes.

No, because they were REQUIRED to comply with this BS law, a law they probably didn’t want to buy into in the first place given the price tag.

You erroneously assume that their “tax credit” is a surplus to be saved for a possible rainy day. How many on the exchanges don’t even have that option? It’s not like a windfall…it’s simply a mitigation of the high sticker price of the lousy exchange plans they are forced to pay.

Of course, as others have said, this is not about affordable health care for all. This was about votes. Medicaid expansion will be a rousing lib voter success for those that want to buy their way into a lifetime political job of lavish benefits while strangling the working class to bribe the indigents for power.

“Ugh, this is incoherent. If they have the subsidies, it shows that the website already worked for them. Thus, asking them to get on the website a second time doesn’t seem like that big a deal.”

You have insufficient experience or info to make such stupid comments, or perhaps you do and just ignore it. The problem with the website isn’t that it works/fails 100%. The problem is that it works sometimes, not others, in an unpredictable pattern, for a very large number of people. Even when it works, there is a substantive rate of connection failure with the health insurance copy, that is, application completed, yay!… but BC/BS or whoever never received it. The website remains a mess. My son has been unable to make it work since last October. Numerous commenters here report many problems as well. Practically everyone knows someone getting screwed by this thing, either by the f-ed up process or the worthless product.

Regarding: “These dollars are not guaranteeing ANY amount of Health Care. Sure, they have insurance. But that’s no guarantee they will be seen.”

Exactly right. A friend had his individual plan cancelled for not meeting Obamacare ‘standards’ and was forced onto the health.gov exchange. His cancelled plan was a fairly standard $1500 deductible, 80/20 after deductible met, for $315/month. The cheapest Obamacare plan he could afford is one of the Bronze Plans: $5000 deductible, 80/20 after deductible met for $527/month. These are the plans the poor people get stuck with, you know, the people they claimed to be helping?

When people regard you in anger, it’s because you are such a glowing example of the liberal ignorance required to get such a monstrosity of a bill passed in th first place.

I lost a perfectly good and affordable Blue Cross individual policy. The crappy ACA Bronze replacement plan was over $200 a month more, with 4x the deductible. But I did the only thing I could, I got married and picked up my new husband’s retiree plan. Oh yes, and I picked up two adult children and three grandchildren. 🙂 Now I have an incentive to make sure he is healthy.

You know the toll free 800 number for healthcare.gov?

It’s a portmanteau word.

F1 – for help, presumably – and something else.

1-800-F1-UCK-YOu

For real.

I don’t know if I should post this.

“Ugh, this is incoherent.”

Never have I seen a better summation of Obamacare.

If healthcare/insurance was “unaffordable” before, getting the government (middleman) involved sure as h3!! isn’t magically going to make things “affordable.”

Amazing how many brain-dead LIVs couldn’t figure that one out.

Repeal the monstrosity NOW. And jail the lying liars responsible for this affront to the Constitution illegally becoming the “law of the land” – ALL of them.

All of them, starting with obama, pelosi and gruber.

Let’s not leave the USSC out of it, either.

They’re responsible for this debacle, too.

Wait until what the insurance companies pay out start getting taxed as income.

It’s going to happen.

Apparently, even if you read it you wouldn’t know what was in it……

May the agony, inconvenience and fraught of coughing up the money, to repay the over-generous taxpayers of this great nation, be bestowed upon those who voted for he who hoodwinked them into believing they were going to get something for nothing…..Amen.

Any reason not to ask for the maximum subsidy and repay it at the end of the year? Effectively you can make a few bucks off of uncle sam’s interest-free loan.

There’s another aspect to this that I haven’t seen discussed. Some people were paying their medical expenses out of pocket – no insurance, or maybe just catastrophic. They could deduct that from their taxes. When they were threatened and coerced to sign up, they gave up the right to take that deduction. They are the most screwed of all if they received even a small subsidy.

In essence, obola, the Grub and Pelosi too away the medical tax deduction from the younger, middle-class non-insured.

And the younger (healthier) middle class typically never meet their deductible and are paying for something they’ll rarely if ever use.

“.. their $5,000 deductible…” I meant to say.

No, it’s just as deductible as before. Well, maybe not, if you had very high expenses in some years and deducted something then, which you could maybe with a catastrophic policy.

the cost of health insurance is deductible just like any other medical exoense. It’s just that you can only deduct on Schedule A medical expenses above a certain percentage of income (and only if it pays to itemize deductions)

That percentage used to be 7.5% but I think it’s gone up, or is going to go up to 10%.

I don’t think the cost of health insurance premiums has ever been deductible for individuals, only for employers.

If the powers that be had indeed been serious about fixing the system, that would have been one of the improvements they could have made, along with opening the insurance market across state lines. The fact that these easy-to-implement fixes weren’t given consideration whatsoever just provides further evidence what the true objective was – and it has nothing to do with health, you can bet on that.

Yes, it is and has been deductible. I see it right here on page 148 of IRS Publication 17 for 2002

The Medical and Dental Expenses Checklist box includes:

~~~~~ Cut ~~~~~~~~~~

Medical and hospital insurance premiums.

Yes, it is is deductible, but it very rarely deducted, because on;y the portion that is above 7.5% of Adjusted Gross Income is deductible(and that may have bene raised now to 10%)

So, if your Adjusted Gross Income (the figure at the bottom of the first page and the top of second page of Form 1040) was $35,000,you could only deduct what was above $2,625.

And only of course if it made sense to itemize deductions, which means for many people only in states with a substantial state income tax.

That 7.5% of Adjusted Gross Income deductible for what is deductible on Schedule A, is for all medical expenses, not just insurance premiums.

Now in New York State, where an individual policy was about $15,000 before Obamacare, that could mean you could have up to $200,000 in individual income for a solitary person, and have no other medical expenses, and still have something to deduct.

Technically, it’s illegal to deliberately guess wrong, but as long as you don’t boast about on social media, and nobody is aiming to make an example of you, and the guess was at least plausible, this ought to be possible.

And you think that’s the worst??

What about somebody getting a bill for $15,000 because they agreed to go on Medicaid?

This happenned to someone I know.

She had quit her as a nurse for awhile. She went to apply for I think CHIPOS, She wasa told, no, you have to go on

Medicaid.

Not all that much later she got anotehr job, which included health insurance,.

And she didn’t use the Medicaid after that.

Now, Medicaid doesn’t work like it did years ago, where the worst that could happen would be a person would be billed for servoces performed. Medicaid now pays an HMO.

http://www.fideliscare.org/

This is in New York, where individually paid (non-group) health insurance long ago went into a death spiral.

Sometime later she got a $15,000 bill from the New york City Human resources Adminsitration.

She called up. She said she didn’t use it. She saiud they told her to go on Medicaid. She did it for her family. The person on the other end said “we were paying for you” and hung up when she continued arguing.

Now it’s been turned over to a collection agency.

Now look – she was advised to sign up for Medicaid by the state government.( this started before Obamacare went into effect with its mandatory insurance)

Nobody warned her to call up and cancel if she got a job- at least not outside the very fine print. She did not use any services after she got the job. They did not tell her they were paying an enormous monthly premium, and they certainly did not tell her the amount. She never saw a monthly dollar figure.

If a private company tried to do they would be guilty of fraud. It would not be alegitimate contract. A person has to have proper notice. There is no meeting of minds.

This is waht Obamacare is doing a massive scale

It’s just that nothing has hit the fan yet.

I don’t think they are going to sue anyone but maybe this massive debt could gove someone trouble with getting credit cards, an auto loan, or buying a house or renting an apaetment.