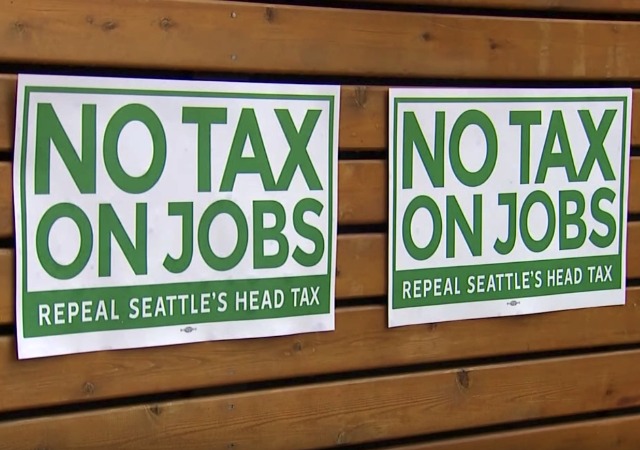

California may cut state’s pot taxes to help lagging legal sales

on January 29, 2019

13 Comments

Late last year, I noted that over-taxation and over-regulation have impacted the amount of tax generated from marijuana sales in California.