What is wrong with this picture? Spending cuts off the table as tax reform moves forward

401(k) Reductions Come Up Again in Tax Reform Talks

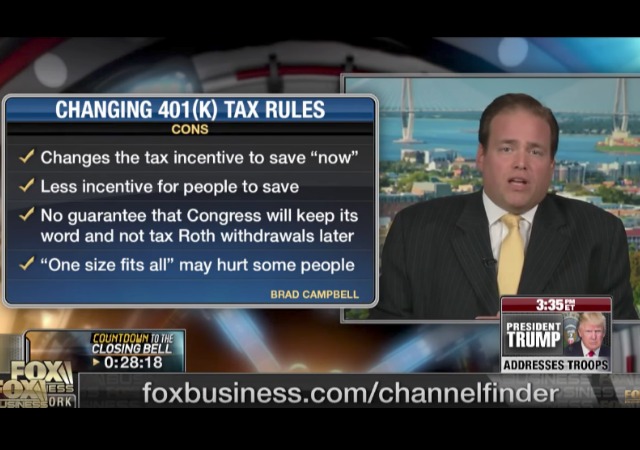

Last month, I blogged how Congress floated around making changes to 401(k) retirement plans in order to make up for lost “revenue” due to tax cuts. That change was taxing the earnings before a person places money into the fund.

Another idea has come up and it’s even worse. Now they are thinking about changing the pre-tax limit to $2,400 instead of $18,000. That’s an 87% change and could force people to put even less into their retirement.

It also adds fuel to Sen. Rand Paul’s (R-KY) opposition to the Senate budget bill that passed, which allows a clearer path to tax reform, but didn’t cut spending enough. Common sense tells us that he is correct.

The Proposal & Opposition

First off, let’s look at the proposal. The Wall Street Journal reported:

Lobbyists and others in the retirement and financial-services industries who have spoken to congressional staff and committee members say lawmakers are looking at proposals that would allow 401(k) participants to contribute significantly less before taxes than what is currently allowed in a traditional tax-deferred 401(k). An often mentioned amount is $2,400 a year. It isn’t clear whether that would apply only to 401(k)s or IRAs or both.

Currently, employees under age 50 can save up to $18,000 a year in a 401(k) before taxes, while those 50 or older can set aside up to $24,000. In an IRA, the annual contribution limits are capped at $5,500 and $6,500 for the same age groupings. The 401(k) limits are scheduled to rise to $18,500 and $24,500 in 2018.

If this happens, then people will have to change their savings amount or take home paycheck. WSJ explained:

For example, someone in the 25% income-tax bracket who puts $1,000 into a traditional 401(k) today would save $250 in taxes, reducing take-home pay by a net amount of $750. But if forced to put $1,000 in a Roth account, take-home pay would decline by the full $1,000, because there was no tax deduction. The advantage is that there would be no taxes due when the money is removed later from the retirement account.

Fidelity Investments Senior Vice President David Gray said this proposal has caused “significant concern” within the company because “it would essentially require trade-offs between the certainty of the immediate deduction and the prospect of tax-free retirement income.” He told the U.S. Chamber of Commerce that the changes would take one to two years to implement, too.

Investment Company Institute said that “Americans have saved $7.5 trillion in 401(k)-type accounts, plus $8.4 trillion in individual retirement accounts.”

Stop Spending

So the tax reform the administration wants, I guess, leads to lower “revenue.” But as I have stated over and over, unlike a sane person, the government refuses to stop spending. When confronted with a budget crunch, a sane person looks at his budget and crosses things off a list. You know, STOPS SPENDING.

Not the government. This is proof that Paul is correct: The Senate budget bill does not cut enough spending. WBKO reported Paul’s comments on why he voted no (emphasis mine):

“The American people are sick and tired of Congress spending recklessly with no end in sight. We can’t spend our way to prosperity. Today, the Senate considered a budget that simply didn’t measure up and spent too much. I will fight for the biggest, boldest tax cut we can pass, but I could not in good conscience vote for a budget that ignores spending caps that have been the law of the land for years and simply pretend it didn’t matter. We can be for lower taxes AND spending restraint.”

“This amendment will allow instructions so we could really do what we say we are going to do, which is cut spending. I think in light of the fact that we are for tax cuts, we ought to also be for reducing spending so we don’t explode the debt,” Dr. Paul said when introducing the amendment.

“What I’m asking us to do is to be responsible, budget for this, stay within the caps that we have self-imposed on us, and actually act like we really believe in what we say, that the debt is a problem.”

“My amendment will provide budget reconciliation instructions so that Republican senators can fulfill their promise. So that they can actually repeal Obamacare root and branch, as they promised.”

“My amendment provides budget reconciliation instructions to increase the tax cut to $2.5 trillion. If we are to believe this budget, it claims to save over $6 trillion over ten years – more than enough to go bigger, better, and bolder on cutting taxes.”

Paul said on the floor before the vote that Republicans should be for tax cuts and “for reducing spending so we don’t explode the debt.”

Only THREE REPUBLICANS voted with Paul on his amendment to cut spending and allow for easier tax reform: Jeff Flake (AZ), Mike Lee (UT), and my senator James Lankford (OK). Why did Republicans hate it? Because it included a cut to defense spending.

THREE REPUBLICANS joined Paul on his amendment that “cut discretionary spending by $43 million.” They were Flake, Lee, and Steve Daines (MT).

Remember this? STOP. SPENDING.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Taxation is the crack cocaine of Governments!!

…and we still have “Taxation Without Representation!!!!!!”

Senator Paul is quoted as saying:

“The American people are sick and tired of Congress spending recklessly with no end in sight.”

This simply isn’t true. The American people not only want the spending to continue, they wish to increase the spending. All the American people really want is for government to find another source of funds for the spending; any source other than themselves will suffice for most Americans.

We get the government we deserve…

It’s all very well to say stop spending, but cutting necessary spending can’t be an option. If something is necessary then one must spend it even if it means going further into debt. No matter how indebted someone is, you cannot tell him to stop eating, or to forgo necessary medical care, or not to heat his home in the winter. Those aren’t discretionary spending, and they’re not negotiable. Cutting military spending may well be seen as in that category.

While I agree with a lot of what you said, I have to remark that that there are cuts in military spending that could be made in areas, those cuts should be moved to other areas of military spending. I doubt that it would be wise to cut military spending in the net.

Additionally, lots of us have had years when we lived in cold houses and/or passed on regular medical care or dental care to make our ends meet without incurring debt. Some of us have eaten a lot of rice, and very little meat in hard times.

My wife and I know what you mean.

Sorry, Charlie, but military spending is always the first thing cut by Congress.

The federal government pends enormous amounts of money of stupid, unnecessary things. The taxpayers are paying for useless grants, such as measuring bovine flatulence and belching, homosexual harassment in Africa, studies on how people shop, save, what they want in a car, etc. None of which the government needs to know. Then we have all of the grant money which is given away every year to local governments. Billions go to planting trees at taxpayer expense [in many cases to replace trees which were cut down at taxpayer expense], to fix up local government buildings, to paint people’s houses, install storm drains which are not only unnecessary, but cause drainage problems for people who never had them before. On to grants to industry. Why is the government paying farmers to allow acreage to lie fallow? Why do the taxpayers have to subsidize fish farms or pay a person to raise goats instead of pigs or vies versa? Why do we, as taxpayers, pay for houses to be built which we do not qualify to get a government loan for? And, why are we paying for loans to people who can not qualify for a bank loan?

Then, we have the enormous bureaucracy needed to administer all of these drains upon the working taxpayer. Why do we need a Department of Education? All that department really does is handout money to local school systems. The same is true of the Labor Department. It is largely engaged in make-work. The few arbitrary services that it provides are duplicated by the states and its advisory functions can be handled by a few dozen people. Yet, it has a budget of $12 BILLION and over 17,000 employees. Then we have the EPA. It might be worthwhile, if it actually did its job. But, as we found out in Flint, Mi and the Gold King runoff fiasco, it can’t even get that right. Yet, we pay $8 billion for the “work” of 15,000 employees there. We could go one through every department in the federal government and see an incredible amount of waste.

On the social service side, again the spending is immense. And, much of it is unnecessary.

By eliminating unnecessary federal expenditures, the taxpayers could save hundreds of billions of dollars a year.But, the main job of the Congress, for the last 1oo years has been to spend OPM [other people’s money]. The main job of the Congress Critter is to bring home the bacon. And, they do that well. But, the windfall that a congressional district gets this year could result in higher taxes for the people living there next year when a congressional district in another state gets an unnecessary grant.

There will be NO spending cuts. That is why it has been so hard to get reasonable tax cuts and why we have deficit spending. It is the J. Wellington Wimpy school of government economics. Its practitioner’s motto is, “I’ll gladly pay you Tuesday, for a hamburger today.”

What are you talking about? There are Americans who do go hungry because they can’t afford food. Who do die when they can’t pay to keep their electricity or gas on in winter. Who do forgo necessary medical care because they can’t afford the premiums + deductibles + co-pays, all of which combined too often cost more than paying out of pocket. When people don’t have money, they have to adjust their spending. Not everyone has a credit card or other means of spending money they don’t have. How do you think people end up homelesss? They’re not all mentally-unstable, addicts, or runaways.

Losing a job and not finding another one relatively quickly means cutting out non-discretionary spending. Once you’re no longer dining out and have cut the cord / changed data plans / cut other frivolous spending, and still find that you can’t make ends meet, you move to checking spending on food, health care, and utilities. If you still don’t find a job, you are forced to whittle your budget still further by moving to cheaper housing (by choice or by foreclosure/eviction), selling a car, or otherwise taking more meaningful steps toward living within one’s new means.

People make decisions every day to adjust their spending. I’ve stood in line at the pharmacy and watched a man tell the clerk that he didn’t want his prescription (it was over $900) and walk away. I’ve personally had to down-size my spending at various points in my life, and it has indeed included cutting back on heat in winter and more healthy and nutrition-rich food choices (ramen was a staple for some time when I was much much younger).

Cutting spending from the bloated monstrosity our federal government has become is hardly a big ask. The problem here is that too many think that a tax cut is something that has to be paid for. That’s backwards.

Military spending can be looked at and there can definitely be cuts, but not in readiness, combat-related training, or equipment. They can stop throwing away millions on training troops to embrace transgender and other PC crap, studies that take years and the results of which are then ignored, and a hundred other lunatic things we hear about.

I’d like to see whole agencies dissolved or combined into a smaller, sleeker, more efficient single agency. We can get rid of the entire department of education, the IRS, and a zillion little sub- and quasi-agencies and offices that are redundant and /or useless. Have you looked lately at how many such taxpayer-funded crap is really layered across the federal government? It’s insane. Our government is a bloated monstrosity that has far too much power and costs far too much of our money.

That’s not even touching on the big three entitlements (four with ObamaCare) and subsidies for insurance, oil, and assorted other industries and sectors.

There’s plenty to cut, and the first place to look is not the military who are tasked with one of the few federal government mandates (national security).

Ramen v meat is discretionary spending. You don’t need meat. But food v starving, or heat v freezing, or medical care v dying, is not discretionary. People never cut those voluntarily; they stop spending on those things only when they literally have nothing to spend, and nobody is willing to lend them anything. If the choice is starving or running up debt, the responsible choice is to run the debt up and let future deal with the consequences. The USA, for all its woes, has not run out of credit. There are still people willing to lend us money, so no matter how reluctant we are to run up the debt, if it comes down to that or cutting necessary spending, such as the military budget, we have no real choice.

As Rags correctly wrote, there are certainly areas within the military budget that can be cut, but they’re matched by areas where more spending is needed, so that net-net defense spending can’t be cut and probably needs to increase. Hence my objection to Mary Chastain’s complaint that “Only THREE REPUBLICANS voted with Paul on his amendment to cut spending and allow for easier tax reform: Jeff Flake (AZ), Mike Lee (UT), and my senator James Lankford (OK). Why did Republicans hate it? Because it included a cut to defense spending.” It seems to me that that is a valid reason to hate it and to vote it down, despite the urgency of the national debt.

Which is not at all to say we can’t or shouldn’t make other cuts. There’s plenty the federal government is doing that it shouldn’t be. Mac45 listed many areas where significant savings can and should be found. But if I have to choose between a bill to cut spending that includes vital defense, and no cut at all, I’ll choose no cut.

Why target military spending. HUD, for instance, has managed to lose 500 Billion dollars. So let’s cut their budget by that amount. Do the same for every other department and agency – if they can’t track to the last $1,000 where their money was spent ax that amount from their budget.

Indeed. But the question was whether the GOP senators were wrong to oppose an amendment that would cut spending, if it hurt our defense, and I think they were not.

http://www.nationalreview.com/article/452966/republican-congress-fiscal-reform-tax-cuts-spending-cuts-bipartisan-democrats

The policy should be to cut taxes (carefully) and cut spending (carefully). There’s no reason not to, and there’s every good reason to to (as it were).

I’m so old that I remember Barracula noting the threat that government debp posed to the U.S., and pledging to cut entitlements. He lied, of course, but it was at least on his radar.

Der Donald never even did the pledging part, but promised NOT to cut entitlements but to keep them fully funded. MAGA was going to make us rich, rich, RICH! So rich, there’d be no need to cut. That was, again, a lie.

One wonders what America would look like with some leadership.

The problem is that we (collectively) get what we want, and right now “we” want to remove some tax burden without cutting any expenses. “We” want to deal with immigration without the interference of spending lots of money and intruding on our privacy and personal freedom. “We” are a fickle lot.

Politicians go to DC to spend money. There is no constituency in Congress to reduce spending to tackle our debt or deficit.

“Everyone wants to live at the expense of the state. They forget that the state wants to live at the expense of everyone.” F. Bastiat

I’m so disgusted by the Republican party and Congress that I could just spit. NO ONE is committed to good government; they all just want to buy votes, so they can keep their phony bologna jobs.

And I’m pretty frustrated with the American people, as well. We had a nice culture going there; it’s a pity that we’re all willing to be distracted by the bread and circuses while the barbarians are surrounding the city.

It’s the great paradox of progressive “thought”; they rely on and strum human weakness (greed, envy, selfishness, bitterness, hate etc.) to transform our culture and politics. Their desire, however, is a perfected humanity without the greed, envy, selfishness, bitterness, and hate they’ve purposefully fueled and nursed until it’s consumed much of our culture and politics.

If it weren’t such a clear and present danger, it would be interesting to sit back and watch this dawn on them as they try (and fail) to put the genie back in the bottle.

Anonamom

Agreed.

And might I say messing with American taxpayers savings is a no win for Trump. This would be a disaster.

Make the cuts and stop abusing the American taxpayer. Make the hard choices, stop the welfare abuse both corporate and social, build the wall, deport the illegals as you said you would, and be amazed at the billions saved on every level.

He alone as the president can’t do what he has campaigned for. I don’t know why we hold him alone accountable for these things, and I think that it is sad that we think that one person alone can do what we think is right.

There is no way they can address both tax reductions and spending cuts in the same bill. They can’t even pull off keeping their promise on repealing ACA. Get the tax reductions done and then circle back on spending cuts later. Remember, democrats as the GOP elites didn’t socialize America in one day.

If there’s anyone who knows how to snatch defeat from the jaws of victory…it’s Republicans.

Reason 28,620 to distrust anonymous-sourced media reports.

😉

@clayusmret

In politics the time to buy votes with the people’s money is always now. The time to cut spending is always later, which means never. The Uni party agrees on this because by and large the voters agree on this because by and large, half of them are not paying federal income taxes, even if they did for many years in the past or will for many years in the future.

Most people think of now and me, anything else is a mosquito to be batted away. It is human nature and that’s why the Founders idesigned a republic with limited democracy not the full democracy we are sliding towards.

#FillingtTheSwamp

Does anyone really think that a Republican Congress will a) cut taxes, or b) cut spending any more than a Democrat Congress will do? Show, Dog and Pony; one each. Same as with “repealing Obamacare”. Not gonna happen.

Can’t we go back and get the government from 1984? You know the one that had military spending large enough to win the cold war?

I don’t own a big house because I don’t want to pay to maintain it. The same is true for government.

401k plans enabled the ordinary income earner to protect himself from the impending disaster with SS. The government has proven over and over that whatever they are in charge of will be corrupted and fail.