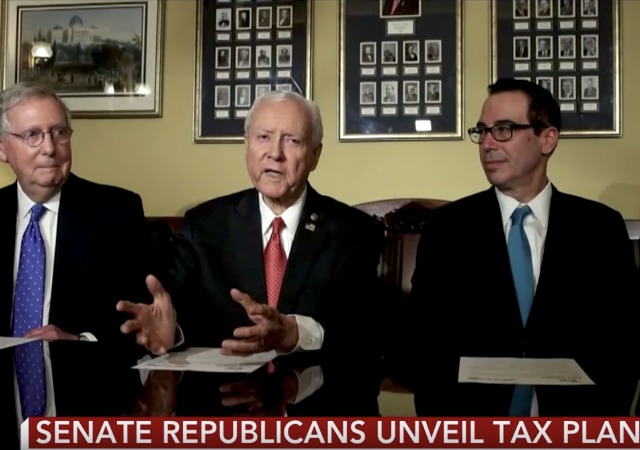

House Committee Passes Tax Bill as Senate Offers Its Own Bill

Both bills do not have language to repeal the individual insurance mandate.

The House Ways and Means Committee passed its tax reform bill down party lines on Thursday after a week of markups. The House is the next step.

The Senate has its own tax bill, which the two chambers will have to reconcile if each approves their own bill. From CNBC:

The House bill, called the Tax Cuts and Jobs Act, cuts the corporate tax rate from 35 percent to 20 percent, while moderately reducing household income tax rates. It changes some popular provisions such as the mortgage interest deduction, but leaves others, like the 401(k) tax benefit, unchanged.

The Senate plan largely overlaps with the House proposal, but does not repeal the estate tax and leaves the mortgage interest deduction unchanged.

The plan’s elimination of a federal tax deduction for state and local taxes has sparked the most resistance from the party. Already, Republican lawmakers in high-tax, blue states have pushed back against the provision.

House Bill

The corporate tax rate goes down to 20% from 35%. Companies can “immediately write off certain capital expenditures for five years.”

It will be hard to pass the tax bill through the House since it eliminates the state and local tax deduction. Republican representatives from high-taxed states like New York and New Jersey have already threatened not to vote for the bill.

The bill does allow people to deduct up to $10,000 on property taxes. However, a taxpayer cannot deduct mortgages for a second home or home equity loans. The taxpayer can deduct “only interest on the first $500,000 borrowed for a primary home.”

The House bill cuts the tax brackets down to 4: 12%, 25%, 35%, and 39.6%. It doesn’t have which incomes fall under each bracket.

The child tax credit goes up to $1,600.

Taxpayers cannot deduct their student loan interest under the House bill. Teachers will no longer have the ability to deduct any supplies they buy for their classrooms.

For medical expenses, the House bill eliminates the deduction for the “expenses that exceed 10% of a taxpayer’s income.”

The estate tax under the House bill will “double the current exemption to apply only to estates worth more than $10 million next year, and phase the tax out completely over six years.”

The Senate Bill

The Senate bill keeps all seven tax brackets, but lowers them: 10%, 12%, 22.5%, 32.5%, 35%, and 38.5%. The top bracket belongs to those making more than $500,000 a year or married couples who make more than $1 million.

The bill will “not change the current limit” on mortgage interest deductions, “which is for the first $1 million borrowed, but would end the deduction for home equity loans.” It will also eliminate the state and local tax deductions along with property tax deductions. The Senate may not encounter a problem with this portion since it does not have any Republicans from those high-taxed states.

The Senate has chosen to “double the exemption” of the estate tax next year, but will keep the tax.

The child tax credit will go up to $1,650.

It also does not change the deduction for major medical expenses, student loan interest, or teacher purchases.

The corporate tax cut will go down, but the bill delays that action for a year.

Neither bill includes language that repeals the individual insurance mandate put in place by Obamacare. That may change, though. From The Hill:

“This tax is deeply unpopular, it punishes working-class families for not being able to afford insurance, and repealing it would save over $300 billion,” said Sen. Tom Cotton (R-Ark.), who wanted the repeal included. “We can improve this bill, and the first priority should be to repeal this unfair tax.”

Senate Republican Whip John Cornyn (Texas), a member of the Finance Committee, told reporters that the panel is “taking a hard look” at adding the repeal of the individual mandate to the bill.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Not allowing home equity deduction, a way a lot of parents financed their child’s secondary education? Hose the taxpayer but don’t cut the budget. What is wrong with this picture?

this is rearranging the deck chairs on the Titanic. I hope they both fail.

Did it occur to them that if they repealed the O-Care mandate, that would go along way to getting them forgiveness for not having repealed the whole thing.

They have no desire for “forgiveness” from the Deplorable voters. They only want to punish us for getting out of “our place”.

And this is how Trump’s tax reform will die…

The Senate bill is at best one scoop of Vanilla ice cream. The House bill is one scoop of Vanilla ice with some spekinles on it. Just plain boring and not appetizing.

Adding the the repeal of the Obamacare mandate adds some chocolate, but still not there.

Here is what will probably happen. In the end, the so called tax bill dies, Republicans lose the House and the Senate in 2018 as a result and Trump is permanently hobbled as a president.

This is worthless. Shuffling the tax numbers around a bit is not what the 2016 election was about. If they think that this kid stuff will make Republican voters forget about the abject ‘Pub failures on all other fronts, say hello to a Democratic Congress. They’ll try to blame it on a “referendum on Trump” but it will be a referendum on Congress. Trump is the “hope”, and Congress had better be the “change” or something else will be changed.

And even if they’re fantasizing about reviving American industry in the face of ever-increasing foreign competition, this trivial stuff isn’t the way to do it. It’s just window dressing to con the rubes. Fiddling with various corporate tax rates is trivial. The expense of the work force must be drastically reduced, and the only way government can to that is by drastically lowering all taxes on everybody. Which of course it will never do.

So Congress will pretend. As usual.

The Dems are extraordinarily weak for the upcoming elections. But the Repubs are even weaker. And they have nobody else to blame for that.

First of all, the Congress can NOT simply reduce taxes to any significant degree. In order to do that, it would have to cut spending to a significant degree. And, it can not do that either.

In 2016, 26% of federal spending went to Social Security payments. 24% went to Medicare and other assorted medical assistance programs. 9% went to various safety net programs. And 6% went to pay down the interest on the national debt. Finally, 8% went to veterans and retired federal employees benefits. That makes up 73% of federal spending. 16% went to military spending. Now we are up to 89%. And the remaining 11% went to all other needs.

So, about the only part of the budget which can be reduced, to any significant degree, is the 11% of all other spending. SS and Medicare and welfare [social safety net programs] as well as veterans and federal retiree’s benefits can not be touched. The shear size of the entitlement programs has become so huge, that there is no way to significantly reduce the budget, safely. The only hope that exists to reduce the deficit, is for the economy to grow significantly. And, that will take several years.

So, no significant tax cuts will take place this year, if ever.