Silicon Valley Cities Still Eyeing a ‘Google Tax’ After Head Tax Failure in Seattle

on June 18, 2018

9 Comments

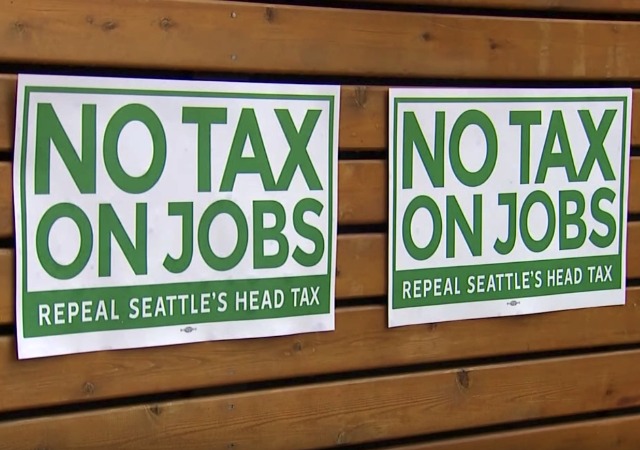

I blogged last week that Seattle's city council pulled its head tax less than a month after the members passed it after legitimate pressure from Amazon, Starbucks, and other businesses.

I detailed in my blog the trouble with unnecessary corporate taxes such as fewer new jobs and less expansion. Despite this, the cities that make up California's infamous Silicon Valley wants to pass its own head tax.