NY phasing in $15 minimum wage

on April 02, 2016

17 Comments

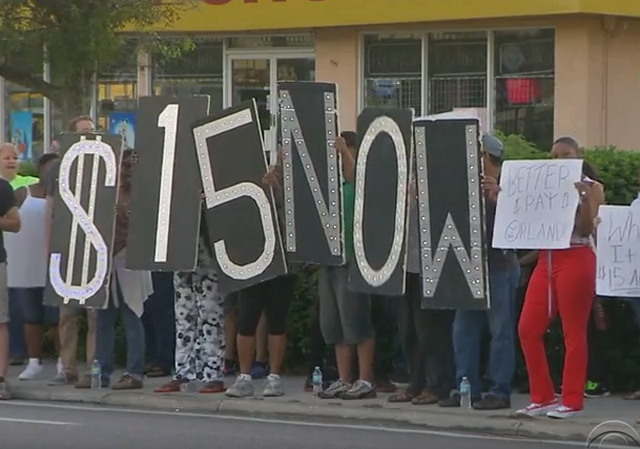

The State of New York just passed two significant measures. One is a new family leave policy and the other is a new minimum wage of $15 an hour.

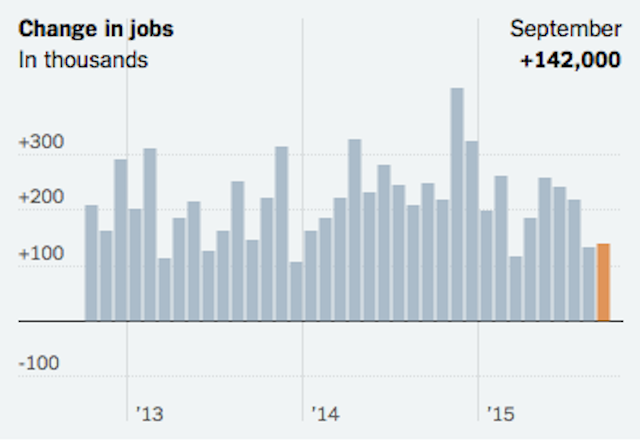

Liberals are pretty stoked about both items. Smaller businesses, particularly in hard-hit upstate NY, not so much. Expect the people intended to benefit -- lower wage workers in marginal industries -- to be hardest hit because there will be fewer jobs. Entry level positions, where many people get their start, will be harder to come by.

New York Mag reports:

New York Just Created a Revolutionary New Family-Leave Policy You say you want a revolution? A political, social, economic policy upheaval that will dramatically alter the playing field for millions of Americans by significantly reducing economic and gender inequality?