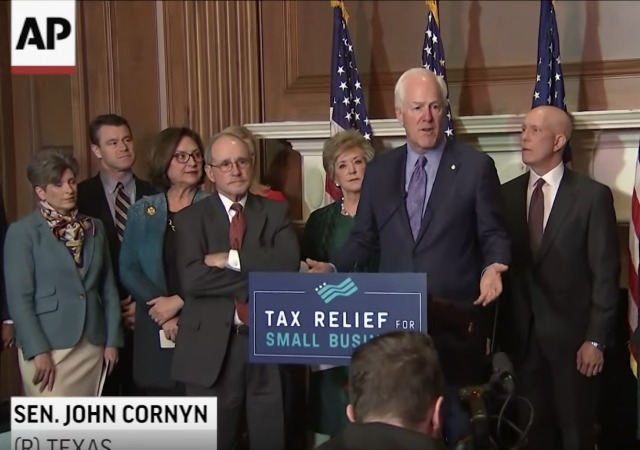

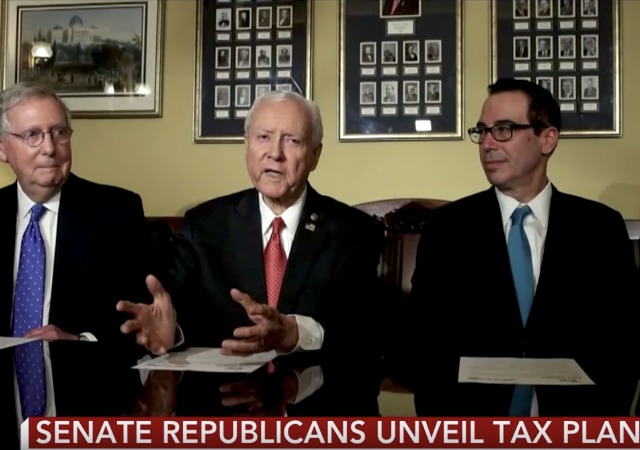

Errors and Reconciliation: The GOP Has a Lot to Do to Pass the Tax Bill by Christmas

on December 11, 2017

12 Comments

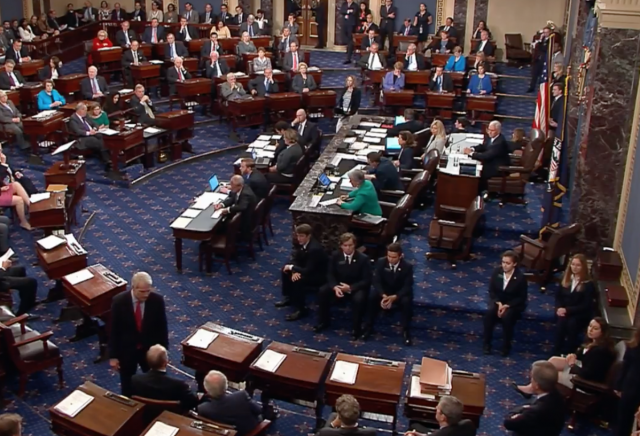

The GOP in Congress are no doubt desperate for a victory after the failed Obamacare repeal attempts, but that desperation could come back and bite them. They want to pass the tax bill before Christmas, but all the rushing and late nights have caused errors. From The Washington Post:

Questionable special-interest provisions have been stuffed in along the way, out of public view and in some cases literally in the dead of night. Drafting errors by exhausted staff are cropping up and need fixes, which must be tackled by congressional negotiators working to reconcile competing versions of the legislation passed separately by the House and the Senate.