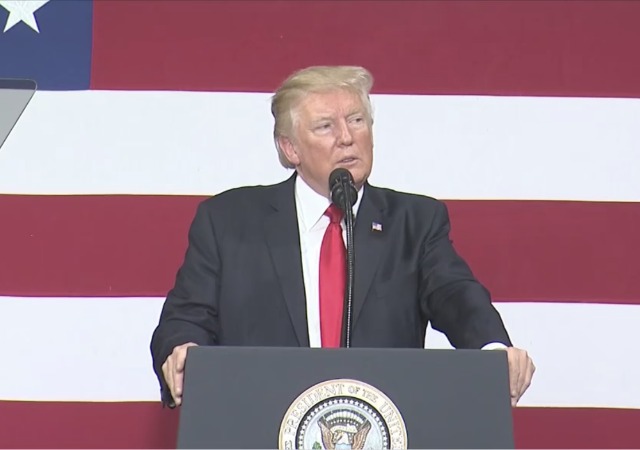

Trump Travels to Missouri to Push Congress on Tax Reform

“Our jobs will both stay here in America and come back to America.”

As Congress is scheduled to return from recess next week, President Donald Trump traveled to Missouri on Wednesday to encourage Congress to tackle tax reform and actually get the job done…unlike the ordeal with Obamacare. From Yahoo! News:

“I don’t want to be disappointed by Congress, do you understand me,” Trump said, pointing into a crowd that included much of the state’s GOP Congressional delegation. “Do you understand?”

“I think Congress is going to make a comeback,” the president added. “I hope so.”

Trump specifically applied pressure to Missouri Democrat Senator Claire McCaskill and reminded everyone Congress has a chance to make an actual change:

“We must lower our taxes,” Trump said. “And your senator Claire McCaskill, she must do this for you and if she doesn’t do it for you, you have to vote her out of office.”

Trump rallied supporters as he tries to bring tax reform to the front of the agenda for Congress, as lawmakers return from the August recess next week. He called this a “once-in-a-generation opportunity to deliver real tax reform for everyday hard-working Americans.”

Then he branched out to other Democrats before he encouraged both sides to come together, according to The Daily Mail:

The president told his supporters that Democrats are standing in the way of tax reforms that would put more money in their pockets, ‘just like they obstructed so many other things, including administration appointments and healthcare.’

‘Not one vote. We got not one vote to try and fix health care,’ Trump said, revisiting his Obamacare repeal criticisms.

He said later that Democrats, in addition to Republicans and Independents, must embrace what he described as ‘pro-American tax reforms.’

‘Let’s put — or at least try to put — the partisan posturing behind us and come together as Americans to create the 21st century tax code that our people deserve,’ Trump said to applause.

Trump also said tax reforms “would allow America to export more of its goods and less of its jobs.” The Daily Mail continued:

‘Our jobs will both stay here in America and come back to America. We’ll have it both ways. Millions of struggling citizens will be lifted from welfare to work. They will love getting up in the morning. They will love going to their job. They will love earning a big, fat, beautiful paycheck. They will be proud again,’ he said.

It’s very important to remember that the White House will not release its own tax reform plan. Over the last couple of months, the White House has released its goals for tax reform. Back in April, Secretary Treasury Steven Mnuchin and Cohn released a one-page outline, which included cutting the corporate tax rate to 15% and forming three tax brackets.

Last week, Trump’s top economic aide Gary Cohn told The Financial Times that the White House will place the responsibility for tax reform on Congress:

“The ‘big six’ have been meeting and have come up with an outline . . . and we have a good skeleton that we have agreed,” Mr Cohn said in a reference to the lawmakers, himself and Mr Mnuchin. “Now it is Chairman Brady’s time to get the [House] ways and means committee together to put flesh and bone on it, and they will do it next week when the House comes back into session.”

That big six included Cohn, Treasury Secretary Steven T. Mnuchin, Speaker of the House Paul Ryan, Senate Majority Leader Mitch McConnell, Senate Finance Committee Chairman Orrin Hatch, and House Ways and Means Committee Chairman Kevin Brady. The six men met last month and released a statement about tax reform:

Above all, the mission of the committees is to protect American jobs and make taxes simpler, fairer, and lower for hard-working American families. We have always been in agreement that tax relief for American families should be at the heart of our plan. We also believe there should be a lower tax rate for small businesses so they can compete with larger ones, and lower rates for all American businesses so they can compete with foreign ones. The goal is a plan that reduces tax rates as much as possible, allows unprecedented capital expensing, places a priority on permanence, and creates a system that encourages American companies to bring back jobs and profits trapped overseas. And we are now confident that, without transitioning to a new domestic consumption-based tax system, there is a viable approach for ensuring a level playing field between American and foreign companies and workers, while protecting American jobs and the U.S. tax base.

The biggest thing is that they all agreed to stop supporting the border adjustment tax.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

A federal district court judge named Orlando Garcia enjoined the new Texas law banning sanctuary cities and forcing local LEO’s to cooperate with the feds. Is anyone preparing an analysis of that?

Quick take: This judge got the law exactly backwards. The whole premise of “sanctuary cities” is that the feds can’t require cities to cooperate with them. Only the states can do that. All the feds can do is ask nicely, and so long as state law is silent it’s up to local authorities whether to say yes or no. State law can force the locals to say no (as in California) or yes (as in Texas).

What may have confused this judge is another principle, that if the feds don’t want local help, the locals have no authority to enforce federal law on their own (this is what got Joe Arpaio in trouble), and states can’t give them that authority, let alone require them to do so. But if the feds are asking, as they are in this case, states absolutely can tell locals what they should do about it.

Pres Trump wants to push tax reform, Ryan and McConnell are aligning the Never Trump Congressional troops and McCain rushes back to DC to help stab the President in the back.