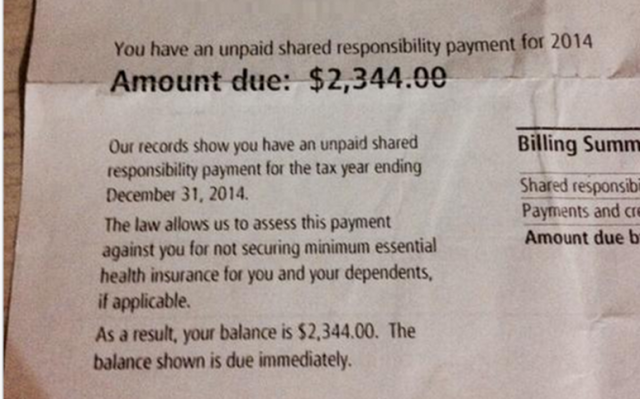

12 of the 23 taxpayer funded non-profit co-ops created under the Affordable Care Act are shutting down, all due to financial trouble. Now, the nation's largest non-profit co-op is under investigation by state authorities.

New York’s largest co-op Health Republic, also on the

failure closure list, is in far worse shape than originally reported. Other co-ops will continue offering their plans through the end of the year, but Health Republic of New York is in such dire financial shape, they’re closing a month early. The closure will leave more than 200,000 New Yorkers with cancelled health insurance plans.

Monday,

The Hill reported the New York Department of Financial Services launched an investigation into Health Republic's financial reporting:

“NYDFS investigators are collecting and reviewing evidence relating to Health Republic's substantial underreporting to NYDFS of its financial obligations,” the state said in a statement. “Among other issues, the investigation will examine the causes of the inaccurate representations to NYDFS regarding the company’s financial condition.”