Weighing in on the “Trans Fat” Ban

on June 23, 2015

20 Comments

The federal government is regulating the American meal, again.

This time, the target is trans-fat!

The Obama administration is ordering food companies to phase out the artery-clogging trans fats that can lead to heart disease, the country's leading cause of death. The Food and Drug Administration announced Tuesday that it would require food makers to stop using trans fats — found in processed foods like pie crusts, frostings and microwave popcorn — over the next three years.It turns out California has banned trans fats since 2008, when our "conservative" Governor Arnold Schwarzenegger signed a bill outlawing them. When I was at the local doughnut shop yesterday, with my husband (who requested the fat-laden extravaganza for his Father's Day Breakfast), I asked the proprietor about living with the trans fat ban. She explained that while she readily complied with the rules, at added expense passed onto the customer, some other shops continued using the banned ingredients. She noted that several were closed temporarily, until legal items arrived. These facilities were then regularly reinspected for compliance. Imagine this on a large scale. It is anticipated that the conversion will cost food manufacturers billions .

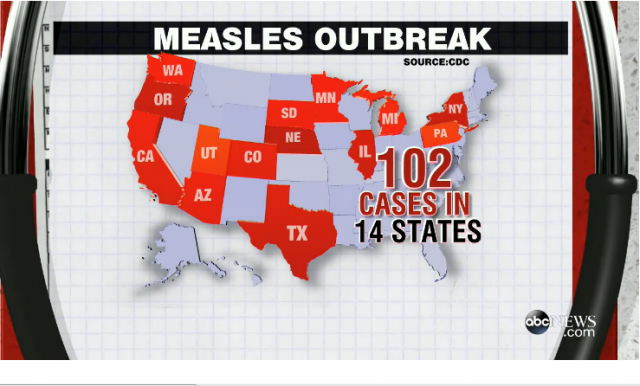

The Obama Administration must be worried that the lack of immunization for childhood diseases is going to blossom into a major healthcare PR crisis of Ebola-like proportions, because its friends in the mainstream media are now smearing those who don't vaccinate with that vile term, "Tea Party." How, then, can these mainstream publishers explain the preponderance of progressive non-takers?

The Obama Administration must be worried that the lack of immunization for childhood diseases is going to blossom into a major healthcare PR crisis of Ebola-like proportions, because its friends in the mainstream media are now smearing those who don't vaccinate with that vile term, "Tea Party." How, then, can these mainstream publishers explain the preponderance of progressive non-takers?