Does Connecticut’s Governor Finally Comprehend Dangers of “Taxing the Rich”?

on June 03, 2017

32 Comments

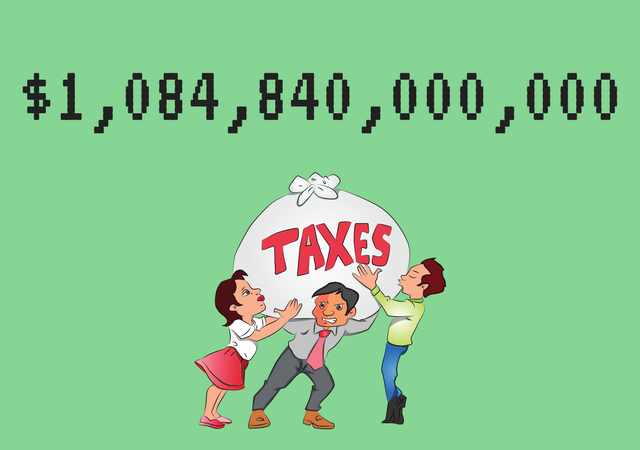

Connecticut governor Dannel Malloy (D) is facing a situation that may make him reconsider his position on taxing the wealthy. Aetna insurance company, based in Hartford since 1853, is looking for a new state to call home, a state that is more business-friendly in terms of taxation.

Having lost GE to Boston last year due to the massive tax load piled on businesses, Malloy is desperate to keep Aetna in Connecticut, but it may be too little, too late.

The Wall Street Journal reports: