Judge Orders IRS to release Tea Party target list

on April 05, 2015

16 Comments

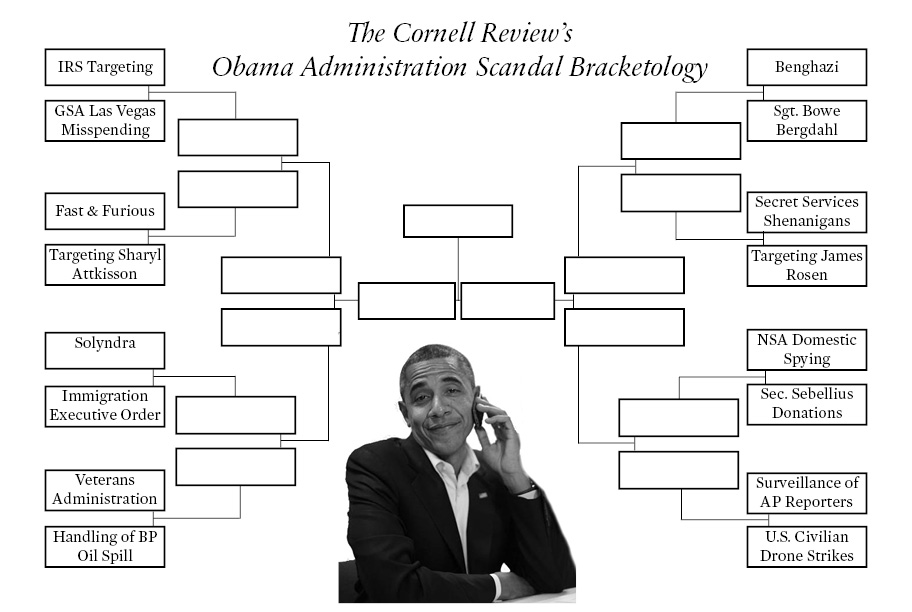

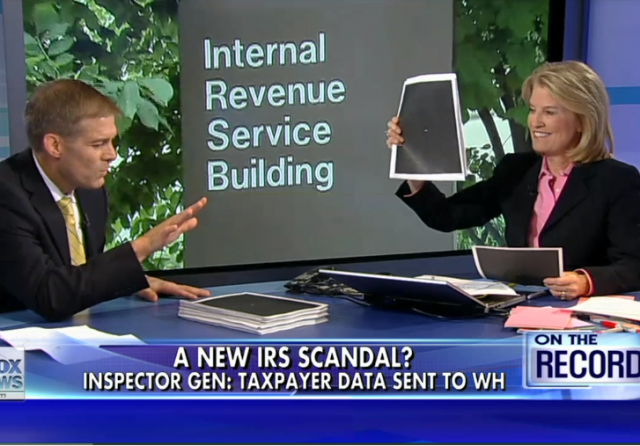

The Department of Justice may have let Lois Lerner off the hook, but a judge has ordered the IRS to release the names of the Tea Party groups that were singled out for scrutiny.

Stephen Dinan of the Washington Times:

Judge orders IRS to release list of tea party groups targeted for scrutiny A federal judge ordered the IRS this week to turn over the list of 298 groups it targeted for intrusive scrutiny as the agency defends against a potential class-action lawsuit by tea party groups who claim their constitutional rights were violated. The IRS had argued it shouldn’t have to release the names because doing do would violate privacy laws, but Judge Susan J. Dlott, who sits in the Southern District of Ohio, rejected that claim and ordered the tax agency to turn over any lists or spreadsheets detailing the groups that were targeted and when they filed their applications. Judge Dlott also ordered the IRS to say whether a partial list of targeted groups reported by USA Today is authentic as a number of tea party groups try to win certification for a class action lawsuit against the IRS.