China Complains to WTO Over Trump Administration’s Tariffs

on September 02, 2019

13 Comments

China filed a complaint to the World Trade Organization (WTO) over the tariffs set in place by President Donald Trump's administration.

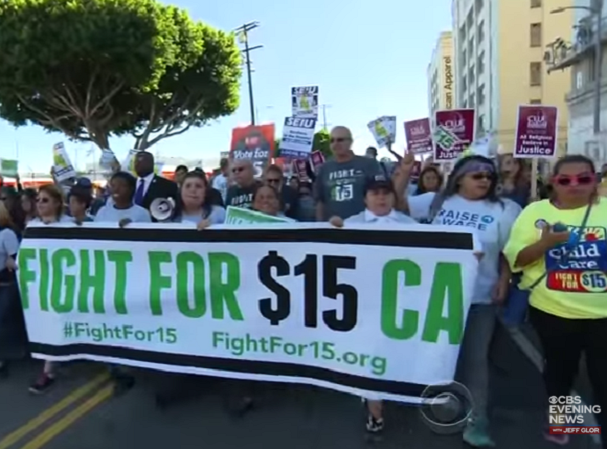

The 15% tariffs went into effect on Sunday. It covers items like tools, apparel, some shoes, and a few electronics. The overall value of the goods adds up to $111 billion.