Dakota Access Pipeline Update: Judge orders redo of environmental review

on June 19, 2017

16 Comments

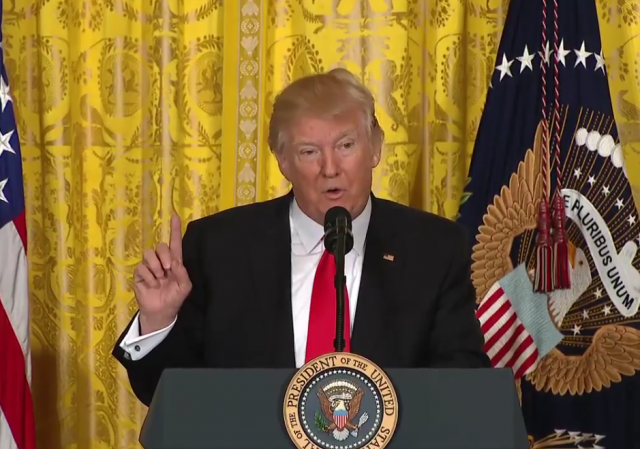

President Trump has faced many opponents during his quest for the White House and the early days of his administration. However, no group seems to be as powerful as the judiciary when it comes to gutting his policies.

Legal Insurrection readers will recall that one of Trump's first acts as President was signing the executive order to move forward with the Dakota Access and Keystone Pipelines. The good news is that the Dakota Access Pipeline began shipping oil on June 1.