In late February, the Washington Post ran an editorial Solution Politics in Virginia that began:

IN VIRGINIA, A REPUBLICAN governor and a GOP-dominated legislature have joined forces with Democrats to enact the first long-term increase in transportation funding since the Reagan administration — and the state’s biggest tax increase in nearly a decade. That is a signal achievement, and one that will stamp Robert F. McDonnell’s governorship as a long-term success.

I’ve emphasized the phrases here that show a certain mindset, all too common in the mainstream media. This mindset is the idea that equates governing with taxing (and spending).

And it’s not just in Virginia where we find the Washington Post cheerleading for more taxes. In an editorial two weeks ago, Mr. O’Malley’s Green Light and this week, Md. Democrats tackle a transportation deficit, the Post is encouraging Virginia’s neighbor to the north to hike taxes again. The latter editorial argues:

THE RULING Democratic triumvirate in Annapolis — Gov. Martin O’Malley, Senate President Thomas V. Mike Miller Jr. and House Speaker Michael E. Busch — has linked arms behind a transportation plan designed to keep Maryland in the road-building business beyond 2017, when it’s projected to run out of money for new projects. Now they will have to mount an effort to sell it.

In addition to reaching recalcitrant state lawmakers, the leaders’ pitch needs to target a skeptical public. Recent polls, including one conducted by The Post, have shown that Maryland residents have not made the connection between terrible traffic and the erosion of the state’s main source of transportation funding, the gasoline tax, which hasn’t been raised in 20 years.

Mr. O’Malley has proven himself adept at making the case for expanding gambling; legalizing same-sex marriage; subsidizing higher education for immigrant students; and raising taxes to balance the budget. The transportation bill may be his toughest sell yet and a stiff test of leadership. It would raise a variety of taxes and sensibly link transportation revenue to inflation, while potentially bumping up gas prices at the pump by 16 cents a gallon over the next couple of years.

Here the Post gives O’Malley too much credit. O’Malley has the advantage of a veto proof majority. This isn’t a matter of persuasion. Even if a majority of the state didn’t agree with these initiatives, a majority of the legislature did. More taxes again could be a problem as O’Malley is in his final term as Governor. His constituency now is the Democratic party (where tax hikes are a sign of “responsibility”) not the state of Maryland. Legislators who will face voters again may not be as willing to raise taxes significantly a third time in eight years. (Furthermore, while the Post may not admit it, there was very little scrutiny into any of these initiatives. Additionally, those opposed to gay marriage or in state tuition for children of illegal immigrants were dismissed by as bigots – not only by the political elite, but my much of the media too. Demagoguery, in which the Post itself participated, played a role in getting these measures passed.)

Another tax hike is not a sign of leadership, though. Commenter, Towson Lawyer, noted last week that Maryland’s government has a habit of raiding the the transportation fund for other expenses. Christopher B. Summers of the Maryland Public Policy Institute has written more extensively about this problem.

Maryland is not alone in diverting transportation funding. The Wall Street Journal, in objecting to Virginia’s eventual transportation bill, wrote:

It’s especially unfortunate to see Mr. McDonnell take this tax turn in the last year of an otherwise successful tenure. One of his two Democratic predecessors passed a major tax increase that was supposed to ease gridlock but instead financed a new, higher general spending plateau. The state’s own audit commission reports that the budget swelled to $39 billion in 2011 from $23.5 billion in 2002, a 66% spending increase.

But it’s not only obvious taxes that the Washington Post advocates. Now it’s Standing up for statewide bag tax in Maryland:

SINCE SAN FRANCISCO first moved in 2007 to staunch the deluge of non-biodegradable shopping bags that harm wildlife and litter streets, waterways and sewers, other jurisdictions have followed suit, including the District, three years ago, and Montgomery County, last year. As the use of 5-cent bag taxes and similar measures have spread, Americans have learned two lessons: The measures are effective at cutting litter and popularizing the reuse of bags; and industry arguments against such measures are nonsense.

That has raised hopes in Maryland of enacting the country’s first statewide bag taxthis year. (Hawaii has a de facto ban, since each of its four counties prohibits the use of carryout plastic bags at checkout counters.) Predictably, plastic-bag manufacturers are again hoping to kill or subvert legislation that would benefit the environment.

The evidence from the District and Montgomery is overwhelming. In the District, plastic bag use has dropped by at least half since the 5-cent tax went into effect in 2010. In Montgomery, the drop was significant — about a third — though not as sharp as in the District; however, the county collected more than $2 million from the tax last year, which will help it pay to remove litter that includes plastic bags.

The “overwhelming” evidence isn’t. Here’s how the Post reported the first year results of the bag tax: Montgomery County bag tax not changing public behavior dramatically:

The idea was not to squeeze more money from taxpayers, county officials said, but to change their behavior. The nickel fee was meant to discourage use of the bags, estimated to make up one-third of the litter found in the streams and stormwater ponds in the county and a significant portion of the more than 120 tons of trash that flows into the Anacostia River each year from Montgomery tributaries. As public awareness of the tax increased and shoppers relied on reusable bags, the thinking went, revenue would start to decline.

The cultural shift has not been as dramatic as hoped. County shoppers have been more willing to pay for their plastic than anticipated. Officials projected a 60 percent decline in bag usage for the current fiscal year — from 82.9 million to 33.1 million. But through the first five months of fiscal 2013, businesses have already sold 24.8 million traditional bags.

The article also reports:

But environmental groups that conduct periodic cleanups of county stream banks report a significant reduction in the number of bags recovered.

Unfortunately, the article provides no hard evidence to confirm those observations.

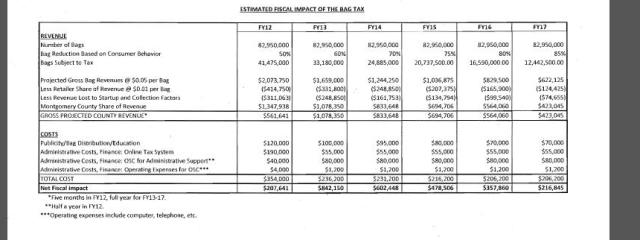

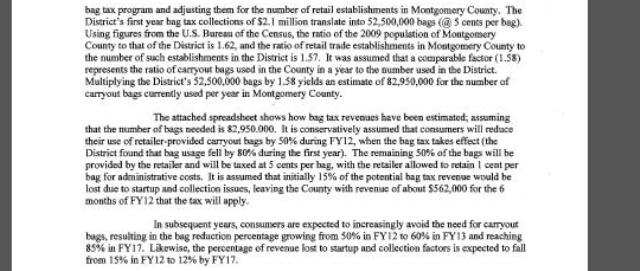

The numbers that are available are the projections of plastic bag usage compiled by the Montgomery County Council in support of the legislation. The final page has a spreadsheet showing the projections of the council.

(The full .pdf document is here.)

First of all the projected decreases in bag usage are all round numbers. According to the document (see below) it appears that the numbers were derived by some by a rough comparison to Washington D.C.’s tax and its consequences. These estimates are the product of estimates and a single point comparison multiplied by a fudge factor. In other words they are bunk.

The Post’s report on the bag tax acknowledged that the tax didn’t change behavior as much as the legislature assumed it would. (The projected drop in usage itself was speculation validated by contrived numbers.) And on that basis the Post illogically declares the bag tax program a huge success that must be applied statewide. Why didn’t the Post, at least, wait until the program had clearly met its contrived goals?

Michael Rubin has written about his personal experiences with the bag tax. He fought it by taking his shopping to Virginia. If a significant number of Montgomery County residents took their business to other jurisdictions then the bag tax was even less successful than advertised. (A higher percentage of shoppers bought the bags out of a lower number of total shoppers.) Good journalists would see if retails sales in Montgomery County suffered since the imposition of the tax.

Another point that’s ignored is that Montgomery County created a new office to oversee the bag tax which would cost over $500,000 to operate over its first two years and projected to cost in excess of $200,000 a year subusequently. Is there any evidence that the supposed cost savings from environmental cleanups cost more than that? Even if the bag tax has been effective – a dubious proposition – it would be hard to argue that it is cost effective.

The editorial also dismisses reports that reusable bags can spread disease or lead to shoplifting.

What these editorials show is a commitment to government exerting its control over the economic aspects of people’s lives. (In areas of morality, the Washington Post, of course, recommends less government intrusion.) There’s no sense that governing involves prioritizing instead of expanding. When politicians want more of our money we can count on the Washington Post to cheer them on rather than scrutinizing their claims. It would be nice to see some editorial recommending that government be less intrusive, allowing business to thrive thus leading to more tax dollars due to increased commerce. Instead the Washington Post puts its faith in government expansion rather than looking out for the finances of its readership.

Author’s note: This post was written and scheduled before the Jewish Sabbath.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

How else, but with OPM (Other people’s money) would Post reporters be able to afford a subsidized ride on the metro to get to their place of work?

It’s easy to understand why they cheer for new taxes. They live and work in Washington DC, and that’s where the tax money flows eventually where it can be doled out to the little people, after the logic-free zone takes it’s piece of the pie.

While I do agree with the basic thesis of this article, that the Washington Post equates successful governing with increased taxing and spending, one of these issues is far more complex.

The transportation mess in Maryland is epic, and the cost of long-overdue highways has been driven up radically by NIMBYs and pull-up-the-ladder jerks who, now that their children are out of school, want to be exempted from paying for schools. The coupling of a plan to deal with the mess along with something approaching a realistic plan to pay for it, is actually a sign of a return to sanity, in my personal opinion.

The bit about the bag tax, however, is pure Maryland Good Gummint. The reason we got the plastic bags in the first place is because the environuts demanded we stop “killing trees” — never mind that growing and using trees would sequester carbon, that paper bags are biodegradable, and that plastic bags are relatively persistent. I define an environut as a very sincere person who has no science background, distrusts anybody who does have a science background, and doesn’t know the difference between ppm (parts per million) and ppb (parts per billion). Environuts are gullible, and in this case, they are paying for added government employees, which was probably the real point of the legislation in the first place.

Valerie, I agree about the NIMBY politics, which really does muck up otherwise thoughtful municipal planning.

Also, I pay property taxes, but wish to God it wasn’t paying for teacher’s union dues. There has to be a way that money for kid’s education can get to kids without running through the governmnet grinder and corrupt largess administrations.

This is why I advocate for privatizing education. Sure local school boards can provide oversight and curriculum standards, but we need to give incentive to tutors and teachers who get results, and not have to deal with union rubber rooms.

Wouldn’t it just be grand if a transportation tax were actually used to keep transportation infrastructure current, rather than being dumped into a general and wasteful government spending account.

As to your final point, I am in total agreement. Environmental science is filled with feel good data cherry pickers and those who ignore the actual results of failed environmental policies.

Anyone remember cash for clunkers?

http://jalopnik.com/5973474/surprise-cash-for-clunkers-was-really-bad-for-the-environment?sessionId=004ab0c5-caf8-49ea-8284-7e8b228e5b21

From what I learned, less than half the money raised from these taxes is meant for road construction. In fact a greater share of these taxes is meant for (subsidizing) public transportation.

While I don’t necessarily object to toll roads, the O’Malley administration has totally botched the Intercounty Connector. It appears to be underused. I wonder if they lowered the tolls, if they’d get more usage out of it and change peoples driving habits.

Additionally, for someone looking to for a shortcut, its route is too far out of the way to be useful in many cases.

Valerie, I agree.

Here’s the real issue: spending versus STUPID spending.

If the spending fixes the problem for which it was passed to fix, fine. I live near a newish toll road (I-355) that has greatly eased my transportation around the south and west suburbs of Chicago. I’m willing to pay the toll because it makes my life easier. My taxes recently financed a widening of I-80 and of US-30 — again, my life is easier, and from what I could see (driving past it every day) the work has been competently done.

We have a good library in m town — I’ll pay for it. We have a pretty decent forest preserve district — ditto.

What galls me is the STUPID spending. Here Mr. Gerstman’s point about the plastic bag nonsense is right on target. There’s plenty of stupid spending in government, and every dollar thrown at foolish projects is a dollar not spent on things we need (or, returned to my pocket).

WaPo and the rest of the liberals don’t get this. That’s why they endorse all these crack-pot schemes. It sounds good and it throws money at some constituency; never mind that even a cursory analysis shows that it’s stupid. That’s why we have trillion dollar federal deficits and states that run huge, hidden deficits.

But a fair number of Pubs and conservatives don’t necessarily understand that there indeed some needed spending, and that there are citizens out there who understand the difference.

I’ve often thought that a Pub who could articulate this difference clearly would do very well in a purple/blue state or district — keep the needed spending, dump the stupid spending, and set taxes accordingly.

Impossible to render unto Caesar his due when Caesar believes that G_d has no place in the allocation and he (Caesar) insists on it all.

Caesar and his cheerleaders like the WP and its ilk have no intention of acting like angels (Madison (Fed. 51), “If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls on government would be necessary”); in fact, fedgov (& its state & local counterparts) has every intention of never being reasonable.

Which is why constitutions are written – to limit. But the paper handcuffs of constitutions (& “oaths” taken to obey them! Ha!) are meaningless without those whom the people elect understanding limits and obeying oaths.

Prognosis. So long as we have public schools and public unions and an outrageously socialist media, then the long term outlook is not good.

I’m not a fan of tax increases, but Virginia’s roads need lots of repairs. That will cost more money than the State currently has. I favor user fees like tolls; I would put tolls on all limited access (freeway-style) roads, but that idea is disliked by a large majority of voters. That being the case, some sort of tax increase is the only alternative.