Bernie Sanders Unveils ‘Tax on Extreme Wealth’ Plan Which Includes National Wealth Registry

As of March 2019, America has 607 billionaires out of around 327 million people.

Self-proclaimed socialist millionaire 2020 Democratic presidential hopeful Sen. Bernie Sanders (I-VT) is going all in.

Sanders announced today that billionaires should not exist. He developed a tax plan specifically to target the few billionaires who exist in America.

Billionaires Shouldn’t Exist

There should be no billionaires. We are going to tax their extreme wealth and invest in working people. Read the plan: https://t.co/RJDLvX5H4c

— Bernie Sanders (@BernieSanders) September 24, 2019

Does he truly think these people made all of this money sitting on their butts all day? That this money magically appeared out of nowhere?

Even if they inherited their wealth so what!? It’s THEIR money.

The plan would also force people to allow the IRS to asses their wealth on an annual basis. As of now, the IRS only does that when they die.

Sanders’ plan would allow some leniency on “assets that are difficult to appraise.” The department would provide an option for “taxpayers to have appraisals done periodically instead of annually.”

Isn’t that nice of him? It gets worse.

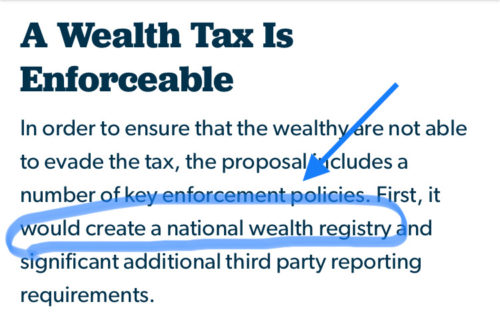

Look at the title of this section. Plus a national wealth registry? Sounds Stalinesque, doesn’t it? What a surprise for someone who honeymooned in the good old USSR.

Sanders tries to justify his plan because it’s constitutional under that wretched 16th Amendment. He also insists this is not a radical idea.

You want people to pay their “fair share?” Get rid of the loopholes and exemptions.

America Doesn’t Have Many “Evil Rich” Households

As of March 2019, America has 607 billionaires out of around 327 million people. That’s what, 0.0000019% of the population?

Taxes would go up for those making millions, including Sanders:

It would start with a 1 percent tax on net worth above $32 million for a married couple. That means a married couple with $32.5 million would pay a wealth tax of just $5,000.

The tax rate would increase to 2 percent on net worth from $50 to $250 million, 3 percent from $250 to $500 million, 4 percent from $500 million to $1 billion, 5 percent from $1 to $2.5 billion, 6 percent from $2.5 to $5 billion, 7 percent from $5 to $10 billion, and 8 percent on wealth over $10 billion. These brackets are halved for singles.

Under this plan, the wealth of billionaires would be cut in half over 15 years which would substantially break up the concentration of wealth and power of this small privileged class.

Again, America has only 607 billionaires. America has around 11.8 million households worth $1 million. But that’s only 3% of the total population.

It does not seem like enough to pay for all of the social programs Sanders wants to implement:

In order to reduce the outrageous level of inequality that exists in America today and to rebuild the disappearing middle class, the time has come for the United States to establish an annual tax on the extreme wealth of the top 0.1 percent of U.S. households.

This wealth tax would only apply to net worth of over $32 million and would raise an estimated $4.35 trillion over the next decade. Anyone who has a net worth of less than $32 million would not see their taxes go up at all under this plan.

The revenue raised under this plan would be used to fund Bernie’s affordable housing plan, universal childcare and would help fund Medicare for All.

Oh, but in order for this plan to work, the IRS needs more funds. He buried that little note in the section about why the government can enforce the wealth tax:

Second, it includes an increase in IRS funding for enforcement and requires the IRS to perform an audit of 30 percent of wealth tax returns for those in the 1 percent bracket and a 100 percent audit rate for all billionaires. Third, the wealth tax includes a 40 percent exit tax on the net value of all assets under $1 billion and 60 percent over $1 billion for all wealthy individual seeking to expatriate to avoid the tax. Finally, the wealth tax proposal will include enhancements to the international tax enforcement and anti-money laundering regime including the strengthening of the Foreign Account Tax Compliance Act.

Gee, I wonder why he put that fact in that section. Nice way to try to hide it.

The Hypocrisy and Lack of Self-Awareness

Has anyone noticed Sanders has targeted billionaires instead of millionaires after everyone pointed out he is a millionaire? Okay, it’s not just me.

As of 2017 Sanders is worth around $2 million. He supposedly brought in $1 million in 2016, which includes $795,000 for a book advance.

Sanders released his tax returns and guess who chose not to pay his fair share. Even The New York Times pointed out he belongs to that evil 1%.

Sanders released his tax reductions in the 2016 campaign as well. Jim Geraghty at National Review wrote on the hypocrisy within the documents. Ryan Ellis at Forbes expanded on the tax forms.

In 2014, Sanders received $26,213 in Social Security. The law states 85% of that amount is taxable. He paid that amount. But Ellis wrote that Sanders “has quite a strong position on Social Security.” He wants those in the top brackets to “pay their ‘fair share’ into Social Security.”

While Sanders followed the law, why did he not practice what he preaches? Why not pay taxes “on all” of his Social Security:

According to the Social Security Administration, these taxes are earmarked for the Social Security and Medicare “trust funds,” so it would be a direct benefit to the programs he loves so much. And it certainly seems more “fair” to tax wealthy retirees with empty nests and paid off mortgages than it does to tax people raising families earlier in life.

There is nothing–absolutely nothing–stopping Sanders from adding in the rest of his Social Security benefit as taxable income. At his marginal tax rate, it would generate another $1733 in taxes if he did, taxes which would pay directly for Social Security and Medicare benefits for seniors poorer than he.

Sanders deducted $8,946 in business meals:

Assuming each meal averaged around $100, that’s about 90 business meals throughout the course of the year. Now, this is probably legitimate and legal. The IRS standard for a business meal can be found in IRS Publication 463. In it, we find that a business meal must be an ordinary and necessary expense in your line of work. In addition, the meal must basically have a direct business purpose that’s substantial and is expected to lead to business activity. It’s not a high standard.

If a legitimate business meal deduction was on a Republican’s tax return, you can bet that Sanders would be railing against it as just another “fat cat” ripping off the U.S. Treasury. So why is he deducting almost $9000 worth of business meals himself?

Pay your fair share, Sanders.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Does he not remember what happened to France when they taxed the wealthy?

They left in droves.

Socialism/communism does not work.

you don’t have to go that far, look at California, New York, and Connecticut for starters. they all had the same problem France had

Third, the wealth tax includes a 40 percent exit tax on the net value of all assets under $1 billion and 60 percent over $1 billion for all wealthy individual seeking to expatriate to avoid the tax.

I am an old person. And a retired Peace Officer. In 28 years on the job, the cheapest contract killing I ever saw was a guy repeatedly stabbed and very, very dead for the total cost of 2 [two] packs of generic cigarettes when they were $0.25 apiece. Mind you, that was a while ago. But even accounting for inflation, how many hit men and women do you think can be hired for the cost of the exit fees.

How much do you think it would take to turn a politicians security force, considering what we have seen about the lack of loyalty and honor in the FBI and Federal intel agencies?

Just sayin’, rich people can have both the rage, and afford to satisfy it.

Subotai Bahadur

They want to implement this globally – so there is nowhere to flee.

Then it will work, gosh darn it!

No, this is not constitutional under the 16th amendment. The 16th amendment made an exception to the requirement that direct taxes be proportional to the state’s population for *income*. It says nothing about *wealth*. If my $100 million yacht isn’t bringing in money, the feds have no constitutional authority to tax me on it.

Well, we just apportion the wealth tax by state. Determine the national wealth, divide by people per state, and have the states figure out how to collect.

Well yeah, but that means that a multimillionaire in Maryland will pay less than a multimillionaire in the similar-sized Missouri, because there are more multimillionaires per capita in MD.

And the tax burden itself won’t go away even if there aren’t any more multimillionaires in MO, so then it would fall to ever lower income and wealth strata.

That would happen for any of these abusive socialist policies. They’ll fall short of expectations and just be cranked up until we’re venezuela write large.

Never said it was a good idea, just that it technically could be done.

How does the Federal government force states to pay this tax and what happens if this causes states to refuse to cooperate? If the Feds can’t force states to cooperate with rounding up illegals then there is no way for them to force them to collect a wealth tax.

So why is the Federal Estate Tax constitutional?

It’s not. See if this helps,

https://taxprof.typepad.com/taxprof_blog/2019/04/the-estate-tax-is-unconstitutional.html

Once again, the problems have arisen because those who’ve taken the Article VI oath to support the Constitution didn’t when the going got tough politically (here, the SC about 100 years ago). Fortunately, the Supreme Court isn’t. Supreme, that is. It’s jurisprudence can be changed.

You’ll notice that in the listing of the authorities which are supreme, USSC opinions are NOT listed.

The estate is taxed as income to the recipients.

Not so. Read IRC section 102, “(a) General rule. Gross income does not include the value of property acquired by gift, bequest, devise, or inheritance.”

I’m pretty sure that if Sanders or any of the other Democrat Marxist fools, miscreants, maladroits, and unindicted co-conspirators . . . including all the currently declared Democrat candidates for president and the probable real candidates either Hillary or Michelle, every get into power; the Constitution will not be a factor from then on without a lot of kinetic energy being expended. They will do what they will do. We will do what we will do. And only the Great Blue Sky Tengri Nor knows what the outcome will be.

Subotai Bahadur

Real estate will likely crash, because all of those valuations will be recalibrated to get reported wealth as low as possible.

We are taking on powerful interests who will do and spend whatever it takes to stop us. Change never happens from the top down.

The office of President is hardly starting from the bottom.

If Bernie looks like he might actually get the nomination, it would be time to start looking for places to hide your wealth offshore. This won’t stop with just Billionaires. Billionaires don’t have enough money to fund his wild, socialist dreams. He is going to come after the savers and investors.

Exactly.

Savers and investors are now very middle class people. Retirement pensions have gone the way of the dodo bird, and more and more older people rely on their IRAs. A nest egg may be substantial but it is hardly extreme wealth.

The golden years? Not if Bernie has his way.

Maybe some of these anti-Trump kooks will wake up about why we have the 2nd amendment. The first step in having your rights taken away is to create a registry. That is what the IRS has become and it was the reason why so many fought the creation of the income tax in the first place.

I’m expecting explosive growth in the “gun nuts” population.

The “gun nuts” that pitch a fit whenever the phrase “national gun registry” comes up?

“Wealth registry” is no less frightening.

There was a time when I would have worried about this.

But not any more.

Too many millionaires and billionaires in the US have tried to ram communism down our throats while giving themselves a pass. They virtue signal while the rest of us suffer.

So I am for confiscation – not mere taxation – of every dime these rich commie plutocrats have. Yes, I know it will turn the US into Venezuela in nothing flat, but thanks to these same greedy rich folks I think that is already unavoidable.

So let the Mark Zukerbergs, Warren Buffets and the rest be homeless, starving, and freezing to death under a bridge next winter. Let them and their families discover the indescribable joy of the socialist gulags firsthand. Let justice fall like a mountain on the rich monsters who seek to enslave the rest of us. It is exactly what they deserve.

None of those things are going to happen. Whatever law might be written is going to contain some loopholes for major Dem donors. The billionaires run the world, not a few millionaire politicians.

Probably. But at some point the Khmer Rouge wannabes will demand to see results in the form of millionaires and billionaires reduced to poverty. If I have to live in Venezuela against my will I am selfish enough to want to see the ultra rich bagmen like Buffett and Zuckerberg be first in line to enjoy socialism’s “benefits”.

Ain’t gonna happen, but it’s interesting that you seem to be including yourself in that “Khmer Rouge”.

Looks like Comrade Sanders is letting the Red out.

https://twitter.com/conserv_voice/status/1176555808798195712

bet I get no answers

“There should be no billionaires”

Bernie, standing on an outside balcony of one of his three homes, surveys the landscape, with the ghost of Joe Stalin next to him, whispering,

“Remember what I did to the Ukraine and its independent farmers in the early 1930s? You could get it to work for you too.”

if they really were serious about rasing taxes on the rich they would start with removing all the various scheduled, removing the various volumes of tax code, I wouldn’t be surprise if a lot of the tax codes are used by single individual or corporations.

Personally I’m for a flat rate tax, everyone pays the same percentage of their income no matter what the source. why should someone willing to work 80 hours a week pay a higher percentage of their income than someone that only works 40 hours or for that matter doesn’t work at all

“There should be no billionaires.”

If America is stoooopid enough to vote commie in 2020 they won’t. At least not in the US. Poof, they’re gone. To some island tax haven. Maybe the Caribbean, maybe one of the Channel Islands.

But Bernie gets his wish.

No one NEEDS three houses, Boinee.

No, but more than one bathroom is always appreciated.

Communist whacko.

Y’all should be scared, really scared. Not of a Bernie Sanders presidency, that’s not going to happen.

You all should be scared for the future of this country because it’s not just Sanders, but most of the Democrat party, especially their left(er) wing.

They are not even shy anymore. They are putting all these extreme radical left wing ideas out there, mainstreaming those ideas, and they are not receiving the universal condemnation that they deserve. They even manage to get millions in donations!

Look at Venezuela. It was just a few years ago, they were saying “Nah, we have a democratic system going here. What happened in Cuba won’t happen to us.”

Well, it did happen to them, and probably worse.

The wife and I just a 3 part program about Bill Gates called “Inside Bill’s Brain” … he and his wife have devoted much of their wealth to 3 humanitarian projects: clean water and sanitation, eradicating polio, and clean power. Warren Buffet devoted a significant portion of his wealth to Gates’ projects as well.

But I think it’s a much better idea for the Government to tax them up to half their wealth to fund even more investigations of Trump, more Enrons, cash for clunkers, etc., while telling them what earned such great wealth to go suck eggs.

Does anyone think this will really effect billionaires? There will be exemptions written for 607 people.

When I read the part about the national wealth registry, the first thing that popped in my head was “We must stop the spread of evil assault style wealth, it’s for the kids you know”.

“..and 8 percent on wealth over $10 billion..”

C’mon Bernie, you can do better than this. Why not 110%. Not fair? Sure it is!

It’s like the IRS that taxes net gains at 100% the year earned, but net losses are limited to $3,000 per year! The gubmint writes the rules! That’s as fair as lying to the FBI is a felony, but the FBI lying to you is … nothing wrong with that.

It is 150%. The wealth tax is in addition to the income tax, which will presumably rise under Sanders. Let’s say Sanders gets Congress to pass a 50% marginal bracket. If you earn 8% on those assets, you pay 4% in income tax and 8% in wealth tax. Indeed, under the proposed plan all assets above $500 million cost more than they earn presuming you can earn 8%. In any year in which you can’t it’s you’re losing money owning them. If you want a little safety you’d have to dump everything above $250 million.

How long do I have to own the asset to pay wealth tax on it? I can easily see situations where wealth tax is assessed several times on the same assets aka tax pyramiding.

So many people dumping so many assets at the same time means a lot of will go for fire-sale prices.

Come on Bernie. Make sure millionaire politicians are in the top tax bracket!

What is it with D and registration lists? Didn’t they oppose lists that Sen McCarthy put together in the 1950’s?

The billionaires of the early 20th century were millionaires.

As you, a middle-class person pays federal income taxes every year, recall how the Woodrow Wilson-era Progressives said that passing a Constitutional amendment initiating a federal income tax would only effect millionaires.

Certain terms the Progressives use may change, but the main tenets of the script do not … and they’ve never wavered from their totalitarian-Collectivist ultimate goals.

Eliminating Kulaks as a class didn’t work out too well the last time it was tried… especially for the Kulaks.

I might have brought home $10,000.00 as a small business Owner putting in 60 hour weeks trying to get this thing off the ground.

Thankfully, my Wife is capable of holding up the household.

Am I going to be placed on the ” Wealth Registry ” Too?

There’s probably no “loophole” which costs the treasury more than mortgage interest deductions. Maybe he should offer to scrap that and see how fast he can start polling at 0%.

The Europeans already tried this. The wealthy fled to Belgium and Switzerland, leaving the Socialist fools bankrupt and taxing the middle class to death. Bernie is a complete fool.

Remember the hooraw when we lost the interest deductions for credit cards?

The 16th Amendment allows the federal government to tax income. Sanders’ plan is unconstitutional because it would tax assets, not income.