Wealthy New Yorkers Eye Exits as State Plans Significant Tax Increases

“New York’s top business leaders are gearing up for a potential mass exodus”

New York’s economy was devastated by the pandemic, specifically the lock downs. Thousands of people with the means to do so have already fled the state.

Now the state is planning to raise taxes. Do they really expect people to stay?

Spoiler alert: They won’t.

Brian Schwartz reports at CNBC:

New York’s wealthiest look for exits as state readies hefty tax increase

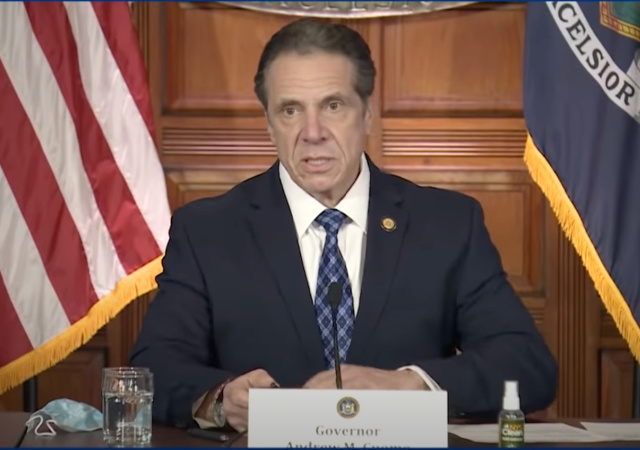

New York’s top business leaders are gearing up for a potential mass exodus as Gov. Andrew Cuomo and state lawmakers prepare to raise their taxes.

With the state budget set to increase the personal income tax on the wealthiest New Yorkers as well as hiking corporate taxes, some executives who fled the city for Florida temporarily due to coronavirus pandemic lockdowns are considering permanent relocation, according to business leaders briefed on the matter.

Wealthy business leaders who have historically resisted moving at least some of their resources to Florida or other less-taxed states explained to CNBC that they are now seriously reconsidering as working from home becomes the norm, allowing more flexibility.

Tracy Maitland, president of investment advisory firm Advent Capital Management, said that while he still loves his home base, he’s not ruling out departing.

“It’s a consideration,” Maitland told CNBC in an interview Wednesday.

Once again, New York’s loss will be Florida’s gain.

Grace Dean writes at Business Insider:

New York’s wealthiest residents are considering fleeing to Florida ahead of income-tax hikes in the state, according to a report

New York’s mega-millionaires are set to start paying the nation’s highest income-tax rates, and some are already considering moving to states with lower taxes, CNBC reported Thursday.

This includes Florida, which doesn’t have a personal-income tax.

New York Gov. Andrew Cuomo revealed plans on Thursday to hike personal-income tax for those earning more than $1 million, with the wealthiest New York City residents set to pay 14.8%, the highest rate in the country.

Francis Suarez, the mayor of Miami, told CNBC that he’d already spoken to some of New York’s biggest firms about possible reallocations to the city.

“I can’t give names but if you’re looking to know if we’re talking to the biggest firms in New York, we are,” he said.

“Clearly, the toxic climate in New York has led businesses to look to Miami as an attractive place for long-term expansion and relocation,” Suarez added.

I recently had a conversation with someone who works in the financial services industry. She suggested to me that we have not yet begun to see the negative effects the last year will have on New York and other cities.

Here’s the simple truth. The tax rate doesn’t matter if there’s no one there to pay the taxes.

"Raising the state tax bite by up to 24 percent … could provide a final push out the door for an unknown number of high earners," writes @EjmEj.https://t.co/BlFqon0og6 via @nypost

— Manhattan Institute (@ManhattanInst) April 10, 2021

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Color me skeptical, but even if they relocate to Florida (and by default, bring their blue state voting habits with them) they won’t be removed from the voting rolls in NY any time soon.

Color me skeptical, but I find it hard to believe that rich NY businesspeople will be able to escape the New York state taxing authority simply by relocating to Florida (or elsewhere). There’s has to be a “gotcha clause” in any legislation raising the tax rates that will put the hook in the rich fleeing to Florida making them liable for NY taxes. Guess I’ll wait and see what happens.

Well, we already know that selfless volunteer medics from other states, who temporarily traveled to NY specifically to address their COVID bubble, received notices that NY was demanding a cut of their pay during whatever time they were instate. I’ve always wondered what recourse NY could bring to bear against a non-resident who replied “GFY,” but never pursued the issue.

They’ll get the Limbaugh treatment and get audited every year.

I think they want to follow California’s example. Under Assembly Bill 1253, the state’s new highest tax rate would be 16.8%. Assembly Bill 2088 proposes to levy a 0.4% wealth tax on a taxpayer’s worldwide assets, based on market value at the end of each year, and this wealth tax would apply to a California resident for up to 10 years after leaving the state.

However, with elections rendered moot anyway by fraud; that will have less of an effect. What they will not be able to avoid is having the resources of the companies and individuals moved out of the reach of the State seizing them.

Subotai Bahadur

NYer by birth, Floridian by choice. Nuff said.

By the way, the Florida prohibition of imposition of income tax is constitutionally mandated. That means it cannot be overturned by a mere legislative act, but only by a vote of the electorate–by a supermajority of 60%.

Taxes are not levied for the benefit of those being taxed.

I am sure that some folks who buy into the ‘NYC is the center of the universe’ won’t depart. These are folks for whom a mention in the society column is an ego boost. Unfortunately they are accompanied by the folks who won’t be able to find similar employment, who purchased property which declined in value or are likewise trapped due to reliance upon a social support network. Maybe they ate the caregivers for elderly family members who are too stubborn to leave and thereby trap the younger generation.

However attractive NYC may have been 5 or 10 years ago the fact is that rapidly diminishing public safety, falling property values, increased taxes and the lockdown providing a test run for a decentralized work remotely model will bring increased movement to other areas.

Shortly after 9/11, the canonical question* was, “How would you feel if some terrorist brought in a suitcase nuke and took out New York City?” If we had only known then how much more economically we could achieve the same effect just by electing Andrew Cuomo, plus take out the entire rest of the state as a BOGO!

*Well, one of the two canonical questions of the period… the other being, “If you had a terrorist who knew where a nuke was set to go off, would you torture him if it was the only way to find out where it was?” To which the correct answer was, “If you had a terrorist who knew where a nuke was set to go off, but would tell you only if he could watch your daughter have sex with a Rottweiler, would you do it?”

Would they delay the explosion until such time as I manage to actually have a daughter?

Torture doesn’t get reliable information.

A friend of mine just relocated from Long Island to the Poconos in Pennsylvania at the same time as her son’s family. They keep running into their former neighbors in the local stores.

Looks like Cuomo’s “Ralph Northam” strategy paid off. He is back to being a Hero of the Glorious Socialist Revolution (TM).

Meanwhile, the Franz von Papen Republicans continue to target Matt Gaetz despite the fact that ZERO victims have come forward.

The numbers won’t show this because Washington State is a destination for fleeing Californians, but a lot of red voters are leaving. I’ve never seen this many people I know leave the state in such a short period of time.

It’s not the job or anything family related… they are tired of the blue state shit.

If this is happening among people I know, it’s happening big time across the state.

In our rural neighborhood in AZ homes are being bought by people fleeing CA and Washington. Luckily, we left CA more than three years ago.

Sadly, all those CA, WA, OR, CO parasites have turned AZ blue. We now have two Democrat-Communist Party U.S. senators. One a lesbian and the other so deeply indebted to China that he can’t be distinguished from Joe and Hunter Biden.

If they hate MAGA I encourage them to remain in NY and pay their fair share — what they voted for. So they don’t metastasize and destroy other states with their leftwing BS.

Can’t happen, but I’d love to see the red states simply refuse to allow them to relocate away from the policies they voted (and paid) for. I wonder how many of these individuals and companies were among those throwing rocks at Georgia for their voting integrity legislation?

It would be even niftier to watch the blue states refuse them.

No, wait, got the gerrymandered colors mixed up again.

Damn good thing traffic lights use green.

What about the Stock Market building? Will that move out of New York with all of its wealthy investors?

Getting ready to sell it all to China?

The vile Dhimmi-crats are so fiscally illiterate and inept, they can’t understand basic economics and fiscal realities. Raise the capital gains rate and you disincentivize investment and reap lower tax revenue, from fewer transactions realizing gains. Raise state taxes, and, you drive away businesses and high earners, eroding your most important base of taxpayers.

If the Dhimmi-crat governors raise taxes to onerous rates, they create a totally fiscally unsustainable situation — a completely unbalanced and fiscally unhealthy tax base consisting of tens of millions of low-income/no income residents reaping vast amounts of welfare and services, a shrinking middle-class that is squeezed to death by taxes and flees (if they can), and, wealthy taxpayers who pay far more than their proportional share of taxes and can easily depart for more fiscally hospitable climes.

But, naturally, the Dhimmi-crats are too stupid to figure any of this out.

Victor Davis Hanson has written some excellent essays on this topic, viewed through the prism of his experiences as a California native and resident.

This one made me laugh and laugh and laugh.

https://nypost.com/2021/04/10/if-it-aint-broke-joe-biden-will-break-it-goodwin/

The exodus puts big-ticket philanthropy at risk, which would be a blow to New York’s cultural, educational and medical institutions.

My friend is angry because he believes the tax hikes were passed only out of spite toward the rich. But he’s also sad, saying: “I’ve lived here for six decades and I’ve never felt more unwanted and despised.”

————————————

He should have left new york more often and stop by red states. We could have made him feel unwanted and despised regularly for his idiotic beliefs.