Yesterday we covered the CBO Report on loss of labor provided by workers as a result of Obamacare subsidies,

CBO confirms Obamacare subsidies create disincentive to work harder.

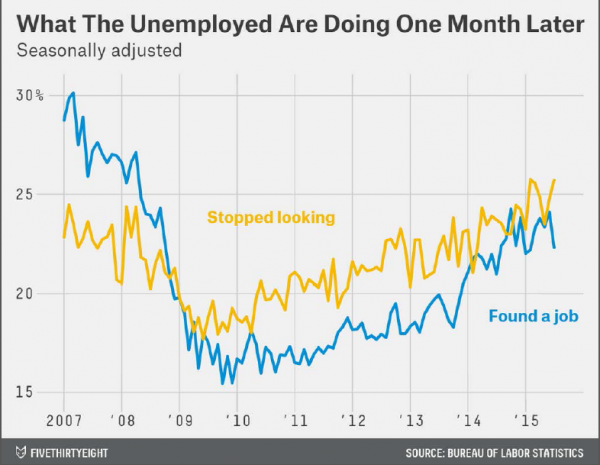

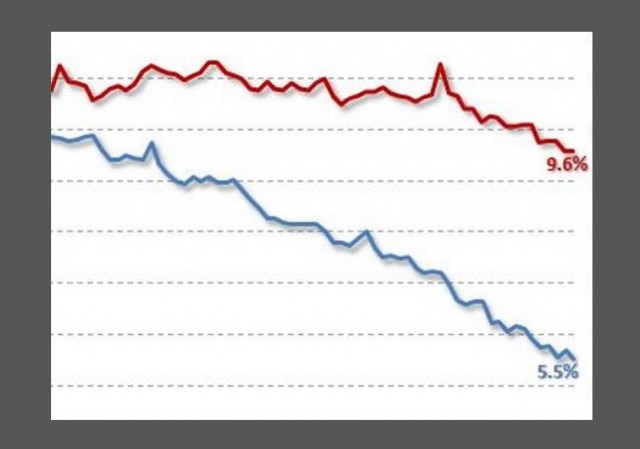

It's all about how the implicit marginal tax rate -- taxes plus loss of benefits -- creates a disincentive to work hard because for each dollar you earn, you lose a huge percentage, sometimes more than 100%, of that earned dollar through higher taxes and loss of government benefits.

It is economically rational, in this circumstance, not to work harder. It has nothing to do with laziness, but with government creating an incentive not to work.

Here's the testimony today from Doug Elmendorf, head of the Congressional Budget Office, via

National Review:

“By providing heavily subsidized health insurance to people with very low income, and then withdrawing those subsidies as income rises, the act creates a disincentive for people to work relative to what would have been the case in the absence of that act,” Douglas Elmendorf told the House Budget Committee on Wednesday. “By providing a subsidy, these people are better off, but they do have less of an incentive to work.”

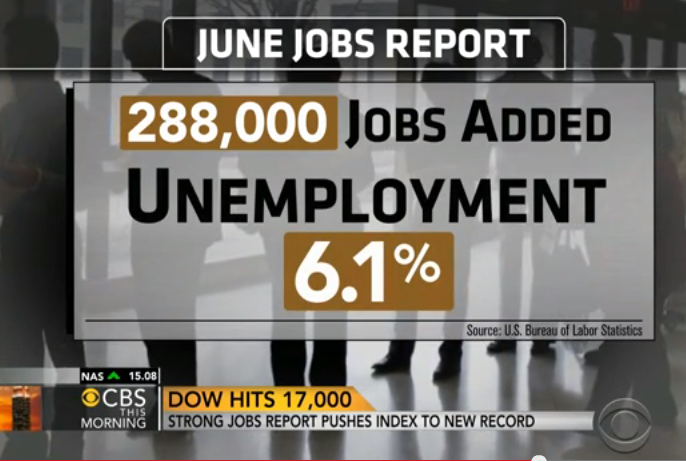

None of this is new. Here's Elmendorf's testimony from February

2011 regarding the same effect, although at that time the projection was only 800,000 jobs: