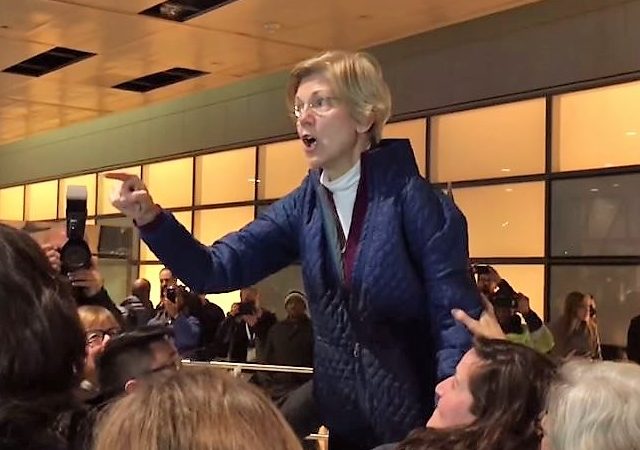

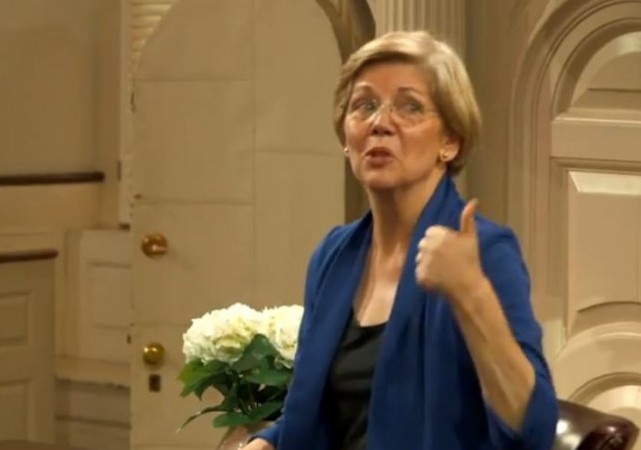

Elizabeth Warren Furious About Lack Of CFPB Oversight . . . That She Designed

on March 18, 2018

17 Comments

Senator Elizabeth Warren (D-MA) is fighting mad. Her pet project, the Consumer Financial Protection Bureau (CFPB), is completely out of her control, and she's taken to Twitter to express her latest dissatisfaction with Trump-appointed CFPB head Mick Mulvaney.