House Appropriations Bill Cuts IRS Budget

on July 08, 2016

14 Comments

IRS Employee Admits He Would Go After, Target, and Try to End Conservative Groups A self-identified IRS employee admitted he would go after, target and try to end conservative groups who wanted to abolish the IRS, to Cleta Mitchell, an attorney representing those groups, on a Washington Journal segment on C-SPAN.

Elizabeth Warren thinks the IRS should fill out your tax returns With Monday’s tax filing deadline looming over many Americans’ weekends, Sen. Elizabeth Warren’s new bill may seem like a godsend. The Massachusetts Democrat introduced legislation Wednesday that would allow U.S. taxpayers to have the government do their taxes for them—for free.

Among the most serious allegations a federal court can address are that an Executive agency has targeted citizens for mistreatment based on their political views. No citizen—Republican or Democrat, socialist or libertarian—should be targeted or even have to fear being targeted on those grounds. Yet those are the grounds on which the plaintiffs allege they were mistreated by the IRS here. The allegations are substantial: most are drawn from findings made by the Treasury Department’s own Inspector General for Tax Administration. Those findings include that the IRS used political criteria to round up applications for tax-exempt status filed by so-called tea-party groups; that the IRS often took four times as long to process tea-party applications as other applications; and that the IRS served tea-party applicants with crushing demands for what the Inspector General called “unnecessary information.”

The Justice Department notified members of Congress on Friday that it is closing its two-year investigation into whether the IRS improperly targeted tea party and other conservative groups. There will be no charges against former IRS official Lois Lerner or anyone else at the agency, the Justice Department said in a letter. The probe found "substantial evidence of mismanagement, poor judgment and institutional inertia leading to the belief by many tax-exempt applicants that the IRS targeted them based on their political viewpoints. But poor management is not a crime."Despite incriminating evidence and findings by IRS inspectors that Tea Party and conservative groups were treated worse than other groups, DOJ found no support for the view that Lerner and others were politically motivated, as CNN further reported:

“It is disturbing that the Obama administration’s explanations to a federal judge about Lois Lerner’s emails become inoperative after only one week. Last week, the court was told that that Lois Lerner had a second alias email account under the name “Toby Miles”. This week the court is told that the “Toby Miles” account isn’t a separate account but that that there still is a second Lerner account, address unrevealed, with IRS-related emails. This game of cat and mouse shows that both the Obama IRS and Justice Department continue with their contempt for Judge Sullivan’s orders that Ms. Lerner’s emails about this scandal be disclosed as the law requires.”The August 31 status report reads, in part (full embed at bottom of post):

Lois Lerner had yet another personal email account used to conduct some IRS business, the tax agency confirmed in a new court filing late Monday that further complicates the administration’s efforts to be transparent about Ms. Lerner’s actions during the tea party targeting scandal. The admission came in an open-records lawsuit filed by Judicial Watch, a conservative public interest law firm that has sued to get a look at emails Ms. Lerner sent during the targeting.The Status Report (embed below) discloses, in relevant part:

On August 24, 2015, the Internal Revenue Service (“Service”) released to Judicial Watch, Inc., a CD containing documents responsive to Judicial Watch’s Freedom of Information Act (“FOIA”) request for Lois Lerner communications regarding the review and approval process for 501(c)(4) applications.... In the process of preparing this status report and for the August 24, 2015, release of Lerner communications, the undersigned attorneys learned that, in addition to emails to or from an email account denominated “Lois G. Lerner” or “Lois Home,” some emails responsive to Judicial Watch’s request may have been sent to or received from a personal email account denominated “Toby Miles.” The undersigned attorneys contacted the Office of IRS Chief Counsel, and IRS Chief Counsel attorneys informed the undersigned attorneys that these denominations refer to a personal email account used by Lerner. (See Pl.’s Mot. for Status Conf., 15 n.8 (Docket No. 20-2) (noting that the Congressional database includes documents that Lerner’s attorneys provided from Lerner’s “personal home computer and email on her personal email” account(s)).)

Lois Lerner: GOP is ‘Evil and Dishonest’ Former IRS official Lois Lerner said that Republicans are “evil and dishonest,” in a email dated March 26, according to Fox News reporter James Rosen. In the email, Lois Lerner described the time when she was called back to testify about the IRS targeting of conservatives before Congress. “They called me back to testify, on IRS ‘scandal,” Lerner wrote. “I took the fifth again and they had been so evil and dishonest in my lawyer’s dealings with them.”Here's the video report with James Rosen of FOX News:

Judicial Watch: New Documents Show IRS Used Donor Lists to Target Audits (Washington, DC) – Judicial Watch announced today that it has obtained documents from the Internal Revenue Service (IRS) that confirm that the IRS used donor lists to tax-exempt organizations to target those donors for audits. The documents also show IRS officials specifically highlighted how the U.S. Chamber of Commerce may come under “high scrutiny” from the IRS. The IRS produced the records in a Freedom of Information lawsuit seeking documents about selection of individuals for audit-based application information on donor lists submitted by Tea Party and other 501(c)(4) tax-exempt organizations (Judicial Watch v. Internal Revenue Service (No. 1:15-cv-00220)). A letter dated September 28, 2010, then-Democrat Senate Finance Committee Chairman Max Baucus (D-MT) informs then-IRS Commissioner Douglas Shulman: “ I request that you and your agency survey major 501(c)(4), (c)(5) and (c)(6) organizations …” In reply, in a letter dated February 17, 2011, Shulman writes: “In the work plan of the Exempt Organizations Division, we announced that beginning in FY2011, we are increasing our focus on section 501(c)(4), (5) and (6) organizations.”

This is a bill that would prohibit the federal government from penalizing individuals or institutions on the basis that they act in accordance with a religious belief that marriage is a union between one man and one woman. The First Amendment Defense Act, which Rep. Raúl Labrador, R-Idaho, will introduce in the House of Representatives, would prevent any agency from denying a federal tax exemption, grant, contract, accreditation, license or certification to an individual or institution for acting on their religious beliefs about marriage.

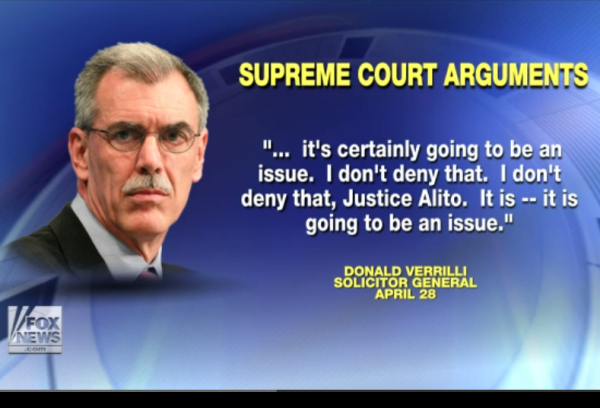

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

After hearing the oral arguments in Obergefell v. Hodges, Sen. Lee was most disturbed by a question asked by Justice Alito.

I stand with Rand in his fight to defeat the Washington Machine and drive a stake through the heart of the IRS by: Ending the workers tax: This plan will end the FICA payroll tax, the largest tax for many working Americans. It goes to zero. Eliminating the headaches and complications in filing federal taxes by allowing every taxpayer to file a simple, one-page return with a low and fair tax rate of 14.5%, saving American families over $2 TRILLION in the first 10 years;

IRS Finds 6,400 Lois Lerner Emails But Won't Hand Em Over The Internal Revenue Service may have found 6,400 emails from Lois Lerner, who oversaw the tax agency’s Exempt Organizations Unit, but the government agency has no plans to share. Attorneys from the Department of Justice representing the IRS say the emails won’t be shared because the service is making sure that none of them are duplicates. Lerner is at the center of a scandal in which the tax agency denied special tax status to conservative groups. Her emails have been sought by members of Congress and conservative groups alike. One of those groups, Judicial Watch, has been seeking emails as part of a Freedom of Information Act (FOIA) request filed two years ago. Originally, the IRS said the email trail was permanently lost because the computer drive that contained it crashed. However, the Treasury Department’s Inspector General for Tax Administration or TIGTA, was able to retrieve 6,400 emails which it has subsequently sent to the agency. It is these emails that the IRS wants to check for duplicates.Watch the video report below.

“This underscores that our investigation into IRS abuse is far from over,” a House Ways and Means Committee spokesman said Wednesday. “The committee will thoroughly review these new emails as part of our ongoing efforts to find out exactly what happened and provide accountability."

Judge orders IRS to release list of tea party groups targeted for scrutiny A federal judge ordered the IRS this week to turn over the list of 298 groups it targeted for intrusive scrutiny as the agency defends against a potential class-action lawsuit by tea party groups who claim their constitutional rights were violated. The IRS had argued it shouldn’t have to release the names because doing do would violate privacy laws, but Judge Susan J. Dlott, who sits in the Southern District of Ohio, rejected that claim and ordered the tax agency to turn over any lists or spreadsheets detailing the groups that were targeted and when they filed their applications. Judge Dlott also ordered the IRS to say whether a partial list of targeted groups reported by USA Today is authentic as a number of tea party groups try to win certification for a class action lawsuit against the IRS.

Donations tax deductible

to the full extent allowed by law.

Founder

Sr. Contrib Editor

Contrib Editor

Higher Ed

Author

Author

Author

Author

Author

Author

Editor Emerita