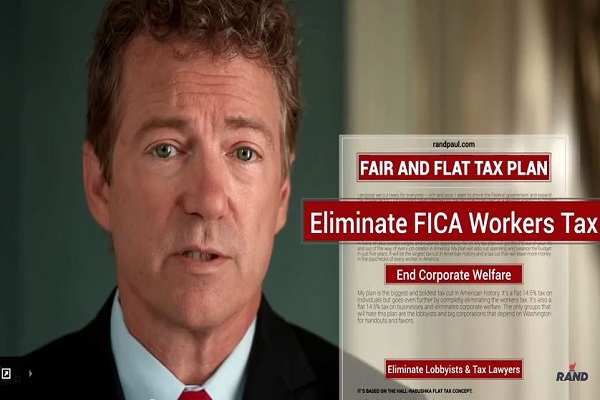

Rand Paul Releases Fair and Flat Tax Plan

“Driving a stake through the heart of the IRS”

Earlier this year, Rasmussen released a poll showing that only 31% of Americans trust the IRS to enforce tax laws fairly. Given the targeting of conservatives, reports of refunds going to illegals who didn’t pay taxes, and the sharing of confidential tax payer information with the White House, it’s surprising the percentage is that high.

It seems clear that there is growing dissatisfaction with the IRS and with the nation’s ridiculously complex tax laws. At 74,608 pages, the U. S. tax code is both ponderous and confusing. With all of the new taxes buried in ObamaCare alone, the tax code has grown by nearly 3,000 pages since 2010.

In response to all of this, Americans are more ready than ever for substantial tax reform, and hearing the call, Rand Paul released a new video outlining his new tax plan that appears to be a hybrid of the fair tax and the flat tax.

Here’s the statement from his website:

I stand with Rand in his fight to defeat the Washington Machine and drive a stake through the heart of the IRS by:

Ending the workers tax: This plan will end the FICA payroll tax, the largest tax for many working Americans. It goes to zero.

Eliminating the headaches and complications in filing federal taxes by allowing every taxpayer to file a simple, one-page return with a low and fair tax rate of 14.5%, saving American families over $2 TRILLION in the first 10 years;

Eliminating payroll taxes, which incentivizes employers to hire more workers and raises after-tax income by 15% over ten years;

Ending corporate welfare and special tax breaks, eliminating the army of lobbyists and tax lawyers gaming the system. That means no more mom and pop small businesses paying 40% of their income in taxes, while big corporations — armed with armies of slick lawyers — pay zero;

Providing a real economic stimulus to our economy by exploding the GDP by almost 10% over the first 10 years.

And here’s the video introducing the plan:

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

I don’t see any “hybrid” quality to this.

I also don’t see Rand giving credit for this to Steve Forbes, who has been pushing some variation on this for decades.

Finally, why is there ANY corporate tax? All that is is a tax on everything we consume, and it is essentially NEVER paid by a corporation, only collected from US by them.

Start somewhere. This will be a monumental fight to get through, congress and then signed by a president. If this gets through, it will be a monumental shift in thinking … if.

He’s in a campaign. The public has a limited attention span. No need to distract by mentioning Forbes. Forbes is an adult; he can handle it.

The most important thing, is to dismantle the tax code. Making it front and center helps.

He credits Forbes on this page, which has more detail on his proposal: http://randpaul.com/news/rand-pauls-fair-and-flat-tax

There’s still room for chicanery around what’s considered an allowable business expense, however. That’s one area where the Fair Tax seems stronger, though British economist Tim Worstall has some good arguments as to why it should be a VAT, rather than a sales tax.

Why are their corporate taxes? First, because someone has to pay taxes. Second, because by placing the liability on an artificial entity/person, the burden is properly placed upon something (an artificial entity) that owes its existence to the state, and not upon natural persons who have a right to exist, to earn money, to acquire property, etc. And third, because no private person/state citizen should be required to make reports of their personal income/financial situation to the federal government. (The reporting of personal income is not only onerous, it is invasive to a degree inconsistent with principles of limited government and personal liberty.)

The last point is why I am opposed to any form of taxation that would require private individuals to make reports or returns of any sort. Government has demonstrated that it cannot be trusted with such information.

I imagine that aside from corporate taxes, the only viable option is a national sales tax. Again, artificial entities (licensed businesses and corporations) would be liable for a sales tax, removing government scrutiny from the finances/income of private citizens. (Sales taxes are indirect taxes upon the revenue taxable activity of operating a privileged/licensed business. If, for instance, retailers didn’t charge the tax at the point of sale, they would still be liable for paying the tax to the state, and it would come out of their gross. This is why retailers shift the burden for the tax – but not the liability – to the purchaser as a condition of the sale.) Some might complain that the poor would suffer under a national sales tax, but there’s a way to mitigate that problem – allow low-income people to file a statement of their income and request relief from the tax. Depending on their income, the state could relieve the applicant of a portion, or all, of the tax, and issue an ID number/card that could be used to mark all their transactions in which the tax imposed upon the transaction is reduced (this is for the seller’s accounting, to prove to the government why he doesn’t owe the full tax on any particular transaction). Such a scheme would shift the filing requirement onto the appropriate persons – those requesting a benefit, that is, special consideration from the government.

Forbes was the best known advocate for the flat tax, or more accurately the marginal flat tax since he allow for a basic deduction, but he hardly invented it.

The problem with most of the proposals for flat or consumption taxes is that they do not add up. The theory requires they should be revenue-neutral in structure so that it is neither a net tax hike or cut. If desired, hikes or cuts can be achieved by changing the rate, but that is not part of the basic proposal.

– –

The main dilemma is federal revenues don’t only come from income taxes, so if the flat tax is to replace them all, it must apply either to all components of GDP or be at a higher rate than the current proposals.

Also, every deduction, exemption, or exclusion also requires a higher rate. Most current proposals simply lie about the revenues they would bring in. Rand’s hasn’t been subjected to a detailed analysis yet, but if 15% didn’t add up, it seems unlikely 14.5 will.

The tax on corporations should be eliminated. No company pays tax. They will just pass any tax on to their customers in a different form. Thus making all taxes paid for by the citizens.

Corporate welfare, to me, is the special tax breaks and allowances and the special contracts awarded to corporations who are getting special treatment or contract through lobbying of the Congress.

Neither will it eliminate the IRS. There will always be some agency to be the central gathering point for paperwork, receipts and payouts and that will an IRS.

There is also great danger of allowing any Congress (especially this one) to modify the tax laws and there should be first a special law laying down how the process of creating a simplified tax law should proceed. Otherwise the lobbyists will just hijack the process and we’ll find thousands of special case imbedded in the new law.

So the FICA tax is eliminated? That’s half of the income of today’s Social Security recipients. And is the corporate half eliminated as well? Sounds like it.

Because SS is a hand-to-mouth scheme, since the genius Congresses of years past saw the early surpluses of the program, and ‘borrowed’ and spent them. Today’s workers are supporting the retirements of yesterday’s retirees. And demographics are inexorably marching us towards ever fewer payers and ever more takers as the Baby Boomers retire.

How does Senator Paul address this situation?

SS is a Ponzi scheme and has been ruled a tax a long time ago. The FICA money goes were all of the other tax money goes … the general fund. SS is simply line item on the governments liability sheet, and as such we should stop pretending that it is going to some special “savings account” and call it for what it is … an expense.

In 1935, the year Social Security was enacted the average lifespan in the US was 61, so the majority of people died before they had a chance to take advantage of Social Security.

In my mind if a corporation is a “person” there should be tax on it. It’s the cost of government insurance aka limited liability and other benefits. I’m not expert but I might be in favor of that legal trade off.

Because…

1. it is NEVER paid by corporations, only by consumers of ALL goods or services. Corporations simply dial it into their prices, collect it from consumers, and pass this hidden tax along to the Feds

2. it is a highly regressive tax, falling most heavily on the poorest consumers

3. it makes American goods and services LESS competitive on the world market. It is one of the…if not THE…highest in the world.

Reply to #3:

Corporate income taxes (and income taxes in general) are indirect taxes on the businesses, occupations, and events that are taxable for revenue purposes (Brushaber v. Union Pacific RR, Stanton V. Baltic Mining Co., Tyler v. United States). The amount of tax owed is determined by the profit made by the activity that generates the liability. (The tax is not upon the income itself.)

Because of this, it would be possible for a corporation to break out its income from the overseas sales of it products and services, and the tax liability on this overseas activity could be reduced or eliminated (and I wouldn’t be surprised if something like this is not already in effect). This would keep the prices of exported goods and services competitive (and would be the reason for any such deductions that may already be in effect – such a deduction would be part of the government’s interest in keeping American industries competitive overseas, unfortunately, this sort of relief is often labeled “corporate welfare”).

You are correct. Corporations and licensed businesses are entities that owe their existence to the state, and exercise certain benefits through their licenses. Their privileged existence is paid back to the people via taxes imposed upon the entities. Yes, the people ultimately shoulder the burden of the tax, but they are not liable for the tax (the state pursues the businesses for any non-payment) and they aren’t required to accept the burden of the tax, they can choose to avoid at least some of the burden (they can elect to not buy certain products, so they can escape some of the burden).

As former Senator Phil Gramm of Texas used to say, “We must starve the spending”. Real tax reform, especially a move to a consumption tax, would do just that.

I own a business. I automatically raise fees when new costs force me. This would include higher taxes. This, I think, it was Rags means – you can tax companies and corporations all you want, but they’ll just raises prices/fees to cover it. Taxing a corporation is the equivalent of taxing the citizens. Congress loves this because most people blame the corporations, not congress.

Here’s what I want to know: He’s in the Senate right now. What is the bill number? Is he planning to introduce it now? Unless he is, then this is just all talk.

Show me the bill.

Obama will never sign such a thing. This is a proposal for his presidential campaign. It would be outstanding for unemployed Americans, because it would make it less of a headache for employers to hire them. I loathe the endless paperwork to hire a minimum wage worker!!!!!!!!!!!!!!!!!!!!!!!

The flat tax is a chimera. It applies only to W-2 income. The IRS will remain, you will still have to prove what is income and what is a legitimate business expense, keep records, pay accountants and lawyers to figure how best to avoid taxes, etc., etc. Only the Fair Tax (a sales tax) eliminates the IRS and frees the economy. Folks like Steve Forbes don’t even pay income tax. They pay almost no tax at all, and to the point they do, it is capital gains, not income tax. Those who tout the Flat Tax are disingenuously suckering their supporters.