Did IRS’ Lerner Target Senator Chuck Grassley?

#BREAKING: #IRS email dump to Congress reveal Lois Lerner sought to have Sen Chuck Grassley (R-IA) referred for IRS examination.

— Chad Pergram (@ChadPergram) June 25, 2014#BREAKING: #IRS email dump to Congress reveal Lois Lerner sought to have Sen Chuck Grassley (R-IA) referred for IRS examination.

— Chad Pergram (@ChadPergram) June 25, 2014Host Megyn Kelly began by discussing the IRS investigation into the lost emails of ex-IRS official Lois Lerner. Initially, Kelly stated, Democrats and Republicans were both equally outraged. But as time has gone by, Democrats have lost their outrage, reinforced by President Obama, who insists not one smidgen of corruption is involved. Kelly said it was like IRS employees were saying, "Whoops! We're sorry, we lost basically all of the evidence you need to prove your case against me."Shapiro explained the role the media plays in the parade of Obama scandals:

"A perpetual adolescent called to do a man's job."...

"I don’t know if you’re floating another conspiracy or if this is a request from Republicans who are floating a conspiracy"...

Ex-IRS official Lois Lerner’s crashed hard drive has been recycled, making it likely the lost emails of the lightning rod in the tea party targeting controversy will never be found, according to multiple sources. “We’ve been informed that the hard drive has been thrown away,” Sen. Orrin Hatch of Utah, the top Republican on the Finance Committee, said in a brief hallway interview.House Oversight and Government Reform Committee Chairman Darrell Issa issued a terse statement following the POLITICO report Wednesday night:

More emails "lost" from Lerner's IRS colleagues during crucial period of Congressional scrutiny...

Today, Ways and Means Committee Chairman Dave Camp (R-MI) issued the following statement regarding the Internal Revenue Service informing the Committee that they have lost Lois Lerner emails from a period of January 2009 – April 2011. Due to a supposed computer crash, the agency only has Lerner emails to and from other IRS employees during this time frame. The IRS claims it cannot produce emails written only to or from Lerner and outside agencies or groups, such as the White House, Treasury, Department of Justice, FEC, or Democrat offices. “The fact that I am just learning about this, over a year into the investigation, is completely unacceptable and now calls into question the credibility of the IRS’s response to Congressional inquiries. There needs to be an immediate investigation and forensic audit by Department of Justice as well as the Inspector General. “Just a short time ago, Commissioner Koskinen promised to produce all Lerner documents. It appears now that was an empty promise. Frankly, these are the critical years of the targeting of conservative groups that could explain who knew what when, and what, if any, coordination there was between agencies. Instead, because of this loss of documents, we are conveniently left to believe that Lois Lerner acted alone. This failure of the IRS requires the White House, which promised to get to the bottom of this, to do an Administration-wide search and production of any emails to or from Lois Lerner. The Administration has repeatedly referred us back to the IRS for production of materials. It is clear that is wholly insufficient when it comes to determining the full scope of the violation of taxpayer rights.”Last month, the Ways and Means Committee indicated that the IRS had finally agreed to turn over all Lois Lerner emails to the Committee. But according to Friday's statement, it appears there had not been any mention until now that some of the emails would not be able to be produced because of the supposed computer crash. Apparently, Lerner tried to have technicians reconstruct her hard drive at the time of the crash, the Wall Street Journal reported.

Lawsuit Alleging IRS Discrimination Against Pro-Israel Groups Moves Forward A lawsuit alleging that the IRS discriminates against pro-Israel groups will be allowed to move forward, a federal judge ruled this week in Washington, D.C. The IRS has been fighting to quash the lawsuit filed in 2009 by pro-Israel group Z Street, claiming the court does not have jurisdiction to hear the matter. However, Judge Ketanje Brown Jackson rejected the agency’s request to dismiss the case on Wednesday and ordered the IRS to respond to Z Street’s complaint within the next 30 days. Z Street says its constitutional rights were violated by an IRS policy that allegedly singles pro-Israel groups out for stricter scrutiny when they apply for tax-exempt status. According to the lawsuit, an IRS official told Z Street’s lawyer in 2009 that the group’s application for tax-exempt status would be “sent to a special unit in the D.C. office to determine whether the organization’s activities contradict the administration’s public policies.”Eugene Volokh provides more insight at The Washington Post...

The IRS has agreed to turn over all Lois Lerner emails to the House Committee on Ways and Means, according to a statement posted on the committee's website Thursday. From the Ways and Means committee website: Today, Ways and Means Chairman Dave Camp (R-MI) announced that one...

Ball now in Eric Holder's court -- expect delay of game....

[B]etween October 1, 2010 and December 31, 2012, more than 2,800 [IRS] employees with recent substantiated conduct issues resulting in disciplinary action received more than $2.8 million in monetary awards, more than 27,000 hours in time-off awards, and 175 quality step increases. Among these, more than 1,100 IRS employees with substantiated Federal tax compliance problems received more than $1 million in cash awards, more than 10,000 hours in time-off awards, and 69 quality step increases within a year after the IRS substantiated their tax compliance problems.The report explains that “the most serious conduct issues included late payment and/or nonpayment of Federal taxes, Government travel card misuse or delinquency, Section 1203(b) violations, misconduct, and fraud issues.” Section 1203 of the 1998 IRS Restructuring and Reform Act provides that certain acts or omissions can be the basis of a removal for cause for misconduct. “Drug use and violent threats” are examples of misconduct, and “fraudulently claiming unemployment benefits and fraudulently entering attendance and leave on timesheets” are examples of fraud. The report includes the following table showing the extent of the problem:

Because Baseball and Steriods can't hurt Democrats...

(Lois Lerner Pleads 5th House Hearing 3-5-2014)[/caption]

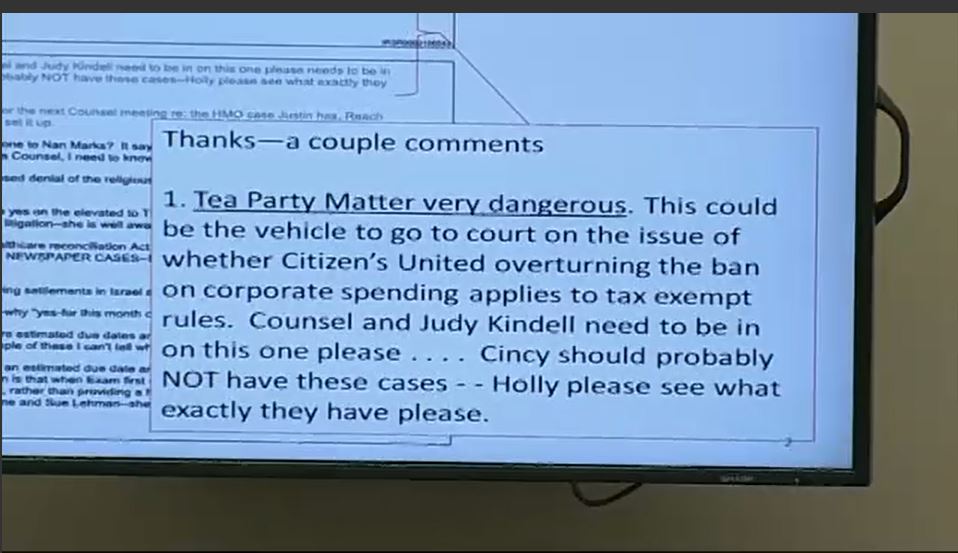

Issa showed an email from Lerner in 2011 demonstrating hostility to the Tea Party and asked her about it, but she refused to answer questions about it:

[caption id="attachment_80338" align="alignnone" width="575"]

(Lois Lerner Pleads 5th House Hearing 3-5-2014)[/caption]

Issa showed an email from Lerner in 2011 demonstrating hostility to the Tea Party and asked her about it, but she refused to answer questions about it:

[caption id="attachment_80338" align="alignnone" width="575"] (Lois Lerner Exhibit House Hearing 3-5-2014)[/caption]

Lerner left the hearing without answering a single quesion:

(Lois Lerner Exhibit House Hearing 3-5-2014)[/caption]

Lerner left the hearing without answering a single quesion:

Emails show negotiation over Lerner testimony, unclear what she will do tomorrow...

An attorney for Lois Lerner says the former Internal Revenue Service official still intends to continue to assert her Fifth Amendment rights before the House Oversight committee, despite earlier claims from a top GOP lawmaker Sunday that she would testify this week. Rep. Darrell Issa (R-Calif.),...

Encouraged by the lack of a public backlash, an uninquisitive press, cover from the White House and an eager-to-please bureaucracy, the Democrats are boldly counting on the IRS to be their political and policy enforcer.This statement isn’t an overreach by the “vast right-wing conspiracy” or a phony crisis created by hecklers (like me) on the right — it goes back to the early stages of President Obama’s reelection campaign.Rogers goes on to list some of the more egregious examples of what has occurred and how the administration has been emboldened by the fact that so far there have been few negative consequences to them for their actions. The hue and cry that might have been expected - and to a certain extent came at first, when some of the revelations about Tea Party harassment were revealed - has been muted and blunted. So now the excesses are being further and more openly institutionalized:

Donations tax deductible

to the full extent allowed by law.

Founder

Sr. Contrib Editor

Contrib Editor

Higher Ed

Author

Author

Author

Author

Author

Author

Editor Emerita