Data Reveals Companies Have Used Tax Cuts to Increase Capital Spending

Why, yes. Companies have used the tax relief to invest more into the business.

Remember when the left said that President Donald Trump’s tax reform would not work because the companies would give those breaks to shareholders instead of reinvesting in the company?

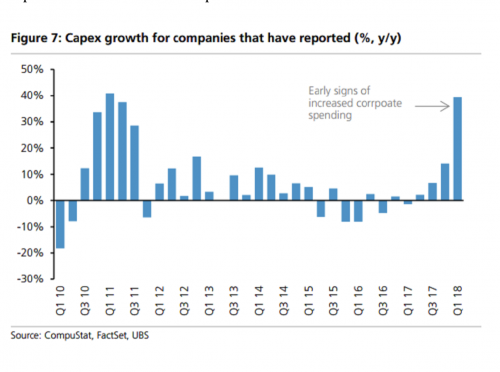

Well, Bloomberg released data that shows capex (capital expenditure) has won out. It shows that the 130 companies in the S&P 500 have increased capital spending by 39%, which is the fastest rate in seven years. Returns to shareholders has only grown by 16%.

Bloomberg continued:

The data is a fresh rebuttal to those who warned that hundreds of billions of dollars of tax relief will head directly to the stock market and be harvested by shareholders already fattened by a nine-year bull market. While buybacks indeed got a boost from the windfall, companies increased the rate at which they unleash cash for building factories and upgrading equipment, a strategy that’s preferred by investors for the benefit of future growth.

Corporate buybacks, while increasingly a key pillar of the second-longest bull market on record, are constantly drawing criticism from politicians and money managers as being short-sighted. By their line of logic, companies take advantage of low interest rates to borrow money and buy back shares as a quick way to boost per-share earnings. In doing so, they’re forgoing investment opportunities that may benefit long-term growth.

Technology has seen a huge upswing in capital spending. S&P Global Marketing Intelligence found that “tech companies posted 48 percent growth in first-quarter capex as of Tuesday.”

Google’s parent company Alphabet increased capital spending from $2.5 billion to $7.3 billion and purchased new offices in New York. CFO Ruth Porat said that Google “has 20 new data centers in construction across the world.”

From The Wall Street Journal:

Many companies are returning their tax savings to their investors. The amount spent on share buybacks in the first quarter rose by more than 50% over the fourth quarter of 2017, and by two-thirds over the first quarter of 2017, according to S&P Dow Jones Indices. Companies have also set plans to invest in expansion and new technology, and paid one-time bonuses to employees.

For 28 S&P 500 companies, lower taxes were enough to account for the difference between reporting earnings growth and an earnings decline. Those included chemical maker Monsanto Co. , asset manager T. Rowe Price Group Inc. and laboratory chain Quest Diagnostics Inc.

The tax cuts have helped small business owners and employees. From CNBC:

In West Virginia, the President spoke with Tony Hodge, a mail carrier, and his wife, Jessica, who said that tax savings are “a big deal for our family.” In Iowa, John Anfinson, a small business owner, was equally pleased, telling the President that revisions to the tax code would ensure his family was “going to have about an additional $6,000 that we get to keep.”

Business owners throughout the country continue to praise tax reform, stating that the savings is allowing them to invest, raise wages, and hire more employees. Small business confidence has reached record highs since passage of the bill, according to a March 2018 CNBC/Survey Monkey survey.

During the tax reform debate, I pushed for lowering taxes on companies so those in charge could keep more money. Honestly, I don’t know why people would think the owners wouldn’t want to invest more money into their business. After all, the more you invest and develop better products, the more money you can make. How do I capitalism?!

Then again, a lot of those people seem to think money grows on trees.

Ben Steverman wrote at Bloomberg that Trump’s loudest critics have also won big with the tax cuts: Hollywood. Not everyone in Hollywood, though, as the tax plan eliminated “deductions for work-related expenses such as union dues, lessons, publicity, travel to auditions and payments to agents who line up jobs.”

But the studios, despite heavily supporting failed Democrat presidential candidate Hillary Clinton, received much relief:

Still, those donations don’t mean the industry’s lobbying groups were absent in Washington as GOP lawmakers were crafting the bill, which passed in December without a single Democratic vote. The big studios such as Walt Disney Co., Viacom Inc., Warner Bros. Entertainment Inc. and NBCUniversal Inc. will benefit from the new corporate tax rate of 21 percent. Most of the studios’ owners, including Disney and Comcast Corp., previously paid effective tax rates above 30 percent.

But beyond that, one of their main lobbyists, the Motion Picture Association of America, successfully pushed for the entertainment industry to immediately write off the costs of large U.S.-made film and TV projects. An earlier iteration of the House tax bill wouldn’t have allowed entertainment projects to be included in the new expanded write-off provision.

The tax bill allows these studios to deduct total production costs “as soon as a new product is released to the public.” Benson Burro, a partner at KPMG, said that these quick write-offs might “make it easier for Hollywood to attract outside investors” especially with an increase “demand from streaming services like Netflix and Amazon.

One think that annoys me nowadays is the need for instant gratification. The overall relief will take time. It doesn’t happen overnight. But it seems so far, so good.

And how much do you want to bet that even though Hollywood has received a huge break they will still hate on Trump and the GOP?

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

There was a VAST pool of capital pent up during the Obamic Era. This was entirely due to the uncertainty that Obama produced in shiploads. Businesses weigh investments according to risks and rewards, and one of the PRIME risks they figure on is how uncertain their risks are. Normally, risks are pretty rational. But when you have a high degree of uncertainty (i.e., WTF is the central government apt to do?), risk analysis pegs the needle on DON’T DO IT.

So there was an ocean of capital that was waiting for a more certain environment.

Sadly, we’ve only seen the partial resolution of the problem. The T-rumpian trade policy, with its unilateral, authoritarian tariffs, has put alllllll businesses on notice that there is still a terrible uncertainty in the economy. The central goverment can still fluck with you, and you can’t predict how it will impart you.

The upswing we see SHOULD be MUCH larger, and that’s a shame.

Sorry Rags. We have already seen massive investments in US Plant and Equipment made by foreign interests. Abe from Japan promises $50 Billion on top of what Japanese businesses are pledging. And, this is just the beginning.

50% of the international supply chains will be unprofitable with just a 10% increase in costs. That will force manufacturers to move to the North America to be on the right side of the Tariff wall. And, the NAFTA renegotiations will keep foreigners from using Mexico and Canada as a free back door into the US market.

So, tariffs good.

Wanna bet?

Every American consumer was handed a hidden…and unapproved…tax increase.

There has never been a tariff that was a net benefit. Ever.

Some tariffs ARE good. And some are not. Do tariffs raise the prices of consumer goods? Yes they do. They also encourage manufacturing businesses to remain within the country and to maintain, or increase, their in-country work force. This in turn provides opportunities for domestic support businesses which further maintain domestic participation in the workforce. This, in turn, maintain or increases the amount of money which is spent within the country. Every single country in the world has import tariffs. And tariffs have been in places, everywhere, for at least a century. Limited tariffs DO benefit a country and its people.

I realize that you are a dedicated free trader and we have had this discussion before. But, whether you like it or not, unfettered free trade benefits the producing country, which has the lower standard of living, and the trader the most. The consumer nation ends up paying for free trade with lower employment, lower tax revenue and a reduction in the standard of living. It results in a redistribution of wealth from the richer nation to poorer nations.

As to the tax cuts being responsible for corporate capital outlays, I think this is an overstatement. The changes in the tax code probably resulted in some of the increase in corporate expenditure. However, there are a number of other market forces in play, as well. One is the foreign capital amnesty. Another is the improved outlook for a broad spectrum of US business. Another, is the threat of future import tariffs. It is simply too early to claim that the increases in capital outlay are either a permanent trend or the result of changes in the tax code.

No, Mac, you are still pig-ignorant. No tariffs are ever good. All the “benefits” you cite are costs. They are bad things that we should prevent, not good things that we should encourage. All the extra “employment” a tariff produces is wasteful and shouldn’t exist. The people who benefit from them are parasites on the consumer, which is everybody. “Increases the amount of money which is spent within the country” is not a benefit, because, as Adam Smith comprehensively showed 240 years ago, money is not wealth.

Another example of ragspee’s “praise” of trump he proclaims he does when he gets something right.

Sounds no different than any other prog.

No, poor old lying nutter. It sounds like anyone who believes it the power of markets, unfettered by central planners in BIG GOVERNMENT.

You are the “prog”, and the cult follower.

The tax cuts were good. They were NOT “T-rump” acting alone.

The tariffs ARE bad, and are T-rump acting alone. Just like a New York Progressive.

“The tariffs ARE bad, and are T-rump acting alone.”

You poor old fool.

Did we have tariffs prior to the election of Trump?

Did we have tariffs under Bush 1 & Bush 2 & Reagan?

Do countries we trade with have tariffs on our goods?

Yes, yes, and yes.

T-rump acting alone, that’s a real good one there.

The cult is the never trump cult and you are a card carrying member. It is a sickness.

Note you can’t meet the facts. You have to resort to “whataboutism”.

The T-rump tariffs are HIS, and HIS alone. Poor lying old nutter.

You poor old fool.You poor old dishonest fool.

Tariffs are a fact, long before trump. So long ago they were in use from the very founding of the country.

No, lying old cultist nutter.

Protectionism is ALWAYS wrong. Lying is wrong.

Lying about protectionism is wrong. You are a lying cultist. And you know it.

You’re a piss poor arbiter of right and wrong.

You can type the word “lying” all you want, but cannot state any lie I have ever told.

Tariffs are a fact of life, Every country has them. Which is why you don’t deny it but just resort to name calling.

You’re nothing more than a bitter, fat, old Trump hater, certifiable member of the antitrump hate group.

And you know it.

Every country has disease and crime too. That doesn’t mean we shouldn’t try to get rid of them.

The best part of this blog post: “…despite heavily supporting failed Democrat presidential candidate Hillary Clinton,…”

https://youtu.be/BD7SvXmjf3U

The Congressional Budget Office originally scored the Tax Cuts as costing $1.4 Trillion. They recently rescored it and because of increased tax collections from the better economy – and because more people have jobs and fewer get government assistance – the new cost is $400 Billion. So, they were off by a Trillion dollars right off the top.

If the economy keeps growing – the tax cuts may cost Zero dollars.

But the left told us businesses would keep all the money for themselves!!!! How incredibly inconvenient for liberals.

I dread they will have to sound like little bitches talking out their arses like Rags.

Yah, you stupid soccer hooligan.

“Business owners throughout the country continue to praise tax reform, stating that the savings is allowing them to invest, raise wages, and hire more employees.”

Each of which are businesses acting in their own self-interest. NONE of it is “altruistic”. EACH of them are specifically intended to make more money for the business. This is rational. Conservatives predict this.

OTOH, NO business sees a clear path when Duh Donald can change…overnight…the entire cost structure of their inputs. This is the injection of uncertainty.

I don’t expect you to comprehend this. You’re an idiot.

“OTOH, NO business sees a clear path when Duh Donald can change…overnight…the entire cost structure of their inputs. This is the injection of uncertainty.”

First, there is always an element of uncertainty in business. Market forces force suppliers, producers and consumers to change their profit projections constantly. When the price of oil goes up, increasing energy and transportation costs, this impacts businesses. When a some condition causes an increase in raw materials, this impacts a business. Some of these changes are temporary, such as a drought or flood in coffee producing areas. Some are relatively steady long-term increases or reductions. In the case of the material cost increases due to tariffs, this can be pretty accurately estimated. The same is true with the cost increase on foreign produced goods. So, except for the “fear” that the government might arbitrarily increase a businesses costs, all of the real costs can be pretty well projected.

What ALL companies, whose end sales are in the US, do know is that the US is the largest market for consumer goods in the world, accounting for nearly 28% of the consumer goods market. This is 3 times the market share of the next highest consumer market, Japan [8%], and 5 times that of China [~5%]. This makes the US the driving force in all industries which directly, or indirectly, rely upon consumer consumption for their income. US consumers are the securely in the drivers seat where the world economy is concerned.

More of your economic bullshit.

EVERY industry faces risks. As I’ve noted, those are rational and can be included in decision-making.

There IS no rational way to calculate what a BIG GOVERNMENT power-broker will do, or how to predict the impact it might have.

Ergo, UNCERTAINTY is exploded, and any rational business person retrenches.

Put down the bong.

Where do you think imported materials come from? That’s right, Buford, they come from other COUNTRIES. What controls those countries? That’s right, Buford, GOVERNMENTS. Why would you think for a single instant that foreign governments are any less likely to do something which is detrimental to a US business than the US government? OPEC just arbitrarily increased oil prices. Remember when Castro nationalized the sugar industry or Venezuela nationalized the oil industry? What about all the arbitrary tariffs around the world? What about the various arbitrary governmental fees and quotas used by China to stifle imports?

At least US corporations and voters have some control over the government of the United States of America.

All this hysterical arm-waving does NOT address anything I’ve established about T-rumpian economic policy exploding uncertainty.

Buford. You moron.

Reading rags replies here I realized we have been wrong about him. Many of us thought that he had learned his debate skills during his 3 weeks at the Sally Struther’s Law Center and Day Care, but we were wrong.

Rags got his skills from the old SNL. He is Dan Aykroyd saying to Jane Curtin, “Jane, you ignorant slut!”

Maybe rags will get an

EnemaEmmy Award.It was funnier and smarter when Dan Aykroyd did it, though.

lol, you don’t even read the articles anymore, just Rags’s posts. He not only lives rent free in your head, but there’s a kegger going on with a mariachi band and monkeys riding unicycles in endless circles.

Note carefully the rational basis that Piglet uses for is attack on me personally.

Yep. You won’t find one. Just sucking him some T-rump. It shows that even he’s nominally bright enough to know that what I’ve said is true. He’s got nutin but stupid bullshit.

Again.

Sure wish some of that $$$ would go towards increasing pay. It’s ridiculous that the wage I’m currently paid is significantly less (without even adjusting for inflation) than what I was getting 20 years ago. My skill set hasn’t decreased – why should pay be so paltry?

Of course, it doesn’t help that the influx of illegal aliens depresses wages, either. This is a huge factor in “trickle up poverty.”

A few points to consider….

The tax bill was signed in late December (22nd). And, even if you had a bunch of tax accountants at your place of business, chances are, you did not realize the full dollar impact of the changes until you ran the numbers.

Add in that it is late December – holidays, vacations, huge increase in business, working like crazy to get the fiscal year end as well as the calendar year end stuff completed.

If you were a calendar year end business, had the available cash and wanted to make an immediate impact as well as change the tax bill for 2017, you opted to give a bonus which is easy to implement. I think the majority of the raises were “announced” but probably would take longer to implement, depending on your payroll system. And, a hourly rate change also changes overtime and double time numbers, the employers portion of FICA/MC, worker’s comp,life insurance, pension contributions and other benefits which are based off of total salary.

The economic impact has been discussed as over a longer 10-year time frame, but most companies can only deal with a shorter time frame – this year. So, ok the tax rate is lower over the next 10 years, but out of this year’s bottom line – how much can I spend and remain viable? Spend too fast or on the wrong thing and you are in trouble next year.

So the bonus crumbs may be small on the individual level or on a 10 year savings level, but they could be significant for that person or for the company for that year. Actually giving out a flat bonus had a greater impact on the lower wage person than the 1% group.

And… remember back to the “shovel ready” infrastructure spending where it turned out that many “shovel ready” projects were not ready. Even if a large or a small business owner had plans for the future, it would be necessary to dust them off and review the plans under the new tax code structure as well as other market impacts.

There is one more thing that is probably holding up hiring by small businesses – the obamacare requirement of providing insurance if you have over 50 FTEs and then defining an FTE as someone who works 30+ hours a week. Until I see a definite repeal of those terms, I would be hesitant of exceeding them because the cost jump could be very significant.

Companies have few options for a cash windfall, employee pay, capital expenditures, dividends, reduce debt, or a bad choice, retained earnings. Retained earnings attracts corporate raiders.