Republicans Have Their Tax Plan: What’s In it And What’s Not

Yes, it includes repealing Obamacare individual mandate.

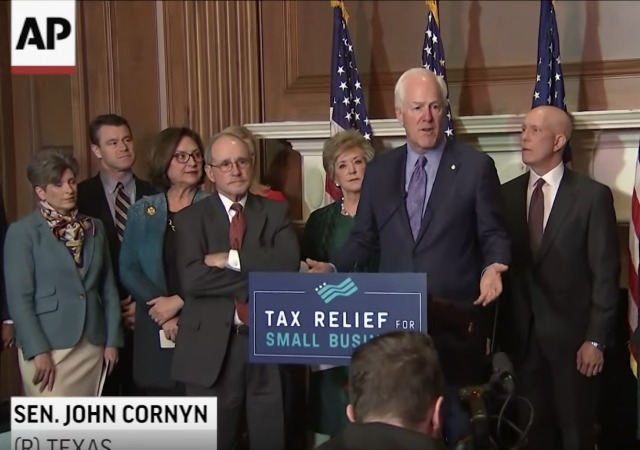

The drama is almost over as the Republicans have unveiled their tax bill. They are also closer to victory since Sen. Bob Corker (TN) and Sen. Marco Rubio (R-FL) have decided to back the bill, leaving the Senate with only two undecided Republicans. From The New York Times:

On Friday, as Republicans released details about the final bill, it became clear that the agreement would provide deep and longstanding tax cuts for businesses, while providingslightly more generous tax breaks to low- and middle-income Americans byreducing some benefits for higher earners.

With the finish line to their first legislative victory in sight, Republican negotiators agreed to provide a more generous child tax credit in the final bill to shore up support from Mr. Rubio, who said he would not vote for the legislation unless it provided more help to lower-income Americans.

One of the bigger things? The elimination of the Obamacare individual mandate remains in the bill. CNBC provided a quick list of the top points:

- The proposal would maintain seven individual income tax brackets at slightly different rates: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The top rate would fall from the current 39.6 percent. The House originally proposed collapsing the system to four brackets, saying it would simplify the filing process.

- The bill would scrap the personal exemption but increase the standard deduction to slightly less than double its current level. It would go to $12,000 for an individual or $24,000 for a family.

- It would drop the corporate tax rate to 21 percent from the current 35 percent. The change would take effect next year.

- The plan would set a 20 percent business income deduction for the first $315,000 in income earned by pass-through businesses.

- The bill would scrap Obamacare’s provision that requires most Americans to buy health insurance or pay a penalty. Doing so is projected to lead to 13 million fewer people with insurance and raise average Obamacare premiums, according to the nonpartisan Congressional Budget Office.

- The plan would eliminate the corporate alternative minimum tax, which the Senate added back to its plan at the last second to raise money. House leaders and corporate groups said the tax would stifle research and development.

- The estate tax, or so-called death tax, would remain but the exemption from it would be doubled.

- The child tax credit would double to $2,000 per child from $1,000. It would be refundable up to $1,400 and start to phase out at $400,000 in income.

- The plan would limit state and local tax deductions. It would allow the deduction of up to $10,000 in state and local sales, income or property taxes.

Yes, the estate tax remains despite the House leaving it out. It doubles to $11 million for a single person and $22 million for a married couple. If anyone exceeds those levels they still get hit.

Even though the state and local tax deductions remain, those who represent those in the northeast said it’s not enough. From Politico:

But some lawmakers, particularly from the Northeast, still say it’s not enough for many of their constituents. Bottom line: The amount of their income that is taxable would increase.

Homeowners, mostly on the East and West coasts, could see their home values decline. It would also affect infrastructure and public services such as education, according to Americans Against Double Taxation, since raising revenue needed to fund the costs of governance would be harder if residents can no longer write off all state and local taxes.

The GOP had a snag with how to treat pass-through businesses “whose owners pay taxes on their businesses through the individual side of the tax code.” The lawmakers want to make it easier for those businesses “to claim the Republicans’ reduced business rate.”

Sen. Ron Johnson (R-WI) and Sen. Steve Daines (R-MT) threatened to vote no on the original bill due to treatment of said businesses. It looks like they didn’t win because the bill will preclude some of the businesses “from the lower tax rates on pass-through income.”

This change in pass-throughs could also harm those “who depend on a regular paycheck.” Politico explained:

Many of them would get a mostly minimal decrease in their marginal tax rate, compared to contractors and the self employed. This is due to the changes in taxation of pass-throughs, and some tax experts say people would try to game the system to take advantage of the pass-through deduction.

College students and teachers gained some in the bill:

College loan interest would remain deductible, and tuition waivers for graduate students wouldn’t get counted as taxable income. Both had been on the chopping block. But an excise tax on large college endowments is expected to remain in the tax package, which opponents are saying could hurt college scholarships going forward. For lower levels of education, teachers would still be able to deduct some of their out-of-pocket expenses for school supplies they buy their students.

Of course the Democrats have accused the GOP of favoring the rich and businesses and stepped all over the little guy. From Fox News:

“Under this bill the working class, middle class and upper middle class get skewered while the rich and wealthy corporations make out like bandits,” Senate Minority Leader Chuck Schumer, D-N.Y., said in a statement. “It is just the opposite of what America needs, and Republicans will rue the day they pass this.”

Chuck and his fellow Democrats could make this a lot easier by CUTTING THE BUDGET. The fact is no one wins because in order to truly have tax cuts, the government has to cut spending. But they are not willing to part with their revenue.

The House plans on voting on the bill next Tuesday. You can read all 1,000 pages here.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

First vote Tuesday? 4 days for a House DIABLO to kill it, plus a couple more for a Senate one. Believe it when I see it. And probably not after that.

The devil is in the details, but I think I like it do far.

Now excuse me, I will drink to celebrate the upcoming death of obamacare’s penalty.

Michael Bloomberg went on record today saying that he hates this tax bill. That’s good enough for me, I’m for it.

20% deduction on the first $315k? Lame. Time to convert to C corp.

The end of the unPlanned (born alive) penalty. Positive progress. Now they need to restore the markets to organically regulate costs and availability, focus on revitalization and rehabilitation, and then support for a public trust (a.k.a. “safety net”).

Oh, and tear down the walls of Planned Parenthood. We can do better than selective-child and recycled-child. Can’t we?

a $10k cap on state income and local property taxes? That doesn’t go very far in greater Boston (we pay almost 3X that in property taxes alone). Awaiting the details on AMT which usually renders moot our deductions for charitable giving. If AMT thresholds are adjusted then perhaps the increased ability to deduct donations could offset the local tax pain.

Somehow I am feeling that my family is about to get screwed by this tax “reform.”

Haven’t seen full details… does anyone know whether the change to FIFO for stock sales went through?

Nothing personal, but all of us in Texas think that this part is one of the most fantastic pieces of this bill! We’ve wanted this for years! We’re the ones who have been subsidizing the high state tax rates of California and the Northeast states – now they’re going to have a strong incentive to reform their tax structures to be more like ours.

Taxes in big cities pay for thins like cheap public transportation (cheap compared to owning a car), parks, museums and such. amenities not available to people in low tax regions.

In Milton Friedman’s terms, it is just government deciding how to spend a portion of your income. The part of your income spent on local taxes is still income being spent for your benefit.

What is this 10 point increase for those in the middle class income brackets?! And for the next (still not “millionaires”) level it’s an 8 point increase?!?! WTH?!

This will hopefully net out to give me more money in my pocket after the tax man cometh, but with a 2-income household, you’re being forced to pay the highest ratio of the federal government’s “tax revenue.”

When I used the Tax Plan Calculator at this website, I netted a gain, based on total household income filing jointly and with deductions. I sure hope it’s true, or the Republicans are going to LOSE BIG in 2018, and again in 2020.

The GOPe tax plan is mediocre at best – though it did poison obamacare.

The GOPe is not mediocre, at best. They are backstabbing cowards, at best.

But at least Trump broke the long-jam.

Now we just have to break the GOPe.

I looks like they kept the Senate’s higher and more numerous tax brackets while still scrapping the personal exemption. The increased standard deduction doesn’t make up for it it you’re itemizing deductions, it’s just a straight up reduction in your total deductions. If you’re upper middle class this looks like a tax increase.