California’s lawmakers vote to raise state gas tax

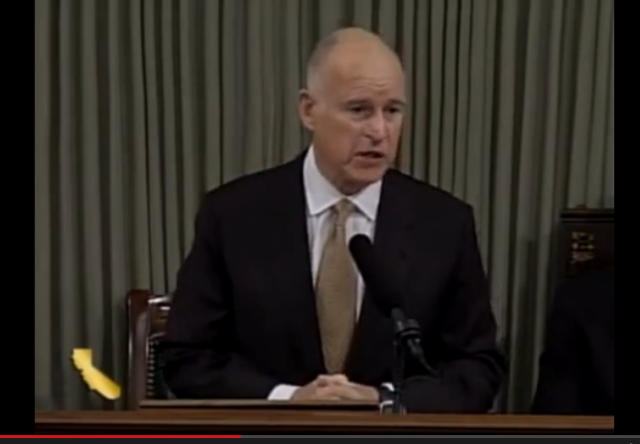

Gov. Brown makes $1 billion in side deals to get the hike through Assembly.

When I wrote about California’s senate mulling over a law that would repeal the state income tax for teachers, I predicted a new tax on fuel and electric cars was poised to slide through our legislature and become law.

Faced with a personal appeal by Gov. Jerry Brown, a Senate panel on Monday gave the first approval to a measure that would raise gas taxes and vehicle fees by $52 billion during the next decade for road and bridge repairs.

The bill by Brown and legislative leaders was approved in a 5-2, party-line vote by the Senate Appropriations Committee, which sent it to the Senate floor, where it is proposed to come up for a vote on Thursday.

“The roads are broken and they are getting worse and they are not going to get better unless we get a significant injection of money,” Brown told the panel in rare testimony to a legislative committee.

California’s intrepid conservative reporter in Sacramento, Katy Grimes, summarizes where we are going to feel the fiscal hit.

- SB 1 will raise the base excise tax on gasoline by 12 cents per gallon, bringing it to 30 cents. Another variable excise tax will be set at 17 cents.

- Diesel fuel and biodiesel will increase the state excise tax 20 cents per gallon from 16 cents to 36 cents a gallon. A diesel-only sales tax which is charged in addition to the state and local sales tax rates, will increase from 1.75 percent to 5.75 percent, going up four percentage points.

- Electric car owners will pay a $100 annual fee, after 2020, and only on new electric vehicles.

- The package also creates an annual vehicle licensing fee ranging from $25 for cars valued at under $5,000, to $175 for cars worth $60,000 or more.

When I discussed the quest of our Democrat politicos for “Sanctuary State” status, I mentioned that the measure was not as popular as was being touted. The gas tax was the focus of enormous push-back by citizens, and the small business community is extremely unhappy with the measure.

The National Federation of Independent Business/California, which represents 22,000 small business owners, deems the measure “bad public policy” and “bad politics.”

Tom Scott, the organization’s executive director, said California’s roads have been “embarrassingly neglected for decades” while billions of taxpayer dollars have been siphoned away from needed road repairs and transportation projects.

And the new bill, he said, was rushed to the Assembly floor without receiving a single committee vote in that house.

Scott also noted the irony in the fact that these same politicians rushed the $15 minimum wage hike through the legislature, but the 50-cent-per-hour pay bump workers got last year as part of the phase-in process will instantly be erased by the new tax increases.

Another measure of how unhappy Californians are about the tax hike is that nearly $1 billion in side deals had to be made to cement legislative vote.

The side deals, which still require legislative approval, showed up in two changes to the budget bill language, with most of it made public at 4 a.m. on the day of the vote.

The biggest concession made was a $500-million budget allocation for pet projects helping the districts of state Sen. Anthony Cannella, a Republican, and Democratic Assemblyman Adam Gray, both of whom held out support for the bill until the day before the vote.

Cannella’s vote proved critical.

Orange County Register author Joel Kotkin recently wrote about California having a “fly-over” country within the state, as the interior has lost virtually all influence, dwarfed politically by Silicon Valley and Bay Area progressives. The gas tax will hurt “red California” most, as it is those areas that have less discretionary monies and longer travel distances to work.

I also suspect that the monies for infrastructure repair will go preferentially to “blue California”, as it did funding for water projects such as dams.

However, one thing is certain: When it comes to wealth redistribution, our governor will persist.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

From the LA Times.

http://www.latimes.com/business/la-fi-gasoline-manipulation-infobox-20150706-story.html

It’s amusing. Like Chevron is responsible.

“California’s tough environmental rules mandate that gasoline sold within the state be produced according to strict formulas that reduce pollution. But the gas is more expensive and difficult to produce than dirtier fuel sold elsewhere. Few refineries outside the state are equipped to produce it. What’s more, the state gasoline formula changes twice a year, from a winter recipe to a summer blend designed to retard evaporation during warm-weather months. The summer blend is even more expensive and trickier to make, increasing the chance of refinery mishaps. In addition, refiners try to use up inventories of one type of fuel before the switch to the other type, increasing the risk of price volatility…”

The evil! It burns! Manufacturers trying to unload inventory.

Does anyone besides me see why Kali is so screwed up?

As far as I know there is only ONE refinery making the special Kali blend. And when that refiner suffers an outage of any sort Kali suffers a death blow.

http://www.latimes.com/business/la-fi-gas-prices-20161011-snap-story.html

I remember watching a news story when Kali gas prices spiked to over five dollars a gallon. And the TV station filmed some young lady trying to film her tank and as she saw the price escalating she exclaimed, “What are they doing to us?”

Safely ensconced in my new home country of Texas, I smirked and asked, “What do you mean ‘they’?”

Seriously, which way to the Alamo? More are coming, and they won’t be so nice. I brought my own musket.

To paraphrase Alexis de Tocqueville, “In a democracy, you get the government you deserve.” Congratulations, Kalifornia (D) voters, you got what you deserve.

“Democracy is the theory that the common people know what they want, and deserve to get it good and hard.”

H. L. Mencken

Plus the “Democrat Partiers” don’t even know we’re a Republic – never been a democracy….ever……..

I’m a fan of the gas tax and to some degree the sales tax. It hits the 47% who pay no other tax. The popular vote can ALWAYS vote in new leadership if they don’t like it.

Sure – if income taxes are lowered. But they won’t be – they’ll be raised.

California is a money rathole if there ever was one.

Or they can just leave.

as with all the previous tax hikes and bond issues to fix “roads & bridges”, i predict that most of the money raised (which won’t be as much as projected) will be squandered on anything BUT roads & bridges…

and whatever projects ARE funded will be given to politically connected contractors, paying top dollar wages to lazyass union slugs who will take twice as long to get anything done as a regular w*rk crew.

it’s #Failifornia, and that’s the only way we know how to do anything.

My dad, the sainted Senior Chief, confronted city councilman over that very issue. You know what he said? “Oh that. We spent it on something else.”

Wake. Up.

Oh, oh, next time Malibu burns we’ll spend the money on radios so police and fire can talk.

Yes. We in Tennessee have a term-limited governor that’s trying to pull the same deal; he calls it the “Tax Cut Act of 2017.”

This money won’t all go to fix roads. It never does.

I wonder if this is a back door way of getting additional funding for High Speed Rail, one of Jerry Brown’s pet projects?

Has California officially entered their much self-earned “death spiral” yet – as has Illinois?

“Illinois Revenue Freefall: Fiscal Year-to-Date -8.1% and Worsening”

“….Tax Hikes Don’t Work

If tax hikes worked, Illinois revenue would be up, not down. But Illinoisans are voting with their feet. On March 25, 2017, I noted Cook County Illinois Suffers Largest Population Drop In Entire US.

On May 18, 2016, I noted Illinois State Workers, Highest Paid in Nation, Demand 11.5 to 29% Hikes.

And on March 14, 2017, I noted Illinois General Assembly Retirement System Only 13.52% Funded: Overall, Illinois Pension Debt Interest Hits $9.1 Billion Per Year….

https://mishtalk.com/2017/04/04/illinois-revenue-freefall/

Two things come to mind when I read this. How much will go to one of two or more high speed boondoggle? And the other thought is how easy it is for politicians to get away with both irresponsible spending and increasing taxes to cover without any need for reconciling the billions and trillions already spent.

Sadly that isn’t necessarily a uniquely red or blue state phenomenon.

Maybe there’s a need for gay teen centers. Maybe there’s even public support for it. But don’t go about it by lamenting the cops can’t talk to the firefighters during major emergencies. The writing up a vaguely worded “public safety” referendum. And then spend the money on everything except radios.

Just ask, straight up.

Not a dime more will be spent on roads, because money is fungible. Besides, good California progressives should be opposed to helping out evil automobile owners. More traffic congestion would be environmentally just, not less.