Former ‘Mayor Pete’ Buttigieg Declares War On Rural Red States With Call For Mileage Tax

The burden of a VMT would fall disproportionately on those Americans already struggling and least able to afford a new tax.

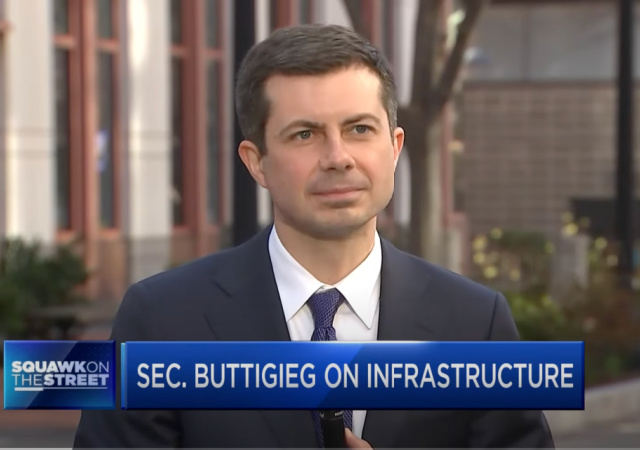

Pete Buttigieg wants to charge you more to get to work and buy groceries. The former mayor-turned-U.S. Transportation Secretary renewed calls for a Vehicle Mileage Tax (VMT).

Buttigieg discussed the Biden administration’s as-yet released infrastructure plan during a maskless (albeit socially distanced) interview with CNBC. He said he believes a mileage-based tax “shows a lot of promise” for funding an infrastructure package that will cost trillions and that existing gas taxes are no longer a feasible funding solution. Buttigieg also mentioned reviving the Obama administration’s “Build America Bonds.”

Not discussed during the interview was the impact of such a mileage-based tax on low and middle-class Americans who do most of the driving in the U.S. The VMT directly targets those people who live in Republican-leaning states, many in rural areas. Urban areas offer residents public transportation and much shorter commutes. However, the backbone of America’s economy is small and medium-sized businesses run by people who still have to drive from suburban and rural areas to get to work and buy groceries to support their families.

The burden of a VMT would fall disproportionately on those red state, rural Americans already struggling and least able to afford a new tax.

He said a gas tax would not work because of the impact on the middle-class. This is no different. It's people who work in city centers but live in outer suburbs for more affordable housing that will get kicked in the teeth with a mileage tax. https://t.co/1w7YfeHevH

— Jay Caruso (@JayCaruso) March 26, 2021

Because gas taxes aren't enough to fund their socialist spending sprees, now Pete Buttigieg wants a mileage tax too.

Democrats are doing their best to destroy business and stick it to the middle class.

— Cassandra (@CassyWearsHeels) March 26, 2021

How exactly is a mileage tax not a burden on the lower & middle class?

Are those not the people who typically can't afford to live close to jobs?

— Allegedly (@Hatem_All_) March 26, 2021

The attacks on the American worker just keep coming from the Biden admin. Now @PeteButtigieg is proposing that we TAX Americans on mileage driven.

For the record, studies have shown that low-wage workers average a 10 mile commute to work every day. https://t.co/H2WJukpyn5

— The Empowerment Alliance (@EmpoweringUSA) March 26, 2021

The addition of a VMT raises obvious questions about Biden’s already walked back promise not to raise taxes on anyone making less than $400,000 per year and serious privacy concerns.

“The President’s made a commitment that this administration will not raise taxes on people making less than $400,000 a year…and so that rules out approaches like the old fashioned gas tax.”

– Mayor Pete

How does that not also rule out a mileage based tax? https://t.co/WkvzkmeTCd

— Kevin McMahon boop/bop/beep (@KevinMcMahonYAF) March 26, 2021

I just don't know how they will calculate the mileage tax. Seems like a privacy issue if you track where people travel

— vajrpolanalyst (@vajrpolanalyst) March 26, 2021

Biden is expected to reveal the details of his administration’s infrastructure package on March 31st, during a trip to Pittsburgh.

Donations tax deductible

to the full extent allowed by law.

Comments

I’d propose a stupidity tax but no one in Washington could afford it.

Stupid people often subscribe to evil, such as communism and fascism. So is Butthead stupid, or evil? Or both?

Embrace the power of “AND”.

This guy’s dumber than Biden.

And younger. And a rising star of the left. (Though obama said he was too short and too gay to go far. The short and gay thing aside, Butthead has little to offer us, any more than he had to offer the small town he was mayor of.)

We already have a mileage tax. It’s called a gas tax.

the mileage tax should be slapped on the electric vehicles

Yup – meter the cars. They could record how much electricity they use to charge via an onboard computer and push the data to the government. And let’s try this for a Democrat idea. They could even charge more for more expensive electric vehicles, so poor people, or a least people with less expensive electric cars, could pay a lower electric charging fee.

The will rather propose universal tracking of all vehicles to know the mileage, however. It will be just another way to control you.

Wouldn’t this hit sprawling urban (and D-voter) areas like LA, Atlanta, Boston, etc especially hard?

No it wouldn’t…they travel short distances (slowly because of traffic).

The ones who will get whacked are the San Francisco Bay Area commuters. Many are driving in from as far away as Davis and Altamont because housing prices on the west side of the hills is so far out of affordability that even parking, cars, and fuel cost less. And, guess how many of them vote for the politicians who propose taxes like this?

No, because they will take money from the RED areas and give it to the BLUE voting areas.

This greedy tax-desiring Dem can stick that tax increase… um… maybe I should rephrase that.

And of course all of the existing gas taxes will magically go away.

Maybe in 100 or so years. Remember: it was only about 20 years ago that telephone subscribers stopped paying for World War One.

This clown can stick this tax up his…oh nevermind.

Connecticut is still waiting for the state sales tax to be retired. That was the whole premise behind a state income tax, that it would replace the sales tax, but now, surprise (not!), we still have both, over 30 years later.

Yeah like the Massachusetts Turnpike. It was supposed to collect tolls only until the cost of construction was recovered. Then every time it came close to meeting that goal, deficiencies were miraculously found that necessitated extensive reconstruction.

Same with the SF-Oakland bay bridge. Built in the mid-30s, we (my parents) were paying the 25-cent toll each trip either way. My dad told me that would stop when the cost of the bridge was covered. Today its $6 and $7 during commute, M-F. However half the bridge is new…. BFD.

No tax goes away. Ever.

Ditto with the Ill-Annoy Tollways – they were sold with the bait and switch that they would be converted to freeways once the construction was paid for. Fifty years later, here we still are, getting soaked.

What’s the Constitutional argument for Congress having the power to issue such a tax?

And from a policy perspective, isn’t this just a gas tax where you penalize people driving fuel-efficient cars? That seems odd.

It wouldn’t penalize them. It just mitigates an “advantage”. They don’t save any more than a gas guzzler with this tax.

I put advantage in quotes because it’s not really an advantage that would have even existed before imposing this ridiculous tax in the first place. There would still be existing advantages for fuel-efficient cars like saving on gas costs and gas taxes (since this is not a gas tax).

It comes from the same argument that allows the Feds to force you to buy health insurance, I imagine. So it’s not a tax, but a penalty, but really a tax, depending on which reitriction it needs to clear.

Silly – there is no Constitutional argument. They don’t need one, since they know better than the Founding Fathers.

Here in the commiwealth of Virginia, enacted January 1st vehicles that get over 25 miles per gallon combined have an added fee because of less gasoline used. If your vehicle gets less the 25 MPG you have an added registration fee because your vehicle uses too much fuel. So we have that going for us.

Really? Did I miss this? So basically, everyone gets a fee? Awesome!

No… they don’t GET the fee. They PAY the fee.

Not sure if you detected the sarcasm in my post.

you do realize that all vehicles will magically start getting over 25 miles to the gal

As I read it, he was saying there was already a fee for 25. Sort of a Goldilocks Registration Tax. Did I read this wrong?

Nah, what he describes is heads I win, tails you lose. No matter what your fuel economy is you have to pay the fee. I wonder, what if all cars magically get EXACTLY 25 mpg.

actually I believe Oregon already ran that tax up the flag pole, but too many bugs to work out

Wait until they reveal what they have waiting in the wings: a European-style Value Added Tax.

That sleazy dirt bag from West Virginia who just got his wife e placed in a wonder position to garner bribes is mulling the idea.

If you send in sizable campaign contribution and hire his wife as a consultant, you might get some attention from him.

Since the government has no God-given right to information about where I go, how far, and when, they also have no God-given right to tax me on my free will-based choices in this particular area.

You and I and most of the comment-makers here know that. But, the government has more badges, guns, and crooked judges than we do.

I flat out refuse to comply, and will actively work to circumvent the system. If our rules don’t apply to them, their rules don’t apply to me.

“If our rules don’t apply to them, their rules don’t apply to me.”

Where on Earth did you get that idea?

Sauce for the goose.

Then members of Congress who are “transported” to Congress currently at OUR expense should have to pay double the expense. Either that or every taxpayer should be able to list them as a dependent on our taxes!! They have too many perks as it is. Thing is, they “vote” themselves these perks without our consent! Often, we have no clue what they are getting (hair salon, barber shop, gym, massage parlors, cafeterias, etc–why? Taxpayers have to visit these places on our lunch hour or on our time off. Lord knows they have enough time off–especially considering the wages and per diems they consume!!!!

Um, no they don’t. Sure, the badges and the judges. But they have a bit of catching up to do.

And how many tanks, jets, and missiles do US citizens have?

You don’t engage the armed forces. You engage their rulers and those rulers’ sycophants.

What kind of defenses do CNN, Twitter, and the SPLC have?

If you’re one of the approx 100% of the population who carries a cell phone with GPS, they already know everywhere you go. All they have to do is ask Apple or Google.

Txvet2,

Point taken and not trying to ‘sharp shoot’ but as of 2019 Pew data, most recent I could find quickly, the rate is:

City 97%

Suburban 96%

Rural 95%

I personally haven’t carried a cell in six years. When I was medically retired from the Army. Prior to that I had a personal, a govt unclass and a govt classified cell.

Very liberating to not have them ringing at all hours. It wasn’t a bumpy transition. Loved it. Of course if one is still in the workforce then it may not be possible to sever from the Borg.

Cool. They can track the turned-off phone in my pocket.

UJ,

They can and do get data off ‘turned off’ cells.

Guess I’ll be taking my chances, then. If this indeed ever comes to pass, that is.

That’s why China God made burners.

I hope that the #NeverTrump Republicans who thought the biggest problem facing the nation was Trump’s Twitter account will relish paying a ton of new taxes like this one. Virtue signaling ain’t cheap!

it would be a huge fee every registration.

current mileage minus mileage at last registration x the fee per mile.

so a normal 155$ registration on an 8 year old vehicle would run 400 or so.

Convert your speedometer to the old Swedish mile of ancient times. I think it was 25,000 feet.

Yeah, but that seriously craters your MPG.

Hmm, disconnect odometer, 0 miles per year x fee = 0

I’ve said before DEMONCRATS aren’t going to be satisfied until we have peasants like all good Communist societies. And like all good Communist societies, they’re going to be the people in rural areas who produce the food everyone else eats. It’s about 25 miles from my house to the nearest hospital, ant that’s the town my doctor is in. The medical practice in my town has had a series of, well, not so good practitioners since my previous doctor was arrested for child porn… Good doctor, bad person. 36 miles to work. If someone wants to have their kids take ballet or dance of any kind or karate, that’s 20-30 miles away. Nearest Wakmart 15 miles away, the nearest other grocery store with an actual large food selection is 20. The school itself is zero to 20 miles away depending on which part of the district you’re in. Between the two towns maybe 9000 people. The suburb I grew up in with 25,000 people was 5 miles across at it’s widest.

It’s a tax on rural residents to subsidize city and suburban residents- and their mass transit.

“”It’s a tax on rural residents to subsidize city and suburban residents- and their mass transit.””

In other words, basically a tax on Republicans to subsidize the Democrat base.

Were I a farmer I would give very serious consideration to doing some subsistence farming with a little on the side to pay property taxes. A super-tough life (my wife is from a country where subsistence farming is the norm), but why produce food for the city slickers who hate your guts anyway?

So Plebe Pete is gonna spend trillions putting in the infrastructure to run buses and trains to rural areas? How regressive can you be when many of these communities are not only rural but poor and hospitals are frequently 25-50 miles away. Big government saw to the takeover of the little hospitals that used to service these areas. Sure they weren’t major medical centers but they were places where citizens could get emergency care when needed. Now, many of them will be forced to choose between the care, the medicine and the insurance.

Way to go Pete. Prostitute the government and the people who live in the country!

Mayor Pete ‘the fool’ would not be talking about these VMT taxes if he didn’t have 51 votes in the Senate to pass it. They have Murkowski, Collins and Romney all wrapped up. Thanks Mitch and Lindsay for wrecking America

I haven’t read anything here that suggests how to pay for roads. Maintenance and repair is especially a red-haired stepchild. Tying tax to fuel purchases worked as long as everybody used gas/diesel. That’s broken as there is no provision to tax that other fuel, electrons. Or hydrogen. Or supercapacitors. Or ….

Harrumphing over paying taxes. a commie plot for sure, is enjoyable but useless. Any suggestions for a fix?

How about gas and diesel taxes actually paying for road repairs? That money is also spent on bicycle lanes, bus lanes and bus stops, sidewalks, pedestrian bridges, some mass transit stuff, and stuff. Little of that mission creep stuff.

Don’t be a fool. The Secretary of Transportation is spreading misinformation. The Federal Excise tax on gasoline and diesel fuel was levied as a consumption tax to fund a Highway Trust to build an interstate highway system. But, the democrats depleted the fund and it’s broke. What the Democrats never thought would happen is that gasoline prices would stay low and their revenue stream became variable. This godawful proposal will fail and if it doesn’t, a GOP-controlled Congress will abolish it in January of 2023.

Q! They tol’ us you wuz hanged!

The Democrats understand something that the Pubs never get — as Senator Huey Long once said, “I won’t tax you, and I won’t tax me, I’ll tax that fella standin’ ‘hind that tree.”

The Democrats try to enact taxes that hurt their opponents. Sometimes they bring a sledgehammer but it’s usually done first and foremost to hurt those who aren’t in their camp.

If the Pubs were smart (hah) they’d do the same — we’d tax the stuff that the Democrats value (Hollywood, university endowments, etc.). But the Pubs aren’t smart.

So what ‘Mayor Pete’ is doing is nothing more than following the Dem playbook. Tax those who are against you.

Passive transgressive.

Mileage tax…no.

Change the way fuel taxes are spent? Maybe

Change the rate of tax back to a percentage consistent with historical standards; a slight increase at Federal level? Maybe

Though it would be nice if we could adhere to the stated purpose of fuel excise taxes; funding roadways. That was how it was sold; a user fee in which the more one drives the more fuel consumed and thus more fuel tax is paid by the users of the roadways.

Every dollar redirected towards other items; bike lanes, bus systems, trolley cars, are dollars that are supposed to have been spent building and maintaining roadways.

No doubt those public transport are desirable and useful in a metro area but not so much in rural places. If metro areas want those things they have State and local tax authorities that can raise revenue to support them.

A per person fee annually at $25 at 350 million Americans would provide a substantial amount of funding. This would be fair in the sense that the roadways have ongoing maintenance costs.

To say ‘I live in metro x and don’t have a car’ doesn’t wash. Your groceries are delivered on the roadways. The uber you utilize uses the roadways. The occasional trip you take from the city to the countryside via rental car uses the roadways.

Similar to electric utilities, the costs are in separate buckets. Initial build out, maintenance and for electricity a third bucket of generating power. Just as folks with enough solar capacity/ battery capacity who remain tied to the grid have a charge for that.

Is anyone actually able to explain how the tax would be determined? I mean mileage would be based on odometer readings right? And odometers can be wound back somehow right? So if the odometer reading goes in reverse does that mean a refund? 😛

George,

Really only three ways to get a total miles traveled:

1. Use odometer reading, likely pulled from the data submitted during a mandatory annual safety inspection like TX has. Could be tampered with.

2. Low jack everyone’s vehicles with a GPS. Many constitutional issues there.

3. Rely upon GPS data from ubiquitous cell phones. ‘Someone borrowed my cellphone, I didn’t travel that far.’

Take that number of miles and apply the rate of taxation.

IMO a simple per capita tax would be much easier and more straightforward while avoiding the data collection and privacy issues.

They can’t just use your cellphone. No way to prove it was you driving and not someone else’s car.

Why can’t they just tax how far your cell phone moves in any given year or month? They could have the cell companies bill you direct. Walking wears out sidewalks, too.

They can do anything they want, and will.

Some of us don’t use cellphones though. Does no Big Brother tracking meaning no taxation? I’m good with that. 🙂

Conversely what of those with cellphones who use busplanetrain? Do they get taxed for mass transit?

You forgot. The insurance companies are already conditioning us for this. “Want lower rates? Just plug this into your car.” Well those plug ins, in addition to monitoring your acceleration and braking g-forces, also monitor the miles you put on the car. The insurance company rates you based upon how hard you drive, plus the number of miles, and probably where you drive. No big deal for one of those devices to be developed for the government and then the data shared with insurance companies. “But that wasn’t me driving!” “Too bad. You own the car. Pay up.”

I’m glad I’m retired and the vehicle I purchased two years ago only has 4,200 miles on it. At my age I will likely never put more than a couple thousand miles a year on it and it should be the last vehicle I’ll ever have to buy.

I’m too old and cranky to put up with this Demonrat BS.

It would be very difficult to monitor and collect that kind of tax. If you want to raise a lot of money quickly I recommend charging a poll tax of ten pesos per head for every migrant that crosses the southern border, At the rate they are coming in the national debt would be paid off by the 4th of July.

C’mon, man. He’s a Democrat. He heads Transportation. So of course he proposes a mileage tax.

If he headed up Energy, it would be an automotive carbon tax.

If he headed up Health and Human Services, it would be a condom tax.

If he headed up Education, it would be a condom tax.

As much as I hate the “tax”, I am worried how the commies will collect it. Stick a chip in my neck? “Register” my vehicles and let ’em look at GPS all day long? I really doubt they’ll just look at my odometer once a year.

There is this sickening feeling that this is a way for them to track every citizens movement, 24/7. The only time they won’t count you and count the miles is at the voting booth, otherwise your privacy is toast.

“As much as I hate the “tax”, I am worried how the commies will collect it.”

Oh, don’t worry. In 10 years no one will be driving at all, except for the oligarchs and their enforcers. Fossil fuels will be outlawed, so no gas powered cars, and the grid run by wind and solar will fail, so no electric cars. And you will not need to drive in any event, because your commute will be from your barracks to the rice patties nearby to plant and harvest the crop, until you grow too weak from the hard labor and starvation, they will have you dig your own grave and lie down in it before they shoot you and cover you up. Then you can get some rest.

That’s typically how communists collect.

Bingo. They’ll SAY it’s because “reasons,” but the fact that it’d be a convenient way to control people (“sorry, you’ve exceeded your mileage ration for the day/week/month, so we are remotely disabling your vehicle for the remainder of this time period”) is just icing on the cake.

Let’s tax all the private jet owners out the sky. People like John Kerry will be giving up that private plane, then move on to large yachts while we’re at it.

It is to force you into the cities. They want you under their thumb. They have hated the suburbs and country side since the late 50s. I think it is because they know as you push people closer together we become more willing to have a forceful government to control all those other people not realizing that they will control you as well.

So if they do this, I’ll have to make it my mission to teach everyone I know how to disconnect that odometer cable. $0 per year in gas taxes…

We have a right to travel and can’t be taxed for exercising it.

Gas taxes are actually imposed on the retailer selling the gas, even though the burden is shifted (by the retailer, and quite wisely) to the purchaser. The important point here is that the citizen traveler is not liable for the tax. If the gas tax isn’t paid to the state, the state goes after the retailer who sold the gas, not the people who purchased the gas. It is the retail transaction that is being taxed. (The amount of gas sold is used to determine the measure of the liability, the tax is not on the gas itself.) This is an essential distinction. If the citizen is made liable for a tax for traveling, that tax will be unconstitutional.

Who will stand up to them or stand up for the Constitution for that matter?

Certainly not John Roberts……

Do you really think they give a flying fig about the Constitution at this point?

“We have a right to travel and can’t be taxed for exercising it”

I would like to see your theory in regards to both these assertions. Indeed, I see not right in the US constitution that grants a right of travel. The interstate commerce clause has been so distorted, that alone could be justification for the government to restrict your ability to travel. As for taxing, the power of the federal government to tax is broad and not much limited. The exact section of the document states:

“The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States:”

So, yes, they can do anything they please, just about, even if they chose to regard the US constitution, which they may well care to disregard.

A moral civilization is not dependent upon some words on a parchment, but rather rests upon the moral character of its citizenry. No words no matter how wise or noble, whether written or spoken, can safely guide a debauched and depraved people who shall, because of their debauchery and depravity, reject the very wisdom and nobility of those words.

In other words, the people get the government they deserve.

In theory “we get the government we deserve,” but in reality we get the government TPTB decide we should have. Anyone who believed otherwise should have been disabused of that quaint notion with the last election. (And it’s “the last election” not only in terms of being the most recent one, but also in terms of being the final one.)

No part of the constitution “grants” rights. In the American system, rights are not a gift from government, but an inherent aspect of man. The constitution clearly states that all rights of the states or people that are not delegated in that document to the federal government remain rights of the state or people.

“Since the circuit court ruling in Corfield v. Coryell, 6 Fed. Cas. 546 (1823), freedom of movement has been judicially recognized as a fundamental Constitutional right.”

The same Wikipedia article also states, right after, that: “However, the Supreme Court did not invest the federal government with the authority to protect freedom of movement. Under the “privileges and immunities” clause, this authority was given to the states, a position the Court held consistently through the years in cases such as Ward v. Maryland, 79 U.S. 418 (1871), the Slaughter-House Cases, 83 U.S. 36 (1873) and United States v. Harris, 106 U.S. 629 (1883).”

I take to heart your statement “No part of the constitution “grants” rights. In the American system, rights are not a gift from government, but an inherent aspect of man. The constitution clearly states that all rights of the states or people that are not delegated in that document to the federal government remain rights of the state or people”

I wish this was in fact so, and it used be taught as being so. However, I can find no evidence this concept is actually applied in modern America. We have been taught, instead, that this is a democracy, and the majority rules, and gets what it wants, the rights of the individual be damned. We have now gone farther. There are now no rights – only privileges, which can be controlled, regulated, granted, or withdrawn as desired, and not even via due process of a court or election and regular legislative order, but rather by the fiat of some mob that has bullied itself into a position of power.

So, on consideration, even if such a right to travel were explicitly enshrined in the constitution, if would not matter. ,which leads me back to my comment “A moral civilization is not dependent upon some words on a parchment,”

Anyway, they will do to you whatever they want and are able and allowed to do.

Your reply to henry doesn’t really support your position. The opinion you cited merely states that the protection of freedom to travel isn’t delegated to the federal government, but to the states. This suggests that it is the obligation of the states to protect freedom to travel.

Not all of our rights are found in the Constitution, and it was a dangerous and stupid habit for attorneys to get into in looking for them there.

There are only three types of activities:

Lawful activities conducted by right

Activities conducted by license (privileges)

Criminal activities (unlawful because they intentionally injure innocent parties and/or their rights)

Americans have traveled for nearly 250 years under the first category. The right to travel has been well established by usage. (I believe arguments should be made from first principles, as those principles are largely ignored due to reliance upon precedent. Precedent has its role, but principle should never take a back seat. Too much precedent is obviously wrong, IMHO. Which leads me to ask – Have any judicial opinion that says travel is NOT a right?)

But, if you must:

The right to travel is a part of the “liberty” of which the citizen cannot be deprived without due process of law under the Fifth Amendment.

Kent v. Dulles

…and they deserve to get it good and hard….

GFY, Booty-Judge.

So, what tax will this mileage tax replace, or does Butthead merely want to take more money from us?

So, what tax will this mileage tax replace, or does Butthead merely want to take more money from us? Greedy little guy, isn’t he?

How does this differ from a gasoline tax?

Some cars get better mileage such as hybrids. Spend a lot of money to buy a hybrid so you can save money on gas and then find out later the rules have changed.

Buttigieg says a tax on the middle class won’t work. So let’s do a tax on the lowest earning Americans! Another great decision from Joe “Cognitive Decline” Biden.