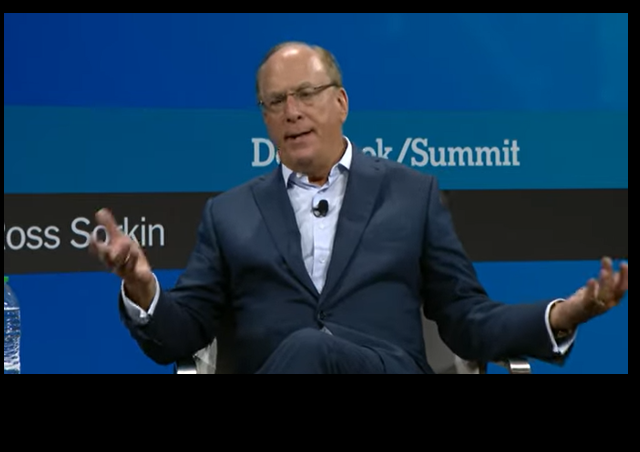

BlackRock CEO Larry Fink Whines that Term “ESG” Has Become “Weaponized”

Fink cites DeSantis decision to pull funds as part of reason. Meanwhile, Florida’s governor calls for ‘crippling the ESG movement’ in his new book.

BlackRock Chief Executive Officer Larry Fink, whose firm has attempted to foist environmental, social, and corporate governance (ESG) standards on the global business community, has stopped using the term, whining it has become too politicized.

BlackRock CEO Larry Fink is reportedly “ashamed” by the environment, social and governance (ESG) investment criteria debate and argued the term was being “misused by the far left and far right.”

“I’m ashamed of being part of this conversation,” Fink said, according to Axios.

Fink admitted during a conversation with the outlet at the Aspen Ideas Festival on Sunday that Florida Gov. Ron DeSantis’ decision to pull $2 billion in assets from Blackrock in 2022 hurt his firm.

“When I write these [investment] letters, it was never meant to be a political statement. … They were written to identify longterm issues to our longterm investors,” he said on Sunday.

In fact, the press is laying the blame thick on Republicans, in general, for the Bud-Lite level of popularity ESG is now experiencing.

Republican politicians have attacked ESG as a way for the corporate world to implement what they argue is a politically liberal agenda, triggering a backlash from Democrats who are seeking to defend it.

The controversy has led to some Wall Street firms backing down on ESG commitments, with insurers abandoning a United Nations-backed climate alliance becoming the latest example last month. BlackRock has itself been the target of investigations by some Republican-controlled states, and even an investment boycott in Texas.

However, as we reported, Florida Gov. Ron DeSantis has been an important leader in the pushback in a movement that attempts to force companies to adopt fiscally draining and time-wasting policies based on climate pseudoscience and social engineering. As we reported in March o this year, he led a coalition with 18 other governors against ESG.

Gov. Ron DeSantis, R-Fla., joined forces with 18 GOP governors to reject President Joe Biden’s environmental, social and corporate governance (ESG) “agenda,” claiming the push is a “direct threat” to the economic freedom of American retirees.

Governors in Alabama, Alaska, Arkansas, Georgia, Idaho, Iowa, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Dakota, Oklahoma, South Dakota, Tennessee, Utah, West Virginia and Wyoming formed the alliance Thursday in what they described as an effort to ensure American retirement funds are not used for “woke” investments.

In fact, a significant part of Desantis’ newsbook is focused on his plans to “cripple” ESG.

“Both the legislative and executive branches should use their respective authorities to defend individuals against large corporations that are wielding what is effectively public power,” DeSantis wrote in “The Courage to Be Free,” which published Tuesday.

“Reining in Big Tech, enforcing antitrust laws, prohibiting discriminatory job training, and crippling the ESG movement are all ways in which the political branches can protect individual freedom from stridently ideological private actor,” he wrote.

However, Florida and the other 18 states are not the only ones disenchanted with ESG. I reported at the end of last year the Europeans were also cooling toward ESG.

European funds that employ environmental, social and governance (ESG) metrics as a group are heavily “underweight” in oil and gas stocks but some tentative signs of a shift in positioning have appeared.

Six per cent of European ESG funds now own Shell, compared to zero per cent at the end of last year, according to Bank of America. Holdings have also risen modestly this year in other energy companies, including Galp Energy, Repsol, Aker BP and Neste, across the 1,200 European ESG active and passive funds monitored by BofA.

“We believe [some] ESG funds are revisiting the cost of exclusion [of energy companies] given their underperformance in the first half of 2022 or waiting for regulations to be finalised amid greenwashing fears,” says Menka Bajaj, an ESG strategist at BofA.

Fink, however, seems undaunted in pushing his climate and social morality on others via investment strategies.

But he said dropping references to ESG would not change BlackRock’s stance. The firm would continue to talk to companies it has stakes in about decarbonization, corporate governance and social issues to be addressed, he added.

On the issue of climate change, BlackRock has sought to strike a balance, continuing to invest in fossil fuel companies while nudging them to adopt energy transition plans. It has projected that by 2030 at least three quarters of its investments will be with issuers of securities that have scientific targets to cut greenhouse gas emissions on a net basis.

However, investment targets and policies based on narrative science and bad data are doomed. Hopefully, the spectacular failure of covid “experts” and the disinformation campaign used to support their destructive tactics has made people aware of the essentially identical approach that has been adopted for the “climate crisis,” but which has played out on a much longer time scale.

Yes – climate change is indeed impacting the world – forcing us to adapt to a much more friendly ecosystem. Looks like the additional CO2 is a big plus. https://t.co/f6N1ZPcMk6 pic.twitter.com/Brq914COC1

— John Shewchuk (@_ClimateCraze) June 26, 2023

I would also like to give the Legal Insurrection team a pat on the back for making the term “ESG” toxic. But it looks like we still have a lot more work to do to make the entire concept unpalatable to sensible investors and responsible politicians.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Well, if you didn’t want your weapon’s name to be weaponized, you shouldn’t have attacked us.

These people have the gall to tell us what they are planning on doing (take our kids, use government agencies against us…) and we don’t really listen to them. But then they actually start living out their plans that negatively affect us all so we stand up and reject them and their plans so they then have the unmitigated gall to act the victim. “You simply don’t understand us, We would never do such a heinous thing, That is simply not in our value system…” is what they claim and then, when they think we’re not looking or paying attention, they go right back to their plans. Their arrogance, like their greed and immorality, knows no bounds.

I don’t know why this would be news to him. He’s the one that weaponized it

Environmental, social, and corporate governance (ESG) standards were invented by the social marxists to be used as weapons Larry. They have no other purpose.

You know that, because you did it.

He did it for so long, now there is increasing backlash, this is the leading edge of such backlash.

What really irritated me as I completed both my undergraduate and MBA was the whole push for “Stakeholders” over shareholders.

While I agreed that consumers, the government, and others had a stake in the success of companies and what they brought to the market, I never accepted the premise that shareholders took a back seat to everyone else. That included the pension programs that purchased stock.

But investment groups like Black Rock took money from small investors through their pension programs, and weaponized their ownership of those shares to control companies.

The true investors were the employees, not the investment managers.

“I’m ashamed of being part of this conversation.”

By now everyone of us read that as “I’ve been caught out and now regret my indiscretion.”

We often see this explicit form of regret expressed by modern aristocrats. Their hubris leads them to the pitfall.

We need to coin a new phrase to capture the nature of “regrettable indiscretion,” as Fink illustrates it.

Something like “Borked,” yet “Finked” doesn’t really work.

However, that rat Fink couldn’t be more appropriately named

“Ratfink” is a pejorative that needs to be revived.

Gee, I think “Finked” is an absolute serendiponicker.

“Jussied” never really caught on.

And “Weingartened” hasn’t a prayer.

finkgrette; finkgrettable. Eh :/

Fink22. No.

Stereotypes are often true.

That is how they became stereotypes, people recognize the truth.

It was invented weaponized. You can’t run form this commie.

Severus Snape : You dare use my own spells against me, Potter? Yes. I’m the Half Blood Prince.

Fink can spin and obfuscate all he wants, but, it’s undeniable that from day one, “ESG” promoted an unabashedly Leftist/Dumb-o-crat socioeconomic agenda and aims. That made ESG sermonizing intrinsically (and, obnoxiously) political in nature and contrary to shareholder and company interests — unavoidably so and regardless of Fink’s retrospective posturing and contortionist spin.

If Larry Fink were secretly trying to validate every conspiracy theory about “International Jewish Financiers”…what would he be doing and saying differently than what he’s doing and saying now?

This is an example of why the culture war issues are worth fighting. As Gretsky told us ‘you miss 100% of the shots you don’t take’. Nice to notch a victory even just a PR victory at a minimum by forcing woke financial firms to climb down from their high horse. Can’t win if you refuse to fight and/or choose to ignore the culture war conflicts.

Has everyone noticed the “feel good” propaganda image focused commercials Black Rock is running these days? We’re nice! We take care of people! Really we are!

Reality: Marxist a-holes, now playing defense.

“When I write these [investment] letters, it was never meant to be a political statement. … They were written to identify longterm issues to our longterm investors,” he said on Sunday.”

Fuck you, Larry. “Do this or else your very existence” is not a “discussion.”

As usual with the left, they’ll play victim, change the narrative and the names, and go back to the same old playbook.

ESG has been weaponized…. By CEO Larry Fink.

Fink doesn’t actually care about DeSantis. As long as he controls boards he can push ESG. Moreover, the whole ESG movement doesn’t care much about governments at all, because their goal is to implement ESG by fiat on all major international exchanges. No ESG, get delisted. Then it won’t matter if DeSantis pulls money from BlackRock, he has no escape for Florida’s assets because none of the national governments involved are likely to decree ESG illegal, and in the case of the UK and US their governments will help in pushing ESG “voluntarily” on the exchanges.

Larry Fink is not disavowing ESG. He is disavowing using the name.. about to rebrand with a new name.

he’s just mad that he got caught and called out–he still thinks he should be able to force the rest of us to do his bidding

https://www.psychologytoday.com/us/blog/toxic-relationships/201907/covert-tactics-manipulators-use-control-and-confuse-you

Look at that and tell me if every single one of those looks like the common tactics of the left on a personal scale?