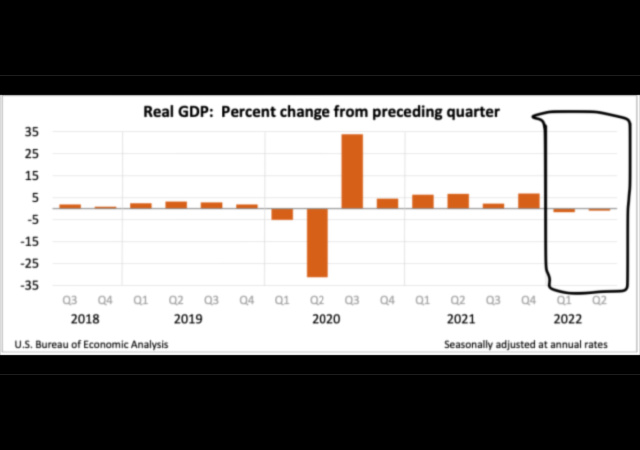

RECESSION: Economy Shrank at Annual Rate of 0.9% in Second Quarter, Biden Thinks We’re on the Right Path

Down two consecutive quarters, which means recession.

America is officially in a recession.

The GDP decreased at an annual rate of 0.9% in the second quarter.

There’s a decrease in private inventory and a cold housing market. Looks like exports helped keep it below 1%:

The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The decrease in private inventory investment was led by a decrease in retail trade (mainly general merchandise stores as well as motor vehicle dealers). The decrease in residential fixed investment was led by a decrease in “other” structures (specifically brokers’ commissions). The decrease in federal government spending reflected a decrease in nondefense spending that was partly offset by an increase in defense spending. The decrease in nondefense spending reflected the sale of crude oil from the Strategic Petroleum Reserve, which results in a corresponding decrease in consumption expenditures. Because the oil sold by the government enters private inventories, there is no direct net effect on GDP. The decrease in state and local government spending was led by a decrease in investment in structures. The decrease in nonresidential fixed investment reflected decreases in structures and equipment that were mostly offset by an increase in intellectual property products. The increase in imports reflected an increase in services (led by travel).

The increase in exports reflected increases in both goods (led by industrial supplies and materials) and services (led by travel). The increase in PCE reflected an increase in services (led by food services and accommodations as well as health care) that was partly offset by a decrease in goods (led by food and beverages).

Real GDP decreased less in the second quarter than in the first quarter, decreasing 0.9 percent after decreasing 1.6 percent. The smaller decrease reflected an upturn in exports and a smaller decrease in federal government spending that were partly offset by larger declines in private inventory investment and state and local government spending, a slowdown in PCE, and downturns in nonresidential fixed investment and residential fixed investment. Imports decelerated.

The income data is not good either when you think about inflation:

Current-dollar personal income increased $353.8 billion in the second quarter, compared with an increase of $247.2 billion in the first quarter. The increase primarily reflected increases in compensation (led by private wages and salaries), proprietors’ income (both nonfarm and farm), personal income receipts on assets, and rental income (table 8).

Disposable personal income increased $291.4 billion, or 6.6 percent, in the second quarter, in contrast to a decrease of $58.8 billion, or 1.3 percent, in the first quarter. Real disposable personal income decreased 0.5 percent, compared with a decrease of 7.8 percent. Personal saving was $968.4 billion in the second quarter, compared with $1.02 trillion in the first quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 5.2 percent in the second quarter, compared with 5.6 percent in the first quarter.

UH OH! How can the White House spin it when the Fed chair says this. Damn.

Fed Chair Powell: "We didn't expect a good reading, but this one was even worse than we expected." https://t.co/oWufOptfcQ pic.twitter.com/uuXHM8NfH7

— The Hill (@thehill) July 28, 2022

The government is making it worse by involving itself in everything. Raising taxes, spending more money, printing more money, etc.

We have low unemployment and lots of jobs. Great. People working still cannot afford anything because salaries aren’t keeping up with the rise in costs.

The Consumer Price Index (CPI) rose again in June and 9.1% in the last year. The Producer Price Index went up 1.1% in June.

As we see above, real disposable income decreased 0.5%. The June jobs report said average hourly earnings for all employees went up…10 cents.

How do I economics? People aren’t spending money the way they used to. They have to make budget cuts thanks to inflation.

Ooooooo gas is below $4 a gallon. WHOOP DEE DOO.

Stop raising taxes. The businesses pass it on to the consumer because they have to remain in business. No business means no jobs or goods.

Biden thinks we’re on the right path.

JUST IN – Biden's statement on the shrinking US economy: "We are on the right path." pic.twitter.com/ukQEN4YVBL

— Disclose.tv (@disclosetv) July 28, 2022

Oh! I found a person trying to work their way around the fact that we’re in a recession:

“We’re in a sentiment recession. I don’t think we’re in an actual recession. The growth slowdown has been driven by inflation and price shocks—as they fade in the near term, that should allow growth to accelerate,” said Aneta Markowska, chief financial economist at Jefferies. She expects the economy to expand 1.7% this year, measured from the fourth quarter of last year.

“Sentiment recession.” Okay, bro.

Let’s see how the media is handling the news. I see a lot of “fueling fears of a recession.” “Technical recession.”

BREAKING: The U.S. economy shrank between April and June of this year, a sign of a possible recession. https://t.co/4Z0ypD0BHK

— CBS News (@CBSNews) July 28, 2022

BREAKING: The US economy shrinks for a second quarter, raising the odds of a recession https://t.co/EPVD7zKdSG

— Bloomberg (@business) July 28, 2022

BREAKING: The U.S. economy shrank for a second straight quarter, contracting at a 0.9% annual pace and raising fears that the nation may be approaching a recession. https://t.co/dYUTWSjd80

— The Associated Press (@AP) July 28, 2022

The economy shrank at a 0.9 percent annualized rate in the second quarter, fueling fears that the U.S. is entering a recession https://t.co/0IzJKOoxe4

— The Washington Post (@washingtonpost) July 28, 2022

BREAKING: GDP fell 0.9% in the second quarter, the second straight decline and a strong recession signal https://t.co/bQT3XG1JMB

— CNBC Now (@CNBCnow) July 28, 2022

Breaking news: The US economy fell into a technical recession in the second quarter https://t.co/dWBQqnTVeG pic.twitter.com/DlBNeJMzEp

— Financial Times (@FinancialTimes) July 28, 2022

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

But it isn’t a recession until they say it is.

If President Trump were in office, they would be calling it a depression.

For those who think otherwise ..

Biden’s ultra extreme omni-radical economic contraction is underway.

Well, yes. I seem to remember a George W Bush “Worst economy in 40 years” claim by the press when the economy actually *grew* in that quarter.

We have been in recession AT LEAST 6 months

For something to be called a recession it has to last long enough to blame it on the next Republican president.

If the Republicans gain Congress in November the media will be blaming them for a recession the next day.

Next up

Changing the definition of definition

As of 9:40 Eastern, the markets don’t seem to be panicking – yet.

I don’t usually follow stocks closely but I’m close to rolling my 401(k) into an IRA. What has happened historically with the market on the announcement of previous recessions?

.

Oops, now they’re falling. Oh, well …

.

After falling ~25% since January, the market came back a bit (got back 15% of what it lost) since

I moved everything out of stock when joetato cheated to occupy the white house. While no one can predict the stock market, one can always predict that the hard core marxists now in control will tank the economy.

One dozen thumbs up.

Well, what is the Potato-head saying?

The whole is or is not a recession dance is political semantics for the 90% of people who don’t closely follow politics. Everyday people understand that their wage levels haven’t kept up for decades. They remember their wages rising in the Trump years with low inflation v the Biden Admin where net real wages (purchasing power) are – 3.5+%.

My amateur opinion is that we are in a low to moderate recession with a stagflation like period to follow. The impact of Rona policies on the labor market are still being felt and we are still adjusting to the change. Just think about schooling. Many former dual income households have pulled their kids out and into home school. One of those parents isn’t returning to the labor force anytime soon.

Airlines lost 35K+ employees due to vax policies. Skilled workers like pilots and mechanics who the Airlines PO took early retirement or found employment elsewhere. It’s going to take time to replace them. That’s on top of demographic issues of a bulge cohort of employees entering eligibility for retirement or mandatory retirement in the case of Pilots in the next few years.

The overhang of those things resulted in a big churn in the labor market as a whole which hasn’t ended. Wages are going to have to increase to attract and retain quality employees or they will jump to somewhere they are appreciated. How many couples downsized their lifestyle during Rona and found they could live on one income? Lots more to play out in the labor market, IMO.

The powers that be really screwed up when they shut everything down. A lot of people realized that it was better for their families if they stayed home, and a lot people and businesses nearing the end, but were still going due to inertia, stopped. Most of them are not coming back.

(last quarter) Yes, this economic report was less than we expected, but we anticipate at least 2% growth this year

(this quarter) Well, this economic report doesn’t include incredible growth we’re making in employment as people take two or three jobs to pay for Trump era inflation

(next quarter) Sure the housing market experienced a minor drop of 50% which drove economic growth into negatives this quarter, but rentals are up and construction in the Hamptons has never been more energetic.

(quarter after that) Reckless Republican budget slashing and criminal restraint of our economic plans may have created a minor economic boost of 2% now, but these cuts into critical essential services can only spell doom for the United States unless we can somehow reverse the electoral gains they made in this election…

May I translate my thoughts into binary then convert the bits to ascii characters via HTML?

For a crowd that denies a recession they sure were warning of one if Trump stayed in office.

Whassamatta, your genie won’t go back in the bottle?

Still shadow banned.

Gee, Wally…

Before everyone goes crazy in response, a few comments on the long term view.

1) the US has been in a long term bull market/ positive growth since mid to late 2009 (with the hiccup from the 2020 covid), 11-12 year long period of growth. So it is long overdue for a downturn.

2) that being said, the idiotic legislation related to covid stimulus will create long term inflationary problems and deepen this recession.

3) The same can be said for all the other progressive economic policies coming out of congress and the idiotic executive branch actions that will deepen this recession

“So it is long overdue for a downturn.”

Says who?

The only reason we have a downturn is the marxists currently in control of the federal government. Period. End of story. Full stop.

Stop making excuses for the marxists.

In response to barry and commochief – as noted in item #1, growth phases and recessions have been part of the normal economic cycle for centuries. A 12 year growth period is much longer than normal

As noted in item #2 & #3, biden’s economic policy[ies] have had and will have a much greater negative impact than would normally be the case.

Joe,

No question that the Biden Admin injecting another few trillion in unjustified govt spending is adding to the problem. As is the conscious decision to disfavor the domestic energy industry with burdensome regulations and actions.

Not to minimize the harm done but, IMO, these are equivalent to the coup de gras in comparison to the damage done by cheap money from the Fed embracing MMT. The low borrowing costs mask mal investment in zombie companies that are widely realized when the cost of borrowing rises to more normal historical levels.

When small investors are left with a ‘choice’ between negative real rate of return from lower risk options and a potential positive return from equity investments with much higher risk that isn’t much of a choice. It becomes a self fulfilling scenario in which TINA rules (there is no alternative) and people buy overpriced equities.

Mom and pop investors and businesses were already bleeding out from the wounds caused by the Fed, our govt’s response to the housing bubble bursting and a commitment to cheap money. Biden’s policies are the final bullet.

The only good to come from the very painful financial future we face will be to discredit MMT and some end foolish overly accommodating Fed rates which destroys these zombie companies and ends mal investment. If not we become Japan.

Joe,

The orgy fueled by cheap borrowing costs by an insanely a comparative Fed over that timeframe looms large. Asset prices, risk assets like equities remain, IMO, overvalued. Housing prices are still way overvalued.

As an exercise search for a home in the retirement location of your choice. Then use a financial calculator and input the costs of 30 year mortgage using average rates as of Jan 2022, July 2022 and for fun 5%, which is less than the historical average.

Compare the cost of the mortgage payment between those at 20% down. Then look at the sales price. Did it drop anywhere near the same % to reflect the addition mortgage costs from January to July? If not it’s overpriced.

Now consider equities v fixed income. Why can’t we get a positive real rate of return in anything but equities? There’s several reasons and some of them have to do with bias as to whom to favor and whom to disfavor. Wall Street institutions and big business are favored while Main Street and individuals are disfavored. It’s similar to the Cross of gold progressive era. Cheap money is on the whole bad for Main street and good for large institutions.

I read somewhere the 1st quarter was revised to negative 2.1%

And inflation is understated, so the contraction is much worse than the official numbers.

The contraction is not trivially worse, as inflation is materially understated. In the 1970’s you had a fixed basket of items against which price change was measured. Now if you substitute sirloin for filet mignon, or the container size shrinks and the price stays the same, that does not count as inflation, etc.

just wait until early fall when the added fuel and fertilizer costs are reflected in food prices.

gonna suck for many that don’t grow stuff.

fuel already hurting my 45x115ft garden but we’ll survive. already on second planting of peas.

Even sending billions of weapons and aid to Ukraine couldn’t prevent a recession

The recession is a plan. The real plan is for economic destruction far worse than the great depression.

And they are well on the way to pulling it off.

They are about 90% there.

Biden says “We are on the right path” precisely because it is his (or more accurately, his puppet master’s) plan to destroy the economy. They want to bring us down to 3rd world status like Venezuela.

Don’t forget: their plan is to own EVERYTHING (and we will own nothing – everything will be rented, right down to your underwear and toothbrush) and relegate the rest of us to serfdom… those of us who are not deemed totally useless eaters and thus escape elimination.

It became obvious the GDP number was going to be negative as soon as they started making the stupid argument that just because it meets the definition of a recession doesn’t make it a recession. This is the wages we pay for having a dementia-ridden, retarded pedophile installed illegitimately into our highest office.

“We are on the right path”

With near 10% inflation, 2 quarters of negative growth, exploding crime, exploding homelessness, exploding fentanyl deaths, no southern border, the Russians having their way with Europe and the Chinese and Iranians openly laughing and mocking us, What would be the wrong path?

You misunderstand Joe. We are on the right path, if your goal is to usher in the WEF as our de facto rulers. Grind the middle class between the millstones of taxation and inflation.

I don’t know about you, but I personally blame this on Climate Change, racism, white privilege and alt right extremists.

BIPOCS and LGBQT+ will be disproportionally impacted.

We can start fixing this by emptying the prisons and defunding the police. Also we need school policies that teach children to better understand their own privilege and how to become better allies for BIPOCS and LGBQT+.

“Biden thinks we’re on the right path”

Biden thinks—ha ha ha! Spilled my coffee.

The unemployment rate might be down (those looking for jobs) but so is the *employment rate* (people with jobs). Not by much, but it’s been stagnate most of the year, and dropped in June. June’s number came in at 59.9%. Pre-covid, the high was 61.2%.

Exactly. 3 million fewer people employed than in 2019 and we have millions of job openings. Wages are too low to attract employees or those open positions would be filled.

Wages will need to rise to attract employees. When that occurs employers will need to compete for the existing (smaller) labor pool than previous to Rona. Those costs will be passed along to consumers which feeds on itself.

I believe the labor market has shrunk permanently as many families decided they could have a higher quality of life with a single income household and homeschooling instead of both parents working full-time. Employers are still adjusting to a constrained labor market and are resistant to raising wages to compete for the best workers. The first companies that figure out the equilibrium point and act on it will prosper while the remainder play catch up.

“Recession, recession, recession, recession, recession, recession, recession, recession, recession, recession, recession, recession, recession.”

H/T Amy Schumer.

Correction. Joe Biden thinks naps are nice. He has no opinion on the current state of the economy, since he can’t even remember what decade this is.

Also, the people who write his teleprompter text think that their jobs depend on pretending all is well, even when it obviously isn’t.

No one thinks we’re actually on the right track, though many may say it.