New Polls Confirm Why Elizabeth Warren Dodges the Middle Class Tax Hike Question

Newly released polling information provides insight as to why Warren won’t go on record admitting her plan will raise taxes on middle-class Americans.

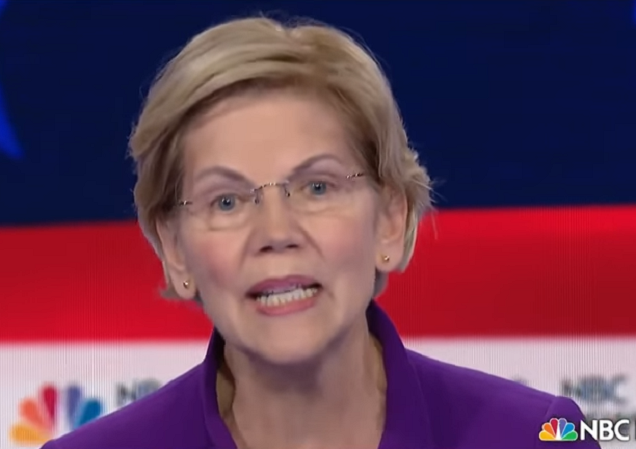

For months, Sen. Elizabeth Warren (D-MA) has tap-danced around the issue of whether or not her Medicare for All plan would raise taxes on the middle class. She’s sidestepped the question when asked about it at debates and she’s refused to directly address the issue when asked about it during post-debate interviews.

To better understand how adept she’s become at dodging the issue, here’s a video of her answers when asked about a middle-class tax hike since June:

Elizabeth Warren refuses to admit her Medicare for All plan would raise taxes on the middle class.

It would also fund abortions.pic.twitter.com/akwtdkxiAC

— LifeNews.com (@LifeNewsHQ) July 31, 2019

Just this past weekend in Iowa, Warren continued to evade the question:

The full back-and-forth w/ press on middle-class taxes vs. lower costs (full transcript above) was a bit tense and is clearly a point of some frustration for Warren.

Also clear that it's one she's going to continue to have to address as Biden, Buttigieg, others, raise it. (2/3)

— Ruby Cramer (@rubycramer) September 21, 2019

Q: “If Sen. Sanders, who wrote the bill, is saying that taxes for middle-class families will go up, will you also acknowledge that?”

EW: “He is saying the costs will go down.” (3/3)

— Ruby Cramer (@rubycramer) September 21, 2019

Liberal icon Stephen Colbert couldn’t get her to outright admit to it during the fawning interview with her last week. He came closer than anyone else, though. She acknowledged his point about using a different approach to try and sell a Medicare for All middle class tax hike to voters.

It’s obvious to just about everyone paying attention that the middle class would have to help pay for her Medicare for All plan. Even Sen. Bernie Sanders has admitted as much. Warren endorsed his proposal, which means she agrees with his plan on how to pay for it, too.

It’s also apparent why Warren doesn’t want to give Republicans and her Democratic opponents a soundbite by going on record and making the admission. It won’t play well with the electorate.

Via Bloomberg, polling information released by a Biden-linked polling firm bears this out:

A new poll by a firm linked to Joe Biden is testing messages designed to undercut support among Democrats for Medicare for All, one of the most contentious issues splitting the party’s top presidential contenders.

The survey, commissioned by the centrist Democratic think tank Third Way, found that primary voters start off favoring the government-run health care system by a margin of 70% to 21%, but can be persuaded to oppose it. The study showed that Democrats are most swayed by the arguments that the program would impose a heavy cost on taxpayers and threaten Medicare for senior citizens.

The poll was conducted by Lisa Grove of Anzalone Liszt Grove Research. Her partner, John Anzalone, is the chief pollster and an adviser to Biden, who opposes Medicare for All and wants to make government-run insurance optional.

[…]

The survey found that Democrats are most swayed to oppose Medicare for All when told it would cost American taxpayers $3.2 trillion per year: 51% of Democratic primary voters said they found that argument convincing, while 43% said they did not.

The poll also found that 51% of Democratic voters said the argument that it would “end Medicare as we know it” was convincing, while 53% said the claim that it would lower quality of care for seniors was convincing. And 51% said the argument that Medicare for All could expand wait times and limit access to medical specialists was convincing.

Those aren’t the only polling numbers on Medicare for All that could mean bad news for Warren with Democratic voters in the coming months. From a new Monmouth poll released today:

BUT an ongoing issue for Warren…

Opposition to Medicare for All seems to be hardening as voters learn more about it vs. public option.

Only 23% of NH Dems support it, 56% want keep private insurance as an option. pic.twitter.com/0KYqhLHhK2

— Alex Seitz-Wald (@aseitzwald) September 24, 2019

And a new WSJ/NBC poll shows eliminating private insurance in favor of a Medicare for All plan is not popular with the general electorate, either:

New WSJ/NBC Poll of ideas in the Democratic Primary:

Majority of voters back the idea of letting anyone buy Medicare, akin to the Biden plan, but a majority opposes Medicare for All that ends private insurance, as Sanders and others propose. https://t.co/vdBlCmubDG— Aaron Zitner (@aaronzitner) September 22, 2019

Look for Biden and Mayor Pete Buttigieg, in particular, to hammer these points home at the 4th Democratic debate scheduled for October 15th. Add Rep. Tulsi Gabbard to the mix, and it could prove to be a very challenging evening for Warren and Sanders both.

— Stacey Matthews has also written under the pseudonym “Sister Toldjah” and can be reached via Twitter. —

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

why is when they said they are going to raise taxes on the rich/wealthy they always seem to miss and hit the middle class.

still think a flat rate tax is the best way for everyone to pay their fair share

Almost 45% of American pay ZERO federal income tax.

Gee, I wonder which party they vote for.

I have 4 issues with the flat tax

1) nobody talks about the conversion costs, from those spending money already taxed to accounting companies and accounting and book-keeping employees whose livelihood is keeping track so that the IRS does not attack under the pretext that taxes were not paid. Or all the specialized government employees working for the various revenue departments. Those skills mostly do not translate to the new needs (the agressive “leave the uppity peasants without a shirt on their backs or any food in their mouths” attitude is likely the only part that does translate to the new governmental needs.

It would eventually be another regulatory compliance cost reduction good, but getting there has a stiff price nobody seems to be admitting.

2) Nobody is ready for the fair tax on top of the existing state, local, excise, and other current taxes there would be.

3)It has never been very clear if corporations are in or out, and if imports are in or out, if it is only end user and who is it that determines who (what) are not required to pay.

4)Nobody has any idea of what it would take to successfully chase black market economy of sales. We can’t even get most black market income when the IRS can look for people spending money they have not paid taxes on. Talk to a buddy who has a business that collects state sales tax and they will affirm those are the aggressive tax people. Nobody is remotely ready for what would be 500x in

StateFederal/State/Local Sales Tax Enforcer Departments.I favor a graded federal sales tax.

Grade D (Basic Necessities) – 1%

Grade C (Bulk Raw Materials) – 2%

Grade B (Consumer Goods) – 5%

Grade A (Luxury Goods) – 10%

Grade S (Egregious Luxuries) – 25%

The FTC would determine the sales grade of a good or service at the time of granting or renewing a trademark, or at the request of a trademark-holder if the good or service in question has significantly changed in the interim.

Fewer bureaucrats, fewer headaches for employers, fewer government noses in our personal financial information.

Probably missing a few nuances though.

Dred, your percentages are off.

23% was admittedly needed as an average for what was taxed. As I said that did not include state or local sales tax or income tax replacement tax.

For areas with high levels of both taxes I would not be surprised to see a 50% average needed. Now refigure as to how much no-tax or low-tax you are going to offer.

By my WAG your “super luxury” class will need well over 500% to make those numbers.

Found it

https://www.thebalance.com/what-is-the-fair-tax-plan-pros-cons-effect-3305765

Before adjustments because tax payers learn to game the new system as they would.

Yeah knew I was missing something.

The more appropriate question is why we should believe her that costs will be less? That was the promise of Obamacare, but costs went up.

The cost of medical insurance went up, while coverage went down: we now pay much more for much less.

The standard Democratic platform is to give every identity group everything they want, and to tell them that someone else will pay the bill.

Slick Willie Clinton said that his tax hike would only hit the rich. Then the IRS told us in the middle class that we were all rich.

Seriously, the Dems figure if they can steal from 40% of the voters to give to give the money to 60% of the voters, then they will always win elections.

I don’t see why she doesn’t just dismiss the problem with an airy assertion that more taxes on “the rich” will fund it all.

I don’t have much faith in a poll that doesn’t have its internals. the MOE is pushing it but the confounding variables are not shown.

If she succeeds in getting the nomination Trump will hammer that point every chance he gets.

Warren might avoid the question with the propaganda media, but won’t be able to hide from Trump asking her directly and not accepting her non-answers.