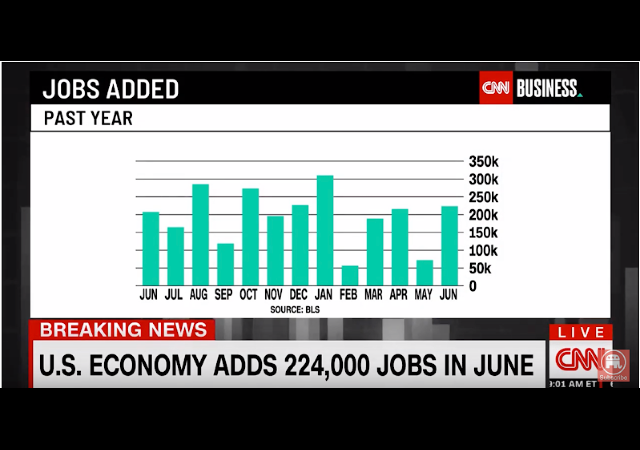

June Jobs Report Blows Past Expectations With 224,000 New Jobs

The unemployment rate only ticked up to 3.7%

The June jobs report blew apart expectations of economists as it showed the economy added 224,000 new jobs. Economists predicted only 160,000 jobs.

Unemployment crept up to 3.7% from 3.6%. However, the revisions are the noisy part of the report. The Labor Department trimmed 8,000 jobs from the April report and 3,000 from May.

With the June report, employers have now “added jobs for 105 straight months, by far the longest streak on record.”

From The Wall Street Journal:

Nonfarm payrolls rose by 224,000 in June, the Labor Department said Friday. The gain was stronger than economists had projected. Meanwhile, the jobless rate last month ticked up from a 50-year low to 3.7% in part because more Americans entered the labor force to look for a job. Wages advanced 3.1% from a year earlier, consistent with the prior month’s pace.

After very strong job growth in 2018, when employers added an average of 223,000 jobs a month, gains have been uneven this year, averaging 172,000 jobs a month through June. May’s dismal gain, revised down to 72,000, stoked fears that the labor market and the broader U.S. economy were quickly cooling.

The latest jobs-creation number provides comfort that is not happening, said Martha Gimbel, economist at job-search site Indeed.com.

“In this expansion, the labor market always seems to deliver a pretty solid number right when we need it,” she said. “While job growth may be slowing, it’s not plummeting off a cliff.”

Manufacturing finally cast a bright light in a jobs report as employment in that sector went up 17,000 in June after a stagnant four months.

Professional and business services also experienced a bump with 51,000 jobs in June compared to 24,000 in May. This sector has only averaged 35,000 jobs a month this year while it averaged 47,000 in 2018.

Construction remains a hot spot as it added 21,000 jobs in June, “in line with its average monthly gain over the prior 12 months.”

Andrew Hunter, a senior U.S. economist at Capital Economics, described the report as “a mockery of market expectations” for the Federal Open Market Committee to make cuts ahead of their July 30-31 meeting. He said the job growth in June “is still much stronger than the levels that have usually prompted the Fed to cut rates in the past and, although we do still expect the weakening economy to prompt the Fed to loosen policy, the first rate cut will probably be delayed until September.”

Wage growth provided great news since hourly earnings went up 6 cents last month to $27.90, which means “[T]he year-over-year gain remains near the best in a decade but is down from a recent peak of 3.4% in February.” I have seen some in the mainstream media try to downplay this growth since it only went up 0.2% instead of the expected 0.3%.

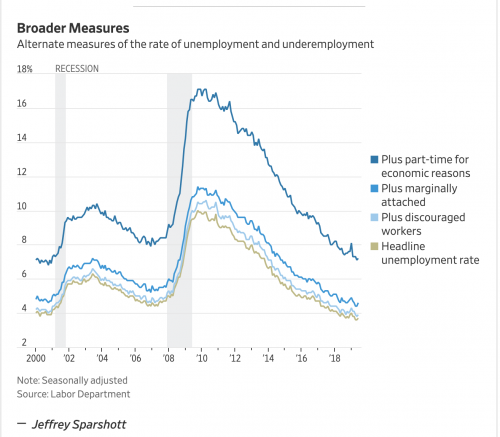

I know the left will freak out over the tiny bump in unemployment, but The Wall Street Journal pointed out there is no reason to panic:

The various measures of the unemployment rate ticked up in June.

Combined with solid payrolls growth and an uptick in participation, it’s likely more people were willing to look for a job in June—and thus be counted as unemployed, rather than outside the labor force.

The broadest measure—which includes part-time workers who want full-time work—rose to 7.2% after hitting a more-than 18-year low in May.

Those with less than a high school diploma saw their unemployment rate go down as well. The unemployment rate for those with some college or a college degree continued to tick down.

The unemployment rate for black men hit the lowest levels since the early 1970s. It’s now at 6.1% after high rates of 6.9% and 7.0% in the first months of 2019. It started to slide down in May at 6.2%.

Labor-force participation continued to climb as it hit 62.9% after reaching 62.8% in May. The rise “marks a positive development after months of stagnation” and “shows employers might be pulling in workers from the sidelines while the unemployment rate remains historically low.”

The participation is also a double-edged sword because it could cause the slow wage growth. If employers do not have to compete to bring in or keep employees, they may choose not to offer raises or a higher salary to new employees.

As I said before, the slash in jobs in May and April raised a few eyebrows. I tried to find a more in-depth analysis of the worry, but if you look at the May jobs report, the answer is quite clear.

May had a brutal jobs report. It showed 75,000 added jobs, but the revision snatched away 3,000 jobs. That is horrible considering the initial report had such a low number.

Either way, we still have a strong economy.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

We need to start getting people weaned off the handout of the regime. When it becomes more profitable to work these jobs will get filled.

Longest streak on record = ever recorded in history

Someone remind me just how Trump was going to economically destroy America again if he was elected Presudent?

The bad news is that reveals that we are back to the days of the market gaming the Fed instead of investing in the US economy. This is because ever lower interest rates allow the government to kick the can down the road on its inevitable day of reckoning for wreckless, out-of-control spending.

The economy will never be strong enough to absorb all of the debt that keeps piling up at an accelerating rate. The usual suspects are again calling for negative interest rates (I will charge you only 1% for lending me $100,000. Yeah, the end of market capitalism. How do you discount future earnings into the stock price?)

Where can we find the correct, latest numbers on the labor participation rates?

Oh great, now the IRS will make me take money out of my 401K.

Won’t stop the MSM/DNC axis from using the “worst economy since the Great Depression” shtick.

Just like “Republican Candidate is Literally Hitler” and “calls for tax cuts are really racist dog whistles”, the media has become boringly predictable.

I love winning