A Few Senate Democrats Join GOP to Ease 2010 Banking Rules

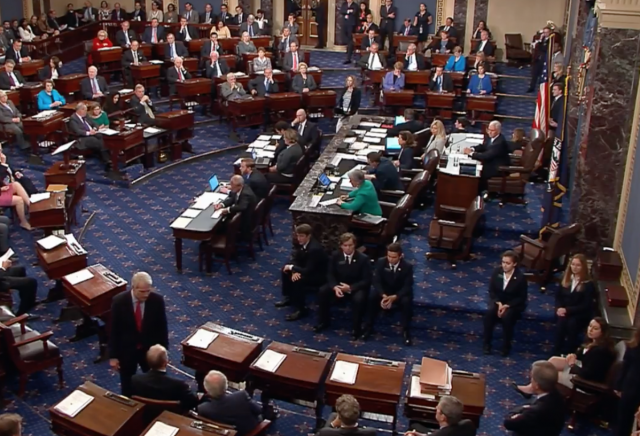

Democrats giving the GOP the votes it needs to pass.

The Senate will take up a bipartisan bill this week that could ease some of the banking rules in the infamous Dodd-Frank reform bill that passed in 2010. Yes, there are some Democrats willing to give the GOP the votes it needs to push it forward.

Last week, Senate Majority Leader Mitch McConnell filed cloture on the bill. So this week the Senate will vote to stop debate on the bill and pass it.

The Bill

From The Washington Post:

The core of the new bill exempts about two dozen financial companies with assets between $50 billion and $250 billion from the highest levels of scrutiny by the Federal Reserve, the nation’s central bank. Supporters argue that the legislation would bring much-needed relief to midsize and regional banks that were treated like their much larger counterparts under the 2010 legislation known as Dodd-Frank. Opponents say it would weaken the oversight needed to stave off the type of dangerous lending and investing that brought the U.S. economy to its knees.

Currently, regulations “requires banks to hold a certain level of capital on their balance sheets based on their total asset size, regardless of how risky those assets are.” The New York Times explained that “cash or customer deposits held at the Federal Reserve are treated the same as riskier assets like subprime mortgages or junk bonds.” Officials implemented this rule as a way to stop “banks from being able to take big risks without properly preparing for a disaster.”

The firms freed from these regulations include American Express, SunTrust Banks, and Fifth Third Bank. Bloomberg said some of the losers in this deal include Capital One Finacial and PNC Financial Services Group.

But some of those big evil banks the left bashes will receive a few benefits in the bill. It will “allow big banks to include municipal bonds in required stockpiles of assets that could be sold to provide funding in a crisis.”

Democrats Joining GOP

The Dodd-Frank bill received its name from its sponsors: former Sen. Chris Dodd (D-CT) and former Rep. Barney Frank (D-MA). The Washington Post noted that Frank opposes this new bill, but acknowledged “that it leaves the major protections of Dodd-Frank in place.” He, like some others, have pushed to adjust Dodd-Frank needs some adjusting. He also does not think that this bill will lead to another financial crisis.

Back in 2010, almost all the Senate Democrats voted for Dodd-Frank, but now some have changed their minds as the party faces a tough midterm this year. The GOP only has a one seat majority in the chamber and the Democrats don’t want to give them more of an edge.

Senate Banking Committee member John Tester (D-MT) has given his support of the bill. He also pointed out that the reforms from 2010 has caused “banks in his largely rural state” to go out of business. Tester said these banks didn’t cause the 2008 financial crisis yet they faced punishment and heavy regulations.

Other moderate Democrat senators that join Tester include Heidi Heitkamp (ND) and Joe Donnelly (IN). All three face re-election in November. All three come from states that chose President Donald Trump over failed Democrat presidential candidate Hillary Clinton.

All three worked with Banking Committee Chairman Mark Crapo (R-ID) to craft this bill.

Frank also said that he’d rather have these three senators “vote for the legislation and get reelected in November than vote against it and lose.” He believes if they lose re-election than the people will “get a much worse bill.”

You know what shocked me, though? I saw that Hillary’s running mate Sen. Tim Kaine (D-VA) even supports this bill along with Mark Warner (D-VA). Both of them helped author the Dodd-Frank reform bill.

But to no one’s surprise, Sen. Elizabeth Warren (D-MA) has railed against the bill:

“On the 10th anniversary of an enormous financial crash, Congress should not be passing laws to roll back regulations on Wall Street banks,” Sen. Elizabeth Warren (D-Mass.) said in an interview. “The bill permits about 25 of the 40 largest banks in America to escape heightened scrutiny and to be regulated as if they were tiny little community banks that could have no impact on the economy.”

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

While I agree major changes to Dodd-Frank are needed, this bi;; should not pass unless it brings back something like Glass-Steaagal. It may be the only way something like that happens.

I’m not sure I agree with bringing back Glass-Steagal, but that’s another discussion. The fundamental effect of the changes will be to create a “separate” banking system focused on underserved areas and markets outside Wall Street. The fact that they will be less regulated than the “to big to fail” banks is a benefit because they will be free to innovate and compete.

Worries about another 2008-style collapse are misplaced. These banks have proven, both before and after that debacle, that they conduct their business according to sound banking principles.

It’s ridiculous, hilarious and tragic, that ANYONE would care what Barney Frank thinks of ANY bill.

The old fag was telling everyone no oversight or concern was need for Freddy and Fannie in the time before the crash.

GIVE ME A BREAK.

The banking world is one the most heavily regulated industries in the history of this planet.

Even a quick search of the fatuous Wikipedia will turn up a competent list of a half dozen major banking ‘reforms’ enacting by Congress during the previous 100 years; from bad to worse sums up most of ’em.

The fact that many small banks were driven out of business by D-F is a feature, not a bug. It’s why nega-corporations love government regulation. The cost of compliance favors the fat cats and hampers or kills young up starts or old mom n pops.

What I really want to know is if this new bill kills the tyrannical, extra-constitutional CFPB, or at least brings it under Congressional oversite?

There was no mention made, so probably not.

And even so, the banks were *still* able to classify as ‘assets’ fractions of slices of mortgage funds made up of bits of other mortgage funds combined with… until nobody knew what *actual* assets the banks had liens on.

Florida (for example) still has a large proportion of their mortgages across the state which are totally and legally undefendable. Literally, nobody knows who has legal claim to the house and property that the mortgage document should show. The actual physical document has been lost in the system, the digital mortgage system shows the document in several banks, with differing signatures due to companies in FL who would literally forge (no other word for it) a mortgage document with chain of custody for as little as a hundred dollars.

There should be no “too big to fail” institutions, therefore we would not need so many regulations.

Agree.

“Too big to fail” = crony capitalism, scandal, corruption and ultimately financial disaster for the nation.

It also is a boost to the infection of socialism.

The FRACTIONAL reserve system, as well as the Federal Reserve, contribute in a major way to the business cycle.

Fractional reserve banking really came as a result of random courts trying to fashion banking law. They were wrong. Banking law needs a complete rewrite from SQUARE ONE.

Bankers centuries ago used a trick, which might be called “fraud,” in issuing more certificates for gold than they actually had. The courts should have put the kibosh on that, IMMEDIATELY, but they didn’t. Instead, they created this legal fiction, that by depositing gold (money) for safekeeping, it created a DEBT by the entity storing the gold, rather than a bailment for the goods deposited.

By saying it’s a “debt” instead of a “bailment,” that converted YOUR DEPOSITED ASSET, into the ASSET of the holder of your gold. They just owe you now, and you can get in line with the rest of creditors to collect. Good luck with that!

We should do it now, demolish banking law and build it from the bottom up! There are books, I assume, on this topic.

That is absolutely insane, and if implemented would literally destroy the entire world economy and drive almost everyone on this planet into poverty.

EVERYBODY OVER THE AGE OF TEN understands that when you cdeposit money into your account the bank does not put your grubby bills and coins in a safe-deposit box for you, waiting for you to withdraw them again. Everyone understands that you are lending that money to the bank for it to use, which is why it pays you interest, rather than you paying it a storage fee. And why when you withdraw money you never get the same bills and coins back, even if it’s the same branch where you made the deposit.

How else did you think banks operated? When you get a bank loan, where did you think the money came from?

“Dr. Rand Paul to Introduce ‘Audit the Fed’ as Amendment to Senate Banking Bill”

https://www.paul.senate.gov/news/dr-rand-paul-introduce-%E2%80%98audit-fed%E2%80%99-amendment-senate-banking-bill