Senate Will Include Obamacare Mandate Repeal in Tax Bill

GOP will add more tax cuts for the middle class with money raised from eliminating the mandate.

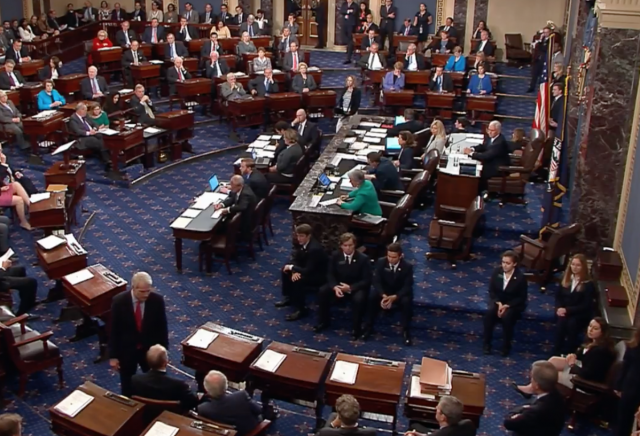

Senate Majority Leader Mitch McConnell (R-KY) announced that the Senate’s tax bill will have language to repeal the individual mandate in Obamacare. From The Hill:

“We’re optimistic that inserting the individual mandate repeal would be helpful and that’s obviously the view of the Senate Finance Committee Republicans as well,” McConnell said.

It will raise an estimated $300 billion to $400 billion over the next year that could be used to pay for lowering individual and business tax rates even further.

The GOP has only a two seat majority in the Senate, which has proven to be not enough on a few occasions concerning Obamacare. Both Obamacare repeal attempts this year have failed because at least three GOP senators decided to vote no.

One of those senators is Rand Paul from Kentucky. He joined forces with Ted Cruz (R-TX) and Tom Cotton (R-AR) to attack this provision into the bill. From The Hill:

“I’m pleased the Senate Finance Committee has accepted my proposal to repeal the Obamacare individual mandate in the tax legislation,” Cotton said in a statement.

“Repealing the mandate pays for more tax cuts for working families and protects them from being fined by the IRS for not being able to afford insurance that Obamacare made unaffordable in the first place. I urge the House to include the mandate repeal in their tax legislation.”

That means if Paul is on board, the Senate can only lose two votes. If it’s set at 50-50 then Vice President Mike Pence will cast a tie breaking vote.

Sen. John Thune (R-SD), the #3 Republican in the Senate, claims that “there has been a whip count and he is confident Republicans can pass a tax bill that includes a measure to repeal the mandate.”

If this is true, that means the other senators who have voted against Obamacare repeal attempts have agreed to vote for the tax bill with the mandate repeal: John McCain (R-AZ), Lisa Murkowski (R-AK), and Susan Collins (R-ME).

Thune is happy about the possibility, saying that the ability to make more tax cuts will give Congress “more of an opportunity to really distribute the relief to those middle-income cohorts who could really benefit from it.” Paul revealed that’s how he wants to handle the money saved from the repeal.

McConnell said that the repeal will allow the corporate tax rate to remain low permanently.

Of course Senate Minority Leader Chuck Schumer (D-NY) babbled on about how the GOP once again sides with the rich and cannot wait to raise people’s premiums and kick 13 million people off insurance plans. That’s how many people the CBO has predicted will “lose” insurance without the mandate.

What Schumer and the hyperactive left forget to mention is that A LOT of those people who will “lose” their insurance will CHOOSE to lose their insurance because they don’t want it.

Also, if insurance companies don’t have HAVE to provide insurance to everyone that could help premiums go down because that will be less coverage. But scare tactics, right? Both sides are so good at that!

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

OMG but that was a no brainer! Why did the GOP in the House not include eliminating that particular outrage?

Smoke and mirrors. The House and the Senate will not be able to come up with a version they can both agree on. Deliberately. It will be enabled by the usual suspects who are making sure that the Republican party betrays every promise.

But the Senators that refused to kill Obamacare in July will claim next year that they really, Really, REALLY tried and all we have to do is re-elect them again and this time they really, Really, REALLY promise they will end Obamacare.

Sadly, you’re probably correct.

Can’t wait for this tax bill that is designed not to cut taxes. The senate republicans refuse to win by changing rules so they can pass a real tax cut. As for obamacare mandate cut. I will believe it when I see it.

At best, a feeble attempt to claim that there’s something worthwhile in this basically worthless tax bill. At worst, just another piece of the usual scheme of raising taxes while pretending to lower them.

Nothing to erase the stigma of failure on undoing the Obamacare trainwreck. But they’re still fantasizing that it is.

Um, I’m all for eliminating the unfair and unreasonable tax on not being insured, but how does it raise revenue that can then fund further tax cuts? The original 0bamacare bill expected this tax to generate significant revenue, so eliminating it would also eliminate that revenue.

milhouse, tax revenue is generated by the flow of private sector money. Putting more disposable income into the economy ALWAYS generates more tax revenue (see multiplier affect: econ 101, and the Reagan boom). The private sector economy is currently expanding. News reports are showing “record tax revenues in October.” We Capitalists understand this concept intuitively. Taxes remove disposable income from the economy. Venezuela is just one recent example.

The lefties predicted an economic COLLAPSE just after President Trump’s election. Please explain from your stated point of view the increase in consumer confidence, economic growth, and dramatic increases in GDP.

The leftie “expectation” of a “significant” generation of revenue to the government forgot the FACT that robbing Peter to pay Paul will ALWAYS reduce disposable income from Peter with no multiplier affect.

Bear, do you really think you have to explain dynamic scoring to me? But the CBO explicitly scores on a static model. Please explain how, on such a model, eliminating a tax that generates revenue can increase revenue.

This is not quite accurate. The original aim of the personal mandate was to force as many people into the insurance pool as possible. This was designed to allow the health care insurance industry to survive until 2017, at which time it was expected to be so weak that it would begin to fail on its own. This would “force” Congress to save people’s lives by forcing a universal, government run insurance provider on the populous. The exemptions which were built into the system virtually guaranteed that most of the people who should have to pay this tax, wouldn’t have to. Which was fine, as this would only have hastened the collapse of the private health care insurance industry.

No, it wasn’t, as evidenced by the fact that they budgeted for significant revenue from those who would choose to pay the tax rather than buy the insurance. Now explain how, on a static model, getting rid of the tax can boost revenue.

I never said that eliminating the mandate WOULD increase tax revenue, in a static model. Ryan, et al, is inferring that he is applying a dynamic model where increased consumer assets will significantly increase the tax revenue through spending. My point is that the increased consumer assets will be so low, that there will be no measurable increase in federal tax revenues.

Now, in NFIB v Sibilius, is largely a total fabrication to justify allowing the unconstitutional penalty to continue. Whether the penalty generates revenue is immaterial as it is still a penalty, much as traffic fines are a penalty which generates revenue.

Here is an indication of the original reason for imposiong the individual mandate.

“Why is the mandate so important?

Uninsured individuals impose major costs on the rest of society. These individuals do use

medical care, and the latest estimates put the costs of uncompensated care at over $50

billion a year in unpaid medical bills. These costs get passed on, raising private insurance

premiums for those who are insured.

In addition, when those with better health opt out of risk pools, prices rise for those in

poorer health, which leads to an “adverse selection” spiral that raises insurance prices for

all. This is particularly important since one of the primary goals of health reform is to fix

the enormous problems that arise in our insurance markets because of price discrimination based on health. Shared risk can lead to higher prices for healthy individuals who pur

–

chase insurance, and without a mandate those individuals might choose not to participate.

This results in even higher prices for the ill, undercutting the very goal of reform.

This is not an idle conjecture. Five states have tried undertaking nongroup insurance market

reforms such as those contemplated in the PPACA without an individual mandate. Those

five states are now among the most expensive states in which to buy nongroup insurance.”

[ https://cdn.americanprogress.org/wp-content/uploads/issues/2010/04/pdf/individual_mandate.pdf ]

From NFIB v Sibelius:

This process yields the essential feature of any tax: it produces at least some revenue for the Government. United States v. Kahriger, 345 U. S. 22, n. 4 (1953). Indeed, the payment is expected to raise about $4 billion per year by 2017. Congressional Budget Office, Payments of Penalties for Being Uninsured Under the Patient Protection and Affordable Care Act (Apr. 30, 2010), in Selected CBO Publications Related to Health Care Legislation, 2009–2010, p. 71 (rev. 2010).

[…]

None of this is to say that the payment is not intended to affect individual conduct. Although the payment will raise considerable revenue, it is plainly designed to expand health insurance coverage. But taxes that seek to influence conduct are nothing new.

[…]

Indeed, it is estimated that four million people each year will choose to pay the IRS rather than buy insurance.

Milhouse: What you’re missing here is the fact that the subsidies for those that sign up on an exchange plan are massively more expensive than the tax revenues paid by those with no insurance.

So, per CBO, if you eliminate the mandate, some 13 million people will voluntarily choose to drop their insurance coverage (many, though not all, obviously, are on Exchange plans). The savings to taxpayers for not having to provide their subsidies MINUS the current tax revenue resulting from other people that have no insurance and are paying the penalty = $300-$400 billion in SAVINGS to the federal govt (ie. Taxpayers) over the next 10 years.

So the money should be denoted as “savings”.

It isn’t. They’re claiming it’s “revenue”, which certainly implies “new money” coming from somewhere. Maybe like manna…???

Welcome to Big Government 101

They also refer to increasing refundable tax credits as a “tax cut” when, in fact, due to the “refundable” bit along with some 53% of tax filers having zero or lower tax liability, it is really just welfare spending and should be referred to as such.

They also refer to actual tax deduction, like those that businesses get for R&D, and which oil & gas companies get for exploration, as a “subsidy” despite the fact that they are simply being allowed to keep their own hard-earned money and are not being handed other people’s money raised through taxes.

Similar examples are legion.

Simplest way to understand it is to just think whether Leftists like it or not. If they do, it gets a name that is positive and poll-tests well. If they don’t, it gets called something that a politician can campaign against.

Perception is Reality.

unless & until this actually becomes law, to me this is all just kabuki theater with the GOPe colluding with their Demonrat allies to F over America and it’s citizens.

i’m not excited and i refuse to get my hopes up.

optimism is its own punishment.

Let’s deal with the Obamacare mandate, first. At this point e have no idea what the Senate means by “eliminating the individual mandate”. If they mean eliminating the penalty, paid by the individual taxpayer, for not having healthcare insurance which conforms to that required under statute, this is good. But, it would not really make a difference as far as generating future tax revenue. In the first place we are talking about $2500 or less for most families and less than $700 for an individual, for the entire year. Not really very much is it. But, it gets better. Nearly 90% of the 30 million people, who did not have acceptable insurance, did not pay this penalty, in 2016, because of a wealth of exemptions. So the claim that this will stimulate any tax revenue increase, let alone a significant amount of tax revenue, is pretty lame.

What it does is two things. The first is that it gives the GOP Senate a way to claim that they tried to reduce the burdens of Obamacare, after they sunk the previous two lame Obamacare replacement attempts. It also diverts attention form the excuse that the elimination of the SALT deductions will kill the bill in the House. The Senate took the hit for the failure of the Obamacare modification bill. The House can not pass a tax bill which eliminates the SALT deductions, before the 2018 midterms or they risk losing the Republican districts in states and cities having large local and state income taxes.

This will actually do little or nothing for the tax payer and will insure the death of tax reform until after the midterms.

Congressional R’s are writing this tax cut to be revenue neutral, by CBO Score.

CBO Scores repeal of the mandate as a SAVINGS of $338 Billion.

That then allows them to include $338 Billion more in actual tax cuts and still end up with a CBO score that is revenue neutral.

Also, it gets the “13 million will lose insurance” (ie. will voluntarily choose not to be covered) nonsense out of the way, so next time they try to repeal Obamacare the D’s won’t have this talking point (which, again, comes from the silly CBO scoring). This was, by far, the favorite claim of the D’s and the media (redundant, I know) during each of the previous battles over abolishing Obamacare.

Sorry, but the assumptions made by the CBO are simply wishful thinking. In the first place it assumes that 13 MILLION people, who no enjoy coverage will VOLUNTARILY choose not to be covered. But, as these people are already in compliance by being covered, they not now paying the mandate. So, as long as the subsidies continue, why would they drop coverage which they can already afford? The only way this becomes feasible, as an assumption, is if the subsidies are eliminated and those requiring the subsidies to maintain coverage will simply drop the coverage. This does not require elimination of the mandate at all. It requires elimination of the subsidies. Something that is not likely to happen.

Eliminating the mandate is a good thing. But, it is still a boondoggle which will not produce any tax revenue increase, on its own.

“Sorry, but the assumptions made by the CBO are simply wishful thinking.”

Absolutely correct.

Also, irrelevant.

Yes, CBO is horrifically wrong about everything and ought to be abolished.

The actual issue here is that Perception is Reality. CBO makes a ludicrous claim, and the entire Liberal Media complex uses it as a talking point to slam Republicans and their agenda.

Doesn’t matter that the actual number that will voluntarily give up coverage is far closer to zero than to 13 million. Most voters have no clue. They hear what the talking heads say on TV.

This is actually pretty smart:

1) The CBO magically believes in the Mandate – the grotesque overestimate of 13 million voluntarily dropping insurance when it is gone is universally ridiculed. However, it gives the D’s a wonderful talking point when opposing Obamacare repeal. So, get rid of it now and when they get back around to Obamacare repeal the CBO score will NOT include the “13 million will lose coverage” nonsense.

2) By doing it now, as part of tax cuts, R’s can sell it by focusing on the $300-$400 billion in savings. <– the savings comes from all the people currently on subsidized exchange plans that CBO thinks will voluntarily drop their own coverage once they no longer have to pay a tax penalty for doing so.

3) By doing it now, as part of tax cuts, R's can use it as their "paid for" to get more actual tax cuts in the bill. Since, stupidly, R's still think they need a "revenue neutral" score on their tax cut bill. Stupidly, because, they still ignore the pro-growth effect of tax cuts, which result in higher GDP and hence, obviously, higher tax revenues despite lower tax rates. Laffer Curve. Does NOT factor into anyone in DC's calculations.

Oh, and "hat Schumer and the hyperactive left forget to mention is that A LOT of those people…". Yeah. "A LOT" = ALL. 100% that "lose coverage" due to this will be doing so ENTIRELY of their own free will. This is a good thing. Government has no authority to force people to buy a product from a private company (or from the govt itself, of course).

John Roberts is an imbecile. Claiming that something which he admits in his ruling is Un-Constitutional (the mandate) can be Constitutionally used as a trigger for a Tax is obscene. It turns the Constitution on its head. EVERYTHING the Govt is prohibited from doing is immediately within their purview simply by imposing a tax for not doing what the government is prohibited from forcing you to do. Voila!! Totalitarian, rather than Limited, government.

Bitch McConnell is a masterful liar. He allowed insertion of the mandate, knowing full well it will derail the tax bill in it’s entirety.