GOP Senators Ask Treasury to End ‘Too Big to Fail’

Nothing is too big to fail.

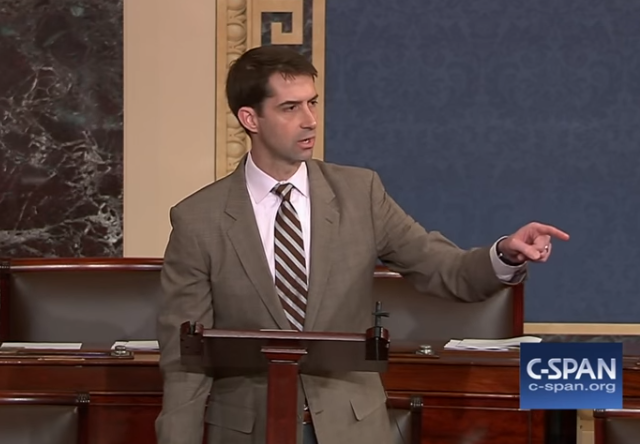

The Republicans on the Senate Banking Committee have asked Treasury Secretary Steven Mnuchin to end the “too big to fail” policy for non-banks. From The Hill:

Ten of the Banking panel’s 12 Republicans wrote to Mnuchin, asking him to freeze the Financial Stability Oversight Council’s (FSOC) ability to classify as “systemically important financial institutions” any organization that isn’t a bank. The SIFI label, nicknamed “too big to fail,” subjects firms to stricter federal oversight and requirements.

The group of Republicans wrote that the FSOC process “lack transparency and accountability, insufficiently tracks data, and does not have a consistent methodology for determinations.” They also claimed the process creates “substantial new regulatory costs while putting taxpayers on the hook for any future bailout to these firms.”

Republicans have long objected to the “too big to fail” label and the process that the federal government would use to dismantle SIFI-designated financial firms on the brink of failure. Republicans claim that process amounts to a bailout, though no taxpayer money goes to the failing firms.

The House Financial Services Committee Republican staff recently released a report claiming the FSOC used the label “arbitrarily and inconsistently.” They’re likely to seek changes the process by either eliminating it or adjusting how a bank or firm is labeled systemically important.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

The whole point of SIFI designation is to ensure large financial institutions have a resolution plan in place that doesn’t rely on taxpayer dollars. In other words, an institution designated as a “SIFI” is required to ensure it can fail without harming the economy, it must show it is not to big to fail.

This is like arguing we need to get rid of the fire department because fires are bad.

If congress were really serious, they would reinstate Glass-Steagall.

Sorry, I thought I was posting the first comment. Obviously, I agree wholeheartedly. The Financial Services Modernization Act of 1999 is when the NWO finally surged into a global banking debt bubble. The math no longer pencils out on a global scale. With all of the derivatives, unregulated wild cat trading avenues, endless loop debt-driven “structured investments”, there is no way to know how much debt is actually out there. All we know is we are all going to be eating shit eventually.

Hey senators, it’s Congress itself that created this problem. A good start would be to re-instate the Glass-Steagall Act to split up the “too big to fail, too big jail” banks. Shut down the bankster casino with ALL of our money! (And audit the Fed!)

“(And audit the Fed!)”

Better yet, get rid of the Fed entirely! Why do we have a non-governmental entity making life-and-death decisions about our financial system? It is an invention of, and servant to, Big Money and has always worked for the interests of banks, not the good of the country. And please, none of that “What’s good for General Bullmoose is good for the USA!” crap! This ain’t Dogpatch!