GOP’s Border Adjustment Tax Reform Plan On Life Support

With no current Plan B, is tax reform possible in this Congress?

House Republicans desperately want to reform taxes, but so far the only plan they have developed has gained no leverage. That’s because border adjustment makes up a majority of the plan, which few, including top retailers, want anything to do with.

The border adjustment is a tariff. It adds a tax on imports, which will inevitably raise prices on consumers. Common sense economics: A business must make a profit in order to supply goods and services. It cannot do that without money. In order to make money when a tax is added or raised, the business must raise the price on its goods in order to make that profit.

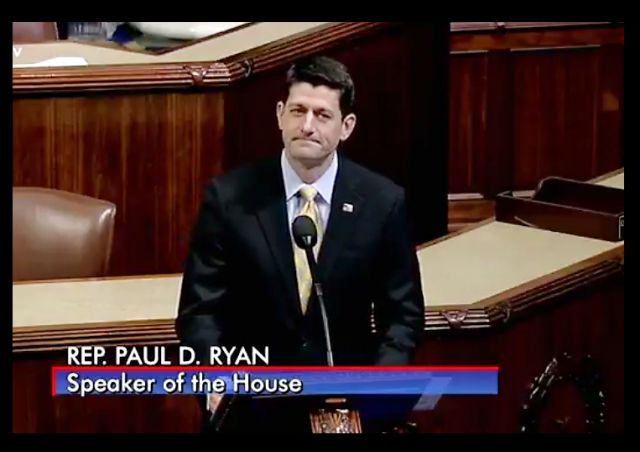

This is why retailers have lashed out against the proposal. It’s also a reason why Speaker Paul Ryan (R-WI) and Rep. Kevin Brady (R-TX), the architects of the proposal, cannot bring in other congressional GOP members.

Ryan tried to do just this at a weekly lunch gathering with Senate Republicans. He begged them to “[K]eep your powder dry.” From Politico:

The next day, Sen. Tom Cotton took to the Senate floor to slam Ryan’s so-called border adjustment tax, saying “some ideas are so stupid only an intellectual could believe them.”

“Many other senators share these concerns and we most certainly will not ‘keep our powder dry,’” Cotton went on, without naming the speaker in his speech.

Politico said many have argued against the proposal privately, but here are a few, besides Cotton, who have expressed doubts:

Senate Finance Chairman Orrin Hatch (R-Utah), sources said, has warned Trump and Ryan that border adjustment won’t likely have the support needed to clear the Senate.

Hatch, in an interview after Ryan’s presentation, said the speaker “didn’t cover [the border adjustment proposal] as specifically as I would have liked.” And Sen. Roy Blunt of Missouri, the fifth-ranking GOP senator, said the Finance Committee will likely go a “different way.”

Others were more unequivocal.

“It’s beyond a complication. It’s a bad economic proposition,” said Sen. David Perdue (R-Ga.).

Greg Valliere, the chief global strategist with Horizon Investment, told CNBC that the proposal is “on life support” especially since President Donald Trump met with those retailers who do not want it:

“[Trump’s] been all over the lot on this issue,” said Valliere. “They [retailers] may have persuaded him to oppose this tax. That’s speculation. If they do, I think Ryan’s got to come up with a trillion dollars. I don’t see a trillion dollars.” Valliere said the remaining options would be to scale back the size of the tax cut or move ahead without the requirement that it be revenue neutral.

Even a senator used those same words:

Senate Majority Whip John Cornyn, R-Texas, joined the list of doubters this week, saying he does not see the votes lining up. In an interview with Bloomberg, he used the same language as Valliere in describing the tax. “The hard reality is the border tax is on life support, and given the imperative of 51 senators and 218 House members and one president, I think we need to look for other options,” he said.

The proposal sounds fine and dandy, but includes too many what ifs. I wrote about those scenarios in my last piece about this subject. Ryan and others brush aside fears by saying those burdens placed on the consumer “would be offset by an increase in the dollar’s value due to the policy, thus negating the need for the importers to hike prices for consumers.”

Nope. That offset is not even close to a guarantee and is unlikely to happen. Steve Forbes explained that politicians forget that the country belongs to “elaborate global supply chains.” No one knows the consequences if those chains come undone.

From The Wall Street Journal:

Tax experts are puzzling over how to describe who wins and loses from border adjustment. One thing is clear, economists say: If the dollar goes up 25%, U.S. holders of foreign assets—including pension funds and endowments—would suffer a one-time loss in wealth of more than $2 trillion.

There is also global uncertainty: Other countries may retaliate, either by border-adjusting their corporate taxes or by challenging the U.S. plan at the World Trade Organization as too tilted toward American producers.

From The Financial Times:

Prices tend to be sticky, particularly when 93 per cent of US imports and more than 40 per cent of global trade is invoiced in US dollars. These prices would have to be renegotiated over time. Furthermore, the Federal Reserve and the People’s Bank of China would do their best to lean against such a currency move.

So on to their backup, right? Well, that’s another problem because that does not exist. As The Wall Street Journal points out, they don’t have a Plan B.

Republicans in Congress may think the time has become ripe for tax reform, but if they refuse to stray from this tariff, it will not get done.

The easiest way to solve the tax problem is to cut the budget and stop spending. Revamp the tax code. Repeal the 16th amendment. Mainly stop spending.

But we all know that will not happen.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

With respect to a tax to secure the border, I would prefer they simply slap a modest tax on remittances.

I’d back a YUGE tax on remittances – say 100%, or 110%……

Nah, a border tariff is long overdue given the USA’s enormous trade deficits with just about everybody.

This idea was well campaigned for in the election. There’s a mandate, maybe even a super mandate given Bernie’s similar rhetoric.

The giant, overdue, infrastructure bill needs to be paid for and a tax bill targeted at foreigners taking one-sided advantage of the American market is the best means to pay for it. Sure, it’s a tax, and part of the tax will hit consumers, but this hits them less hard than raising other taxes. Finally the USA government is looking after American business and not just international merchants.

Let’s think RATIONALLY about the idea of national “trade deficits”.

At its most basic, it implies that one country’s consumers (free to use THEIR property as they wish) buy more of another country’s products than the other way around.

Sweden has a “trade deficit” with us about equal to the Mexican’s.

Ever hear anyone get the squirts about Sweden beating us?

Now, what do we buy from Sweden? Not that much. But Americans DO decide to spend THEIR money on some Swedish products. AND the US is ENORMOUS as the consumer market goes. We ARE the King-Cat-Daddy of consumers.

What do Swedes buy from us? What could their relatively tiny population POSSIBLY buy from us in the volumes that would “balance trade”?

See, the idea is stupid. There isn’t a nation in the world, in this basic illustration, that could possibly have a “balance of trade” with the US, given the people here are free to use their property as they wish.

Which is ANOTHER reason that tariffs are an obscene idea. They are an affront to liberty, and to our natural rights to both our property and free association.

“The giant, overdue, infrastructure bill needs to be paid for and a tax bill targeted at foreigners taking one-sided advantage of the American market is the best means to pay for it.”

When did you realize you were a New Dealer and Keynesian?

—- The border adjustment is a tariff. It adds a tax on imports, which will inevitably raise prices on consumers. Common sense economics: A business must make a profit in order to supply goods and services. It cannot do that without money. In order to make money when a tax is added or raised, the business must raise the price on its goods in order to make that profit. —-

Or they can find a new supplier that has products that do not fall under the tax. The goal is not to increase taxes on everyone. This is about creating an incentive to make products here whenever possible.

So, we are trapped in a repeating cycle of labor and environmental arbitrage, debt, and social justice, which precludes the operation of a functional capitalist market. It is a practical monopoly that is routinely interrupted by misalignments and resets (e.g. recession, depression, war, abortion).

http://www.gallup.com/poll/204044/record-high-foreign-trade-opportunity.aspx

“Nah, a border tariff is long overdue given the USA’s enormous trade deficits with just about everybody.

This idea was well campaigned for in the election. There’s a mandate, maybe even a super mandate given Bernie’s similar rhetoric.”

Well, no. Neither is true. Americans recognize trade as a very beneficial thing.

We HATE hidden taxes, which is what, among other bad things, tariffs ARE.

As to the “trade deficits” bullshist (for the doily-twisting sisters here), that’s a term for demagogues. I’ll bet you run a tremendous, really YUGE trade deficit with your grocery store.

I’m always appalled at the economic ignorance displayed here.

So don’t make the tax hidden. Make it EXPLICIT.

The “FairTax” proposal is the way to deal with this.

Eliminate the Income, FICA, Corporate, Gift & Estate taxes in their entirety, repeal the 16TH Amendment and replace the whole thing with one time basic national consumption tax on all purchases of new goods. Counter-act the alleged “regressive” nature of the tax (even though it’s NOT regressive in ANY way) by paying a pre-rebate to each household based on family size to bring expected spending up to the HHS poverty level.

All goods, regardless of location, are taxed at the same rate. Goods being sold OUT OF COUNTRY to citizens of other nations are sold at the base rate, and subject to THOSE countries sales taxes (or import tariffs) only, which acts as a WTO legal trade subsidy of US goods to foreign countries.

There IS a one-time “hit” to “savers” without any FUTURE income streams in that their existing savings will roughly be able to purchase 30% less goods due to the expected initial rise in sales costs, but that will balance out in approximately 3.5 years.

I generally agree. Up and down.

So whatever happened to cutting the Corporate Income tax rate?

And howse come Der Donald hasn’t sent a bill to the House?

THAT should have been in the hopper months ago.

Remember the soda tax that was enacted in Philly – it was on the distributors of sodas, but the retailers increased prices to cover their additional costs.

The mayor complained and accused the retailers of price gouging.

http://reason.com/blog/2017/01/11/philly-mayor-blames-price-gouging-for-ou

When you look at Squeaker Ryan, you’re not just seeing a Muppet lookalike, but a rino obstructionist more loyal to an utterly corrupt establishment than he is to the American people.

In other words, he’s a rat.

The sooner we boot this guy out of the Squeakership, the sooner we can move forward with getting our nation back.

This guy is boehner, but without the alcohol.

https://www.youtube.com/watch?v=wYsG4Enkcz0

Here, peeps. Watch and learn. Watch as many times as it takes you to grasp the concepts.

“Border Adjustment Tax Reform Plan”? Can’t they just put a tax on NewSpeak? Seems to be an endless supply. It’s an import tax, pure and simple.

I strongly favor free trade with allies and strategic partners. Mexico is neither. They are 100% to blame for the illegal immigrants, narcotics, and violence that come in through the porous border.

And no, this tax will not be paid by US consumers because they will find other goods and services, either domestically or from other countries that are better partners. And yes, those goods may be higher cost initially, but that will serve to encourage more suppliers based either here or in countries that we can actually work with.

This is pure bullshist.

Mexico is NOT “100% responsible” for anything that comes here, good or bad.

There is a DEMAND here for illegal drugs, and illegal workers.

If there were NOT, nobody would pay for them. Nobody would would find meeting that demand lucrative. NOBODY would take the risks that certainly DO.

“And no, this tax will not be paid by US consumers because they will find other goods and services, either domestically or from other countries that are better partners. And yes, those goods may be higher cost initially, but that will serve to encourage more suppliers based either here or in countries that we can actually work with.”

More nonsense. You screw with markets like this, and cut off a portion of the supply your population can purchase from artificially, and prices will escalate.

Finally, you cut off people from their ability to EARN funds from the US, and you cut off their ability to CONSUME from the US.

Watch and learn, AGAIN.

https://www.youtube.com/watch?v=zv5SiQpG6sg

IF anyone here is interested in an excellent model of what government screwing with markets DOSE do in real life, look here…

http://www.heritage.org/agriculture/report/the-us-sugar-program-bad-consumers-bad-agriculture-and-bad-america%5D

For “unintended, but who cares” consequences, look to Chicago, which USED to be the candy-making capital of the world.

It’s widely known that Mexico encourages its citizens to break US immigration law and receives $20B+ a year from its citizens here. And also, if Mexico is either a producer or a transit point for illegal narcotics entering the US, then they’re at fault for letting that happen.

And US “demand” is a red herring and you know it. If I were to demand, for example, the head of John the Baptist, and someone provided it to me, that wouldn’t make me responsible for his death.

Do tariffs work? Two words: Smoot Hawley.

But a heavy tax on botox and cosmetic surgery.

Why was tax reform pushed as an import tax? Clean up and simplify the corporate and income tax codes first. Getting rid of about 200,000 pages of tax code would do wonders for our economy.

Better yet, get rid of the WHOLE thing, replace it with the 3-page FairTax proposal, eliminate the IRS and all deductions and make it collectable by the roughly 1,000,000 businesses that transact 97%+ of the business in the US as a point-of-sale transaction on the purchase of new goods and services.

THAT is the way to break special interests and eliminate tinkering with the code. No deductions, no exemptions, no exceptions.

This is *NOT* a tariff. I am not sure if its a good or bad idea, but we need to address it on its merits, not on how it is ‘interpreted’.

https://taxfoundation.org/house-gop-s-destination-based-cash-flow-tax-explained

At first glance, a border adjustment sounds like a tariff…

A border-adjusted tax falls equally on domestic and imported goods, in order to tax the amount of income people spend on consumption. A domestically produced good and an imported good will face the same tax. Goods produced in the U.S. and exported abroad are exempt from taxation, but exports are not consumed at home. However, the foreign buyer may be subject to a consumption tax levied in his home country, but that is not the concern of the U.S. taxing authority.

IFFFFFF that’s true, it’s a tax on all consumption in the US, regardless of its source.

AND…there being no mention of this…it is ADDITIONAL to whatever the income tax would be.

Now, the authors state that the income tax rate would be lowered to 20%.

BUT there’s no impediment to it being raised right back to present levels or beyond.

So, no, and HELL NO.

That is absurd “Don’t lower taxes, because they can be raised later”

The entire point is to tax imported goods at the same rate that you tax domestically produced goods. The idea is to create a balanced field.

I see no reason to assume this method is any worse than a normal corporate tax, all corporate taxes get paid by consumers.

What’s absurd is slathering on a NEW tax without permanently limiting the old one.

I’m for REAL tax reform. Burning down the income tax all together. Repeal the amendment.

And I often inveigh for a complete killing of ANY corporate tax.

Just so’s you know.

This exactly what JFK was talking about in the 60’s when he said that a thriving economy was the only way to get out of the low GDP and high tax zone. He actually said that “Arising tide lifts all boats”. There will be no way for these spineless wimps in Congress to go forward if they must have a concrete plan of success before they proceed. This is one of those things that you have to have faith and good judgment in to make it work. If they have to have written proof of success they will fail.

Nonsense.

Reagan DID what Kennedy was talking about.

Now, post where Kennedy wanted to tax=and=spend our way to more jobs and prosperity?

We need to make our products competitive with the rest of world or we need to make the rest of world’s products competitive with ours. As long as our government forces our companies to comply with complex, overwrought regulations and excessive taxes, our companies will never be competitive. When our government introduces the ‘border tax’, our government is simply introducing the costs our native businesses already endure to the international producer.

The pro-tariff segment wants our uncompetitive companies to survive at a cost paid by our consumers. The free-trade segment wants the lowest price for the best product, no matter what happens to our uncompetitive companies. The free-trade people as well as the pro-tariff people may or may not recognize that our producers cannot compete due in a large part to our government’s policies.

The best solution of course, is for the cost of our policies to be shared with all who take part in our market. We’re not going to reduce the cost of doing business here, so I’d give the edge to the pro-tariff guys. There’s a price for a place at the table; pay the price or move along.

Here is why the US needs to impose tariffs.

The US is the number one consumer products consumer in the entire world, having THE lions share of the consumer market at ~27%. Remember that number for it is the crux of the whole argument.

Now the same wage structure which makes us numero uno as consumers also makes it next to impossible for the US manufacturers to produce products which can be competitively priced for consumption in other countries. So, US based manufacturers end up selling, mainly, to the US market. And, without tariffs, foreign based manufacturers, who produce the same products as those made in the USA, can sell their products more cheaply in the GIGANTIC US consumer market.

Got it so far? As long as the US remains the number one consumer, by virtue of having higher wages than most of the rest of the world, US based manufacturers can never compete with imports, unless those imports are subjected to a tariff. And, if US manufactures can n ot compete, they will move their production facilities outside the US. This reduces the workforce, which reduces the purchasing power of US citizens which causes more manufacturing plants to leave which causes more lay-offs which causes more reduction in purchasing power, and on and on until the US economy collapses.

So, we are faced with a situation where the high wages which allow the US to be far and away the largest consumer on the planet also make it difficult, if not impossible, for US manufacturers to compete in the global market. How ever as almost 1/3 of the market for consumer goods exists in the US, if US manufacturers target that market, they can make money and not have to compete outside the US market. However, for this to work, tariff have to levied on imports in order to bring their cost of production into the same ballpark as that of domestically produced goods.

Great comment. Look, I have no trouble giving countries like the UK, Canada, Australia, Germany, etc free trade privileges in the USA, provided their willing to do the same for us and let us access their consumer market. Those markets are actually valuable.

But seriously, why sign a free trade agreement with a country like Vietnam or Mexico with no consumer market at all? So their corrupt government officials don’t have to travel to Miami to buy iPads? I mean, other than the obvious reason which is that you can then build a bunch of factories that can sell into the US domestic consumer market at no cost while ignoring every US domestic business requirement and squeeze out the US worker.

“US based manufacturers can never compete with imports, unless those imports are subjected to a tariff.”

This is simply a stupid lie.

The US is manufacturing MORE now than ever before.

There are MANY things that we manufacture at LEAST COST, regardless of relative wage scales. The US worker is the most productive in the world, and those things we make are where we have our advantagesssssss.

Cars are an example, and American cars are competitive with anyone’s cars PRIMARILY because they’ve had to be, exposed as they are to market competition.

“But seriously, why sign a free trade agreement with a country like Vietnam or Mexico with no consumer market at all?”

Milton Friedman answered that stupid question, based on a false statement, in the videos I posted.

You need to look up the numbers for the Mexican consumer market. You need to acquaint yourself with how much Americans make from exporting into Mexico.

You seem enamored with the idea that the US should impose on the liberty of its people in this weird use of economics as a weapon. I consider that BIG GOVERNMENT notion simply corrupt.

Nice talking points, but only talking points.

Take automobile manufacture, for example. If it was not MORE profitable to manufacture automobiles in Mexico and ship then to the US, than it is to manufacture those same vehicles in the US for sale in the US, then automakers would never move out of the country to places like Mexico. Why would they trade a stable nation for one that is totally corrupt and teetering on the verge of anarchy all the time? How about clothing manufacture? Why move to Bangladesh, with all of its inherent problems to manufacture products for the US market when you could produce the same items in the US? Because the manufacturing costs are significantly cheaper overseas, largely due to staggering differences in wage and benefit packages for workers.

The US export market is largely dominated by low volume, high cost items such as aircraft and spacecraft, machinery, high end commercial electronics and refined petroleum products. None of these industries employ a significant amount of the work force in the US. Though the US has a large negative trade balance with the rest of the world, it maintains a very diverse set of trading relationships. While the US exports $60 billion dollars worth of cars, it imports $155 billion worth of cars from a variety of trading partners. But, our total balance of trade is -$750 billion dollars; one half the value of our total exports [$1.49 trillion]. And, our level of exports has decreased by almost 3% in the last year and 6% over the last five years.

Trade, to be effective, has to be relatively equal between trading partners. If it is not, the purchasing power of the richer consumer nation will be eroded while the lesser consumer nation will be enhanced until they are relatively equal. Or, if the lesser trading partner is overly reliant on the greater partner, the greater will simply dominate the lesser. This is the position that Mexico finds itself in today.

Mexico has entered into a parasitic relation with the US as the host country. And parasites are not beneficial to the host. 73% of Mexico’s exports go to the US and 50% of its imports come from the US. On top of that, Mexico uses the US as a release valve for population overflow while, at the same time, using that migrant population to siphon off material wealth from the US. It is a totally parasitic relationship. On the other hand, Mexico only accounts for 13% of the imports into the US while being the recipient of only 13% of US exports. This places the US in the position of essentially controlling the Mexican economy. And, if Mexico was a smart parasite, it would do everything in its power to appease its economic host. The only thing that gives it even a smidgen of leverage is the amount of money that US [really global] financial institutions have invested in Mexico.

Free trade is fine, if the partners are relatively equal. But, the US finds itself in the position of supporting the global consumer economy while making itself less self reliant and increasing the power that other trading partners have over it. The US is currently recovering only 2/3 of what it spends on imports, through exports. This has to be made up through domestic consumption. And, to maintain domestic consumption, you have to maintain a manufacturing base which employs sufficient workers to create a large enough and rich enough customer base to generate a usable profit margin.

More total bullshit (there…I said it) related as fact.

Admit that you’re just another BIG GOVERNMENT fan-boi, who thinks it’s swell to MAKE people trade as you STUPIDLY want them on on completely FALSE predicates.

Step up. Admit it.

Big government fanboy? Not at all. Just the opposite, in fact. What you, and most other “free trade” advocates, fail to understand, is that “trade” has changed in the last 200 years.

Two hundred years ago and earlier, most trade goods were luxury goods, or goods which could not be made in a given location. So, trade goods from India were rarely, if ever, in competition with locally produced goods of the same type in England. You may be familiar with the phrase “taking coals to Newcastle”, which indicated the foolishness of transporting competing goods to a market which was producing those same goods.

The main reason for this, was transport costs. The cost of transportation would drive the price of the goods far higher than those charged for similar goods of local manufacture. But, in the 20th century, transportation became much more efficient and therefor the cost became lower. This allowed foreign manufactured goods to be imported into major consumer markets at greater profit.

Now free trade economists argue that free trade reduces costs to consumers and is therefor a good thing as it will encourage investment in business. However, it fails to take into account the negative ramifications of job loss due to the failure of domestic manufacture or moving domestic manufacturing out of the country. It doesn’t matter to a person that the cost of a product is a few cents lower, if that person does not have an income to spend on the product.

If the trading occurred on a level playing field, then free trade would work wonderfully. But, a clothing manufacturer in Bangladesh has a significant financial advantage over a clothing manufacturer in the US. So much so, that the unit price of the US manufactured product is significantly higher than the unit price of the foreign product. And, as the foreign product undercuts the domestic product’s customer base, the domestic manufacturer can not even rely upon volume to produce decent revenues. So, the domestic manufacturer has to move off-shore to compete. This eliminates jobs and further erodes the consumer base in the wealthier country. Moving off-shore benefits the owner of a company, its shareholders and financial concerns, but does nothing to help the employees who no longer have a job. The same is true when domestic employees are replaced by illegal or even legal immigrant labor which will work for a much reduced wage and benefit package.

There is nothing mysterious about this process. It is readily observable in the economy of the US at the moment.

More complete bullshit, starting with the proposition you never come close to supporting…

You are a BIG GOVERNMENT fan-boi. In addition to being a bloviating idiot.

But I do love the image of you slaving over the long-winded crap you post.

If you reduce the out-flow of the money, it stays in the country. We have been constantly creating new wealth, but so much has been leaving the country that we do not realize it.

Now, if you stop the leakage, the money stays home, the new money becomes apparent, and suddenly… our domestic products become quite affordable. Everyone has more money.

But, they never taught this in school…other than basic math.

There’s no “leakage”. Not unless you consider going to the grocery store to buy the wonderful things that markets have brought us, including produce from all over the world, “leakage”.

When was the last time you bought something where you didn’t get more value from your purchase than the value you traded for it? That’s the working of markets. And it doesn’t matter if you traded with your family, the people in your community, your county, or your nation. It all works the same. We don’t trade unless we get more value than we are giving.

The money “leaving the country” has brought you and I greater wealth, a higher standard of living.

If you want to keep your money from “leaking”, you’ll have to hide it and never use it.

Oh, and another coupla thangs…

Ancient Athens could not have existed without trading with all the world.

Ancient Rome could not have existed without trading with all the world.

We could not exist as we do, enjoying our standard of living, without trading with all the world.

You want an example of a country that doesn’t “leak”; North Korea. Think about it…

It’s not like Congressional GOP haven’t had 7 years to get a plan together. Then again the majority of that time they were lead by Boner and McTurtle. Their plan was “do whatever Obama says”…