Internet sales tax “will put me out of business” (Update — Maybe not)

That’s the point — Stop the Internet Sales Tax

The freewheeling, somewhat tax-free, internet business community consists not only of big businesses like Amazon.com, but also of innovators and small entrepreneurs who create self-employment, supplement incomes, and sometimes just have fun doing what they are doing.

Yesterday Mandy noted that the feds are about to authorize states to tax internet sales, Fight Over Online Sales Tax Bill Heats Up in Senate. The key point is that states now have difficulty collecting taxes from sellers unless the internet business has a physical presence in the state. The new law will change that and make mom-and-pop internet sellers tax collectors for the states.

Amazon.com doesn’t care since it has the staff and technology to handle the paperwork. This is yet another example of how regulatory burden favors big business.

(Update — thanks to commenter for tip) The new law apparently would apply only to businesses with sales over $1 million, a point missing from much of the discussion and worry about the law.

A reader commented in response to Mandy’s post as follows:

I have a small hobby business. I specialize in painting pet portraits. I do not make a lot of money from this. I do it because I love to paint and love to see how people enjoy seeing their pets in a portrait. It truly brings joy to their life remembering pets that have passed or have a painting of their current pet. I keep my prices low so people can afford an original oil painting of their pet.

I sell most of my paintings thru the internet. This will put me out of business. I do not sell many per year and the increased burden of learning all the tax regulations for all 50 states and local municipalities is just not worth continuing….

If this tax goes through I will not be able to continue. This is a hobby business! I work full time. If this legislation passes and I need to add the burden of collecting taxes country wide, not to mention exposing myself to every tax jurisdiction in the country, just for an additional $1200.00 it truly is not worth the effort.

There will many people in my position who just will have to close up their business because of the increased burdens our government keeps piling on us. That’s the world we are being forced to accept.

(added) As noted above, that commenter’s fears may not be realized, but the new law still will stifle competition and will benefit local retailers and the largest internet retailers over the competition. $1 million in sales might mean a small profit margin, so the burden still is great.

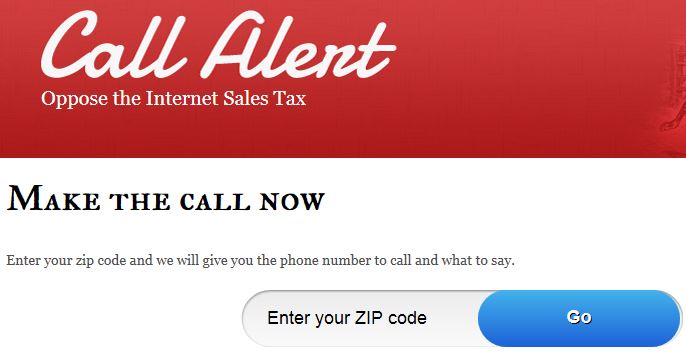

Help stop the internet sales tax by calling your Senators now: heritageaction.com/call/senate/ #haction #tcot

— Heritage Action (@Heritage_Action) April 23, 2013

Click the link in the Tweet above and it takes you to a screen where you can find the number to call very easily:

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

This will put me out of business.

Unfortunately, I believe that’s the point. Since small upstarts have always been a threat to big businesses, what better way to eliminate the competition then by having their payroll’d congresscritter pass laws that bury the little guy under mounds of paperwork.

Illustrating Chicago’s Murders, Homicides, Violence and Idiocy at heyjackass.com

Let’s face it – Democrats *LOVE* taxes. The question is, can this be stopped by a Republican-controlled House?

Wow. He makes over a million dollars in revenue by selling pet portraits? He must be very talented.

From S.743:

They’re already taxing internet sales in Illinois through the back door–when you (if you) file IL income taxes, there is a form you must file either documenting your internet purchases or using a table based on AGI. Pony up!

Slowly but surely you will be paying a 100% tax rate where the guv’ment will issue you a “fair” stipend for you to live. This will be a great job creator because it will take scores of bureaucrats to determine each vict.. er, ah taxpayer’s rate of return and the determination of their level of lifestyle.

Naturally the public servants will reap the most since they are the benevolent caretakers for the rest of us.

Utaxia indeed…

$1M in REVENUE is peanuts if you sell 1,000 of an item that costs $1,000 and have to know tax requirements in 1,000 jurisdictions across the country. If you make 1,000 sales, and have a profit of $10 or even $100 on each sale, then this could still kill you. You have to mail a form and a check to each of those jurisdictions then just the stamp, envelope, form, and check will cost you $1,000. Then there is the time involved in determining possibly multiple taxes in the remote jurisdiction. Of course, to the fascists, your profit isn’t YOURS, as it’s an opportunity provided by the government–so you must happily be their slave. (If you’re Amazon then you are their politico-economic(-socio) partner already.) Sure, you could outsource it, creating yet another fake industry that does nothing to improve lives and civilization–but that will cost you just a little less than your other pain point. Then there would be the lingering liability question if something was done wrong. Resolving that could become a full-time job. This is more tyrannical than we can guess at this time.

Lets work this out using your example,

Lets say a $1,000 product yields $100 in profit (10% profit) and 1,000 of the product is sold to pass the threshold. That is $100,000 in profit.

Cutting from the total revenue:

6% in state taxes -> $60,000.

+ Accounting -> unknown figure (lets say ~ $5,000)

Conclusions:

– Now lives on $35,000 instead of $100,000.

+ $60,000 in new annual state revenue.

– Will have to raise prices (~unknown figure).

– Fewer sales(~unknown figure).

+ More sales for traditional stores(~unknown figure).

+ New spending on accounting software(this figure has already been accounted for).

+ New state revenue from online taxes on the big corporations(~unknown figure).

– Less profit for the large corporations.

– Incentive to create and sell less.

Questions:

Will that $60,000 in revenue actually help him and his community? Will states reduce sales tax on online sales? Does this hypothetical small businessman exist, and how many? Is this “fair”? Does (state) government spending stimulate the economy?

Edit: I’m assuming this was a one man operation.

Newsflash non-business people. One million dollars in sales is not a big business by any stretch. Particularly on any sort of high cost/low volume items. Add in thing like inventory carrying costs, and other operating expenses and that Million dollar business may pay it’s owner and (maybe) an employee or two something on the order of an RN’s paycheck. If that.

Also, this is not indexed for inflation (as if that mattered since the Feds are gaming those numbers as well.)

Don’t be fooled by cheap lies.

This bill was introduced into the Senate on April 16, 2013 by Senator Michael Enzi…a REPUBLICAN from WY. I like to see an investigation into which business interest approached Enzi.

I am not surprised that the giant online conglomerates are supporting this Bill. Amazon.com has been systematically pushing smaller online retailers to use them as the sole distribution and fulfillment platform. This Bill strikes me as strategy to create a tax collecting duty that’s so daunting that it will incentivize independent online shops to become vendors of Amazon.

Enzi and his special interest sponsors ought to be investigated for anti-trust practices.

Top 20 contributors to Mike Enzi 2007-2012. Seems to be mostly health care, insurance, and pharmaceutical companies…

Enzi is probably doing this for someone else in the Senate (no doubt another R) who wishes to keep a lower profile. the real question is: what is Enzi getting in return?

Enzi’s constituents must be really upset at him. As I posted on the previous thread, we rural people really depend upon buying things online because we don’t have many “brick and mortar” stores within a reasonable driving distance.

Since when do Senators actually deign to represent the people of the State from where they originated?

If not Wyoming, the least populated State in the Union, then effectively nowhere.

Wyoming resident here.

A bit of background, the GOP controls the state offices in Wyoming, iirc the percentage of Republicans elected to state offices is 90%.

The GOP in the state just passed a $0.10 increase in gasoline tax. Now we have Enzi wanting to tax internet sales. The people I talk to are very upset with the GOP.

I doubt that it will mean that Enzi will get booted out, though. The odds of Wyoming electing a Democrat senator while Obama is president is very small. No one else will have the name recognition in the state to go against Enzi in the primary, especially while Enzi will get the establishment support.

I’m beyond outrage that A REPUBLICAN, a tax payer-funded pensioned one at that, is so morally destitute as to sponsor yet another form of pillage when small online business owners are hunkering down for the coming massive extortionary onslaught of Obamacare.

Well, my internet business doesn’t pull in a million a year, but I’d like to have built it up to that level. If this goes through, I’ll make sure that my business does not break the 1M per annum mark. Heck of an incentive to NOT expand.

Of course, I’m not foolish enough to think that the exemption would stay at 1 Million. I’m sure that the schmucks in Washington will soon decide that it isn’t ‘fair’ to exempt a business that pulls in $999,999.00 and so that exemption amount will soon start slipping lower and lower until no one is exempt. Once they start, they won’t stop. Tax dollars are like crack to these folks and they’ll take more. All in the name of ‘fairness’ of course….

It’s hard to think of a much bigger waste of time than contacting Rhode Island’s two US Senators. Both of them would be right at home as back bench Socialists in most any European parliament.

Also, lets not forget that gross revenue would include shipping charges, something that can easily represent anywhere from 10-50% of the value of the items being sold.

All that is needed is to pass this. It could be for businesess above 1Billion in revenue, that isn’t the point and politicians know it!

Once it’s passed it is easy to lower the amount from 1Million or whatever number pleases the gullible!

Even if you do not pay until you reach $1M in sales across the US, I can easily imagine you having to provide paperwork to each of the tax hungry states to show the sales to their citizens, each with a different form, and each backed by state tax collectors that want to prove you lied on your form to screw them over.

Not to be contrarian but here goes.

I don’t get why vendors should think that they would be exempt from ponying up sales taxes for sales made to customers in other states, except that they have not done so to this point in time. It’s tradition, nothing more.

The solution is obvious: charge the proper sales tax and remit. In the example being used above, you collect the sales tax for the $1,000 item ($70 here in Illinois). Yes, that’s a pain in the tush, especially since the tax rates are different from state to state and sometimes within states (e.g., Illinois again). But that’s part of doing business.

Someone has to explain to me WHY it’s proper for Amazon to get a break that Ma Kettle’s Stop-N-Shop down the street can’t have. As a conservative, I think the tax base should be broad, simple and fair so that the overall tax burden is as low as possible. Exempting internet transactions takes away the ‘broad’ part of that. And big businesses profit more by this exemption — they’re more skilled at taking advantage of it. Think Amazon hasn’t done well? Their whole model is based in part on conning their customers that they can avoid taxes by ordering directly from them. So far that’s worked, but it’s to their advantage, not to yours or mine.

If you really want to solve the problem then advocate for a uniform (or more uniform) sales tax across the country with as few exemptions as possible. Then make the tax as low as you can and force the states to live within their means.

Taxes with lots of loopholes and exemptions are taxes that are exploited by the apparatchiks and nomenklatura. They can afford to do it, you and I can’t. Don’t give them the opportunity. Make the tax base as uniform as you can.

If I have an internet based business, why should I be forced to collect taxes for a state other than my own? Why should I, as a resident of New Mexico, be forced to be an unpaid tax collector for the state of Illinois?

I’m really tired of the “cost of doing business” argument coming from people who view my time as being worth absolutely nothing. Business owners don’t have a greater obligation to the “common good”. We have the same obligation as any other citizen and if states want to capture sales taxes on purchases from their citizens out of state, they need to do it without involving me.

to SteveWhiteMD:

1) So you think local jurisdictions don’t already have enough sources of revenue?

2) So you think that the money to pay the local taxes doesn’t already come from the same pot? (The tax collectors already have other ways to get the same amount of revenue. All this legislation does is provide NEW ways to make America less-competitive.)

3) So you say, “Move your business out of the US” and taxes will be “fair?”

4) So you have no appreciation for making small businesses know ALL taxing authorities and their various taxes–and suddenly having the “opportunity” to get sucked into court all over the country just to “clear up this paperwork?”

Yeah, let’s stop making and selling products altogether. Let’s just be 100% “services-based.” The next national crisis comes along there won’t be anybody who can do things melding mind and hands …except our enemies and the criminals.

Go ahead. Be “contrary.” Enjoy your “utopia.”

“The solution is obvious: charge the proper sales tax and remit…Yes, that’s a pain in the tush…But that’s part of doing business.”

As you pointed out in your own previous paragraph, it actually has NOT been part of doing business, to date, for any Internet-based sales operation.

“Someone has to explain to me WHY it’s proper for Amazon to get a break that Ma Kettle’s Stop-N-Shop down the street can’t have.”

Because it’s always proper to treat like things alike, and different things differently. Ma Kettle’s is a brick-and-mortar operation that (presumably) makes all of its sales to locals or to people passing through. It pays taxes to its community in exchange for the benefits that being part of a community provides it.

Amazon is a fundamentally different operation. They have very few physical facilities, despite their massive operation. (And it’s worth noting that they pay taxes in the places where they do.) They don’t use your local community’s resources, like water and roads. Why then should they be ensnared into helping every local community collect taxes?

“Exempting internet transactions takes away the ‘broad’ part of that.”

So, do you also advocate for the collection of appropriate national, state/provincial, and local taxes for any customers who do business on the Internet across international borders? If not, why not? Shouldn’t an American-based business be helping out communities in Britain who are being cost sales tax when their residents order from me?

“Think Amazon hasn’t done well? Their whole model is based in part on conning their customers that they can avoid taxes by ordering directly from them. So far that’s worked, but it’s to their advantage, not to yours or mine.”

And now Amazon is explicitly lobbying FOR this tax, which you’re also lobbying for, because they know it’s to their long-term advantage to force future competitors to deal with hurdles and costs of doing business that they didn’t have to deal with when they were a start-up. They know that long-term, a tax like this would help them maintain their massive market share — even when they factor in the cost of submitting to it themselves. Conservatives don’t advocate policies that promote corporatism.

“If you really want to solve the problem then advocate for a uniform (or more uniform) sales tax across the country with as few exemptions as possible.”

So, your solution to the problem of tax revenue slipping through the hands of local authorities is to advocate for a national standard — and the simultaneous reduction of local control. And you say you’re a conservative? If I like my Internet retailers, I can keep them, right?

Now me, I’m not only a conservative, I’m a realist. I can see when the horse has escaped the barn, and I understand when you can’t get it back inside without hobbling it. Any chance that anybody had of forcing Internet businesses to submit to traditional philosophies of tax collection, without doing very apparent damage to their model and sparking a massive public backlash, ended some years ago.

Expanding on what you said about brick and mortar businesses: THEY can ALSO have an Internet sales business, thereby not being “at a disadvantage” vis-a-vis Internet-only businesses.

Related point: Some businesses know, sell, and support products they don’t even warehouse. They arrange for drop shipping.

Another related point: If a small business manages to make enough to sustain itself then it will feed the local economy–and pay all those other taxes in the local community and state.

…but I guess in “utopia” everybody has free everything, doesn’t have to work (except maybe at a government “job”) so it doesn’t really matter what utopia taxes because, gee, it’s all coming back to you anyway.

“Utopia” ain’t “Realville.”

Just a thought. Most bootlegging operations, regardless of what is sold or the reason for it being off the books [item sold is contraband, overtaxed, socially unacceptable, or just an attempt to avoid overhead] depend on communications networks out of the norm. Usually a form of word of mouth with social network credentialing. One of the best somewhat covert organizing tools [covert in the sense that the government does not openly listen to everything said online … yet] is the internet. Businesses run off profit and loss. One can expect informal networks to arise to allow businesses to create markets outside the norm, markets that avoid ALL possible contact with the government. In effect, going Galt will be encouraged as new enterprises organize covertly from the beginning, and current enterprises work to shift enough of their businesses under the table to avoid government strictures.

Right now, starting a small business in a conventional way is all but impossible, due to government/rentseeker interference in the market. Online has become the outlet for entrepreneurs. Now covert activities and a black market will be the new outlet. Over at another site, Megan McCardle is positing that the new taxes will discourage small businesses. This is a surprising revelation from her, given her support for Obama. However, such an effect may well be the intent.

As the State tries to capture what they projected as the revenue that they believe is rightfully theirs by increasingly onerous enforcement; more activity will be driven into the black market. I note that even in the Soviet Union, where the State owned all, black markets thrived and were how people survived. I suspect that Americans are somewhat more ingenious at such matters.

Subotai Bahadur

Yeah, pretty much. The single biggest effect this legislation will have on non-Amazon level retailers is to make them into criminals for NOT abiding by the many byzantine laws of the 50 states.

Just as a benchmark, I ran a very successful business with a gross of $10 million a year in sales. Out of that I netted about $60k a year. If my business had been through the internet it is quite likely that the costs of compliance would have made it not worth my time to start or grow such a business. I had as many as 34 employees on my payroll at one time and provided literally hundreds of people jobs at one time or another. That is a lot to forgo in order to get a few more bucks for the government to buy votes with.

The reason Europe is so stagnant is that they are eaten up with these sorts of barriers to entry. There just aren’t a lot of small businesses there and there is not a lot of innovation as a result. But the big corporations love this sort of thing.

It’s not surprising that a politician would believe that $1,000,000 in gross revenue makes a business owner a millionaire.

Successfully operating a small business ought to be a criteria for anyone who wants to pass laws telling us how we can and should operate.

It’s not ‘tradition’ it is Constitution, law, and SCOTUS ruling. Allowing one State to force a private resident of another State to do their bidding is an affront to the entire notion of sovereign States.

Economic rights are human rights and this is truly a camel’s nose under the tent moment.

They’ll collect sales taxes from the seller because it is virtually impossible to tax the individual buyers.

Wait until they force banks and credit card issuers to collect and remit taxes on online merchandise bought via credit or debit card, as almost all of it is. I’m guessing they’d try that next, if ordering the seller to collect taxes proves unenforceable or too expensive to enforce.

Geez, pretty soon they’ll be taxing the rain. Oh yeah…

https://legalinsurrection.com/2013/04/maryland-pols-have-been-standing-in-the-rain-too-long/