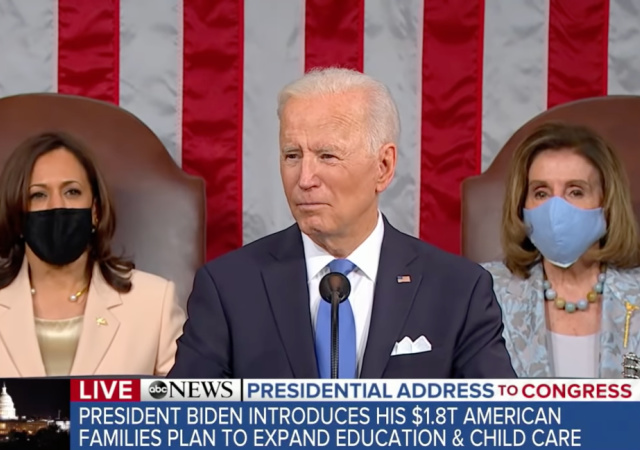

Biden’s $1.8 Trillion American Families Plan Includes Free Community College, Massive Tax Hikes

They’re going to raise the tax rate on those evil millionaires making..$523,600 a year.

President Joe Biden detailed his $1.8 trillion American Families Plan during his SOTU, which is all about the government taking advantage of the pandemic to expand government and spending.

The plan, which is the second part of Biden’s so-called infrastructure bill, concentrates on students and workers.

- Universal prekindergarten

- Federal paid leave program

- Money to make child care more affordable

- Free community college

- Aid for students at historically nonwhite communities

- Expand subsidies under Obamacare

- Extending federal efforts to fight poverty

Big Government

Here comes the heartless libertarian! The left will scream I hate children or something, but geez. The government is opening doors to your personal life. You think they will stop here?

The Democrats want to extend the child tax credit through 2025 and make it “permanently refundable“:

That plan raised the $2,000 per-child CTC to $3,000, set the credit at $3,600 for parents of children under age 6 and made parents of 17-year-olds eligible. It also made the credit fully refundable, so low-income households would get the full benefit, no matter how little they earn. For a household with a 4-year-old and 7-year-old that doesn’t earn enough to pay income taxes, the plan would boost their maximum child tax credit to $6,600 from $2,800. The March law also ordered the Internal Revenue Service to start making periodic payments of the credit, which should start this summer.

I honestly don’t know how this would work, but the Democrats want to make sure non-wealthy families do not pay more than 7% on child care:

To lower the cost of child care, the American Families Plan would guarantee that low- and middle-income families pay no more than 7% of their income on child care for children under 5 years old. According to the administration, this would save the average family $14,800 a year on child-care expenses. The mechanism for paying for this is unclear—the Biden plan just says that families will have their costs covered according to that formula.

The amount families pay would be based on a sliding scale, from low-income families whose costs would be fully covered to families earning 1.5 times their state median income, who will pay no more than 7% of their income.

Free preschool and community college? I mean, how!? The Democrats claim it will cost $200 billion over 10 years:

The administration wants to add four more years of free schooling for all Americans, two on the youngest end in the form of universal prekindergarten for three- and four-year-olds, and two after high school in the form of tuition-free community college.

The preschool program would apply to families of all income levels and would cost $200 billion over 10 years, though according to the administration it would “prioritize high-need areas.” The plan promises teacher training, wages of at least $15 an hour for all employees, and compensation similar to that of kindergarten teachers for educators with comparable qualifications.

Then $109 billion goes towards community college. Biden wants to increase Pell Grants $1,400 from $6,495. Pell Grants are awarded to a student who has an “exceptional” need for financial aid.

The Democrats want to enforce a paid leave program. I assume this also applies to the private sector:

The Biden plan’s paid leave program would take a full decade to fully implement, and would cost $225 billion over that period. It starts slowly, ensuring workers get three days of bereavement leave a year. By the 10th year of the program, it will have scaled up to guarantee 12 weeks of paid parental, family and personal illness leave.

It will pay workers up to $4,000 a month, with a minimum of two-thirds of average weekly wages replaced. For low-wage workers that could be closer to 80% of their wages.

Fair Share

Reading about the tax hikes in the plan makes me replay the best portion in Parks and Recreation history. I swear the show had a libertarian on staff.

I thought it was all about making millionaires and billionaires paying their fair share.

Since when did we start calling a person making $523,600 a year a millionaire? A couple making a combined income of $628,300 is a millionaire couple? I’m so confused.

Those people are in the top tax rate, which will go up to 39.6% from 37%.

The Democrats, who are worth millions, apply their hatred of millionaires when it comes to tax rates on dividends and long-term capital gains.

Dividends are the “payments a company makes to share profits with its stockholders.” They hand them out on a regular basis and “paid per share of stock. You can learn more about them at Nerd Wallet.

This is what the Democrats want:

Long-term capital gains are assets held for more than a year. Short-term capital gains are the assets held for less than a year

They would increase more sharply for households making more than $1 million, from today’s 23.8% to 43.4%, including a 3.8% tax on investment income. According to the administration, that would affect 0.3% of households, where investment income is concentrated.

Currently, there is a 3.8% tax on investment income and an equivalent set of taxes on wages and self-employment income. The administration, citing holes in the law, says it would apply those taxes consistently to income over $400,000.

That could mean applying a 3.8% tax to the active income earned in businesses such as S corporations and partnerships. Mr. Biden used a common technique involving S corporations to avoid the 3.8% tax on much of his speech and book income after he left the vice presidency.

Did you think the Democrats would give you a break after a loved one passes away? Of course not! Tax all the things:

Currently, people who own appreciated assets owe capital-gains taxes when they sell. If they die, that entire gain goes untouched by the income tax. Their heirs then pay capital-gains taxes only if and when they sell and only on the gain since the original owner’s death.

By contrast, the Biden plan would treat a bequest other than a charitable donation as a sale for tax purposes. So an individual who bought a business for $2 million and dies when it is worth $9 million would have a $7 million capital gain on his final tax return. The Biden plan would offer a $1 million per-person exemption to reduce that taxable gain to $6 million. The existing exclusions of up to $500,000 for the principal residence of a married couple would also remain.

God forbid people use the tax code to help their gains escape the income tax:

That change would prevent some gains from escaping the income tax entirely. And without that change, the rate increase on capital gains would actually lose money. That’s because with a higher capital-gains rate—likely anything above 28%—asset holders would become more likely to hold on to their unrealized gains and wait to pass them to heirs rather than sell them.

The potential tax at death would change that calculation because there would be no significant tax benefit from holding assets until death. The estate tax, which Mr. Biden proposed to increase during his 2020 campaign, wouldn’t change under this plan. That’s based on someone’s total net worth, not the value of their unrealized gains alone.

Donations tax deductible

to the full extent allowed by law.

Comments

If you look at the substance, this makes no sense. If you look at the process, it is a beautiful path to a Marxist Utopia where we have the ruling elite who live like royalty and the mass of serfs/slaves with no middle class. The Revolution moves forward.

Not really, Biden is getting it in the neck from the left side of the Democrats for not going far enough.

From a politics point of view only Americans find the idea of paid maternity leave controversial. Pretty nuts.

“Biden is getting it in the neck from the left side of the Democrats for not going far enough.”

That is theater; actors on a stage. Part of a con game.

That’s pretty disengenuous

No it’s honest.

@recivering Lutheran

No it’s not, it’s basically implying motive without a shred of evidence. If you are going to make an accusation against a group back it up with something. On its face it nonsense as well, the idea that the left wing of the Democrats are just pretending to be difficult that somehow they don’t want more out of the deal is really fucking stupid.

It’s not paid maternity leave, it is family leave basically for any reason.

It’s braider than maternity leave that’s true but I’m not sure any reason is quite right. It seems like a variety of circumstances qualify but never the less it would have to be a described circumstance within the framework of the proposed law.

*broader

“”From a politics point of view only Americans find the idea of paid maternity leave controversial. “”

No, we find the idea of government enforced paid maternity leave controversial. It isn’t controversial at all if it is part of an employment contract between an individual and an employer.

Yeah which is stupid. It makes life very difficult for large sections of society who have no power to negotiate with there employer. Sure the middle class and the wealthy are fine because they can negotiate to an extend but fuck poor people right. That’s what you are in effect saying.

I was not born into money, but I was lucky to have a good upbringing. Good education and work ethics made me successful. I don’t buy this ship about poor people. I have had plenty of exposure, most poor people are poor because they made a very long string of poor choices.

The genius of the Federal Gov’t is it is truly gifted at making problems they try to solve much less worse while spending an unbelievable amount of money. Don’t just say NO, say He!! NO to Biden’s dumb ideas to expand government into every phase of our lives.

That should read — The genius of the Federal Gov’t is that it is truly gifted at making problems they try to solve much worse while spending an unbelievable amount of money. Don’t just say NO, say He!! NO to Biden’s dumb ideas to expand government into every phase of our lives.

Progressive prices and redistributive change to manufacture an illusion of compensation. Also, [catastrophic] [anthropogenic] immigration reform to sustainably gerrymander the vote. Planned Parent/hood to relieve “burdens”, and keep the female sex/feminine gender appointed, available, and taxable. Diversity, inequity, and exclusion. One step forward, two steps backward.

I’d say three steps backwards plus more taxes for everyone.

“We haven’t done enough about X” = “We haven’t spent enough money on X” = “We haven’t taxed enough to do X”

Yes Joe, the 17th amendment is absolute… just like death.

Indoctrination of the masses to create a permanent slave state does not come cheap.

It won’t be hard, though. America is mostly there now. And there is no Undo key.

So what the point of the DNC sabotaging Bernie’s campaign? Biden is implementing his agenda

This is going to put the thumb down hard on farmers, many of which are above what normal people think of as retirement age. An average small farm has hundreds of thousands invested in hardware, buildings, and such, with potentially up to a million invested in land. When these farmers pass away or retire, the inheritors get (censored) good and hard, so goodbye independent farmers, hello giant corporate farms.

And various colleges just looked at this speech and marked up their tuition, we just don’t realize it yet.

“An average small farm has hundreds of thousands invested in hardware, buildings, and such, with potentially up to a million invested in land.”

Far more than a few hundred thousand.

Because… infrastructure.

Whoo hooo, free money all around, just keep printing it and it will be all fine, trust me.

Sundowner

For how many years will CC be “free”? The 2 year graduation rate at CCs is 13%. In 3 years it jumps to 22%. By making it “free” will these %s go up or down?

It actually doesn’t matter because they are already fake. I’ve been in situations where undeserving grant recipients that didn’t attend classes begged and pleaded for their passing grades, so they didn’t have to pay back the tuition they wasted by doing nothing. I held my ground (fortunate to be in Texas when doing so and not under admin pressure to push along). I know from the experience of others in my current purple state of Virginia that standing on principle is not so easy here because of those in charge.

Fun fact: you can find a lot of other entitlement benefits and get a year or two of grift if you jump on the Pell grant wagon. Some can’t even manage to pass when they take all of this free money because they can’t be bothered to give two f*cks about anything but themselves.

The truth is that this liberal mythos of a highly educated and productive, fully entitled socialist society is going to go up in flames. The Swedes and others were smart enough to realize this some time ago. However, because of the factions we have in this country it’s going to take enough time and waste enough resources along the way before the most zealous believers will finally be convinced of their folly. By then, these idiots will have dragged us all down into the sh*t with them. Once there, they’ll admit that “we failed” (not them) and expect “all of us” (not them) to fix it.

Looks like Biden* and his speech has only the fraction of viewers than Trump did:

https://mobile.twitter.com/greg_price11/status/1387853372615692288?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1387853372615692288%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=http%3A%2F%2Face.mu.nu%2Farchives%2F393616.php393616

But not to worry. About 4AM the networks will report that about 80M additional Biden* viewers have been “discovered”.

Never fear…the Ds will make damn sure that taxes go up on EVERYBODY except the grifters – meaning, those in CONgress as well as those welfare queens who get their gub’mint checks every month.

D Party, nationally, isn’t quite the wholly owned subsidiary of the Teacher’s Unions as they are in some States like NJ, but they aren’t far off.

Making community college “free” is a subsidy to faculty and administration, not the students. If CC budgets are not constrained by the ability of students to pay those budgets will increase enormously. That is why universities got so much more expensive: grants and loans make ability to pay cash today less and less relevant.

Those budgets already increased greatly because of Pell.