Appeals Court Allows Trump to Continue CFPB Cuts

“These requirements—agency action, finality, ripeness, and discreteness—reflect that the APA does not make federal courts ‘roving commissions’ assigned to pass on how well federal agencies are satisfying their statutory obligations.”

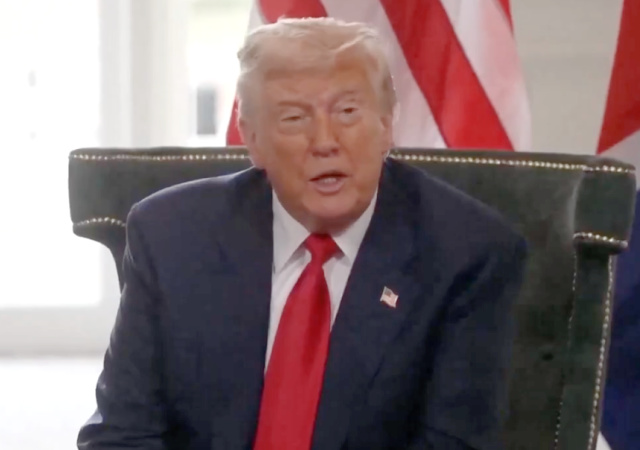

A panel of three judges of the DC Court of Appeals voted 2-1 to allow President Donald Trump’s administration to keep making cuts at the Consumer Financial Protection Bureau (CFPB).

Trump’s agenda at the CFPB included:

- Terminating employees

- Cancel contracts

- Decline additional funding

- Moving to smaller headquarters

- Require advance approval for agency work

The CFPB has been a mess since its formation in 2010. Yes, another government idea that sounded like a great idea: “enforce federal laws that protect consumers of financial products.”

Yeah, except Congress gave the CFPB “broad discretion” on how to achieve its goals. No oversight. It can organize its internal affairs however it wants.

DOGE wanted access to the CFPB to achieve Trump’s agenda.

Unions, groups, and employees threw a hissy fit. They received an injunction, blocking the Trump administration from continuing the cuts.

The plaintiffs claimed the administration’s “actions to eliminate” the CFPB “usurp legislative authority conferred upon Congress by the Constitution.” They also invoked the APA (Administrative Procedure Act).

Ah, yes. The APA…again. Have you noticed all these people drag the APA into their cases?

Judge Gregory Katsas, the author of the opinion, pointed out that the plaintiffs organized their lawsuit incorrectly. He mentioned they could have gone after Trump’s planned actions:

- Aggrieved employees could challenge terminations

- Aggrieved service providers could claim breaches of contract

- Aggrieved consumers of services “could file APA actions alleging that the service has been unlawfully withheld or unreasonably delayed.”

“Such challenges would target specific agency action or inaction that is alleged to be unlawful and to harm specific individual plaintiffs,” explained Katsas. “And the courts, if they set aside the specific action alleged to be unlawful, or compelled the specific action alleged to be unlawfully withheld, could redress the specific injuries of individual plaintiffs.”

Here’s more:

This case is not constructed like that. Instead, the plaintiffs seek to challenge what they describe as a single, overarching decision to shut down the CFPB, which they infer from the various discrete actions noted above. To remedy that asserted decision, they seek pervasive judicial control over the day-today management of the agency, including decisions about how many employees the agency may terminate, how many contracts it may cancel, how it may approve work, which buildings it must occupy, and how employees will complete remote work. Furthermore, the plaintiffs urge all this despite the lack of any causal connection between many of the specific agency actions alleged to comprise the shutdown (for example, not providing reports regarding credit cards) and the specific injuries alleged by these plaintiffs (for example, Mr. Steege’s ongoing difficulty in addressing his late wife’s student loans).

As we now explain, this challenge is not viable. It cannot be brought under the APA because that statute provides a cause of action to challenge discrete, final agency action, which the claims here do not target. And it cannot be brought in equity because the claims here neither raise constitutional questions nor satisfy the stringent prerequisites for ultra vires review.

Here’s another significant fact: Where is the proof that Trump would shut down the CFPB?

“The plaintiffs point to no regulation, order, document, email, or other statement, written or oral, purporting to shut down the CFPB,” stated Katsas. “Instead, they infer such an overarching decision from various discrete ‘actions’ taken by agency leadership to downsize the Bureau, ‘including by issuing stop-work instructions, cancelling contracts, declining and returning funding, firing employees, and terminating the lease for its headquarters.’”

Overall, though, I just hope everyone stops clinging to the APA. This is getting ridiculous.

Katsas destroyed those using it and courts that have been allowing those people to go after Trump:

These requirements—agency action, finality, ripeness, and discreteness—reflect that the APA does not make federal courts “roving commissions” assigned to pass on how well federal agencies are satisfying their statutory obligations. Broadrick v. Oklahoma, 413 U.S. 601, 610–11 (1973). Rather, a court may intervene only when a specific unlawful action harms the plaintiff, and only to the extent necessary to set aside that action. By avoiding premature adjudication and narrowing the scope of judicial review, these requirements “protectagencies from undue judicial interference with their lawful discretion[] and … avoid judicial entanglement in abstract policy disagreements which courts lack both expertise and information to resolve.” SUWA, 542 U.S. at 66.4

Boom. In other words, stop it.

Donations tax deductible

to the full extent allowed by law.

Comments

The CFPB should be eliminated in its entirety. It is government overreach at its worst.

At no time did it sound like a good idea.

“The CFPB has been a mess since its formation in 2010”

You know they spent oodles of time carefully designing it, from the fact that they gave it the same initials as the Corporation for Public Broadcasting, and never even noticed.

It should be, but only Congress can do it, and it would need to overcome a Dem filibuster. Trump can’t do it on his own authority, which is the only reason he isn’t trying to. The plaintiffs here are correct that he wants to, but he’s allowed to want to. We all want it too, and we’re entitled to want.

Notice how the judge has given the plaintiffs a road map on how to proceed?

Not really. They wanted to court to infer a consequence of shutting down the agency from a series of individual actions.

If you’ll permit: Imagine the CFPB as a car. Trump wants to remove the doors, windshield, seats, steering wheel, radiator, and exhaust system and many other parts as well.

The lawsuit claims that Trump will destroy the car. However, the Court points out that technically he will not. The car will continue to be a car despite the removal of the parts. The Court notes that they could have challenged his powers regarding the removal of each individual part, but they didn’t. The suit claims that the removal of the parts makes the car impossible to drive, will make its passengers uncomfortable and no doubt late for work. The suit therefore demands that the Court keep Trump from even touching the car.

The Court says that it’s not up to the Court to make an assumption about how well the car will function, and declines to make any decisions about that.

I hope you are right.

This agency is absurd. It literally attempted to run the entire country.

Yes, but unfortunately Congress created it so it must exist until Congress can be persuaded to change its mind.

Did the Appeals Court consult Liz Warren before their decision? If not, she will be very angry. /sarc

At least we’re not Indian Takers. We gave her idea back to her.

Let me guess, she’s shaking with indignation (her standard MO). Warren is a national embarrassment.

One small correction. The CFPB never sounded like a “good idea.” And the Constitution should stop it. All the federal courts need to do is follow the law. That would be the aforementioned Constitution thing.

Gosh it is almost as if there’s a growing awareness that ‘The Executive Power shall be vested in a President’ actually means just that. All these oddball ‘agencies’ run into a brick wall when we stop the attempts to ‘Philadelphia Lawyer’ these discussions. These ‘independent’ agencies must exist within our Constitutional framework. That allows for three boxes; Legislative, Executive or Judicial. No one claims these agencies are contained in the Legislative or Judicial boxes which means they are in the Executive box…and that means the President is the HMFIC period.