As Investors Lose Interest, Sustainability Funds Don’t Appear to be….Sustainable

One investment expert’s did not “expect their whimpering demise so quickly.”

I recently reported that investors are fleeing renewable energy funds due to rising costs and escalating rates.

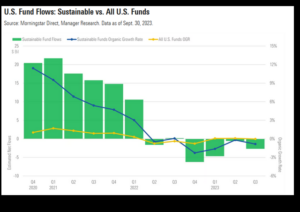

Now, it looks like “Sustainability Funds” are not sustainable. Morningstar, a firm specializing in investment research and management services, recently issued a fascinating report indicating that investments fell by nearly $3 billion over the last quarter.

Investor appetite for sustainable funds waned in the third quarter. U.S. sustainable funds endured their fourth-consecutive quarter of net withdrawals. Sustainable bond funds stood alone in registering net inflows. For more detail, download the full report here.

Investors pulled $2.7 billion from U.S. sustainable funds in 2023′s third quarter, for a total of $14.2 billion over the past year.

Although the motivations behind outflows cannot be perfectly quantified, many factors are in play. These include rising energy prices, high interest rates, concerns about greenwashing, and political backlash. U.S. equity and fixed-income markets fell by 3.2% in the third quarter, as illustrated by the Morningstar US Market Index and Morningstar US Core Bond Index, respectively.

This trend is a dramatic shift from the golden days of 2021.

Investment products with a declared aim to promote ethically responsible practices, from cutting greenhouse gas emissions to increasing workplace diversity, have lost their lustre in the U.S. since a 2021 boom, as regulators scrutinised how they were marketed and Republican politicians alleged industries were being boycotted to the detriment of retirees’ savings.

“For the first time in recent history, sustainable fund departures outpaced arrivals” in the three months September, Chicago-based researcher Alyssa Stankiewicz wrote.

Three new funds were launched while thirteen closed in this category. One existing fund took on the “sustainable” label and four other funds moved away from that mandate.

A few weeks ago, David Moon, president of Moon Capital Management, offered his insight on this trend.

Environmental, social and governance mutual funds and other investment products were created as marketing gimmicks – with no real economic basis – so I never expected them to last. But neither did I expect their whimpering demise so quickly. Some of the largest investment firms are shuttering ESG-labeled funds this year, after spending several years trying to capitalize on increasing and widespread interest in social responsibility.

BlackRock, Hartford, Janus, Columbia and Fidelity have all closed or announced the coming closures of funds purporting to promote good corporate governance practices, sustainable energy policies and social justice. What these swift ESG fund birth-to-death cycles remind us is that while some people use their investment decisions to virtue signal, if it costs them money, they won’t do it forever.

…The environmental part of the ESG term is important, but it is almost impossible to define and measure the environmental impact of a large organization with decimal precision – which is why S&P no longer issues ESG scores linked to its credit analysis. Someone finally realized that the ESG measurement charade couldn’t continue with a system that determined cigarette company Phillip Morris was more “environmentally sustainable” in its business practices than Tesla.

If something can’t continue, it isn’t “sustainable.”

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

My wife and I use two money mgmt firms to keep an eye on our retirement savings since neither of us have sense enough to keep up with markets anymore. We gave each only 3 directives: no ESG investment, no China investment and no Black Rock.

Same here… but I didn’t give them any directives.. I am not good at finances,, forget about due diligence.. SMH…

For years niche funds have existed to cater to whackadoodles. Those who study finance are repeatedly told that broad diversification is key, and that narrowing the investment field increases risk and lowers returns. But the masters of the universe decreed that this ESG marketing ploy was to be let loose on the general public in order to justify higher fees. The 7-figure-salary analysts were ordered to whore themselves to write papers and give lectures on how the established rules of investing could be suspended for the new woke world. Buy a good index fund and listen to nobody.

Yep. Read ‘A Random Walk Down Wall St.’ by Burton Malkiel and ‘The Little Book of Common Sense Investing’ by John Bogle. Both will offer more detailed info on why average retail investors are better off with the bulk of their investments in index funds.

Provided the indexes don’t tweak their admittance criteria to pay homage to the gods of ESG and Global Climate Change, like the Leftists have been trying so hard to do for the last few decades. I think the main reason the indexes have been holding out so well is they realize the first index to step on that land mine will be the example why the rest of them have avoided stomping on it.

Yes indeed. No upside for an investment firm to use their broad based index fumd, such as SP 500, to go first into ESG and blow up their returns. ESG funds, at least one that that lives up to the spirit and intent, is going to lag the returns of regular funds who keep their focus and emphasis on maximizing returns.

I have always said the sustainability is a first world problem. Easy to do when you are prosperous. All these poor countries just want to become less poor and have no interest in green energy.

Sustainability funds are unsustainable. No one could have foreseen this! ¯_(ツ)_/¯

Biden green new deal is trillion dollar fraud.

Won’t lower temps by 1 degree.

I think most of the savvy investors in this sector were investing with a bet on a huge stimulus from subsidy. That hasn’t happened, so the sector is stale. It needs that to make money for anyone, at the cost of the taxpayer.

The entire ESG grift would make PT Barnum proud.

The heavy subsidies required for “sustainable” industries — not just to startup, but to remain solvent year after year — is all the proof you need that they are sustainable in name only.

Many of them are nothing but technological crutches for old lifestyles that Americans abandoned decades ago because of the availability of more efficient solutions. And to the extent those solutions are no longer as efficient or available, in almost all cases you will find it is due to artificial suppression by the government of the resource involved, not natural exhaustion of the resource.