94-year-old Grandmother Wins Home Equity Theft Case at the U.S. Supreme Court

Justices unanimously side with elderly homeowner in tax foreclosure dispute.

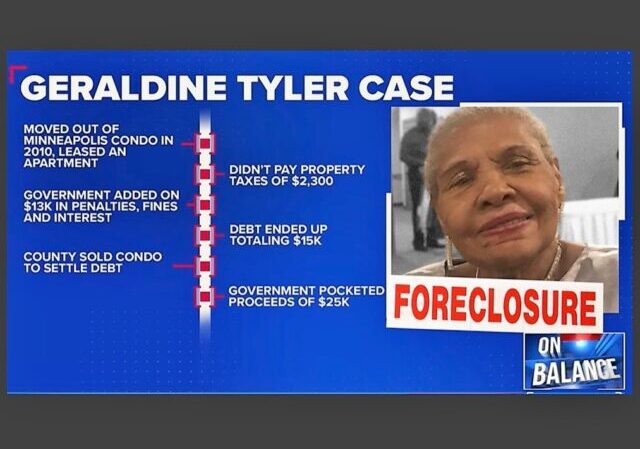

Late last month, we reported on the case of 94-year-old grandmother Geraldine Tyler, whose Minneapolis condo was sold by Hennepin County in Minnesota for $40,000 to pay off a $15,000 tax debt: 94-year-old Grandmother Fights Home Equity Theft at the U.S. Supreme Court

The kicker was that instead of returning the $25,000 surplus over the amount Geraldine owed the state, Hennepin County decided to keep the whole amount! Even worse, the County’s retention of those funds was entirely in keeping with Minnesota state law, as we reported:

It turns out, as both parties agreed in court, that Minnesota state law provides for just such a result. Pacific Legal [Foundation] reports: “State law allows Minnesota counties to keep such windfalls at the expense of property owners like Geraldine. From 2014 to 2020, 1,200 Minnesotans lost their homes and all of the equity they had invested for debts that averaged 8% of the home’s value.”

Upset at that result, Geraldine sued Hennepin County in federal court:

But, not so fast, said Geraldine Tyler. The Fifth Amendment to the United States Constitution, which trumps state law, says in the “Takings Clause” that “private property [shall not] be taken for public use, without just compensation.”

And not only that, the Eighth Amendment to the United States Constitution provide[s]: “Excessive bail shall not be required, nor excessive fines imposed, nor cruel and unusual punishments inflicted.”

But the federal district court dismissed Geraldine’s case:

“[T]he United States Supreme Court has unambiguously declined to recognize a former property owner’s ‘fundamental interest in the surplus’ by virtue of her prior ownership of the forfeited property. To the contrary,…[a] former owner has a property interest in the surplus only if a provision of a constitution, statute, or municipal code creates such an interest…[but] Minnesota’s statutory scheme gives the property owner no right to the surplus.”

The court also held that Geraldine’s “excessive fines” argument was without merit because “Minnesota’s tax-forfeiture scheme bears none of the hallmarks of punishment,” and so “the statute does not impose a ‘fine’ within the meaning of the Excessive Fines Clause.”

Geraldine appealed to the U.S. Court of Appeals for Eighth Circuit, but they affirmed the district court’s dismissal, saying that “[w]here state law recognizes no property interest in surplus proceeds from a tax-foreclosure sale conducted after adequate notice to the owner, there is no unconstitutional taking… [and] the governmental unit does not offend the Takings Clause by retaining surplus equity from a sale.”

Geraldine then appealed to the U.S. Supreme Court, who felt the case important enough to hear it, even though “the Court [only] accepts 100-150 of the more than 7,000 cases that it is asked to review each year.”

At oral argument, which you can listen to here, it appeared that the Justices were firmly in Geraldine’s corner, as Amy Howe at the excellent Scotusblog reported: Justices appear likely to side with homeowner in foreclosure dispute.

Earlier today, the Court, in fact, sided with Geraldine. You can review the Court’s opinion here and below.

In it, in a unanimous opinion authored by Chief Justice Roberts, the Court gave short shrift to the Eighth Circuit’s “state law controls” argument:

The Takings Clause does not itself define property…For that, the Court draws on ‘existing rules or understandings’ about property rights…State law is one important source…But state law cannot be the only source. Otherwise, a State could sidestep the Takings Clause by disavowing traditional property interests in assets it wishes to appropriate.

In other words, a state cannot just pass a state statute that lets them take your property without compensation, which is apparently what the County, and the federal district and appeals court thought. Or as the Supreme Court puts it: “The Takings Clause would be a dead letter if a state could simply exclude from its definition of property any interest that the state wished to take.”

So how do we figure out what property is subject to the Takings Clause? The Court answers: “So we also look to traditional property law principles,’ plus historical practice and this Court’s precedents.”

The Court then gives a history lesson, going all the way back to the Magna Carta, which said that “when [a] sheriff or bailiff came to collect any debts owed [the King] from a dead man, they could remove property ‘until the debt which is evident shall be fully paid to us; and the residue shall be left to the executors to fulfill the will of the deceased.” Blackstone, the leading legal authority in England in the 1700s, said, “[i]f a tax collector seized a taxpayer’s property, he was ‘bound by an implied contract in law to restore [the property] on payment of the debt, duty, and expenses, before the time of sale; or, when sold, to render back the overplus.'”

The founders adopted England’s understanding in this regard:

This principle made its way across the Atlantic. In collecting taxes, the new Government of the United States could seize and sell only ‘so much of [a] tract of land . . . as may be necessary to satisfy the taxes due thereon.’ Ten States adopted similar statutes shortly after the founding.

And the Court cites an early U.S. Supreme Court opinion, authored by the first giant of the Court, Chief Justice John Marshall, who, in enforcing a state statute against a Georgia tax collector, reasoned that “if a whole tract of land was sold when a small part of it would have been sufficient for the taxes, which at present appears to be the case, the collector unquestionably exceeded his authority.”

Even in the present day, the Minnesota statute is a “minority rule” and “[t]hirty-six States and the Federal Government require that the excess value be returned to the taxpayer.”

What is more, Minnesota itself returns the excess property to taxpayers in every other context besides real estate:

Finally, Minnesota law itself recognizes that in other contexts a property owner is entitled to the surplus in excess of her debt…if a bank forecloses on a home because the homeowner fails to pay the mortgage, the homeowner is entitled to the surplus from the sale.

If a taxpayer falls behind on her income tax and the State seizes and sells her property, any surplus proceeds…shall…be credited 0r refunded to the owner… So too if a taxpayer does not pay taxes on her personal property, like a car.

The Court summed up:

The Takings Clause was designed to bar Government from forcing some people alone to bear public burdens which, in all fairness and justice, should be borne by the public as a whole…A taxpayer who loses her $40,000 house to the State to fulfill a $15,000

tax debt has made a far greater contribution to the public fisc than she owed. The taxpayer must render unto Caesar what is Caesar’s, but no more.Because we find that Tyler has plausibly alleged a taking under the Fifth Amendment, and she agrees that relief under ‘the Takings Clause would fully remedy [her] harm,’ we need not decide whether she has also alleged an excessive fine under the Eighth Amendment.

The judgment of the Court of Appeals for the Eighth Circuit is reversed.

It is so ordered.

Celebrations have ensued:

Insane story & amazing victory. @GOPMajorityWhip & MN Republicans filed an amicus brief in support of Geraldine Tyler earlier this year! https://t.co/kiHpOHADfV

— Theresa Sophia Braid (@TheresaSMeyer) May 25, 2023

VICTORY! 🎉 Today’s unanimous Supreme Court decision in Tyler v. Hennepin County is a major win for property owners nationwide.

The Constitution guarantees that private property may not be taken by the government without just compensation.

The Court affirmed today that a state…

— Cato on Law (@CatoOnLaw) May 25, 2023

THREAD: Today, the Supreme Court unanimously vindicated 94-year-old Geraldine Tyler. A few years ago, the government took her home, sold it over a small tax debt—and *kept the profit.*

The ruling is amazing news. Here's what that means for her—and for the many victims like her. pic.twitter.com/RMIrMulDet

— Billy Binion (@billybinion) May 25, 2023

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Major setback for govt attempting to confiscate property. Next up civil asset forfeiture …hopefully.

One could certainly read this opinion and think that civil asses forfeiture is on thin ice.

Asset forfeiture is even worse than this. Here, at least, there are unpaid taxes the government entity is owed. With forfeiture no crime of any type is alleged. The asset is arrested and if you don’t prove it was legally gained it is sold off which is entirely backwards.

IMO civil asset forfeiture is legalized piracy. After a conviction if the govt wants to show that the cash, cars, boat, plane house, jewelry, artwork or whatever are proceeds of criminal activity then ok. That’s not what’s happening though. The govt basically just hijacks people’s property, sometimes without any charges being filed much less proven in court.

The presumption of innocence must always prevail and that extends to someone’s property in all forms. Civil asset forfeiture as form of administrative punishment doled out by a consortium of Fed, State and Local agencies who share the spoils is horrible policy and should never have been allowed.

Piracy is a great way to put it.

This is truly ironic, since asset forfeiture was originally designed to punish piracy.

The state’s conduct produced a manifestly inequitable result. This case never should have had to be appealed to SCOTUS, to achieve an equitable resolution.

True- but the good thing is- there is absolutely no ambiguity in their decision. So it renders moot any similar state laws in other states that exist.

But what person in their right mind could have EVER thought this was legit? People need to be fired and have their pensions revoked. Until these over-reaching government hack c*nts start getting hurt they’ll keep it up. Until one day the tar and feathers come out again and nobody likes that… it’s impossible to get hot tar out of your clothes.

I believe I read that a dozen or so States also operate the same way as Minnesota did here.

Lowe’s and Home Depot sell tar. Who sells feathers?

Let’s also recall that all of Minnesota’s Dumb-o-crats Congressional reps refused to side with the elderly homeowner “of color” in this case, and chose instead to side with the unfettered, inequitable and lawless exercise of State power.

I’d have expected nothing different.

Not surprised at all. Dead colored folks, I mean, “people of color” at the hands of white people are the only type who have currency in the Democratic Party.

These out of control county officials have no shame. They should be horsewhipped.

The bad news is this ruling shows how corrupt the lower courts are. This was so obviously the correct decision.

It was the Pacific Legal Foundation (https://pacificlegal.org) that took the case to the Supreme Court. This is their 17th win at the Supreme Court! If anyone want to support an organization that is dedicated to freedom and liberty, this is the one to support. PLF is a non profit legal organization that defends Americans from government overreach and abuse. All of their cases are pro bono. PLF champions property rights, equality under the law, individual rights, economic liberty, free enterprise, and educational reform.

My only surprise is that it was unanimous.

That is the sad truth.

The blind squirrels found a nut.

Note that this is also a class-action suit, so presumably everyone who has ever lost equity due to a tax sale is due any surplus the government kept. That might just reach all the way back to 1934, when this now overturned state law was enacted.

Oh my, that would create a circus, as far as records and bureaucracy.

Maybe that’s why I’m smiling.

This is the proper role of the Court. If the Court peeled itself from involving itself in social issues of any kind we wouldn’t have a lot of the problems we have today.

And good on them siding with the plaintiff. It is malevolent what the state did, both in snatching her house to settle a tax debt and then to keep the remainder of the proceeds. Straight theft.

It is malevolent what the state did, both in snatching her house to settle a tax debt and then to keep the remainder of the proceeds.

She abandoned her property and stopped paying property taxes on it for years. What do you propose the state should do in such a case??

She could have sold the property off and paid the taxes – which would have been the responsible thing to do. Instead, she decided to leave it to the state to dispose of the property – which is not the function of the state.

Take what it was owed in taxes and give the rest back to the citizen.

Win-win for everyone.

Of course it should never have got to this point because either her family should have helped her out OR the State should have helped her sort her affairs so the house wouldn’t need to have been confiscated in the first place.

Sometimes a little effort up front from everyone avoids a whole load of shit down the road.

I wish they had pressed the “excessive fines” part as well. Charging her $15K on a $2.3K debt is ridiculous.

This issue always gets misreported. Her unpaid tax bill for the first year was $2.3K. But several years passed before final action was taken, so there was not only interest, but a brand new tax bill due and unpaid each year.

So what about her attorney’s fees????

Pacific Legal is pro bono.

They weren’t so kind in the Kelo vs. New London case, where properties were seized via eminent domain. The Supreme Court stated that “the City of New London did not violate the Fifth Amendment’s public use requirement and validly exercised its eminent domain authority when it took private property and distributed it to private developers for the purposes of creating jobs and raising tax revenue.” I believe it was 5-4 with the majority being the Democrats. Surprise.

I believe the property sat vacant at least 9 years later (2015). The people that were uprooted had lived there for generations, some for 60 years. But New London believed they could get more money from the private developers.

Were they white? Being black apparently helps alot

If you read the Kelo decision you will see that the Supreme Court illegally reworded the 5th Amendment from “public use” to “public purpose”.

I am glad that Geraldine Tyler outlived some the “Justices” in the Kelo case.

Anybody that thought this outright theft was a good idea should be lined up against the wall and shot in the head at least three times.

Gut shot would be better, then pull an intestine loop out and turn the coyotes loose on them.

Granny is whole at last unless that Daniel Perry breaks his bail terms and strangles her.

Oops it’s Penny. Getting my race killers mixed up

As I have noted previously, aside from the excessive fine mentioned earlier, this also does nothing for the likely frequent situation when the seized property is sold on the courthouse steps for less than it would get in a normal sale. It just takes care of the obvious theft.

Not just frequent, it happened IN THIS SITUATION, and the SC punted on addressing it.

In this case the condo was appraised for ~$90,000, and they sold it for only $40,000.

So first they massively undersold it, and THEN they tried to keep even that small amount!

So … someone can abandon a property, stop paying property taxes, and then get the government to act as her real estate agent, selling the property, without any commission.

Are you stupid?

The government sold a $90,000 valued condo for only $40,000, AND the Court agreed that they could indeed keep the unpaid taxes out of the total. They just weren’t allowed to keep ALL of it. So if they had acted rationally and in accordance with this judgement, then she would have only gotten ~$25,000 back out of a $90,000 condo.

Seriously that’s the dumbest argument against this possible.

Lighten up, Francis.

Educate yourself, Frances.

Reason has a very good backstory to all of this as to how it happened in the first place and other stories of the same type of thing