China Spends Billions Bailing Out Countries Caught in ‘Belt And Road’ Debt Trap

Financial Times UK : “China’s $1tn Belt and Road Initiative infrastructure finance programme has been hit by spiralling bad loans.”

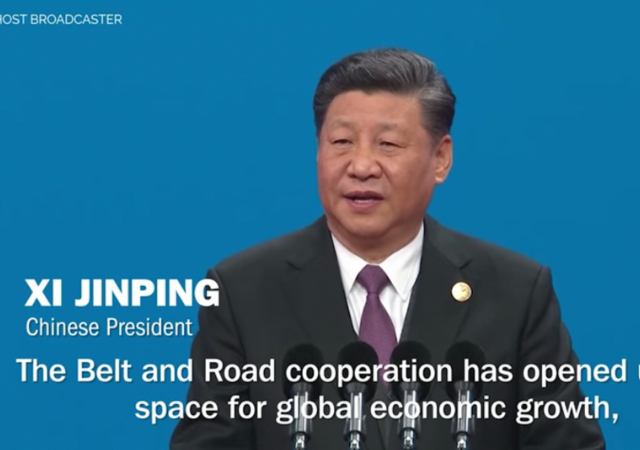

President Xi Jinping’s ‘Belt and Road Initiative’ is in huge financial trouble as Beijing is forced to bail out countries deeply indebted by Chinese infrastructure projects, new research shows.

Since 2020, Beijing “renegotiated” $78.5 billion worth of loans with partner countries failing to pay for costly airports, ports, and other infrastructure projects constructed by Chinese companies, a study released by the New York-based think tank Rhodium Group disclosed.

Under the Belt and Road program, China has already invested a trillion dollars in constructing roads, railways, and power grids in nearly 70 countries across Asia, the Middle East, Europe, and Africa. The project seeks to increase Chinese global influence and open foreign markets for its cheap exports.

On Monday, the British newspaper The Financial Times reported the Rhodium Group’s study:

China’s $1tn Belt and Road Initiative infrastructure finance programme has been hit by spiralling bad loans, with more than $78bn-worth of borrowing turning sour over the past three years.

The scheme made China the world’s largest bilateral creditor, but the figures suggest it has become a financial millstone for Beijing and its biggest banks.

About $78.5bn of loans from Chinese institutions to roads, railways, ports, airports and other infrastructure around the world were renegotiated or written off between 2020 and the end of March this year, according to figures compiled by New York-based research organisation the Rhodium Group.

This is more than four times the $17bn in renegotiations and write-offs recorded by Rhodium in the three years from 2017 to the end of 2019.

There are no official figures for the total scale of BRI lending over the past decade, but it is believed to total “somewhere in the ballpark of $1tn”, according to Brad Parks, executive director of AidData at William and Mary university in the US.

In addition, Beijing has extended an unprecedented volume of “rescue loans” to prevent sovereign defaults by big borrowers among about 150 countries that have signed up to the BRI.

The value of such sovereign bailouts amounted to $104bn between 2019 and the end of 2021, according to a study by researchers at AidData, the World Bank, Harvard Kennedy School and Kiel Institute for the World Economy. Over a longer timeframe between 2000 and the end of 2021, such bailouts to developing countries totalled $240bn, the study found.

Increasing numbers of BRI borrower countries are being pushed to the brink of insolvency by a slowdown in global growth, rising interest rates and record high debt levels in the developing world. Those countries’ western creditors, meanwhile, have blamed China for blocking debt restructuring negotiations.

Another comprehensive study released last month painted an even grimmer picture of China’s trillion-dollar bid for global dominance. “Between 2008 and 2021, China issued $240 billion (€221.7 billion) in bailout loans to 22 countries,” Germany’s DW TV reported, citing a World Bank study.

“According to the report, Argentina received the most rescue loans from China, totaling $111.8 billion. It was followed by Pakistan with $48.5 billion and Egypt with $15.6 billion,” the German broadcaster added.

Mongolia, Sri Lanka, and Suriname also “received significant sums” in bail-out money, the World Bank report said.

The revelations vindicate former U.S. President Donald Trump’s administration, which warned developing countries against falling into the Beijing debt trap. China was creating “an unsustainable debt burden” for poor countries, the then-U.S. Secretary of State Mike Pompeo cautioned in 2020.

The news comes as China wants countries in the Middle East, Africa, and South America to sign trade agreements based on the yuan, a currency the Communist regime keeps artificially low to make its export more attractive.

Following President Lula da Silva’s recent state visit, China eyes Brazil as a potential bridgehead for making further inroads into South America. “Beijing is trying to broaden its political and economic influence in Latin America amid tensions with the United States,” The South China Morning Post reported last week.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Such bailouts are really just investments toward China’s ultimate goals, helping to create subservience in the nations that have taken part in Belt & Road.

Isn’t that the whole point? China will end up owning these poor saps. Including ourselves as we owe them a ton of money and we can’t live without their cheap crap. They get to build coal-fired power plants and we can’t have even a gas stove — who wants to bet they’re exempt from the virtue-signaler’s preposterous rice ban? That and they own our country’s illegitimate puppet CEO and his family.. No wonder Winnie the Pooh is grinning like a cat full of canaries

Yep, their ROI is not in finance, it’s in politics.

I am confused. Yes, the loans are doomed but China isn’t losing. Look at Kenya…. when they defaulted China got control of the shipping port of Mombasa. It isn’t a one way deal… China does get something in return for many of these loans. Look at Ethiopia… they own the country and guess who headed WHO at the start of the WuFlu.. and still is.

Hey, if Pres Biden trusts Uncle Xi, then y’all should get on board too.

America spends trillions bailing out… fill in the blank.

Cancelling the pipeline, increasing the load on rail, is a progressive problem.

I think the tenor of the comments (with which I agree) is that “bailout” is the wrong word. The right word is “foreclosure.” Or maybe just “pillage.”

It’s akin to a loan shark operation (China). The nice guys at the utility company (Western Banks/Govts) will eventually disconnect the power but they don’t break legs. So when money is tight you figure out how to make sure the loan shark is paid or bought off and worry about the other bills after making sure you make this week’s vig.

The borrower is slave to the lender.

So the PRC is a bunch of capitalist pigs?

The CCP is terrible but we are distracted from the larger issue: if we cut our own government spending then nothing the CCP does will ever threaten the status of the USD. We need to get our fiscal house in order.

The indefensible naivete of leaders all across the globe in dealing with the transparently malicious, malignant, self-serving, deceitful and evil Chinese communist regime is astounding, at this point. I could understand it if leaders were approaching the Chinese regime with cautious goodwill in the immediate aftermath of President Nixon’s visit in 1972, but, with fifty years of belligerent behavior to take stock of since that time, there are no excuses for having blinders on in dealing with these snakes.

小熊维尼 knows that China is the world’s last, best hope for 20th century totalitarianism.

Courtesy of the American Emperor: Spurned by Biden, Israel Asks China to Help Contain Iran Threat

https://www.breitbart.com/middle-east/2023/04/18/spurned-by-biden-israel-asks-china-to-help-contain-iran-threat/

Finding more ways to weaken America and its actual allies.

Belt and Road has always been about Control and Influence, not profits.

They make the loans knowing full well that the countries they are lending to can’t pay them back. When the crisis comes, in each case they use the leverage to increase control.

Exactly. That has always been the plan, and it has been working. China winds up controlling the debtor countries infrastructure, AND its foreign policy.

Not to hijack the topic, but I was told tonight that beginning May 15(?), the mortgage process will be turned upside down, so that people with higher credit scores and more substantial downpayments will actually get more expensive terms than riskier homebuyers. The solid citizens end up subsidizing the bad risks, and the lenders (just like China) fully expect to be able to reclaim and resell a substantial number of the high-risk homes.

I don’t understand the story and the comments. The USA did the same thing in the late 70s and it was called the Latin America debt crisis. Mexico outright defaulted on its loans and some of our biggest banks almost went under. The IMF got involved and try to restructure the loans and get the money paid back and was imposed of creating “austerity” that led to more poverty. In retrospect, loaning poor countries with broken and corrupt economies wasn’t any kind of diplomatic or economic coup, it was just unbelievably stupid and short-sighted and probably driven by corruption more than anything else.

“and was accused of creating “austerity” that led to more poverty”

So you can’t edit comments here?

Debt is only a trap if rule of law prevails. CCP-China is not “bailing out”; they’re renegotiating to take what they can get as deals that included influence and coercion play out in a changing world.