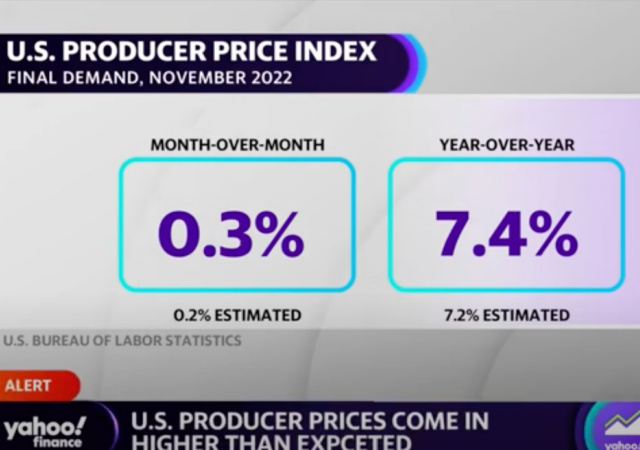

Wholesale Prices Up 0.3% in November and 7.4% From a Year Ago

The producer price index (PPI) increased 0.3% in November from October and 7.4% from a year ago. From CNBC:

The producer price index, a measure of what companies get for their products in the pipeline, increased 0.3% for the month and 7.4% from a year ago, which was the slowest 12-month pace since May 2021. Economists surveyed by Dow Jones had been looking for a 0.2% gain.Excluding food and energy, core PPI was up 0.4%, also against a 0.2% estimate. Core PPI was up 6.2% from a year ago, compared with 6.6% in October.

I thought inflation was going away:

Services inflation accelerated for the month, rising 0.4% after being up just 0.1% the previous month. One-third of that gain came from the financial services industry, where prices surged 11.3%. That was offset somewhat by a sharp decline in passenger transportation costs, which fell 5.6%.On the goods side, the index rose just 0.1%, a steep decline from its 0.6% October gain. That modest gain came despite a 38.1% acceleration in prices for fresh and dry vegetables. Prices moved higher across multiple food categories even as the gasoline index tumbled 6%.

The consumer price index comes out next Tuesday. Then on Wednesday, the Federal Reserve will end its two-day meeting.

Experts believe the Fed will issue a “0.5% hike that would push benchmark borrowing rates to a target range of 4.25%-4.5%.”

Policymakers want this to happen “to quell stubborn inflation.” But are these mistakes?

Lindsey Piegza, Stifel Financial’s chief economist: “This is going to be a complicated process, not a flip-the-switch scenario for the Fed. We’re consistently under-evaluating, or under-appreciating, the stickiness of inflation.”

Jeffrey Roach, LPL Financial’s chief economist: “The monthly increase in producer prices illustrates the need for continued tightening, albeit at a slower pace. The inflation pipeline is clearing and consumer prices will slowly move closer to the Fed’s long run target.”

CLICK HERE FOR FULL VERSION OF THIS STORY