Majority of Student Loan Bailout Plan Recipients to Spend Money on Travel, Eating Out

“That extra cash will be a much needed lifeline to cover other bills or necessary expenses for many. But some borrowers plan to spend the money more freely.”

Advocates of student loan forgiveness have told us it is needed because people with this crippling debt are having trouble affording basic things like food and rent.

Yet, according to new reporting, the people who will benefit from Biden’s program are planning to spend the extra cash on vacations and meals in restaurants.

Once again, reality does not match what taxpayers are being told.

From CNBC:

After student loan forgiveness, 73% of borrowers plan to spend more on travel and dining out

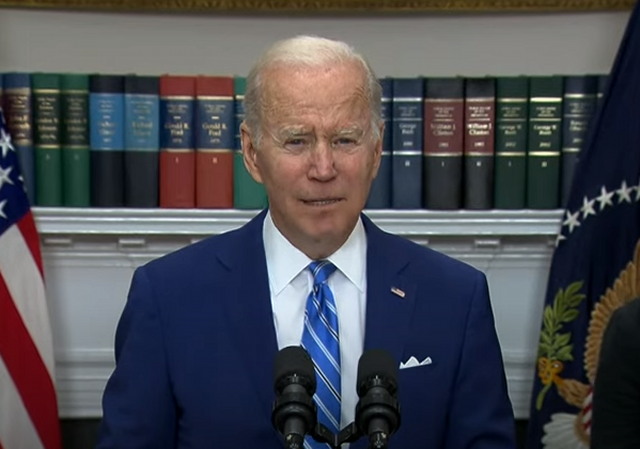

Any day now, federal student loan borrowers throughout the U.S. could see their balances reduced by up to $20,000 thanks to President Biden’s student debt forgiveness plan. The administration is waiting on a green light from a federal judge to actually start reducing balances, but still says applicants can expect good news in the coming weeks.

While recipients won’t see that aid in the form of a check, any remaining balances will be re-amortized, meaning monthly payments will be recalculated to reflect the new balance. For borrowers, that means monthly payments could drop by up to $300 per month.

That extra cash will be a much needed lifeline to cover other bills or necessary expenses for many. But some borrowers plan to spend the money more freely.

In fact, 73% of anticipated recipients say they expect to spend their debt forgiveness on non-essential items, including travel, dining out and new tech, according to a recent survey from Intelligent.com.

That discretionary spending won’t come guilt-free though. The same percentage of recipients — 73% — say using debt forgiveness funds on non-essentials isn’t the right thing to do.

Watch this:

CNBC: 73 percent of those receiving Biden's student loan forgiveness plan to spend more on dining out, travel pic.twitter.com/mfhtItVwIS

— Tom Elliott (@tomselliott) November 9, 2022

Many people have suggested that Biden’s plan was little more than a bribe to young voters. Well, guess what? It worked.

From the Insider:

Biden’s student-loan forgiveness is at risk. It may have helped stop a ‘red tsunami’ as Gen Z flocked to the polls to save their relief.

If President Joe Biden didn’t enact broad student-loan forgiveness, Republicans may have gotten the electoral wins they were hoping for.

Gen Z may have helped.

Leading up to the midterm elections, the polls were predicting massive GOP victories across the board, allowing them to regain significant control over the House and Senate. But as the results continue to trickle in, it’s become clear that the red wave turned into a ripple, with control of both chambers of Congress too close to call the day after the election.

While it’s difficult to pinpoint what exactly may have caused this shift, opinions of young voters should be taken into consideration. According to the Edison Research National Election Pool exit poll, 63% of voters aged 18-29 supported Democrats, and 89% of Black youth and 68% of Latino youth voted for a Democratic House candidate. With the oldest Gen Zers turning 25 this year, this group includes the youngest Millennials and those Zoomers of voting age.

This is a con. Plain and simple.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Buying votes with my money.

Just another reason to become John Galt.

Biden is helping children remain children.

The safety net has become a hammock.

We all know Biden likes children.

It’s quite befuddling to me that individual congress critters wouldn’t have standing to challenge Brandon’s usurpation of the “power of the purse.” Perhaps incoming (probably) speaker McCarthy can ask the court to delay any action on student loan forgiveness until the incoming House of Representatives can challenge this unconstitutional power grab in court in January. To me, how McCarthy handles this issue and investigating the Biden Crime Family will be litmus tests of whether the GOPe is ready to stand up and fight for its voters. But losing gracefully seems to be wired into their DNA.

Many people have yet to learn that a policy should not be judged on the intentions of its creators and cheerleaders; it should be judged based on the incentives it creates. So even if the Democrats’ intentions were pure (highly doubtful) this was still an easily foreseeable result.

Instead of reducing the amount they owe to the feds they actually send them cash? So it is not a loan bailout, it’s just another entitlement.

Or, the payment money can now go for luxuries rather than the debt they voluntarily took on.

Many of the people who paid their loans made less money than the freeloaders who didn’t pay.

Freeloader. Hmm. In biology, we call them parasites.

In the words of a famous Supreme Court Justice, “I’m not a biologist.”

Our inner cities have been parasites for at least 50 years.

I’m waiting to see who’s the first to default on every other contract they’ve signed onto, since Biden unilaterally eviscerated contract law.

Biden may have overstepped his authority as President, but he didn’t nullify any contracts. Creditors have the authority to forgive debt. That’s not controversial. An argument can be made that the decision to forgive debt owed to the US Government lies w/ congress, rather than the President, but that’s a separate issue.

CNBC from article:

“In fact, 73% of anticipated recipients say they expect to spend their debt forgiveness on non-essential items, including travel, dining out and new tech, according to a recent survey from Intelligent.com.”

Safe bet – that 73% of the anticipated recipients ended up with an unnecessary amount of that student debt by travel, dining out, and new tech.

Instead of working off their debt, like say in college, where party was the name of the game, they will just take the largesse of the Biden vote buying regime and run.

What a waste of money; teaches no responsibility or work ethic.

Naturally, every student after this will expect the same benefit.

How about just making the colleges lower their tution/fees etc?

And use their massive, untaxed endowments.

I’m sorry, but I can’t read that sentence without an immediate mental image of Carol Doda.

Hah! Hah!

The 73% that probably used student loans to pay for unnecessary travel, dining out, and new tech while they were in college, probably ALREADY SPENT anything they hoped to get from the Biden Bailout that just got canceled. (It was just a dem political move anyway)

I’m drowning in schadenfreude.

Just to be clear, I’m laughing at anyone who already spent what they expected from Biden’s executive overreach.

I guess I’m also laughing at those who spent a fortune going to expensive colleges to study stupid subjects. Get a degree that will get you somewhere and a library card to study the latest woke fads.

Since monthly payments have been suspended for a couple years now due to covid, payments will not change at all. At least, not at first.

When they come back , people who have been spending the money every month will suddenly have to come up with it. Most won’t, whether the amount is reduced by the giveaway or not.

Yep. They’ll more than likely end up in a deeper financial hole when the loan payments resume than where they’re are now.

Imagine how many GenZ folk had their absentee ballots cast on their behalf. I wouldn’t be surprised if that was the biggest tranche of mail-ins that could be massaged.

IMO if the Republicans do not learn to play the same mail-in game, how are the results of this election not the best that they will ever do? You will never have a President and party with worse policies and worse execution than for this year.

Exactly! Either outlaw this travesty of justice, or “do as the Romans do.”

Florida proved what a scam it is.

The student loan forgiveness was bad public policy but good politics. Even if it is eventually declared illegal by the courts, the election is over, it’s already served it’s purpose.

Said Harry Reid: “It worked, didn’t it?”

Ummm, they’re already spending that money on those things. It’s why they can’t pay off their loans. It’s not like they’re receiving a bundle of cash, they’re simply having some obligations relieved. But they haven’t been making those payments, lately, anyway (and some probably never have).

And this sure won’t teach them the value of paying off debts.

Another Democrat nail in the coffin of the United States.

So in short, the current resident of the Executive office made a program to bribe young voters with ten grand of cash against the debt they incurred and can’t pay off despite this being the best economy in the last hundred years etc… And when the Republicans manage to scotch this unconstitutional power grab, the Dems will point fingers and exclaim at the top of their lungs, “See! They’re stealing your money! Elect us and we’ll give it back to you!”

Bread and circuses for the youthful idiots.

Oh, yes! Millennials and Gen Z wanna go traveling and seek adventures with their new entitlement!

I have to laugh at them. For all their student-loan based education, they’re shockingly ignorant about reality. They don’t realize they are being used like cheap rags. And it is only the beginning for them.

They better be careful what they wish for. They want to travel. They’re going to get travel. Lots and lots of travel!

You’ll see. You’ll see….

Travel in “battle rattle”? LOL at least they won’t have to spend anything on buying clothes for the trip…

But they hafts do this travel in ELECTRIC CARS with a range of 175 miles to the next charging station 250 miles down the road. Gen Z STOOPID

Bidencares. And the best part, while the profits are retained, the public shares responsibility a la Obamacares.

The vast majority of these kids have less than 20k in loans, Not even a used car. They NEED to stop buying so much avocado toast and lattes. Only a smaller number of folks, looking for higher degrees or professional (doctor, Lawyer) are looking at high loans and they’ll be making a pile eventually.

So no, no payouts. Suck it up. If you got a PhD in Studies it maybe that your purpose in life is to serve as a warning to others, to not be stupid.

Their lives will become a warning to others, trust me.

Can I get in on this swag? I had about $10,000 in student loans when I graduated from college in 1983. Foolishly, I paid them back, but maybe I can claim ignorance and get some retroactive cash for a trip/car/boat/Harley . At 6%, my $10,000 in loans could get me about $50,000

In 1992 I graduated with $8,000 in debt due to the G.I. Bill, working 2 jobs during the school year and pouring foundations in the summer. Couldnt find a job in my field of Wildlife Biology so started driving a semi 70hrs/week and paid it off in 2 yrs. What a fool I was being responsible.

You know, all you can do at this point is teach your own kids. Insert tiresome Biblical “remnant” cliche here. But it’s true.

So people who racked up a $100,000 or more in debt getting degrees in Gender Theory, Black Studies and the like only to find the only jobs they are qualified for involve Barrista in the title are going to make a bad financial decision? This is my stunned face.

It does not matter. With redistributive change come minority benefits, a trickle-down economy, and progressive prices in shared responsibility, then the cycle repeats following an ouroboros model, typically until catastrophic anthropogenic climate change provides “burden” relief.

Judge strikes down Biden student loan forgiveness plan as unconstitutional ”… no one can plausibly deny that it is either one of the largest delegations of legislative power to the executive branch, or one of the largest exercises of legislative power without congressional authority in the history of the United States,” Pittman wrote.

The loan bailout is unconstitutional because the power of the purse is granted to Congress, not the Executive. Congress would have to have enacted legislation permitting loan forgiveness.

The HEROS Act, which the administration based such a sweeping Executive Order, was enacted explicitly for veterans.

So anti-capitalist reactionaries turn out to be bad capitalists: their investment in education turns out to be no use for them, or anybody else.