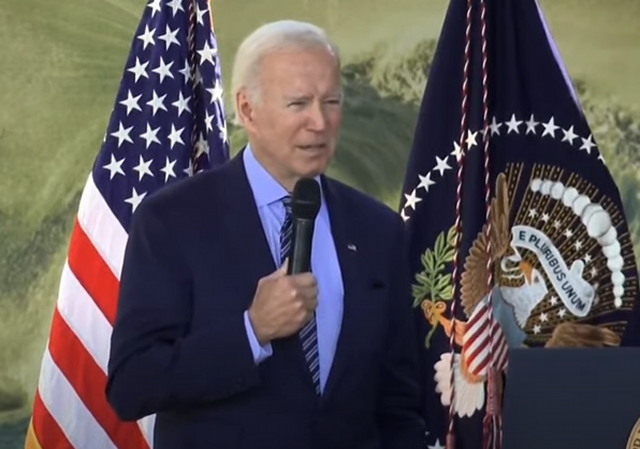

Federal Appeals Court Temporarily Blocks Biden’s Student Loan Debt Relief Program

“The injunction will remain in effect until further order of this court or the Supreme Court of the United States.”

The 8th Circuit Court of Appeals in St. Louis temporarily blocked President Joe Biden’s student debt relief program.

The ruling pertains to the Emergency Motion for Injunction Pending Appeal filed by the six states suing the Biden administration last month.

The 8th Circuit granted that administrative stay.

Therefore, this ruling is not on the legal merits of the case. It just suspends the program while the case continues through the courts.

“We conclude that, at this stage of the litigation, an injunction limited to the plaintiff States, or even more broadly to student loans affecting the States, would be impractical and would fail to provide complete relief to the plaintiffs,” the judges wrote in the ruling.

Six states, led by Republicans, claimed the student debt program “threatens their future tax revenues, and that the plan circumvents congressional authority.”

The states are Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina.

The court explained how the Missouri Higher Education Loan Authority (MOHELA) includes “support{ing]n the efforts of public colleges and universities to create and fund capital projects.” A Missouri law “specifically directs MOHELA to distribute $350 million ‘into a fund in the State Treasury’ for this program.”

“Given this statutory framework, MOHELA may well be an arm of the State of Missouri under the reasoning of our precedent,” stated the judges.

However, cutting off debt repayments would harm MOHELA even if it didn’t have a place in the State of Missouri:

But even if MOHELA is not an arm of the State of Missouri, the financial impact on MOHELA due to the Secretary’s debt discharge threatens to independently impact Missouri through the LCD Fund. It is alleged MOHELA obtains revenue from the accounts it services, and the total revenue MOHELA recovers will decrease if a substantial portion of its accounts are no longer active under the Secretary’s plan. This unanticipated financial downturn will prevent or delay Missouri from funding higher education at its public colleges and universities. After all, MOHELA contributes to the LCD Fund but has not yet met its statutory obligation.

Due to MOHELA’s financial obligations to the State treasury, the challenged student debt loan cancellation presents a threatened financial harm to the State of Missouri.

“Consequently, we conclude Missouri has shown a likely injury in fact that is concrete and particularized, and which is actual or imminent, traceable to the challenged action of the Secretary, and redressable by a favorable decision,” the judges decided. “Missouri, therefore, likely has legal standing to bring its claim.”

Therefore, the judges didn’t need to “address the standing of the other States” since they found that “at least one party likely has standing.”

The judges also determined the equities “favor an injunction” because of the “irreversible impact the Secretary’s debt forgiveness action would have as compared to the lack of harm an injunction would presently impose.”

The judges then explained why their ruling applies to all six states in the lawsuit. It’s quite simple:

We conclude that, at this stage of the litigation, an injunction limited to the plaintiff States, or even more broadly to student loans affecting the States, would be impractical and would fail to provide complete relief to the plaintiffs. MOHELA is purportedly one of the largest nonprofit student loan secondary markets in America. It services accounts nationwide and had $168.1 billion in student loan assets serviced as of June 30, 2022. See Rodgers, 942 F.3d at 458. Given MOHELA’s national role in servicing accounts, we discern no workable path in this emergency posture for narrowing the scope of relief. And beyond Missouri, tailoring an injunction to address the alleged harms to the remaining States would entail delving into complex issues and contested facts that would make any limits uncertain in their application and effectiveness. Although such complexities may not counsel against limiting the scope of an injunction in other contexts, here the Secretary’s universal suspension of both loan payments and interest on student loans weighs against delving into such uncertainty at this stage.

“We grant the Emergency Moption for Injunction Pending Appeal” concluded the judges. “the injunction will remain in effect until further order of this court or the Supreme Court of the United States.”

As noted above, the ruling just extends the administrative stay, which means this could remain unsolved for a long time.

DONATE

DONATE

Donations tax deductible

to the full extent allowed by law.

Comments

Good! The one who signed for the loan should be paying it back, such is the nature of contracts. Plus, if what you got for that money isn’t worth YOU paying for, I certainly want no part of paying for something worthless.

Shared responsibility. First Obamacares, now Bidencares. However, Unless there was a government mandate, or the schools defrauded the students, there is personal responsibility to mitigate redistributive change (e.g. progressive prices, trickle-down economics) , social progress and dysfunction.

As San Fran nan loved to point out. ” The House controls the purse strings” The house is no under new management.

Is it? I would not be surprised to see the communists steal the rest of them.

Doesn’t matter. Brandon’s handlers knew this wouldn’t fly but did it anyway to get votes. Worked.

Does not the fact that the attempted bribe “worked” mean that the education paid for was worthless and we should not pay for it, as the first poster noted?

Sure, if the standing argument holds, likely the whole thing will fail (although standing in this context is really not a sure win argument) But, just hypothetically, not being antagonistic, if you had an eligible student loan, are you saying you wouldn’t have applied for relief out of principle?

It doesn’t matter now. The election is over. It is moot.

It is by no means moot-elections have zero impact on the constitutionality of such actions, which are determined by the courts

As to the law, you’re right of course. I wouldn’t argue that it is moot as far as the law is concerned.

It’s moot to Biden though. Biden doesn’t care if it’s blocked or over-turned now. It served it’s purpose. He didn’t initiate student debt relief because he cares deeply about students. He initiated it because he cares deeply about votes.

IDK. The folks out there gonna PO that Grandpa couldn’t deliver on this promise.

It doesn’t matter, they can’t take back their votes and the dems will try to find new bread and circuses to bribe stupid children with in two years. The children will either be new voters or have no memory of how they were lied to last time, or more likely the media will spin it as the evil evil republicans blocked it.

The point wasn’t to forgive debt, it was to get the idiots who put themselves in that situation out to vote to steal from the rest of us and bail them out.

2024? Although, in the future, let’s use quotations around that word, “election.” There are no real elections in this country anymore. Just ballot harvesting.

Not supporting Brandon but just have standing concerns. I have a hard time seeing that a debt servicer should have any protected interest in keeping student debtors in debt in this context. I doubt the federal gov’t guarantees them a specific quota of debtors to service.

Some here. If all the student loans were paid off at the same time MOHELA would still lose its’ revenue stream and be “harmed” by completely legal behavior.

Kamala Harris on college-aged kids:

https://twitter.com/DailyCaller/status/1592226438991806464